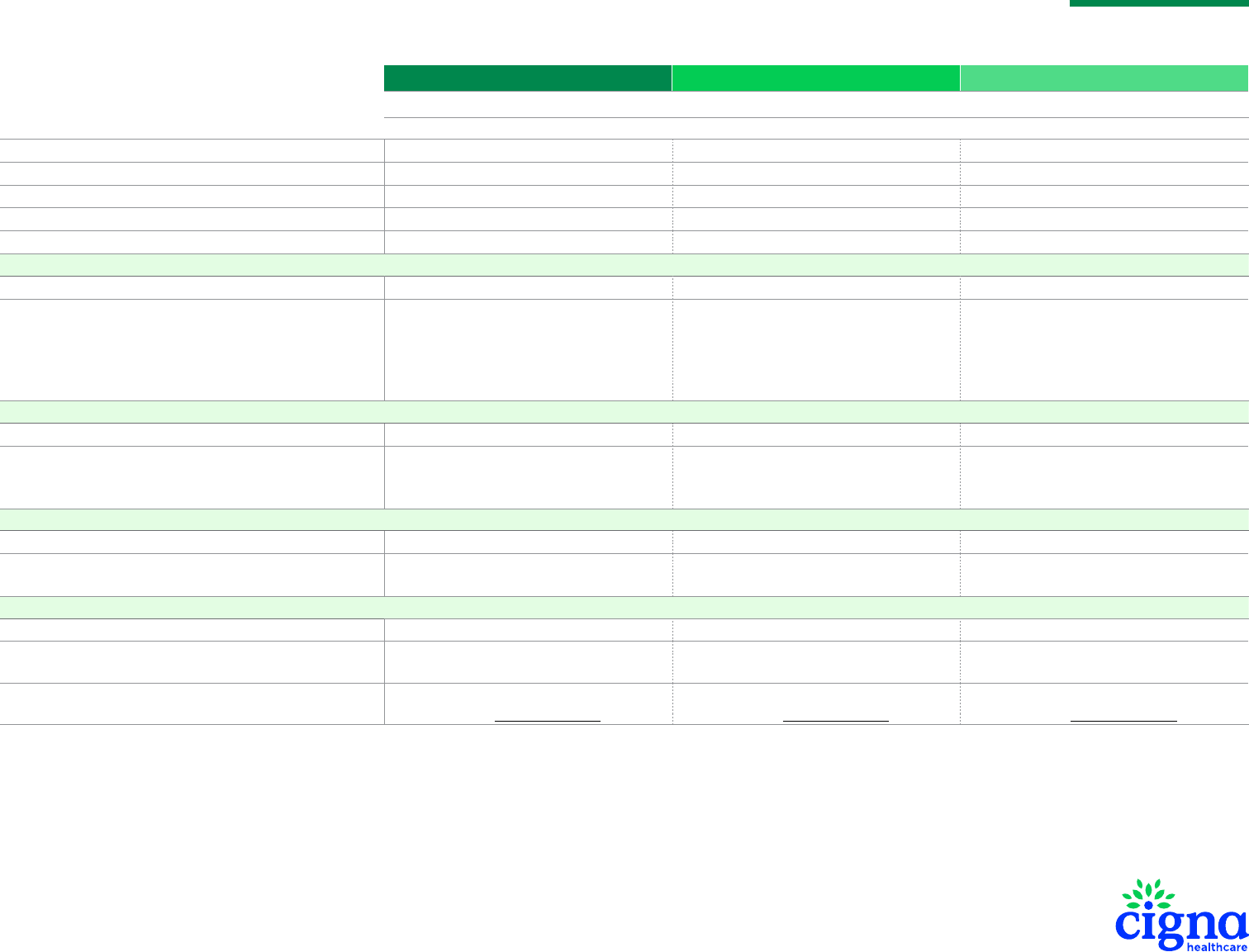

Individual and Family Dental Plan Comparison

Cigna Dental Preventive Cigna Dental 1000 Cigna Dental 1500

IN-NETWORK

DENTAL PLAN

Cigna DPPO Advantage Network

Individual Calendar-Year Deductible Not applicable $50 per person $50 per person

Family Calendar-Year Deductible Not applicable $150 per family $150 per family

Calendar-Year Maximum (For Class I, II and III services) Not applicable $1,000 per person $1,500 per person

Lifetime Deductible (Separate per person for orthodontia) Not applicable Not applicable $50 per person

Lifetime Maximum (Separate per person for orthodontia) Not applicable Not applicable $1,000 per person

Class I: Preventive/Diagnostic Services

Preventive/Diagnostic Services Waiting Period Not applicable Not applicable Not applicable

Preventive/Diagnostic Services

Oral Exams, Routine Cleanings, Routine X-Rays, Sealants,

Fluoride Treatment, Nonroutine X-Rays, Periodontal

Maintenance, Emergency Treatment, Space Maintainers

(Non-orthodontic)

You pay $0 You pay $0 You pay $0

Class II: Basic Restorative Services

Basic Restorative Services Waiting Period Not applicable 6-month waiting period

1

6-month waiting period

1

Basic Restorative Services

Fillings, Periodontal (Deep) Cleaning, Routine/Impacted Tooth

Extraction, Root Canal Therapy

You pay 100% of the provider’s

actual billedcharges

You pay 20% of the provider’s contracted fee

(after deductible)

You pay 20% of the provider’s contracted fee

(after deductible)

Class III: Major Restorative Services

Major Restorative Services Waiting Period Not applicable 12-month waiting period

1

12-month waiting period

1

Major Restorative Services

Crowns, Bridges, Dentures/Partials

You pay 100% of the provider’s actual billedcharges

You pay 50% of the provider’s contracted fee

(after deductible)

You pay 50% of the provider’s contracted fee

(after deductible)

Class IV: Orthodontia

Orthodontia Waiting Period Not applicable Not applicable 12-month waiting period

1

Orthodontia You pay 100% of the provider’s actual billedcharges You pay 100% of the provider’s actual billedcharges

You pay 50% of the provider’s contracted fee

(after separate lifetime deductible)

Out-of-Network and Dental Terms

For out-of-network benets and dental terms,

see the Summary of Benets

For out-of-network benets and dental terms,

see the Summary of Benets

For out-of-network benets and dental terms,

see the Summary of Benets

MARYLAND

This summary contains highlights only. For additional plan information, including out-of-network benets, view the Summary of Benets.

If you choose to visit a dentist out-of-network, you will pay the out-of-network benet and the dierence in the amount that Cigna Healthcare reimburses for such services and the amount

charged by the dentist, except for emergency services as dened in your policy. This is known as balance billing.

1. Waiting periods for Class II and III will be waived at the individual member level if the application indicates that there were 12 months or more of prior dental coverage which included coverage for Class III,

Major Restorative Services, and not more than 63 days have lapsed between the prior coverage and this plan. Any prior dental insurance plan that did not include Class III services will not count toward waiting

period waiver. Class IV, Orthodontia, waiting period cannot be waived. Refer to the policy for details.

969361 5/23

FOR AGENT/BROKER USE ONLY. DO NOT DISTRIBUTE.

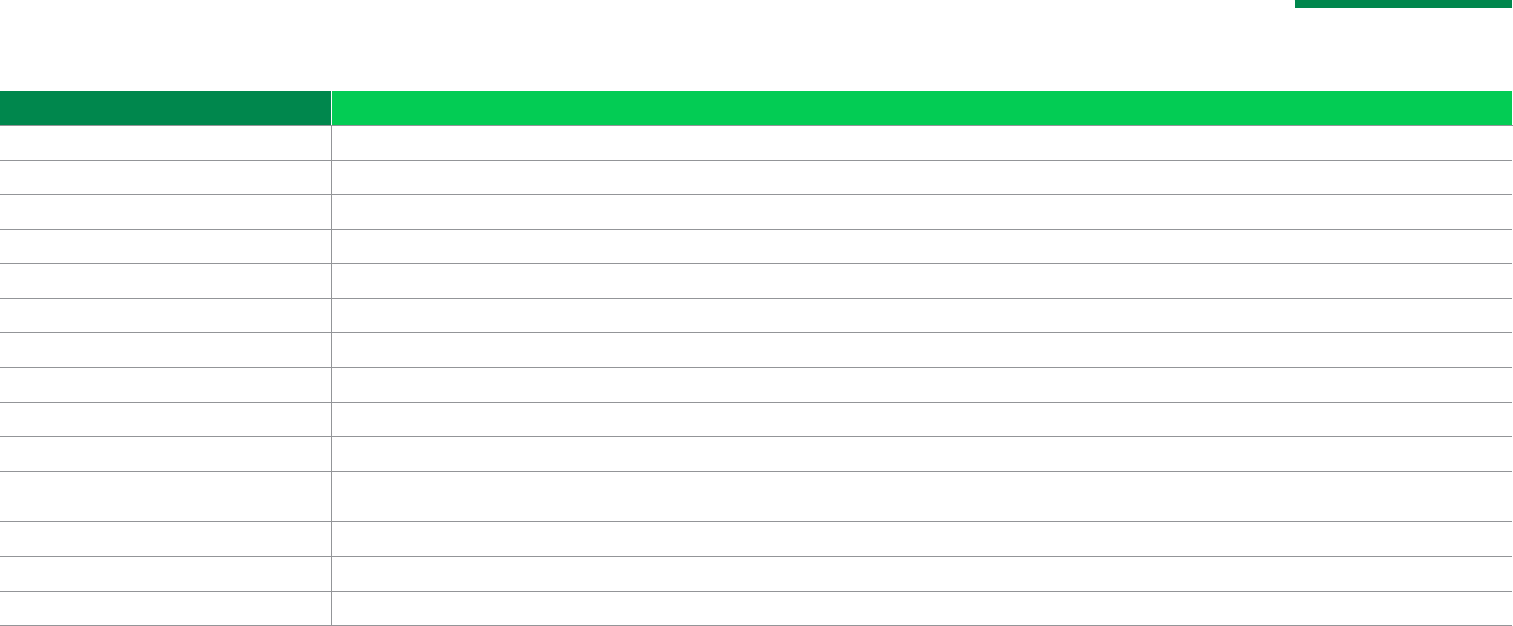

Procedure Frequency/Limitation

Oral Exams 1 per person per calendar year

Routine Cleanings 1 routine prophylaxis or periodontal maintenance procedure per person per calendar year (routine prophylaxis and periodontal maintenance are Class I procedures)

Routine X-Rays Bitewings: 2 sets per calendar year

Sealants 1 treatment per tooth per lifetime, payable on unrestored permanent bicuspid or molar teeth for participants younger than age 14

Fluoride Treatment 1 per calendar year for participants younger than age 14

Nonroutine X-Rays Full mouth or Panorex: 1 in any 5-year period

Periodontal Maintenance 1 periodontal maintenance or routine prophylaxis procedure per calendar year (periodontal maintenance and routine prophylaxis are Class I procedures)

Space Maintainers (Non-orthodontic) Limited to non-orthodontic treatment for prematurely removed or missing teeth for participants younger than age 14

Periodontal (Deep) Cleaning 1 per person per lifetime

Root Canal Therapy 1 per tooth per lifetime

Crowns

1 per tooth per consecutive 84-month period. Benets are based on the amount payable for non-precious metals. No porcelain or white/tooth-colored material on molar crown or bridges.

Replacement must be indicated by major decay. For participants younger than age 16, benets limited to resin or stainless steel.

Bridges 1 in any 5-year period. Benets will be considered for the initial replacement of a necessary functioning natural tooth extracted while the person was covered under this plan.

Dentures and Partials 1 per arch in any 5-year period

Missing Teeth Limitation There is no payment for replacement of teeth that are missing when a person rst becomes insured. This payment limitation no longer applies after 12 months of continuous coverage.

Individual and Family Dental Plan Comparison

MARYLAND

FOR AGENT/BROKER USE ONLY. DO NOT DISTRIBUTE.

This summary contains highlights only. For additional plan information, view the Summary of Benets.

With our dental plans,

there is more to smile about.

You get flexible benefits and premium levels to meet your needs and

budget, plus:

• Access to the Cigna DPPO Advantage Network with 80,000+ unique

dental providers at more than 300,000 locations across the U.S.

2

• No referral needed to see a specialist

• 15% discount on monthly premiums for any additional eligible

dependents

3

on the plan

• Availability for all ages, including those 65 and older

• No application or processing fees

• No waiting period for Class I services. (Waiting periods may

be waived for select procedures if you have had prior similar

dentalcoverage.

4

)

• No need to submit claims when you use a Cigna DPPO Advantage

Network provider

• 24/7/365 customer service

• One-stop plan access and help choosing the right dentist with the

Brighter Score®

5

feature on myCigna.com® or the myCigna® app

6

You have freedom.

You are free to choose a provider from our large national network or

from outside the network. Keep in mind, you’llsave the most if you visit

a Cigna DPPO Advantage Network provider.

Find providers in our network at Cigna.com/ifp-providers.

To see how your savings may be greater when visiting a

Cigna DPPO Advantage Network provider, see the

Summary of Benefits.

Cigna Dental Preventive plan MD

Cigna Dental 1000 plan MD

Cigna Dental 1500 plan MD

What is not covered by this plan

Excluded services

Covered expenses do not include expenses incurred for:

• Procedures which are not included in the policy.

• Procedures which are not necessary and which do not have uniform

professional endorsement.

• Procedures for which a charge would not have been made in the absence

of coverage or for which the covered person is not legally required to pay.

• Any procedure, service, supply or appliance, the sole or primary purpose

of which relates to the change or maintenance of vertical dimension.

• Procedures, appliances or restorations whose main purpose is to diagnose

or treat dysfunction of the temporomandibular joint.

• The alteration or restoration of occlusion.

• The restoration of teeth which have been damaged by erosion, attrition

or abrasion.

• Bite registration or bite analysis.

• Any procedure, service or supply provided primarily for cosmetic purposes.

Facings, repairs to facings or replacement of facings on crowns or bridge

units on molar teeth shall always be considered cosmetic.

• The initial placement of a full denture or partial denture unless it includes

the replacement of a functioning natural tooth extracted while the person

is covered under this plan (the removal of only a permanent third molar

will not qualify a full or partial denture for benefit under this provision).

• The initial placement of a fixed bridge, unless it includes the replacement

of a functioning natural tooth extracted while the person is covered under

this plan. If a bridge replaces teeth that were missing prior to the date

the person’s coverage became effective and also teeth that are extracted

after the person’s effective date, benefits are payable only for the pontics

replacing those teeth which are extracted while the person was insured

under this plan. The removal of only a permanent third molar will not

qualify a fixed bridge for benefit under this provision.

• Replacement of teeth that are missing prior to coverage. In MD, payment

limitation no longer applies after 12 months of continuous coverage.

• The surgical placement of an implant body or framework of any type;

surgical procedures in anticipation of implant placement; any device,

index or surgical template guide used for implant surgery; treatment or

repair of an existing implant; prefabricated or custom implant abutments;

removal of an existing implant.

• Crowns, inlays, cast restorations or other laboratory-prepared restorations

on teeth unless the tooth cannot be restored with an amalgam or

composite resin filling due to major decay or fracture.

• Core build-ups.

• Replacement of a partial denture, full denture or fixed bridge or the

addition of teeth to a partial denture unless:

– Replacement occurs at least 84 consecutive months after the initial

date of insertion of the current full or partial denture; or

– The partial denture is less than 84 consecutive months old, and the

replacement is needed due to a necessary extraction of an additional

functioning natural tooth while the person is covered under this plan

(alternate benefits of adding a tooth to an existing appliance may be

applied); or

– Replacement occurs at least 84 consecutive months after the initial

date of insertion of an existing fixed bridge (if the prior bridge is

less than 84 consecutive months old, and replacement is needed

due to an additional necessary extraction of a functioning natural

tooth while the person is covered under this plan. Benefits will be

considered only for the pontic replacing the additionally extracted

tooth).

• The removal of only a permanent third molar , which will not qualify

an initial or replacement partial denture, full denture or fixed bridge for

benefits.

• The replacement of crowns, cast restoration, inlay, onlay or other

laboratory-prepared restorations within 84 consecutive months of the

date of insertion.

• The replacement of a bridge, crown, cast restoration, inlay, onlay or other

laboratory-prepared restoration regardless of age unless necessitated by

major decay or fracture of the underlying natural tooth.

• Any replacement of a bridge, crown or denture which is or can be made

usable according to common dental standards.

Plan Exclusions and Limitations

5. Brighter Score features may vary by dentist. These and other dentist directory features are for educational purposes only and should not be the sole basis for decision-making.

They are not a guarantee of the quality of care that will be provided to individual patients, and you should consider all relevant factors when selecting a dentist.

6. Download and use of the myCigna mobile app is subject to app terms and conditions and the online store from which it is downloaded. Standard mobile phone carrier and data

usage charges apply.

2. Data as of April 2023. Subject to change.

3. For each additional eligible dependent, as dened by the policy, added to a

primary policy, a 15% discount is applied to the standard rate. Discount is

applied in the quote tool.

4. Eligibility for waiting period waiver is on a per-person basis. Waiting periods for

Class II and III will be waived at the individual member level if the application

indicates that there were 12 months or more of prior dental coverage which

included coverage for Class III, Major Restorative Services, and not more than

63 days has lapsed between the prior coverage and this plan. Any prior dental

insurance plan that did not include Class III Services will not count toward

waiting period waiver. Class IV, Orthodontia, waiting period cannot be waived.

• Replacement of a partial denture or full denture which can be made

serviceable or is replaceable.

• Replacement of lost or stolen appliances.

• Replacement of teeth beyond the normal complement of 32.

• Prescription drugs.

•

Any procedure, service, supply or appliance used primarily for the

purpose of splinting.

• Athletic mouth guards.

•

Myofunctional therapy.

• Precision or semi-precision attachments.

•

Denture duplication.

• Separate charges for acid etch.

• Labial veneers (laminate).

• Porcelain or acrylic veneers of crowns or pontics on, or replacing, the

upper and lower first, second and third molars.

• Precious or semi-precious metals for crowns, bridges, pontics and

abutments; crowns and bridges other than stainless steel or resin for

participants under 16 years old.

•

Treatment of jaw fractures and orthognathic surgery.

• Orthodontic treatment, except for the treatment of cleft lip and cleft

palate. Exclusion does not apply if the plan otherwise covers services

for orthodontic treatment.

• Charges for sterilization of equipment, disposal of medical waste or

other requirements mandated by OSHA or other regulatory agencies

and infection control.

• Charges for travel time; transportation costs.

• Temporary, transitional or interim dental services.

• Any procedure, service or supply not reasonably expected to correct

the patient’s dental condition for a period of at least three years,

as determined by Cigna.

•

Diagnostic casts, diagnostic models or study models.

• Any charge for any treatment performed outside of the United States

other than for emergency treatment (any benefits for emergency

treatment which is performed outside of the United States will be limited

to a maximum of $100 per consecutive 12-month period).

• Oral hygiene and diet instruction; broken appointments; completion of

claim forms; personal supplies (water pick, toothbrush, floss holder);

duplication of X-rays and exams required by a third party.

• Any charges, including ancillary charges, made by a hospital,

ambulatory surgical center or similar facility.

• Services that are deemed to be medical services.

• Services for which benefits are not payable according to the

“General Limitations” section.

General Limitations

No payment will be made for expenses incurred for you or any one of

your dependents:

• For services not specifically listed as covered services in the policy.

• For services or supplies that are not dentally necessary.

• For services received before the effective date of coverage.

•

For services received after coverage under this policy ends.

•

For services for which you have no legal obligation to pay or for which no

charge would be made if you did not have dental insurance coverage.

• For professional services or supplies received or purchased directly or on

your behalf by anyone, including a dentist, from any of the following:

– Yourself or your employer.

– A person who lives in the insured person’s home or that person’s

employer.

– A person who is related to the insured person by blood, marriage or

adoption or that person’s employer.

•

For or in connection with an injury arising out of, or in the course of, any

employment for wage or profit.

• For or in connection with a sickness which is covered under any workers’

compensation or similar law.

• For charges made by a hospital owned or operated by or which provides

care or performs services for the United States government, if such

charges are directly related to a military-service-connected condition.

•

For services or supplies received as a result of dental disease, defect or

injury due to an act of war, declared or undeclared.

• To the extent that payment is unlawful where the person resides

when the expenses are incurred.

•

For charges which the person is not legally required to pay.

•

For charges which would not have been made if the person had

no insurance.

• To the extent that billed charges exceed the rate of reimbursement

as described in the schedule.

• For charges for unnecessary care, treatment or surgery.

• To the extent that you or any of your dependents are in any way paid or

entitled to payment for those expenses by or through a public program,

other than Medicaid.

• For or in connection with experimental procedures or treatment methods

not approved by the American Dental Association or the appropriate

dental specialty society.

• For procedures that are a covered expense under any other dental plan

which provides dental benefits.

• To the extent that benefits are paid or payable for those expenses under

the mandatory part of any auto insurance policy written to comply with

a “no-fault” insurance law or an uninsured motorist insurance law. Cigna

will take into account any adjustment option chosen under such part by

you or any one of your dependents.

Plan Exclusions and Limitations

All Cigna Healthcare products and services are provided exclusively by or through operating subsidiaries of The Cigna Group.

The Cigna Healthcare name, logo, and other Cigna marks are owned by Cigna Intellectual Property, Inc.

Not for use in New Mexico.

969361 5/23 © 2023 Cigna Healthcare.

Cigna Dental insurance coverage shall be only for the classes of service referred to in the Schedule of a purchased plan.

Dental plans are insured by Cigna Health and Life Insurance Company with network management services provided by Cigna Dental Health, Inc. Rates may vary based on age, family size, geographic location (residential zip code) and

plan design.

In MD, rates are subject to change upon 40 days’ prior notice. Dental plans apply waiting periods to covered basic (6 months), major (12 months) and orthodontic (12 months) dental care services. Some covered services are

determined by age: topical application of fluoride or sealant, space maintainers, and materials for crowns and bridges. If the plan covers replacement of teeth, there is no payment for replacement of teeth that are missing prior

to coverage. In MD, payment limitation no longer applies after 12 months of continuous coverage.

Notice to Buyer: This policy provides dental coverage only. Review your policy carefully.

Dental preferred-provider insurance policies MD: INDDENTPOLMD and MDINDSADOHIPAMND10-20 have exclusions, limitations, reduction of benefits and terms under which a policy may be continued in force ordiscontinued.

The policy may be cancelled by Cigna due to failure to pay premium, fraud, ineligibility, when the insured no longer lives in the service area, or if we cease to offer policies of this type or any individual dental plans in this state, in

accordance with applicable law. To cancel your policy, you must inform us in writing. Your policy will be cancelled on the first of the month following our receipt of your written notice. We reserve the right to modify this policy, including

policy provisions, benefits and coverages, consistent with state or federal law. This individual plan is renewable monthly or quarterly.

For costs and additional details about coverage, contact Cigna Health and Life Insurance Company at 900 Cottage Grove Rd, Hartford, CT 06152 or call 866.GET.Cigna (866.438.2446).

Please contact your insurance carrier, agent/producer or the Health Insurance Marketplace if you wish to purchase PPACA-compliant pediatric dental coverage.

Important Plan Disclosures