SWT-2017-9 JUNE 2017

E

LECTRIC

V

EHICLES IN THE

U.S.:

PROGRESS TOWARD BROADER ACCEPTANCE

B

RANDON

S

CHOETTLE

MICHAEL SIVAK

ELECTRIC VEHICLES IN THE U.S.:

PROGRESS TOWARD BROADER ACCEPTANCE

Brandon Schoettle

Michael Sivak

The University of Michigan

Transportation Research Institute

Ann Arbor, Michigan 48109-2150

U.S.A.

Report No. SWT-2017-9

June 2017

i

Technical Report Documentation Page

1. Report No.

SWT-2017-9

2. Government Accession No.

3. Recipient’s Catalog No.

4. Title and Subtitle

Electric Vehicles in the U.S.: Progress Toward Broader Acceptance

5. Report Date

June 2017

6. Performing Organization Code

383818

7. Author(s)

Brandon Schoettle and Michael Sivak

8. Performing Organization Report

No.

SWT-2017-9

9. Performing Organization Name and Address

The University of Michigan

Transportation Research Institute

2901 Baxter Road

Ann Arbor, Michigan 48109-2150 U.S.A.

10. Work Unit no. (TRAIS)

11. Contract or Grant No.

12. Sponsoring Agency Name and Address

The University of Michigan

Sustainable Worldwide Transportation

13. Type of Report and Period

Covered

14. Sponsoring Agency Code

15. Supplementary Notes

Information about Sustainable Worldwide Transportation is available at

http://www.umich.edu/~umtriswt.

16. Abstract

This report examines

the current status and recent progress regarding various technical and

public acceptance-related issues that have historically

hindered the more widespread

acceptance and adoption of plug-in electric vehicles (PEVs), which includes both battery

electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV)

. As a reference for

comparison, information for current gasoline-

powered internal combustion engines is also

presented where appropriate.

The main issues explored in this report include:

• vehicle availability, including sales trends and costs

• fuel economy, GHG emissions, and petroleum usage

• batteries, charging time, driving range, and range anxiety

• charging infrastructure availability and smart charging

• public opinion and government support

Overall, recent advances and improvements in several of these areas have led to PEVs

becoming increasingly more competitive with conventional gasoline-

powered internal

combustion engine (ICE) vehicles. Furthermore, future costs of the vehicles an

d fuel, coupled

with rising public interest

and increasing numbers of charging locations, are expected to make

such vehicles even more capable of replacing ICE vehicles for the majority of U.S. drivers in

the relatively near future.

17. Key Words

plug-in electric vehicle, PEV, battery electric vehicle, BEV, plug-in

hybrid electric vehicle, PHEV, greenhouse gases, internal combustion

engine, batteries, energy density

18. Distribution Statement

Unlimited

19. Security Classification (of this report)

None

20. Security Classification (of this page)

None

21. No. of Pages

43

22. Price

ii

Abbreviations used in this report

Abbreviation

Definition

AC

alternating current

ANL

Argonne National Laboratory

BEV

battery electric vehicle

Btu

British thermal units

CAFE

corporate average fuel economy

CD

charge depleting

CO

2

carbon dioxide

CS

charge sustaining

DC

direct current

EV

electric vehicle (any type)

EVSE

electric vehicle supply equipment

g

gram

gal

U.S. gallon

GGE

gasoline gallon equivalent

GHG

greenhouse gas

hr

hour

ICE

internal combustion engine

kg

kilogram

km

kilometer

kWh

kilowatt-hour

L

liter

lb

pound

mi

mile

min

minute

mpg

miles per U.S. gallon

mpge

miles per U.S. gallon equivalent

PEV

plug-in electric vehicle

PHEV

plug-in hybrid electric vehicle

quad

quadrillion Btu

V2G

vehicle-to-grid

V

volt

VMT

vehicle miles of travel

Wh

watt-hour

ZEV

zero-emission vehicle

iii

Contents

Introduction ..........................................................................................................................1

Vehicles ................................................................................................................................4

Vehicle availability and sales trends ...............................................................................4

Vehicle prices ..................................................................................................................7

Vehicle fuel economy .....................................................................................................8

Well-to-wheels GHG emissions and petroleum usage ...................................................9

Driving range, charging time, and range anxiety ..........................................................11

Energy density and battery cost ....................................................................................14

Summary of key vehicle-specific aspects of BEVs and PHEVs ...................................15

Charging infrastructure ......................................................................................................17

Current and future availability ......................................................................................17

Fuel pricing trends and effective cost per mile .............................................................21

Fuel production and renewable power sources .............................................................24

Smart or intelligent charging .........................................................................................25

V2G (vehicle-to-grid) technology .................................................................................26

Summary of key aspects of fuel sources and related refueling infrastructure ..............27

Public opinion regarding PEVs ..........................................................................................28

Government support ...........................................................................................................29

Key Findings ......................................................................................................................31

Summary ............................................................................................................................34

References ..........................................................................................................................35

1

Introduction

Currently, electricity accounts for just 0.1% of all transportation-related energy

consumption in the U.S., while 92% of transportation-related energy consumption is still derived

from petroleum (0.03 and 25.7, respectively, out of a total 27.9 quads

1

consumed for

transportation) (LLNL/DOE, 2017). However, in recent years, sales of plug-in electric vehicles

(PEVs)—both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs)—

have begun to accelerate, with sales of each vehicle type increasing by more than 700% since

2011 (AFDC, 2017g). This rapid increase in sales for these relatively new (and still evolving)

vehicle technologies was due in part to the need for automobile manufacturers to begin to meet

the increasingly stringent requirements to lower CO

2

and other greenhouse gas (GHG) emissions

(and the corresponding performance gains in fuel economy) to help comply with current and

future CAFE standards.

2

Zero-emission vehicles (ZEVs) such as BEVs have played an

important role in recent years to help manufacturers achieve their CAFE targets; California and

several other states have recently required the sale of such vehicles (Carley, Duncan, Esposito,

Graham, Siddiki, and Zirogiannis, 2016).

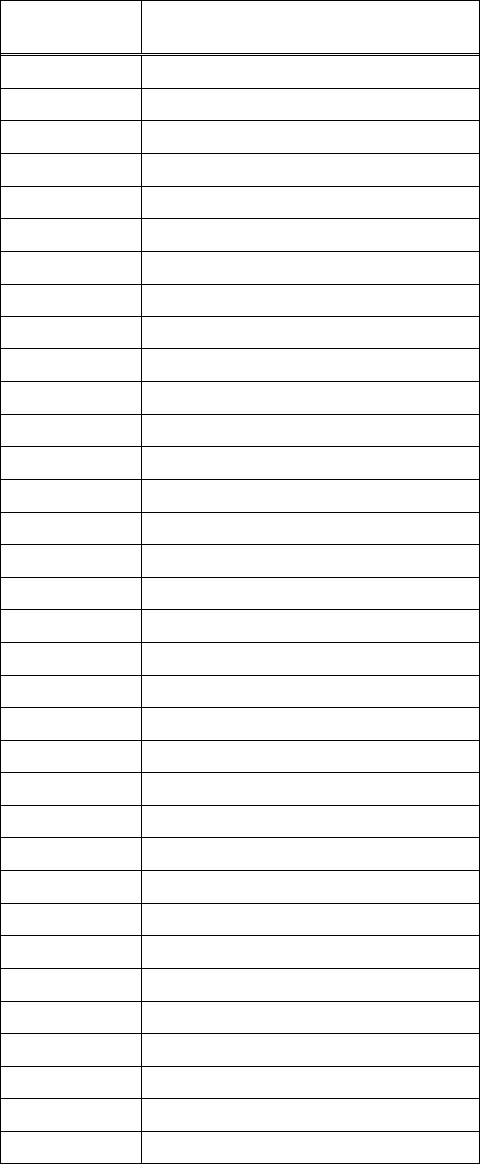

Battery electric vehicles (BEVs) operate entirely on electricity stored in on-board battery

systems that are charged from the main electrical grid, usually via a special high-voltage

charging station and using special electrical connectors. Plug-in hybrid electric vehicles

(PHEVs) can also operate on electricity stored in on-board battery systems that are charged from

the main electrical grid or by an internal combustion engine (ICE), but with the option of

switching to the internal combustion engine for power when the battery runs low. Example

illustrations of the key differentiating components for each vehicle type are shown in Figure 1

(AFDC, 2017e, 2017f). The advantage offered by PEVs over conventional ICE vehicles is their

ability to operate on little to no petroleum (depending on the vehicle design and operating mode).

Correspondingly, little to no CO

2

emissions are associated with such vehicles when calculating

CAFE compliance.

1

One quad (one quadrillion Btu) is equal to approximately 8 billion U.S. gallons of gasoline or 293 billion kWh of

electricity.

2

In March of 2017, the EPA and NHTSA officially announced that the midterm review of CAFE targets for model

years 2022-2025 would be re-reviewed (EPA/NHTSA, 2017), reversing the decision to confirm the targets set by the

previous administration (EPA, 2017c). Therefore, it is possible that the CAFE targets for 2022-2025 could be

altered or eliminated during the upcoming midterm re-review.

2

Figure 1. Illustrations of the key differentiating components for all-electric vehicles (called

battery electric vehicles, or BEVs, in this report) and plug-in hybrid electric vehicles (PHEVs)

(AFDC, 2017e, 2017f).

All-Electric / Battery Electric Vehicle (BEV)

Plug-in Hybrid Electric Vehicle (PHEV)

3

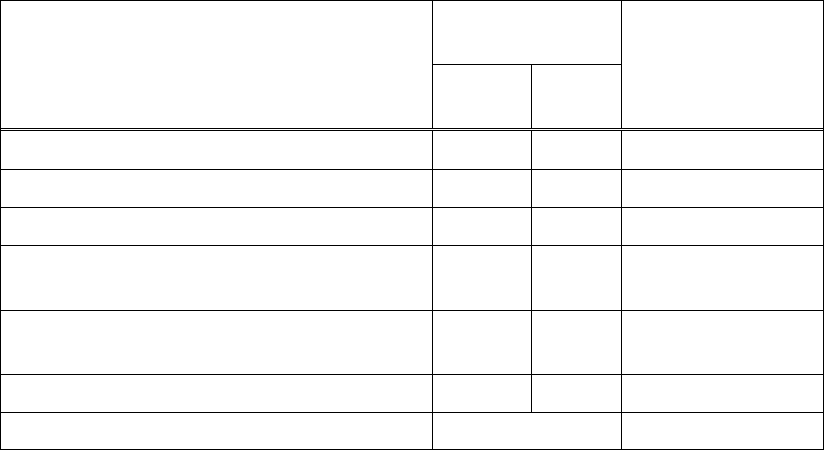

The main advantages and disadvantages of each PEV type are listed below in Table 1

(EEA, 2016).

Table 1

Main advantages and disadvantages of each PEV type over

conventional ICE vehicles (EEA, 2016).

Vehicle type Advantages Disadvantages

BEV

• Higher fuel efficiency

• Lower fuel cost

• Home/workplace recharging

• Low engine noise

• Zero tailpipe emissions (ZEV)

• Higher vehicle price

• Fewer recharging stations

• Long recharge times

• Short driving range

• Eventual battery disposal

PHEV

• Higher fuel efficiency

• Lower fuel cost (for electricity)

• Home/workplace recharging

•

Many refueling stations (for gas)

• Higher vehicle price

• Technologically complex

• Semi-long recharge times

•

Eventual battery disposal

The current state of the major barriers that have hindered the large-scale adoption of

PEVs by consumers thus far—driving range, charging time, and vehicle price—will be examined

and discussed, and comparisons of electric vehicles relative to gasoline-powered vehicles and

other available vehicle types will be presented where applicable. As a reference for comparing

the current state of PEVs, information for current ICE vehicles and gasoline as a fuel will also be

presented.

4

Vehicles

Vehicle availability and sales trends

BEVs have been generally been available for sale to the public in the U.S. since 2008,

with the majority of models being introduced within the past six years. For model year 2017, 14

unique models of BEV are offered for sale by 13 different automobile manufacturers (EPA,

2017a). Table 2 shows the recent history of BEV availability by manufacturer and model year.

In total, 19 automobile manufacturers have offered 86 models (by company and model year) of

BEVs for sale in the U.S. since model year 2008.

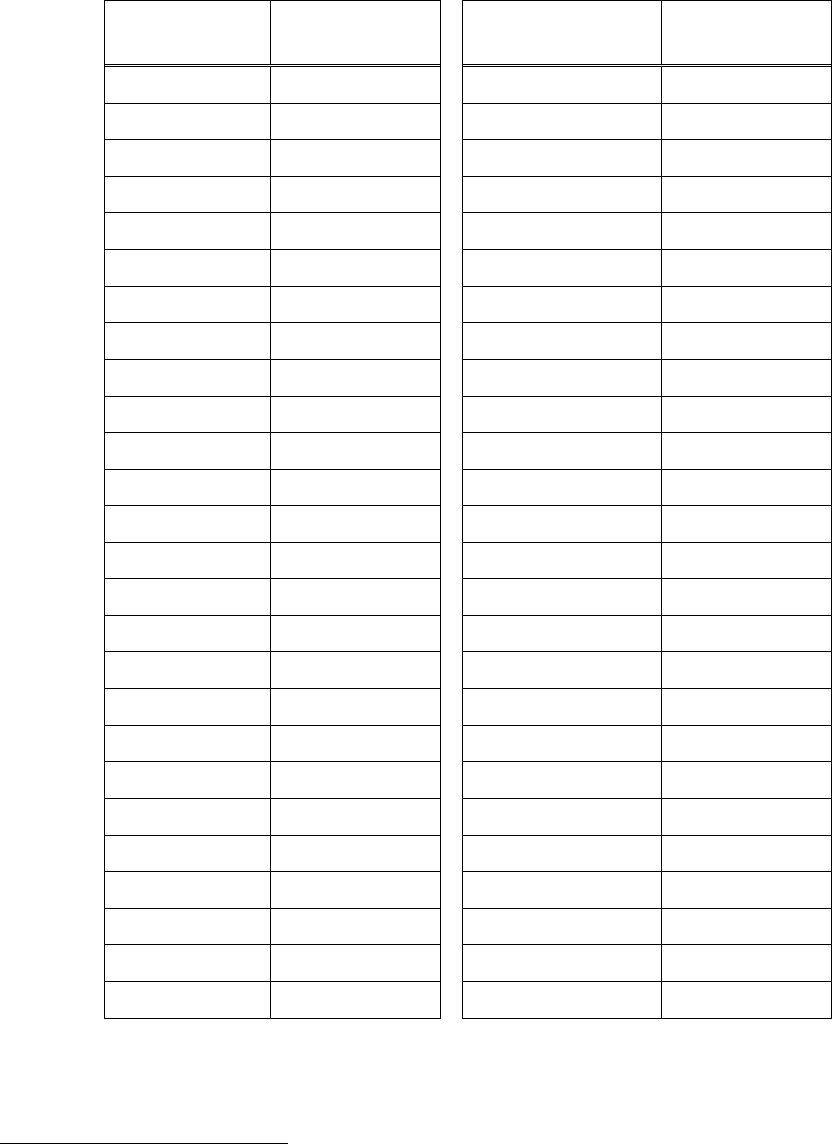

Table 2

Number of individual models of battery electric vehicles (BEVs) available in the U.S.,

by company and model year (EPA, 2017a).

Company

Model year

Total

2011

2012

2013

2014

2015

2016

2017

BMW

1

1

1

2

5

Chevrolet

1

1

1

1

4

Coda Automotive

1

1

2

Fiat

1

1

1

1

1

5

Ford

1

2

1

1

1

1

1

8

Honda

1

1

1

3

Hyundai

1

1

Kia

1

1

1

3

Mercedes-Benz

1

1

1

1

4

Mitsubishi

1

1

1

1

1

1

6

Nissan

2

1

1

1

1

1

1

8

Scion

1

1

2

Smart

1

1

1

1

1

5

Tesla

1

1

1

1

1

4

11

20

Toyota

1

1

1

3

Volkswagen

1

1

1

3

Total

4

8

10

13

11

13

23

82

PHEVs became available to the general public in the U.S. starting in 2011, with the

majority of models being introduced within the past four years. For model year 2017, 22 unique

models of PHEVs are offered for sale by 12 different automobile manufacturers (EPA, 2017a).

5

Table 3 shows the recent history of PHEV availability by manufacturer and model year (from

2011 through 2017). In total, 13 automobile manufacturers have offered 69 models (by company

and model year) of PHEVs for sale in the U.S. since model year 2011.

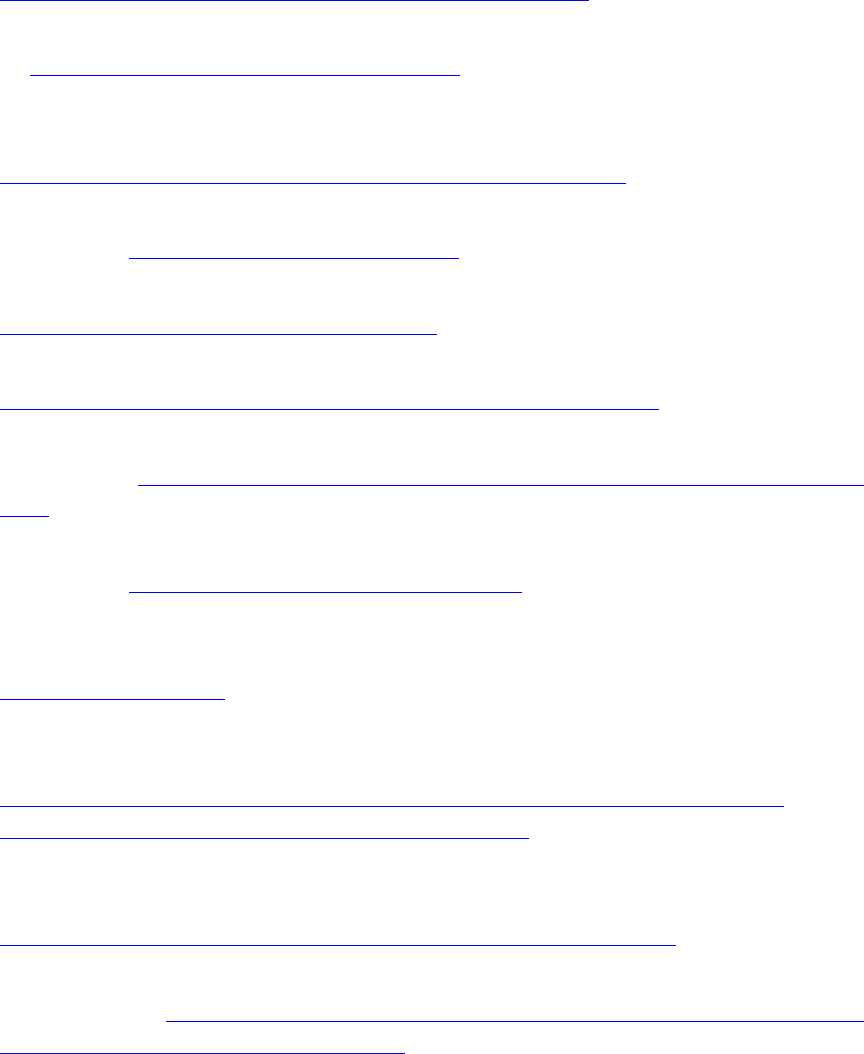

Table 3

Number of individual models of plug-in hybrid electric vehicles (PHEVs) available in the U.S.,

by company and model year (EPA, 2017a).

Company

Model year

Total

2011

2012

2013

2014

2015

2016

2017

Audi

1

1

1

3

BMW

2

2

3

4

11

Cadillac

1

1

1

1

4

Chevrolet

1

1

1

1

1

1

1

7

Chrysler

1

1

Ford

2

2

2

2

2

10

Honda

1

1

2

Hyundai

2

2

Kia

1

1

Mercedes-Benz

1

2

3

6

Porsche

1

3

2

4

10

Toyota

1

1

1

1

1

1

6

Volvo

1

2

3

Total

1

2

4

9

13

14

23

66

While there have historically been more BEV models available from more individual

companies than PHEVs (82 versus 66, respectively), there are currently equal numbers of BEV

and PHEV models available for model year 2017 (23 for both). Companies that offer both

vehicle types tend to have more models of PHEVs available than BEVs.

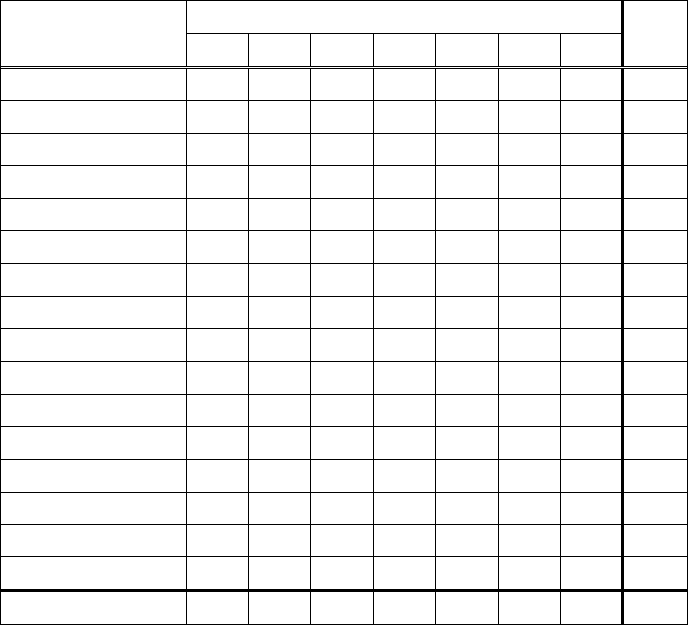

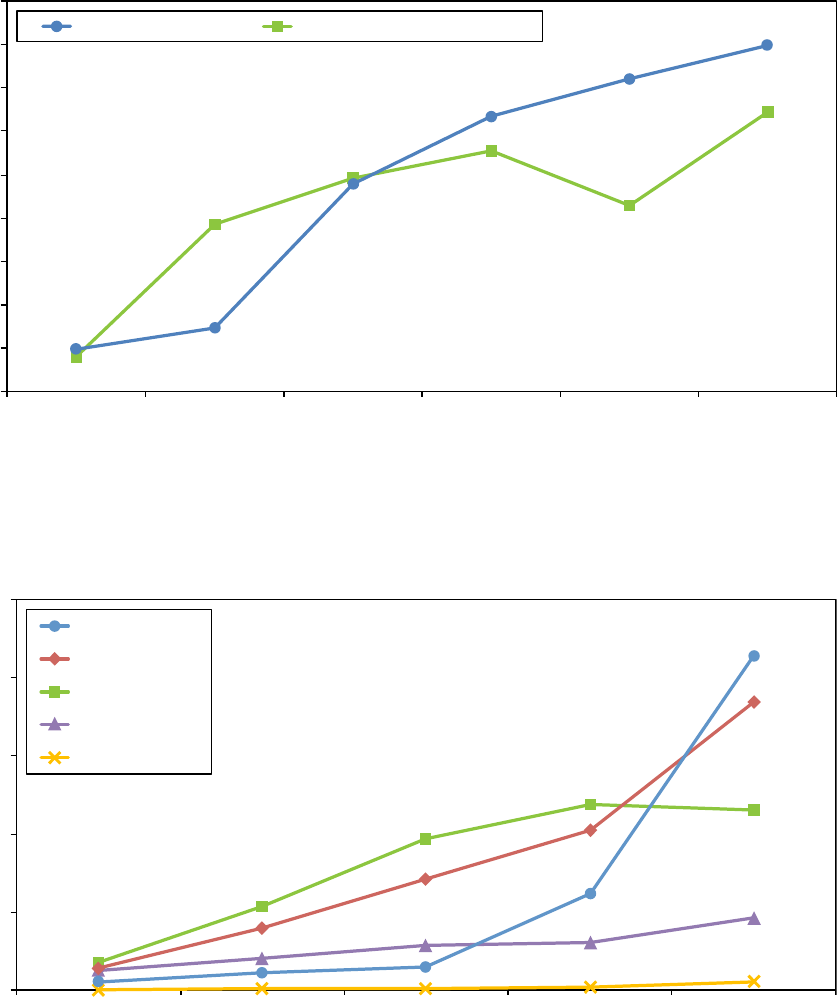

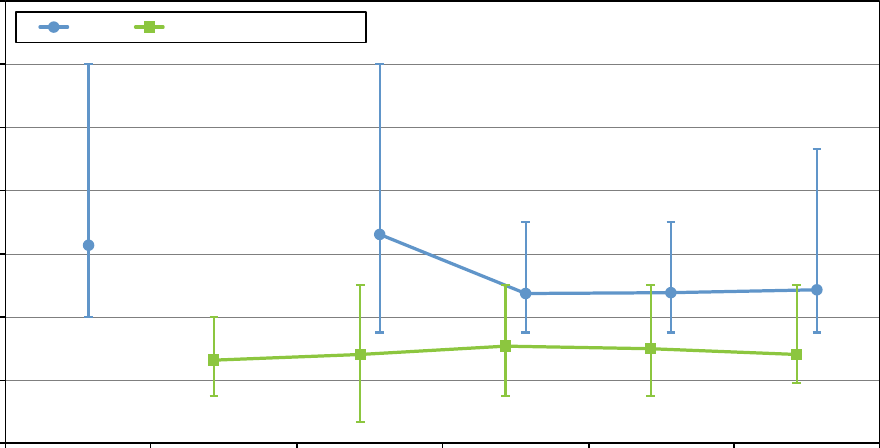

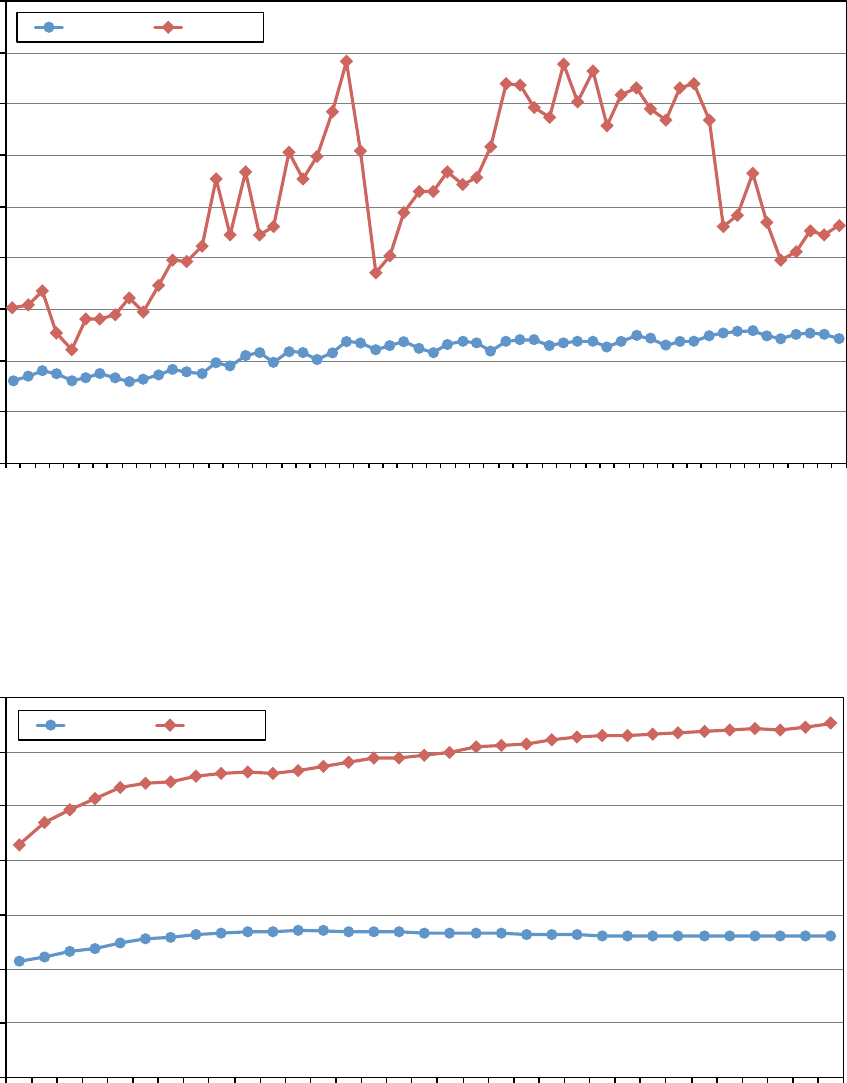

Figure 2 illustrates the recent sales trends for both vehicle types. Figure 3 shows the

international PEV sales trends for recent years in several major automotive markets (accounting

for approximately 95% of global PEV sales) (DOE, 2016a). Both figures show the rapid

increase in sales of PEVs in recent years, especially for China and Western Europe.

6

Figure 2. Sales trends for battery electric vehicles (BEV) and plug-in hybrid electric vehicles

(PHEV) from 2011 to 2016 (AFDC, 2017g).

Figure 3. International sales trends for plug-in electric vehicles (PEVs) from 2011 to 2015

(DOE, 2016a).

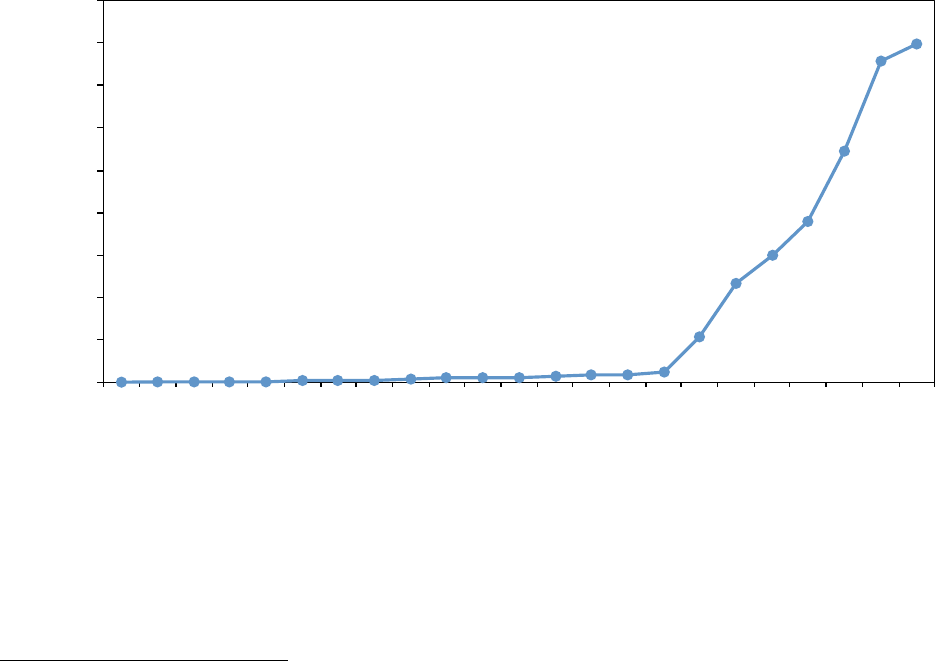

In keeping with these trends, sales of PEVs are expected to continue climbing in the

coming years. An analysis by the U.S. Energy Information Administration (EIA) projects that

BEV sales in the U.S. will significantly surpass PHEV sales, totalling approximately twice the

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

2011 2012 2013 2014 2015 2016

Total annual U.S. sales

Year

Battery electric (BEV) Plug-in hybrid electric (PHEV)

0

50,000

100,000

150,000

200,000

250,000

2011 2012 2013 2014 2015

Total annual PEV sales

Year

China

Western Europe

United States

Japan

Canada

7

volume of BEVs as PHEVs by 2050 (EIA, 2017b). (However, a recent study by Axsen and

Kurani [2013] suggests that more initial success may be achieved in gaining market share

through the sale of small-battery PHEVs rather than BEVs. This pattern has already been

observed in Europe, with PHEVs outselling BEVs by a wide margin [EEA, 2016].) By 2025, the

EIA analysis estimates that electric vehicle sales will make up about 9% of all light-duty vehicle

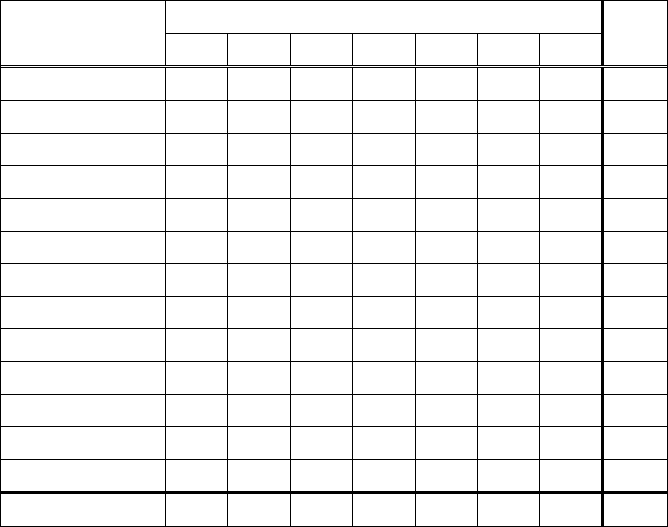

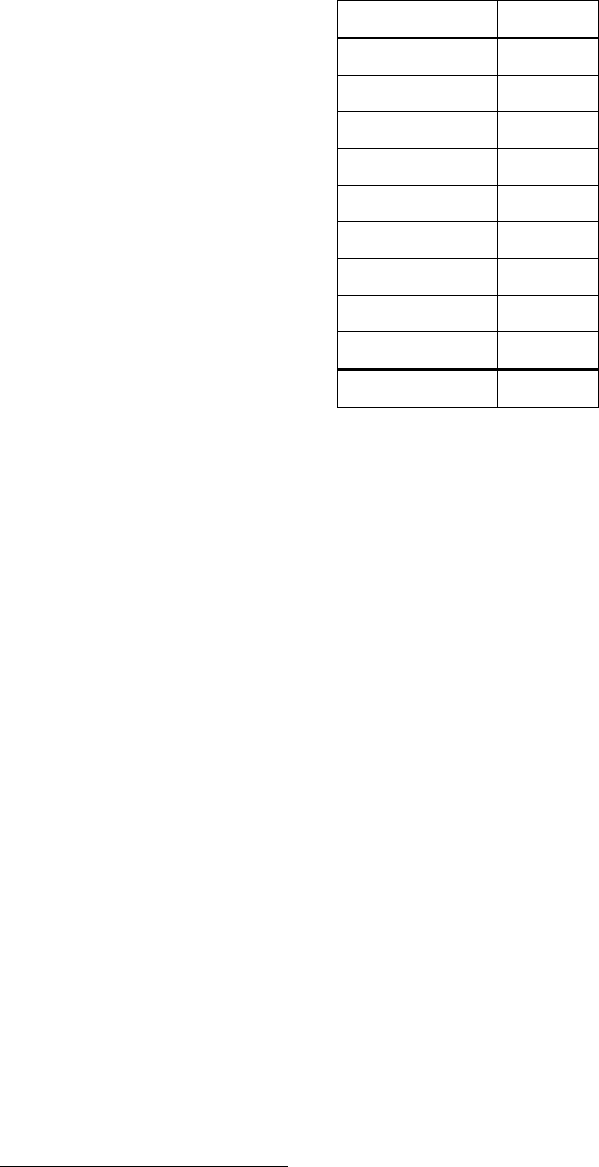

sales. Figure 4 shows the projected sales estimates for BEVs and PHEVs from 2018 to 2050

(EIA, 2017b).

Figure 4. Projected sales estimates for BEVs and PHEVs in the U.S., 2018 to 2050 (EIA,

2017b).

Vehicle prices

The cost of PEVs has historically been higher, mostly due to the cost of developing the

advanced technology and manufacturing required for such vehicles and their batteries (Wolfram

and Lutsey, 2016). However, the median cost

3

of PEVs relative to the average cost of all new

vehicles have slowly dropped, and for model year 2017, the differential between median vehicle

costs was less than $10,000. A comparison of median new vehicle costs in the U.S. for the 2017

3

The PEV costs discussed here have not been reduced by any of the available state or federal incentives, including

the $7,500 (maximum) federal tax credit. Therefore, the actual cost of purchasing a PEV would likely be lower than

the costs discussed here after including all available incentives.

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

2018 2020 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 2048 2050

Total annual U.S. sales (projected)

Year

Battery electric (BEV) Plug-in hybrid electric (PHEV)

8

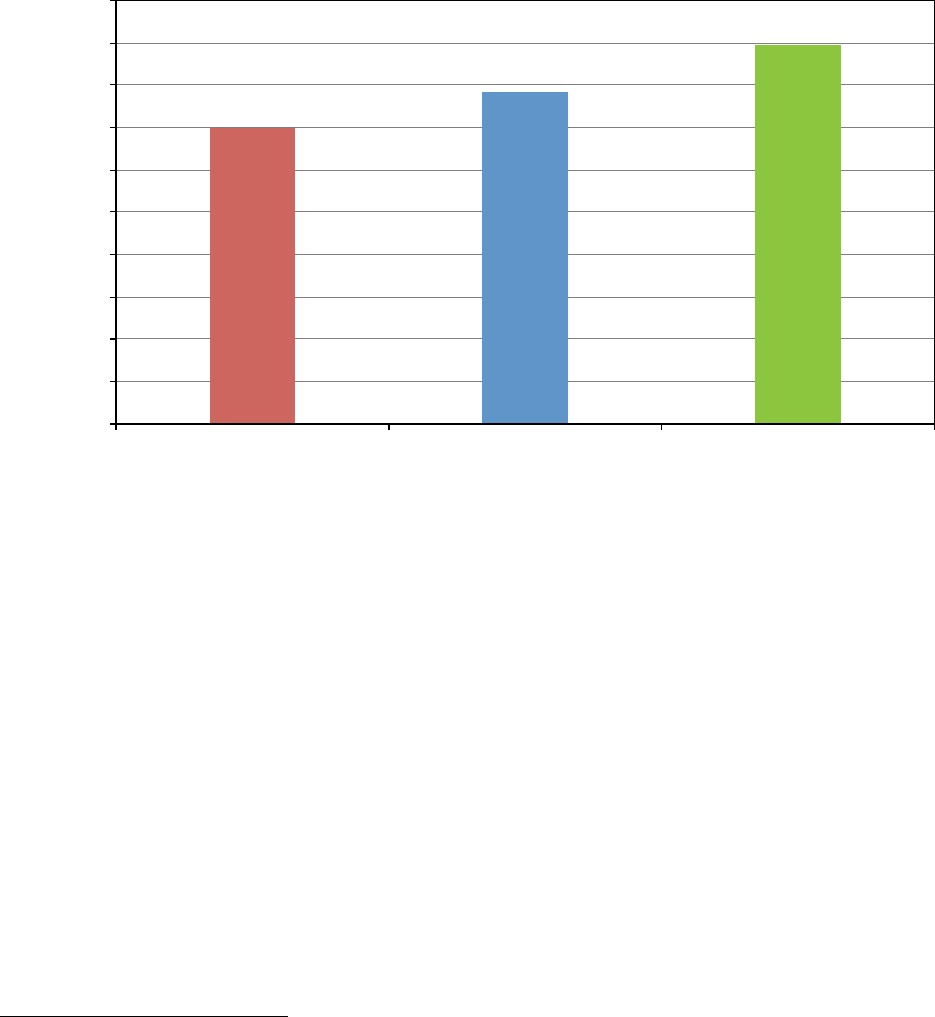

model year for each vehicle type is shown in Figure 5. The prices of PEVs are expected to

become comparable to prices for the average ICE vehicle in the next several years, especially in

Europe (Forbes, 2017; Wolfram and Lutsey, 2016).

Figure 5. Median new vehicle prices for model year 2017 in the U.S., by vehicle type

(Automotive News, 2016; Green Car Reports, 2017a, 2017b).

Vehicle fuel economy

The average fuel economy

4

of modern BEVs has always been substantially better than

comparable conventional ICE vehicles. Compared to the average fuel economy of 22.8 mpg for

current ICE vehicles,

5

the average available fuel economy of BEVs is more than 4.5 times

higher, averaging 103.0 mpge (miles-per-gallon equivalent). Furthermore, the range of

minimum and maximum fuel economies for each vehicle type do not overlap; ICE vehicles range

from 11 to 39 mpg, and BEVs from 72 to 136 mpge.

When operating in charge-sustaining (CS) mode with only gasoline being consumed,

PHEV efficiency performance averages 33.8 mpge, falling slightly above that of ICEs, but well

4

Fuel economy of electric vehicles is expressed in miles-per-gallon-equivalent (mpge). The calculation of mpge is

based on the equivalent mpg that would be required for a gasoline-powered ICE to emit the same level of GHGs,

based on the average amount of GHGs emitted to generate each unit of electric energy (e.g., kWh).

5

Average (non-sales-weighted) combined city/highway window sticker values for model year 2017 (EPA, 2017a).

$35,000

$39,160

$44,795

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

$45,000

$50,000

All new vehicles BEV PHEV

Vehicle price

Vehicle type

Model year 2017

9

below BEVs; when operating in charge-depleting (CD) mode, these vehicles average 80.1 mpge,

slightly below most BEVs. Argonne National Laboratory estimates that PHEVs are operated

approximately 50% of the time in each mode (ANL, 2015). A comparison of fuel-economy

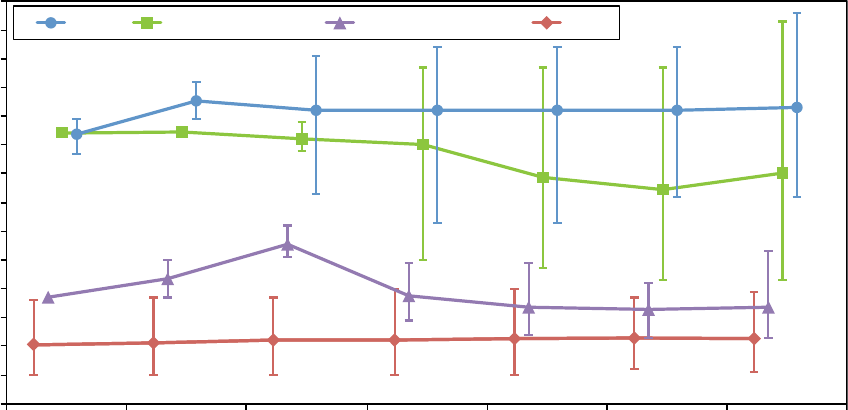

trends by model year for each vehicle type is shown in Figure 6.

Figure 6. A comparison of fuel-economy trends (combined city/highway window-sticker value

[EPA, 2017a]) by model year for each vehicle type. The symbols mark the average fuel-

economy value for each vehicle type, while the ranges represent the minimum and maximum

fuel-economy values. The graphs for the different vehicle types within each model year have

been staggered to help illustrate any overlap between each set of fuel economy values.

Well-to-wheels GHG emissions and petroleum usage

The following well-to-wheels calculations use the GREET model (Greenhouse gases,

Regulated Emissions, and Energy use in Transportation; 2015 release) developed by Argonne

National Laboratory for model year 2015 passenger cars to calculate GHG emissions and

petroleum usage during vehicle operation (ANL, 2015). Well-to-wheels calculations estimate

the GHG emissions resulting from: (1) the production and delivery (well-to-pump), and (2) the

final consumption (pump-to-wheels) of a particular fuel or energy source. As such, well-to-

wheel results do not include GHG emissions or petroleum usage during the vehicle

BEV

20.5

21.1

22.0 22.0

22.6

22.9

22.8

37.0

43.5

55.5

37.4

33.5

32.8

33.8

0.0

10.0

20.0

30.0

40.0

50.0

60.0

70.0

80.0

90.0

100.0

110.0

120.0

130.0

140.0

2011 2012 2013 2014 2015 2016 2017

Fuel economy (mpg or mpge)

Model year

PHEV: electric PHEV: gasoline ICE

74.4

94.0

94.5

92.3

90.1

78.7

80.1

93.8

105.3

102.2

102.0 102.0

102.3

103.0

10

manufacturing process. A comparison of well-to-wheels GHG emissions and petroleum usage

for each vehicle type is shown in Figure 7.

Notes: ICE = gasoline-powered, spark-ignited ICE

ICE-DI = gasoline-powered, spark-ignited ICE with direct fuel injection

FCV-Liq = fuel-cell vehicle using liquid hydrogen

FCV-Gas = fuel-cell vehicle using gaseous hydrogen

PHEV10 = PHEV capable of at least 10 miles on battery power alone

PHEV40 = PHEV capable of at least 40 miles on battery power alone

Figure 7. A comparison of well-to-wheels GHG emissions and petroleum usage for each vehicle

type based on the GREET model (ANL, 2015). For comparison, two types of PHEV are

modeled. Results for fuel-cell vehicles (FCVs) have also been included to show the relative

performance of both nonhydrocarbon-based alternative-fuel-powered vehicles that are available

to the public (i.e., electricity and hydrogen).

Based on the average mix of renewable and nonrenewable electric power sources in the

U.S.,

6,7

the average well-to-wheels GHG emissions for BEVs is the lowest, at 214 g/mi. The

corresponding values for two different PHEV implementations—PHEV10 and PHEV40—range

6

The implications of this average mix of electric power sources is discussed in the Fuel production and renewable

power sources subsection on pages 23-24 of this report.

7

Well-to-wheel GHG emissions and petroleum usage by BEVs occurs almost entirely during the well-to-pump stage

(i.e., electricity generation and transmission), with no GHG emissions occurring at the vehicle (i.e., pump-to-

wheels), and negligible petroleum usage at the vehicle for lubrication, etc.

409 g/mi

356 g/mi

364 g/mi

260 g/mi

278 g/mi

253 g/mi

214 g/mi

4359 Btu/mi

3791Btu/mi

67 Btu/mi

27 Btu/mi

2588 Btu/mi

1588 Btu/mi

54 Btu/mi

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

0

50

100

150

200

250

300

350

400

450

ICE ICE-DI FCV-Liq FCV-Gas PHEV10 PHEV40 BEV

Well-to-wheels petroleum usage (Btu/mi)

Well-to-wheels greenhouse gas (GHG) emissions (g/mi)

Vehicle type

GHG

Petroleum

11

from 253 to 278 g/mi, respectively. Gasoline-powered vehicles produce the most GHGs per

mile, ranging from 356 to 409 g/mi, depending on the specific type of ICE (direct fuel injection

versus conventional port fuel injection, respectively). The results of this GREET model indicate

that a typical BEV emits approximately half the amount of GHGs as a typical fuel-injected ICE.

A study by the European Environment Agency (EEA, 2016) estimates that BEV GHG emissions

could be reduced by a factor of 10 if completely renewable power sources were used.

When total well-to-wheels petroleum usage is compared (in British thermal units [Btu]),

there are also significant improvements for both PEV types versus conventional ICE vehicles.

For example, BEVs use the least amount of petroleum at 54 Btu/mi, with a typical PHEV40

vehicle model ranking the second lowest in usage at 1588 Btu/mi, and a typical PHEV10 vehicle

model using the third lowest amount at 2588 Btu/mi. Predictably, gasoline-powered vehicles use

considerably more petroleum per mile, with direct fuel injection ICEs averaging 3791 Btu/mi

and traditional fuel-injection ICEs averaging 4359 Btu/mi. While the PHEV40 consumes 29

times the amount of petroleum a typical BEV consumes, a typical fuel-injected ICE still

consumes nearly 3 times the amount of petroleum as a PHEV40 (and around 80 times as much as

a BEV). Future development of PHEV models with longer electric-only ranges will further

improve the overall PEV emissions and petroleum-consumption advantages over ICEs, while

also narrowing the gap between BEV and PHEV electric-only driving ranges and efficiency.

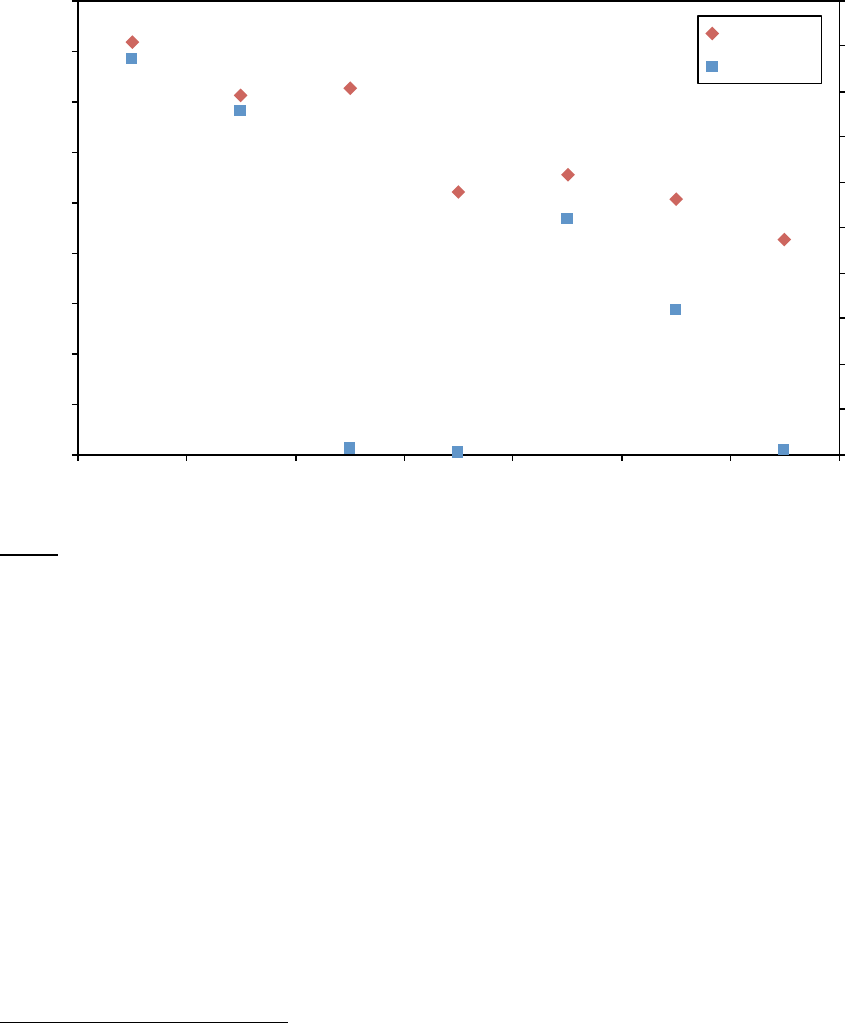

Driving range, charging time, and range anxiety

The average driving range of current BEVs is less than half that of PHEVs operating in

combined gasoline and electric mode (187 miles versus 462 miles, respectively) (EPA, 2017a).

However, BEVs significantly outdistance the range of current PHEVs operating in electric-only

mode (i.e., charge depleting), achieving more than 7 times the range on average (187 miles

versus 26 miles, respectively) (EPA, 2017a). Figure 8 shows the average driving ranges of each

vehicle type and operating mode, as well as the range of minimum and maximum distances, for

each recent model year. While the combined gas and electric ranges of PHEVs tend to be much

greater than BEVs, in recent years the BEV with the longest outperforms the PHEV with the

overall shortest range by a large margin (335 miles versus 180 miles, respectively); conversely,

the PHEV with the longest range when operating in electric-only mode can now outdistance the

BEV with the lowest range by 38 miles (97 miles versus 59 miles, respectively).

12

Figure 8. A comparison of average driving distances by model year for each vehicle type and

(for PHEV) operating mode. The symbols mark the average driving range for each vehicle type

and driving mode, while the ranges represent the minimum and maximum driving ranges (EPA,

2017a). The graphs for the different vehicle types within each model year have been staggered

to help illustrate any overlap between each set of driving ranges.

For a discussion of the current challenges related to charging time versus driving range,

see Schoettle and Sivak (2016). As described in SAE (2011), charging performance approaching

that of DC Level 3 (<10 min to charge to 80%) would generally alleviate the limitations (in

terms of both performance and public acceptance) imposed by long charging times for BEVs

relative to most other vehicle/fuel combinations. However, charge times for recent models of

BEVs and PHEVs have converged somewhat, with BEV charge times improving to just under

double the required charging time for a PHEV (4.8 hours versus 2.8 hours, respectively).

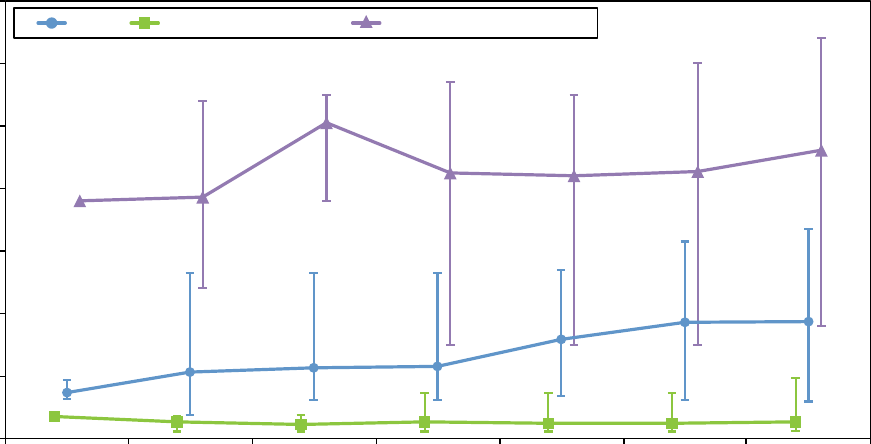

Figure 9 shows the recent trends for charging times by vehicle type. While BEVs require

approximately twice as much charging time, on average they are capable of more than seven

times the driving range of PHEVs, as previously illustrated in Figure 8 (187 miles versus 26

miles, respectively). Furthermore, the slowest charging PHEV (5 hours) now requires about the

same amount of time as the average BEV (4.8 hours), and the best BEV (3.5 hours) is

approaching the charge time of the average PHEV (2.8 hours).

380

387

505

425

419

426

462

73

106

113

115

157

185

187

35

26

22

26

24

24

26

0

100

200

300

400

500

600

700

2011 2012 2013 2014 2015 2016 2017

Driving range (miles)

Year

BEV PHEV: electric only PHEV: gas + electric

13

Figure 9. A comparison of average charging times (in hours @ 240V) by model year for each

vehicle type. The symbols mark the average charging time for each vehicle type, while the

ranges represent the minimum and maximum charging times (EPA, 2017a). The graphs for the

different vehicle types within each model year have been staggered to help illustrate any overlap

between each set of charging times. Data were not available for years with missing values.

Recent improvements in range and charging times for both vehicle types move closer to

wider acceptance based on the ability to satisfy the daily driving requirements of most drivers

while lessening the overall range anxiety that plagued PEVs (particularly BEVs) when first

introduced. Two separate studies concluded that the current performance (or expected near

future performance) of BEVs and PHEVs is now more capable of meeting the daily travel needs

(based on daily vehicle miles of travel [VMT]) of a majority of U.S. drivers. FHWA estimates

that BEVs with a range of at least 120 miles would be able to cover 99% of all household vehicle

trips (FHWA, 2016). An analysis conducted by Argonne National Laboratory (Elgowainy, Han,

Poch, Wang, Vyas, Mahalik, and Rousseau, 2010) estimated that a PHEV with an all-electric

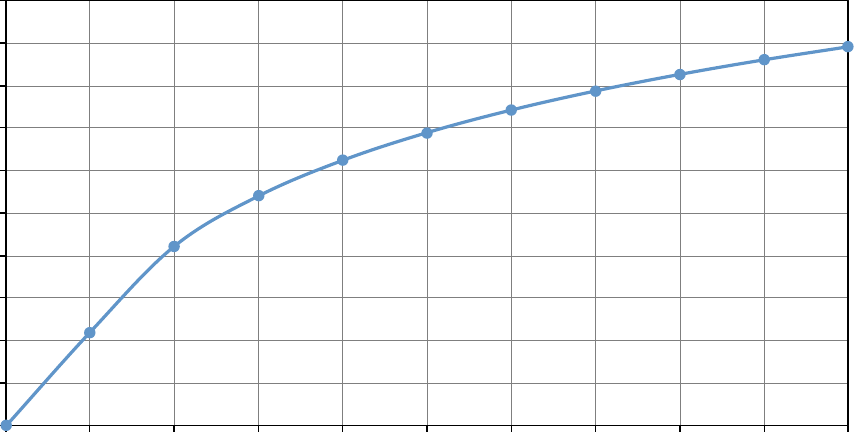

range of 30 miles (PHEV30) would be able to replace more than half (54%) of all daily VMT for

trips by U.S. drivers operating on battery power only (i.e., charge depleting or CD mode). Figure

10 reproduces Figure 3.8 (based on data in Table 3.4) from that report, showing the model

developed by ANL and the corresponding percentages of daily VMT in the U.S. that could be

replaced with PHEVs operating in CD mode, based on various PHEV driving ranges in CD

6.3

6.6

4.7 4.8

4.8

0

2

4

6

8

10

12

14

2012 2013 2014 2015 2016 2017

Charging time (hours)

Year

BEV PHEV (battery only)

2.6

2.8

3.1

3.0

2.8

14

mode. Based on the ANL analysis, a PHEV40 would be capable of replacing around 62% of

daily VMT in the U.S., while a PHEV100 would be able to replace around 89% of daily VMT.

Figure 10. Percentage of daily VMT available for replacement by a PHEV in CD mode

(reproduced from Elgowainy et al., 2010).

Energy density and battery cost

Current automotive lithium-ion battery packs contain approximately 1.1 MJ/L (300

Wh/L) (OECD/IEA, 2016), or 1/32 the volumetric energy density of a similar volume of liquid

gasoline. The energy per mass (i.e., gravimetric density or specific energy) of relatively heavy

batteries remains at approximately 0.5 MJ/kg (150 Wh/kg) (DOE, 2013; Young, Wang, Wang,

and Strunz, 2013), compared with 44 MJ/kg for gasoline, which translates to 88 times less

energy density by mass than gasoline. However, achieving equal energy density may not be

required, as several estimates suggest that achieving 350 Wh/kg or better (still more than 30

times less energy dense than gasoline) would enable BEVs to generally replace gasoline-

powered ICE vehicles for most U.S. drivers (DOE, 2013; Nature, 2015). One study estimates

that the ability of batteries to equal gasoline performance as an energy source may occur as soon

as 2045, primarily due to future powertrains with greater efficiency and less mass than

comparable ICE vehicles (Vijayagopal, Gallagher, Lee, and Rousseau, 2016).

0

10

20

30

40

50

60

70

80

90

100

0 10 20 30 40 50 60 70 80 90 100

Percent of daily VMT in CD mode

Driving range in CD mode

22%

42%

54%

62%

75%

69%

79%

83%

86%

89%

15

Matching the rapid increase in battery energy density has been the rapid decrease in

battery cost. Battery cost ($/kWh) dropped by 80% over six years, to around $250/kWh in 2015,

and then to approximately $200/kWh by 2016 (McKinsey, 2017; OECD/IEA, 2016). Several

estimates expect the cost to drop below $200/kWh in the next several years (McKinsey, 2017;

OECD/IEA, 2016), although some manufacturers claim to have already achieved this goal

(Electrek, 2017).

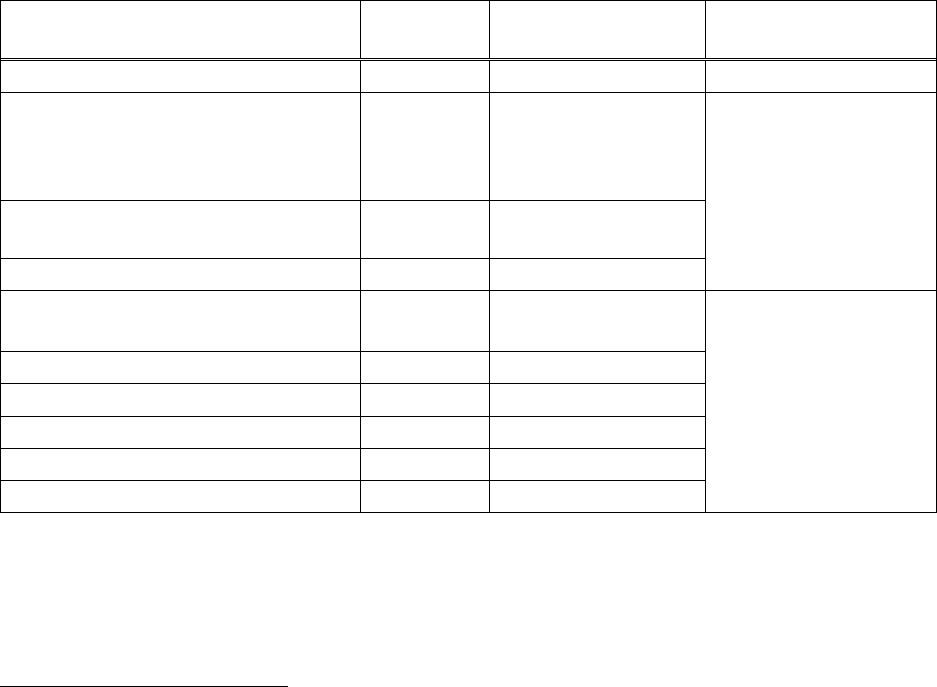

Summary of key vehicle-specific aspects of BEVs and PHEVs

Table 4 summarizes several key vehicle-specific aspects of battery electric vehicles and

plug-in hybrid electric vehicles. Current ICE vehicle technology is presented for comparison to

the alternative vehicle types.

16

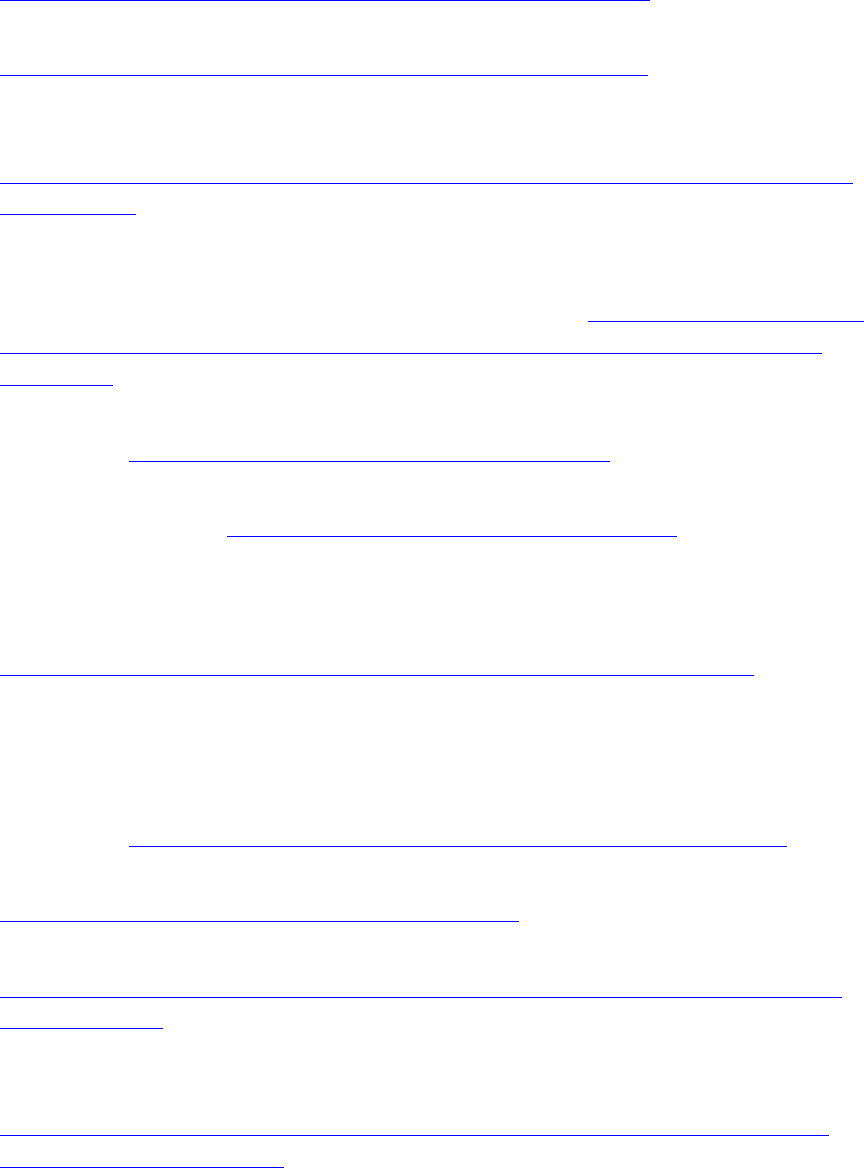

Table 4

Relevant aspects of vehicle performance for model year 2017 battery electric vehicles (BEV) and

plug-in hybrid electric vehicles (PHEV).

Aspect Current ICE

Battery electric

(BEV)

Plug-in hybrid electric

(PHEV)

Fuel type Gasoline Electricity Gasoline + electricity

Number of vehicle models available 283 23 23

Average vehicle price $35,000 $39,160 $44,795

Average fuel economy 22.8 mpg 103.0 mpge

33.8 mpge (gasoline)

80.1 mpge (electric)

Fuel economy range 11 – 39 mpg 72 – 136 mpge

23 – 53 mpge (gasoline)

43 – 133 mpge (electric)

Effective cost per mile $0.10 $0.04

$0.07 (gasoline)

$0.05 (electricity)

Well-to-wheels GHG emissions

(g/mi)

8

356 – 409 214 253 – 278

Well-to-wheels total petroleum usage

(Btu/mi)

8

3791 – 4359 54 1588 – 2588

Driving range (average) 475 mi 187 mi

26 mi (electric)

462 mi (combined)

Driving range (min – max) 381 – 716 mi

59 – 335 mi

12 – 97 mi (electric)

180 – 640 mi (combined)

Time to refuel/recharge ~ 5 min

~ 30 min, 80% charge

(DC Level 2)

~ 5 hr, 100% charge

(AC Level 2)

~ 5 min (gasoline)

~ 3 hr, 100% charge

(electricity; AC Level 2)

Availability of qualified mechanics Yes Limited Limited

Availability of qualified emergency

responders

Yes Yes Yes

Vehicle maintenance issues

9

-

• Lower maintenance

than ICE

• Possible battery

replacement required

during vehicle lifetime

• Similar routine

maintenance as for ICE

• Possible battery

replacement required

during vehicle lifetime

• More technologically

complex than ICE or BEV

8

GREET 2015 release, using default settings for model year 2015 passenger cars (ANL, 2015).

9

AFDC (2014).

17

Charging infrastructure

Current and future availability

With the ability to tap into the existing electrical grid, the electricity required for BEV

charging is readily available in most commercial and residential settings. However, for the more

advanced AC Level 2 (current standard) and DC Fast Charging,

10,11

installation of special

charging equipment is required. Approximately 16 thousand public charging stations (individual

charging sites) offering nearly 43 thousand charging outlets (individual charging

connectors/plugs) are currently available across the U.S. (AFDC, 2017a). As is evident in

Figure 11, the number of publicly available charging stations has grown rapidly since 2011. For

comparison, there are approximately 112 thousand individual gasoline stations covering all 50

states and the District of Columbia (U.S. Census Bureau, 2015).

Figure 11. Public charging stations available in the U.S. (as of May 22, 2017) (AFDC, 2017a).

Table 5 summarizes the availability of charging levels at public stations in the U.S., while

Figure 12 shows the breakdown of connector types (and related charging levels) available at

10

For detailed descriptions of each charging level and type of connector, see AFDC (2017b) and SAE (2011). For a

summary of international standards and charging equipment, see Green Transportation (2017).

11

DC Fast Charging is expected to replace AC Level 2 charging as the prevailing standard for future vehicles (IHS

Markit, 2013).

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

1989 1995 1997 1999 2002 2005 2007 2009 2011 2013 2015 2017

Public charging stations in the U.S.

Year

15,949

18

these stations. While J1772 with AC Level 2 is currently the most common connector and

standard combination in the U.S., various forms of DC Fast charging (although with varying

connector types) are offered at 36% of public stations, making up 13% of all public charging

connections. (This discrepancy is due to the fact that stations offering multiple connection types

tend to offer more of some types than others.)

Table 5

Charging levels and number of physical connections available at public stations in the U.S. (as of

May 22, 2017) (AFDC, 2017a). Note: Some stations offer more than one level of charging.

Charging standard (level) Stations Connections

AC Level 1 1,482 2,924

AC Level 2 14,433 34,148

DC Fast 2,080 5,607

Inductive (wireless)

63

81

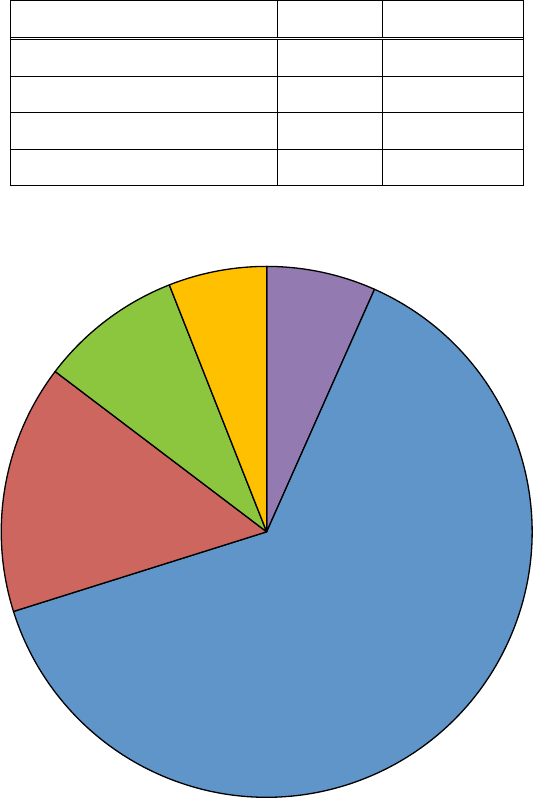

Figure 12. Percentage of public charging stations in the U.S. offering each connector type and

associated charging level (as of May 22, 2017) (AFDC, 2017a). (Inductive or wireless charging,

while still requiring specially equipped vehicles and EVSEs, is not shown here because it does

not require a unique physical connection.) Note: Some stations offer more than one connector

type.

J1772

(AC Level 2)

75.6%

Tesla

(DC Fast)

18.1%

CHAdeMO

(DC Fast)

10.4%

NEMA

(all types;

AC Level 1)

7.9%

Combo/CCS

(DC Fast)

7.1%

19

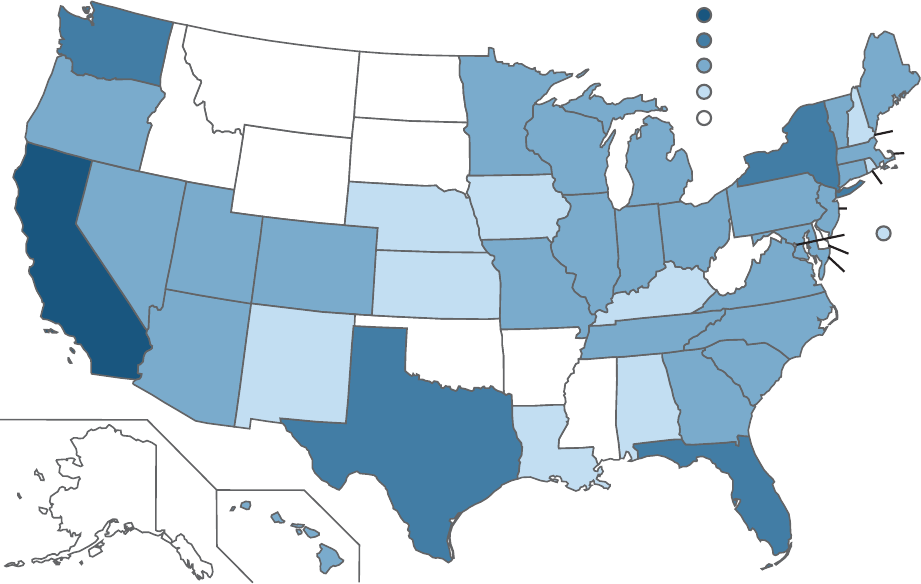

Figure 13 shows the general distribution of public charging stations within the U.S., by

state. The distribution of charging stations across the U.S. is strongly positively correlated with

state population size, r(49) = 0.867, p < .001, as states with larger overall populations tend to

have proportionally more public charging stations. Furthermore, within each state, public

charging stations also tend to cluster around large population centers, dropping in density in less

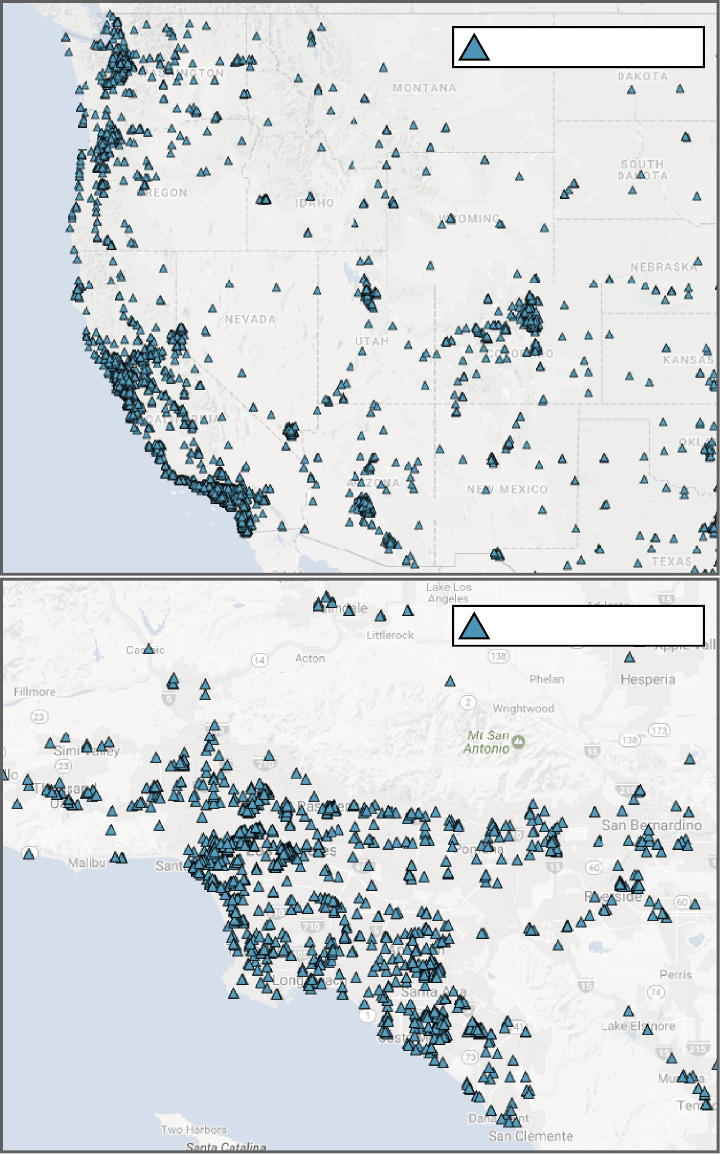

populous, more rural areas. Figure 14 illustrates the high density of public charging stations

around population centers (and correspondingly low density of stations in more rural areas) for

an example region and metropolitan area—the western U.S. (top pane) and the Los Angeles

metropolitan area (bottom pane).

Figure 13. Distributions of public charging stations within the U.S., by state (AFDC, 2017a).

Public charging stations per state:

1000+

501-1000

101-500

51-100

<50

WA

OR

CA

NV

AZ

UT

NM

TX

OK

CO

ID

MT

WY

ND

SD

NE

MN

IA

MO

AR

LA

WI

MI

OH

IN

IL

ME

NY

PA

FL

GA

AL

MS

TN

KY

VA

NC

SC

KS

NH

VT

M

A

RI

CT

NJ

DC

MD

DE

WV

HI

AK

20

Figure 14. Distributions of public charging stations relative to population centers versus rural

areas (Top pane: western U.S., bottom pane: Los Angeles metropolitan area) (AFDC, 2017a). In

each pane, examples of large population centers have been labelled.

Map data ©2017 Google, INEGI

Map data ©2017 Google, INEGI

Los Angeles

public charging station

Los Angeles

San Diego

San

Francisco

Denver

Seattle

public charging station

Phoenix

Portland

21

Expansion of the BEV charging network is relatively inexpensive, costing approximately

$1,000 for home-based charger installation, and ranging from approximately $5,000 to $50,000

for public charging station units (Green Car Reports, 2016; Inside EVs, 2014; Plug In America,

2017; Wolfram and Lutsey, 2016). For comparison, the cost of installing a gasoline station is

typically in the range of $1 million to $2 million (NPC, 2012).

General availability of public charging stations may prove to be more important for

BEVs than PHEVs, as drivers of PHEVs may often rely on the on-board ICE to power the

vehicle when the battery runs low; there is also evidence that PHEV users tend to charge mostly

at home, in the evening, relying less frequently on public charging than BEV users (DOE, 2014;

Kelly, MacDonald, and Keoleian, 2012; Tal, Nicholas, Davies and Woodjack, 2013).

Fuel pricing trends and effective cost per mile

Because units of sale are not standardized across different fuel types (gallons of gasoline

versus kWh of electricity), fuel pricing poses a challenge for customer acceptance and

understanding when comparing different vehicles and fuel types. Furthermore, the conversion

factors to the gasoline-gallon equivalent (GGE: the amount of an alternative fuel required to

equal the energy in one gallon of gasoline) are generally not known or easily understood by most

consumers.

For BEVs, 33.7 kWh of battery power is equal to the energy in 1 gallon of gasoline

(AFDC, 2014). With a national average price of approximately $0.128/kWh and GGE

conversion factor of 0.031 (GGE = kWh x 0.031; DOE [2017]), the current fuel cost

12

for

charging a PEV is $1.21/GGE (AFDC, 2017). The average fuel economy for model year 2017

BEVs is 103.0 mpge, resulting in an effective cost per mile of $0.04. Analogously, the cost per

mile for PHEVs is $0.05 when operating electrically in CD mode with an average fuel economy

of 80.1 mpge, and $0.07 when operating on gasoline in CS mode with an average fuel economy

of 33.8 mpge. For current gasoline-powered ICE vehicles, an average fuel economy of 22.8

mpg, coupled with a fuel price of $2.38 per gallon (AFDC, 2017d), results in a cost of $0.10 per

mile. The average effective fuel cost per mile for current ICEs is approximately two and a half

12

Per the AFDC (Department of Energy): “Electric prices are reduced by a factor of 3.4 because electric motors are

3.4 times more efficient than internal combustion engines” (AFDC, 2017d).

22

times the cost of operating a BEV, two times the cost of a PHEV operating only on battery

power, or one and a half times the cost of operating a PHEV on gasoline.

Examples of the preceding calculations are shown below:

*+,

=

$0.128 ℎ

0.031 ℎ

3.4 = $. /

*+,

=

$0.128 ℎ

0.031 ℎ

103.0 = $.

In addition to considerably lower fuel costs per mile, PEVs also have the advantages of

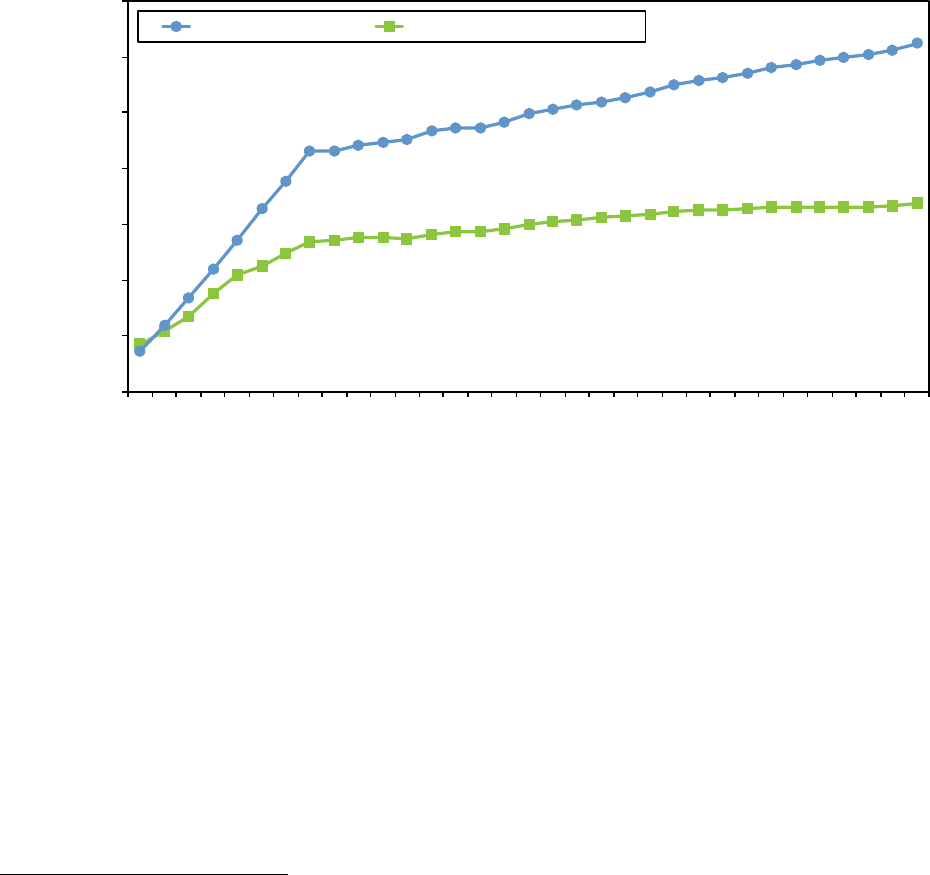

price stability (i.e., lack of volatility) and projected slow increases in overall price. Figure 15

shows the recent price trends for both fuel types going back to April 2000, illustrating the

significant volatility of gasoline prices during that time relative to electricity prices (AFDC,

2017d). From April 2000 through January 2017, the maximum price fluctuation for electricity

(percentage difference between the minimum and maximum price per GGE) was 62% ($0.50)

versus 253% ($2.80) for gasoline. Figure 16 shows the fuel prices for both fuel types projected

out to 2050 (EIA, 2017a). The EIA projects that the price of electricity (in 2016 $/GGE) will

increase by less than $0.50 over the next 30 years (possibly even decreasing toward the end of

that period), while the price of gasoline is expected to increase by more than $1.00 per gallon

during that same time.

23

Figure 15. Recent trends in fuel pricing (in $/GGE) for gasoline and electricity (AFDC, 2017d).

Figure 16. Projected fuel pricing (in 2016 $/GGE) for gasoline and electricity (EIA, 2017a).

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

Apr-00

Oct-00

Jun-00

Oct-01

Feb-02

Apr-02

Jul-02

Oct-02

Feb-03

Dec-03

Mar-04

Jun-04

Nov-04

Mar-05

Sep-05

Jan-06

May-06

Sep-06

Feb-07

Jul-07

Oct-07

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Sep-11

Jan-12

Mar-12

Jul-12

Sep-12

Jan-13

Mar-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

Apr-16

Jul-16

Oct-16

Jan-17

Average U.S. retail price per GGE

Month-Year

Electricity Gasoline

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2018 2020 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 2048 2050

Retail price (2016 $/GGE; projected)

Year

Electricity Gasoline

24

Fuel production and renewable power sources

As discussed earlier in this report, the well-to-wheels GHG emissions and petroleum

usage for BEVs and PHEVs are both considerably lower than for comparable ICE vehicles.

However, analysis of emissions for these vehicle types assumes an average mix of various power

sources for electricity generation.

13

Table 6 lists the average distribution of energy sources for

electricity generation in the U.S. (LLNL/DOE, 2017), with renewable sources listed in bold.

(Although nuclear power does not result in any GHG emissions, the uranium used in such power

plants is considered nonrenewable [EIA, 2016]. There is also some debate regarding the extent

to which biomass is truly carbon-neutral, and thus renewable [Cho, 2016].)

Considering that 86% of electricity in the U.S. comes from nonrenewable sources, and

65% comes from GHG emitting fuels, the cleaner average nature of BEVs and PHEVs can be

improved considerably by increasing the use of renewable fuels (and/or nuclear) to generate

electricity across the U.S. As a result of the variability across the country regarding the specific

sources of electricity generation, the overall cleanliness of PEVs relative to ICEs can differ

considerably based on where (state, county, etc.) the vehicle is driven and charged (CityLab,

2015; Scientific American, 2012). A report by the European Environmental Agency

(EEA, 2016) estimates that current BEV GHG emissions could be reduced by a factor of 10 if

completely renewable power sources were used.

A practical option to increase the use of renewable fuels for generating electricity

specifically for vehicle charging involves integrating solar-powered stations to supply electricity

directly to the ESVEs within a specific charging station or location (Bloomberg, 2017;

CleanTechnica, 2016; HybridCars.com, 2014).

13

The resultant emissions from this average mix of power sources also determine the mpge of vehicles that operate

on electric power. The calculation of mpge is based on the equivalent mpg required for a gasoline-powered ICE to

emit the same level of GHGs, based on the average amount of GHGs emitted to generate each unit of electric energy

(e.g., kWh).

25

Table 6

Average distribution of energy sources for electricity generation in the U.S.

(LLNL/DOE, 2017). Renewable energy sources are listed in bold.

Energy source Percent

Coal

37.6%

Natural gas 26.3%

Nuclear 21.9%

Hydro

6.3%

Wind 4.8%

Biomass 1.4%

Petroleum 0.7%

Solar 0.7%

Geothermal 0.4%

TOTAL 100.0%

Smart or intelligent charging

A survey conducted last year revealed that many “smart” or “intelligent” charging

functions in development are desired or expected by vehicle users when charging a PEV

(Schoettle and Sivak, 2016). In general, scenarios that enable consumers (or the PEV itself) to

exercise greater control and management over vehicle charging were given a higher preference

level than those that offer greater convenience. A partial list of smart-charging functions

includes plug-and-charge (automatic payment authorization), eVehicle roaming (prenegotiated

billing agreement that is applicable most places the vehicle is publically charged), optimized load

management (balancing of charging cost versus real-time demand), and vehicle-to-grid

applications (ability to use vehicle to supply power back to the grid in exchange for

compensation—also called reverse charging).

However, the currently competing protocols

14

to fully enable such smart charging—ISO

15118 and SEP 2.0—are also still in development, and do not always equally satisfy the

expectations of PEV users. Table 7 (from Schoettle and Sivak, 2016) shows a comparison of

charging scenarios in terms of support by current protocols (i.e., ISO 15118 and SEP 2.0) and

consumer expectations (based on ranking of relative importance). Two of the top four most

14

For additional details and discussion of these smart charging protocols, see Schoettle and Sivak (2016).

26

important scenarios to consumers are not currently supported by the SEP 2.0 protocol, and the

remaining two scenarios are only partially supported. However, all of the top four scenarios are

currently supported by the ISO 15118 protocol. Furthermore, the remaining two applicable

charging scenarios in Table 7, although ranked as least important, are (or will be) at least

partially supported by both protocols.

Table 7

Comparison of charging scenarios, support for such scenarios by current protocols, and

consumer preferences (relative importance based on rank), sorted by rank (from Schoettle and

Sivak, 2016).

Charging scenario

Supported by

protocol?

Relative

importance

to consumers

(rank)

ISO

15118

SEP

2.0

Optimized load management

✔ ✔

#1

Plug-and-charge

✔

✖

#2

eVehicle roaming

✔

✖

#3

Optimized load management to maximize

renewable energy usage

✔ ✔

#4

Optimized load management for home

area networks

✔ ✔

#5

Vehicle-to-grid (V2G) energy source

✔* ✔

#6

Inductive (wireless) charging

n/a

#7

✔ = Fully supported ✔ = Partially supported ✖ = Not supported

✔* = Fully supported in a future revision

V2G (vehicle-to-grid) technology

Vehicle-to-grid (or V2G) functionality, likely a key component of future smart-charging

systems, allows the exchange of power bidirectionally between the vehicle and the electrical

grid, typically with an agreement that the vehicle owner may be compensated for supplying such

energy, depending on the specific circumstances. A recent analysis concluded that a single

vehicle using V2G technology could generate around $1,000 per year for the owner (Shinzaki,

Sadano, Maruyama, and Kempton, 2015). In addition to the obvious monetary benefit to vehicle

27

owners, IEEE estimates that if 1 million PEVs were connected, roughly 10,000 megawatts would

be available (“about 20 average sized power plants”) for V2G power exchanges (IEEE, 2012).

Summary of key aspects of fuel sources and related refueling infrastructure

Table 8 summarizes several key aspects of the underlying fuel sources for PEVs and the

related refueling infrastructure. Gasoline and is presented for comparison to the alternative fuel

sources.

Table 8

Relevant aspects of the fuel sources and charging infrastructure for battery electric vehicles

(BEV) and plug-in hybrid electric vehicles (PHEV).

Aspect Current ICE

Battery electric

(BEV)

Plug-in hybrid electric

(PHEV)

Fuel type

Gasoline

Electricity

Gasoline + electricity

Refueling infrastructure Yes

Electric grid readily

available; charging

station required for

Level 2 or higher

Can use both BEV

and ICE refueling

infrastructures

Total number of existing and planned

public refueling stations

15, 16, *

112,458

15,949 (stations)

34,993 (connections)

Home and/or workplace refueling No Yes

Fuel price

17, 18

$2.38 / gal

$1.21 / GGE

$0.128 / kWh

Fuel properties of both

gasoline and electricity

apply for PHEVs

Gasoline-gallon equivalent (GGE)

19

1 gal 33.7 kWh

Flammable fuel Yes No

High voltage

No

Yes

Gravimetric energy density (MJ/kg)

20

44

0.5

Volumetric energy density (MJ/L)

20

32

1.1

*

For BEV and PHEV recharging, stations are the physical sites that contain one or more connections (i.e.,

individual connectors or EVSEs); these counts do not include private (fleet or business) or residential

chargers.

15

U.S. Census Bureau (2015).

16

AFDC (2017a).

17

National average prices for gasoline and electricity, April 1 – April 17, 2017 (AFDC, 2017d).

18

AFDC (2014).

19

EIA (2017c).

20

OECD/IEA (2016).

28

Public opinion regarding PEVs

Public opinion is generally positive regarding acceptance of PEVs. For example,

individuals have expressed an interest in PEV technologies over traditional ICE vehicles as

gasoline prices climb (Schoettle and Sivak, 2015). Another recent study documented the fact

that many vehicle owners would be interested in upgrading to more electrified vehicles, with

many conventional ICE owners willing to consider purchasing a hybrid (including PHEV) and

many hybrid owners willing to consider purchasing a BEV (Sivak and Schoettle, 2014). A

survey of light-truck owners—a group traditionally opposed to PEVs—found that around 10%

would consider an all-electric light truck, and around 15% would consider an all-electric light

truck of the same make/model as their current light truck (Schoettle and Sivak, 2017). (Similar

views about interest in PEV ownership were also expressed by passenger-car owners in that

survey.)

29

Government support

Support from the U.S. government for both alternative fuel types and vehicle types is

relatively strong.

21

In 2015, funding support for battery research and development was

approximately $80 million (DOE, 2016b). Several goals of this research for electric vehicle

batteries include the following targets for 2020: reduce cost by a factor of four, reduce size by

factor of two, reduce weight by a factor of two (or more), all in an attempt “to more than double

the battery pack energy density (from 100 Wh/kg to 250 Wh/kg)” (DOE, 2016b).

In addition to research funding, various government agencies at both the national and

state level have enacted legislation specific to PEVs, often with the goal of encouraging or

incentivizing vehicle owners (including government, commercial, and individuals) to consider

purchasing PEVs. Such laws generally specify tax breaks, reduced cost of vehicle registration,

rebates or grants for equipment installation, and other similar cost reductions to encourage the

purchase of PEVs. One of the more significant incentives to encourage the purchase of a PEV is

a federal tax credit of up to $7,500 (EPA, 2017b).

22

Table 9 shows the number of individual

laws and incentives in place for the U.S. (National) and for each state.

21

The government support as discussed in this report was established and/or provided under the previous federal

government administration, and is less certain with the current administration. For example, future CAFE standards

established with the previous administration will be re-reviewed and possibly modified or eliminated (EPA/NHTSA,

2017).

22

Another significant, long-running incentive program that allowed for a tax credit of up to $1,000 for installing

charging equipment expired at the end of 2016 (IRS, 2016).

30

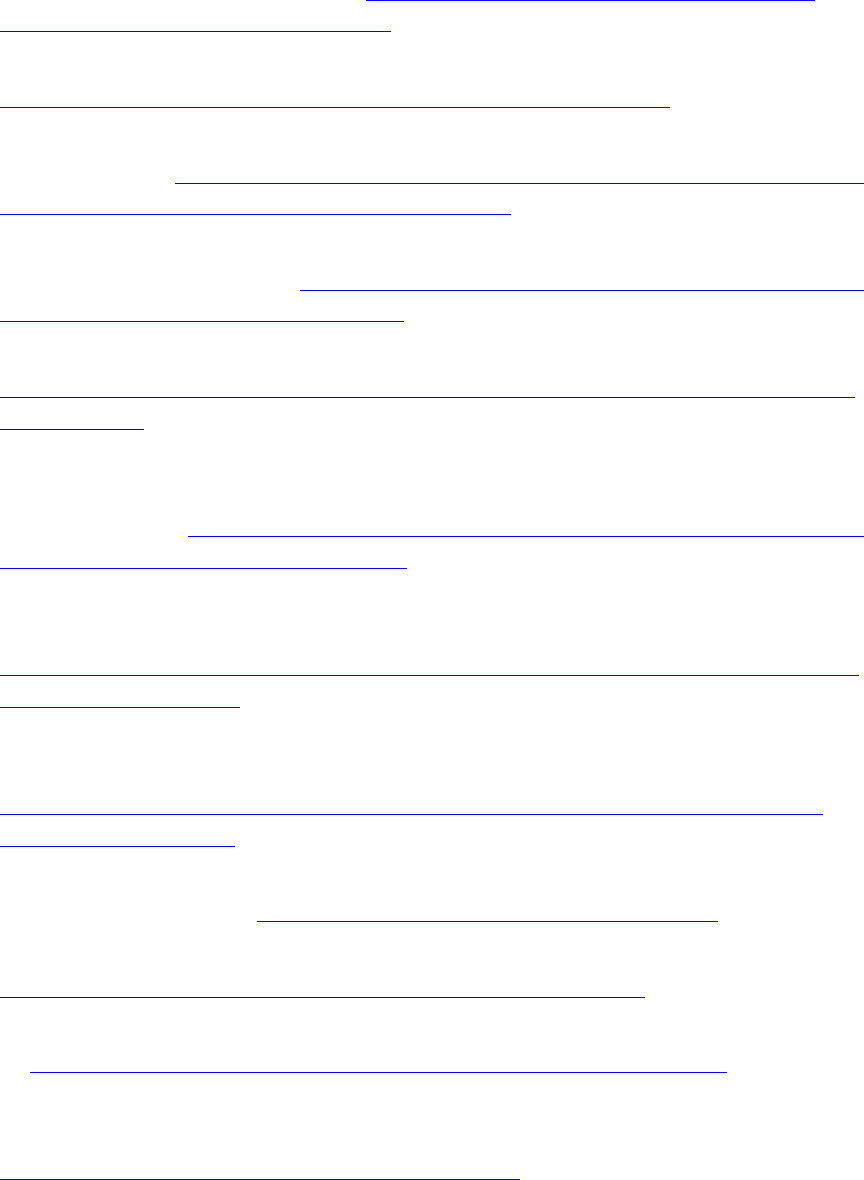

Table 9

Number of PEV-related (BEV and PHEV) laws and incentives currently in place

(as of May 22, 2017) (AFDC, 2017c).

State

PEV-related

laws/incentives

State

PEV-related

laws/incentives

National

23

26 South Carolina 7

California 56 Wisconsin 7

Washington 21 Missouri 6

Colorado 18 Delaware 5

Illinois 16 Iowa 5

Arizona 15 Idaho 5

Maryland 15 Vermont 5

Connecticut 14 Alabama 4

Oregon 14 Maine 4

Massachusetts 13 New Mexico 4

Virginia 13 Pennsylvania 4

North Carolina

12

Washington, D.C.

4

Rhode Island 12 West Virginia 4

Utah 12 Wyoming 4

New York

11

Arkansas

2

Minnesota 10 Kentucky 2

Florida 9 Louisiana 2

Georgia

9

Nebraska

2

Hawaii 9 New Hampshire 2

Indiana 9 Tennessee 2

Nevada 8 Alaska 1

Ohio 8 Mississippi 1

Texas 8 Montana 1

Michigan 7 Kansas 0

New jersey 7 North Dakota 0

Oklahoma 7 South Dakota 0

23

National includes all EV-related U.S. laws and incentives enacted on a national level, independent from

individual state laws and incentives.

31

Key Findings

Vehicle availability and sales

• The number of individual PEV models available for purchase has increased rapidly

recently, nearly doubling from model year 2016 to 2017.

• Sales of PEVs have also increased significantly in recent years, increasing by more than

700% in the U.S. since 2011. China and Europe have seen even larger increases in PEV

sales in recent years.

• The prices of PEVs are slowly dropping and approaching prices that are similar to

comparable ICE vehicles.

Fuel economy and emissions

• The fuel economy of both types of PEVs is substantially better than comparable gasoline-

powered vehicles; PHEVs and BEVs average more than 3.5 times and 4.5 times better

fuel economy, respectively, than ICE vehicles.

• Even PHEVs with the lowest electric-only ranges emit lower levels of GHGs and

consume less petroleum (well-to-wheels) than comparable ICE vehicles.

• BEVs emit lower levels of GHGs and consume much less petroleum on average than

comparable ICE vehicles or PHEVs. Additionally, BEVs would have the potential to be

even cleaner if a higher percentage of energy sources used to generate electricity in the

U.S. were renewable.

Batteries and charging

• Charging times have dropped slightly in recent years but are still much longer than

refueling a gasoline-powered vehicle; however, PHEVs can operate on gasoline only so

they do not require charging the same way a BEV does.

• Energy density of batteries is increasing while the cost ($/kWh) continues to decrease.

Both trends enable increasingly less-expensive, longer-range, and faster-charging PEVs.

32

Driving range and range anxiety

• Maximum driving range, a significant factor in limiting BEV acceptance (based on so-

called range anxiety for drivers), has improved in recent model years, with some of the

longest-range BEVs capable of distances similar to some PHEV and ICE vehicles.

• The maximum driving range of PHEVs (which combines the gasoline and electric

ranges) is already comparable to the range of most ICE vehicles.

• Some PHEVs are now capable of electric-only driving ranges that are longer than some

of the lowest-range BEVs.

• Advances in battery performance and driving range may soon enable BEVs (and PHEVs

operating on electricity) to replace conventional ICE vehicles for most U.S. drivers’ daily

trips.

Refueling infrastructure

• The infrastructure to enable PEV charging is readily available through the current

electrical grid throughout the U.S. in both commercial and residential settings

• Charging is often available or can be installed at home or work (unlike ICE refueling).

• The number of public charging stations has grown very rapidly in recent years, with

approximately 16 thousand currently available in the U.S. (supplying approximately 35

thousand individual connections).

• As one might expect, states with larger populations tend to have more public charging

stations; correspondingly, areas of higher population density tend to have more stations

than lower-density rural areas.

• The average mix of fuel sources for generating electricity in the U.S. is approximately

65% fossil fuels (coal, natural gas, and petroleum), while only around 14% is generated

from renewable resources (the remainder of electricity in the U.S. comes from non-

renewable nuclear power); BEVs (and PHEVs operating on electricity) can be even

cleaner if electrical utilities could make greater use of renewable resources.

33

Fuel pricing

• Compared to gasoline, electricity prices have been remarkably low and stable for at least

the past decade.

• Electricity prices are projected to remain relatively low and stable in comparison to

gasoline prices over the next several decades.

• “Smart” charging can enable various advanced charging-related functions such as

optimized balancing of charging prices versus demand. It can also allow for vehicle-to-

grid (V2G) capabilities so that vehicle users are potentially able to supply (i.e., sell)

electricity back to the grid as needed, based on the local demand for electricity at any

given time.

Public opinion and government support

• Public interest in PEVs (as demonstrated by sales trends) has increased considerably in

recent years.

• Users of most vehicle types would be more willing to consider a PEV if it were offered in

their current vehicle type (car, pickup truck, etc.), with interest increasing if a PEV were

offered in the specific make and model of their current vehicle.

• Government support has been relatively strong in recent years, especially for advanced

battery R&D and in the form of financial incentives such as tax rebates. The federal

government currently offers a $7500 (maximum) tax credit for the purchase of a PEV; all

but three states offer some form of financial incentive for owning a PEV.

34

Summary

This report examined the current status and recent progress regarding various technical

issues and issues related to public acceptance that have traditionally hindered the more

widespread acceptance and adoption of plug-in electric vehicles (PEVs), which include both

battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). As a reference for

comparison, information for current gasoline-powered internal combustion engines was also

presented where appropriate.

The main issues explored in this report include:

• vehicle availability, including sales trends and costs

• fuel economy, GHG emissions, and petroleum usage

• batteries, charging time, driving range, and range anxiety

• charging infrastructure availability and smart charging

• public opinion and government support

Overall, recent advances and improvements in several of these areas have led to PEVs

becoming increasingly more competitive with traditional gasoline-powered internal-combustion

engine (ICE) vehicles. Furthermore, future costs of the vehicles and fuel, coupled with rising

public interest and increasing numbers of charging locations, are expected to make such vehicles

even more capable of replacing ICE vehicles for the majority of U.S. drivers in the relatively

near future.

35

References

AFDC [Alternative Fuels Data Center]. (2014). Fuel properties comparison. Available at:

http://www.afdc.energy.gov/fuels/fuel_comparison_chart.pdf

AFDC [Alternative Fuels Data Center]. (2017a). Alternative fueling station locator. Available

at: http://www.afdc.energy.gov/locator/stations/

AFDC [Alternative Fuels Data Center]. (2017b). Developing infrastructure to charge plug-in

electric vehicles. Available at:

https://www.afdc.energy.gov/fuels/electricity_infrastructure.html

AFDC [Alternative Fuels Data Center]. (2017c). Federal and state laws and incentives.

Available at: https://www.afdc.energy.gov/laws

AFDC [Alternative Fuels Data Center]. (2017d). Fuel prices. Available at:

http://www.afdc.energy.gov/fuels/prices.html

AFDC [Alternative Fuels Data Center]. (2017e). How do all-electric cars work? Available at:

https://www.afdc.energy.gov/vehicles/how-do-all-electric-cars-work

AFDC [Alternative Fuels Data Center]. (2017f). How do plug-in hybrid electric cars work?

Available at: https://www.afdc.energy.gov/vehicles/how-do-plug-in-hybrid-electric-cars-

work

AFDC [Alternative Fuels Data Center]. (2017g). U.S. plug-in electric vehicle sales by model.

Available at: https://www.afdc.energy.gov/data/10567

ANL [Argonne National Laboratory]. (2015). The Greenhouse gases, Regulated Emissions, and

Energy use in Transportation (GREET) model [2015 release]. Available at:

https://greet.es.anl.gov/

Automotive News. (2016, December 15). Average U.S. transaction price hits record $34,077,

Edmunds says. Available at:

http://www.autonews.com/article/20161215/RETAIL01/161219904/average-u.s.-

transaction-price-hits-record-%2434077-edmunds-says

Axsen, J. and K. S. Kurani. (2013). Hybrid, plug-in hybrid, or electric—What do car buyers

want? Energy Policy, 61, 532–543. Available at:

http://www.sciencedirect.com/science/article/pii/S0301421513004771

Bloomberg. (2017, April 24). Tesla doubles its Superchargers with massive solar stations.

Available at: https://www.bloomberg.com/news/articles/2017-04-24/tesla-doubles-its-

superchargers-with-massive-solar-stations

36

Carley, S., Duncan, D., Esposito, D., Graham, J. D., Siddiki, S., and Zirogiannis, N. (2016).

Rethinking auto fuel economy policy. Technical and policy suggestions for the 2016-17

midterm reviews. Available at: https://spea.indiana.edu/doc/research/working-

groups/fuel-economy-policy-022016.pdf

Cho, R. (2016). Is biomass really renewable? Available at:

http://blogs.ei.columbia.edu/2011/08/18/is-biomass-really-renewable/

CityLab. (2015, June 29). Where electric vehicles actually cause more pollution than gas cars.

Available at: https://www.citylab.com/environment/2015/06/where-electric-vehicles-

actually-cause-more-pollution-than-gas-cars/397136/

CleanTechnica. (2016, December 24). Solar-powered Tesla Superchargers with extreme power

(#ElonTweets). Available at: https://cleantechnica.com/2016/12/24/solar-powered-tesla-

superchargers-extreme-power-elontweets/

DOE [U.S. Department of Energy]. (2013). Advanced battery development. Available at:

https://energy.gov/sites/prod/files/2014/05/f15/APR13_Energy_Storage_d_III_Adv_Batt

ery_Dev_0.pdf

DOE [U.S. Department of Energy]. (2014). Evaluating electric vehicle charging impacts and

customer charging behaviors: Experiences from six smart grid investment grant projects.

Available at: https://energy.gov/oe/downloads/evaluating-electric-vehicle-charging-

impacts-and-customer-charging-behaviors

DOE [U.S. Department of Energy]. (2016a). Fact #918: March 28, 2016 global plug-in light

vehicle sales increased by about 80% in 2015. Available at:

https://energy.gov/eere/vehicles/fact-918-march-28-2016-global-plug-light-vehicle-sales-

increased-about-80-2015

DOE [U.S. Department of Energy]. (2016b). Vehicle technologies office: 2015 energy storage

R&D annual report. Available at:

https://energy.gov/eere/vehicles/downloads/vehicle-technologies-office-2015-energy-

storage-rd-annual-report

DOE [U.S. Department of Energy]. (2017). Fuel conversion factors to gasoline gallon

equivalents. Available at: https://epact.energy.gov/fuel-conversion-factors

EEA [European Environment Agency]. (2016). Electric vehicles in Europe. Available at:

https://www.eea.europa.eu/publications/electric-vehicles-in-europe

EIA [U.S. Energy Information Administration]. (2016). Renewable energy explained. Available

at: https://www.eia.gov/energyexplained/index.cfm?page=renewable_home

EIA [U.S. Energy Information Administration]. (2017a). Annual energy outlook 2017, Table 3:

Energy prices by sector and source. Available at:

https://www.eia.gov/outlooks/aeo/excel/aeotab_3.xlsx

37

EIA [U.S. Energy Information Administration]. (2017b). Annual energy outlook 2017, Table 36:

Light-duty vehicle sales by technology type. Available at:

https://www.eia.gov/outlooks/aeo/supplement/excel/suptab_39.xlsx

EIA [U.S. Energy Information Administration]. (2017c). Electric power monthly. Available at:

https://www.eia.gov/electricity/monthly/current_year/april2017.pdf

Elektrec. (2017, January 30). Electric vehicle battery cost dropped 80% in 6 years down to

$227/kWh – Tesla claims to be below $190/kWh. Available at:

https://electrek.co/2017/01/30/electric-vehicle-battery-cost-dropped-80-6-years-227kwh-

tesla-190kwh/

Elgowainy, A., Han, J., Poch, L., Wang, M. Q., Vyas, A. D., Mahalik, M., and Rousseau, A.

(2010). Well-to-wheels analysis of energy use and greenhouse gas emissions of plug-in

hybrid electric vehicles. Available at: https://www.anl.gov/energy-

systems/publication/well-wheels-analysis-energy-use-and-greenhouse-gas-emissions-

plug-hybrid

EPA [U.S. Environmental Protection Agency]. (2017a). Download fuel economy data.

Available at: http://www.fueleconomy.gov/feg/download.shtml

EPA [U.S. Environmental Protection Agency]. (2017b). Federal tax credits for all-electric and

plug-in hybrid vehicles http://www.fueleconomy.gov/feg/taxevb.shtml

EPA [U.S. Environmental Protection Agency]. (2017c). Final determination on the

appropriateness of the model year 2022-2025 light-duty vehicle greenhouse gas

emissions under the midterm evaluation (EPA-420-R17-001). Available at:

https://www.epa.gov/sites/production/files/2017-01/documents/420r17001.pdf

EPA/NHTSA [U.S. Environmental Protection Agency and National Highway Traffic Safety

Administration]. (2017). Notice of intention to reconsider the final determination of the

mid-term evaluation of greenhouse gas emissions standards for model year 2022–2025

light duty vehicles. Federal Register 82:54 (March 22, 2017), pp. 14671-14672.

Available at: https://www.gpo.gov/fdsys/pkg/FR-2017-03-22/pdf/2017-05316.pdf

FHWA [Federal Highway Administration]. (2016). Electric vehicle feasibility. Available at:

http://nhts.ornl.gov/briefs/EVFeasibility20160701.pdf

Forbes. (2017, May 22). Electric car price parity expected next year – report. Available at:

https://www.forbes.com/sites/neilwinton/2017/05/22/electric-car-price-parity-expected-

next-year-report/

Green Car Reports. (2016, March 29). How to buy an electric-car charging station: Buyer's

guide to EVSEs. Available at:

http://www.greencarreports.com/news/1103133_how-to-buy-an-electric-car-charging-

station-buyers-guide-to-evses

38

Green Car Reports. (2017a, January 17). Electric car price guide: Every 2017 all-electric car,

with specs (updated). Available at:

http://www.greencarreports.com/news/1080871_electric-car-price-guide-every-2015-

2016-plug-in-car-with-specs-updated

Green Car Reports. (2017b, February 10). Plug-in hybrid price guide: Every 2017 model, with

specs. Available at: http://www.greencarreports.com/news/1108383_plug-in-hybrid-

price-guide-every-2017-model-with-specs

Green Transportation. (2017). EV DC fast charging standards – CHAdeMO, CCS, SAE combo,

Tesla Supercharger, etc. Available at: https://greentransportation.info/ev-

charging/range-confidence/chap8-tech/ev-dc-fast-charging-standards-chademo-ccs-sae-

combo-tesla-supercharger-etc.html

HybridCars.com. (2014, June 10). Google testing fully autonomous EV charging station.

Available at: http://www.hybridcars.com/google-testing-fully-autonomous-ev-charging-

station/

IEEE [Institute of Electrical and Electronics Engineers]. (2012). Plug-in hybrid electric vehicles

(PHEVs). Available at:

https://www.ieee.org/about/technologies/emerging/emerging_tech_phev.pdf

IHS Markit. (2013). Number of fast-charging stations for electric vehicles set to rise to nearly

200,000 in 2020. Available at: http://news.ihsmarkit.com/press-release/design-supply-

chain-media/number-fast-charging-stations-electric-vehicles-set-rise-nea

Inside EVs. (2014, May 5). How much do public and home EV charging stations really cost?

Available at: http://insideevs.com/how-much-do-public-and-home-ev-charging-stations-

really-cost/

IRS [Internal Revenue Service]. (2016). Alternative Fuel Vehicle Refueling Property credit at a

glance. Available at: https://www.irs.gov/credits-deductions/individuals/alternative-fuel-

vehicle-refueling-property-credit

Kelly, J. C., MacDonald, J. S., and Keoleian, G. A. (2012). Time-dependent plug-in hybrid

electric vehicle charging based on national driving patterns and demographics. Applied

Energy, 94, 395–405. Available at:

http://www.sciencedirect.com/science/article/pii/S0306261912000931

LLNL/DOE [Lawrence Livermore National Laboratory and U.S. Department of Energy]. (2017).

Estimated U.S. energy consumption in 2016: 97.3 quads. Available at:

https://flowcharts.llnl.gov/content/assets/docs/2016_United-States_Energy.pdf

McKinsey [McKinsey & Company]. (2017). Electrifying insights: How automakers can drive

electrified vehicle sales and profitability. Available at:

http://www.mckinsey.com/industries/automotive-and-assembly/our-insights/electrifying-

insights-how-automakers-can-drive-electrified-vehicle-sales-and-profitability

39

Nature. (2015, October 28). Technology: A solid future. Available at:

http://www.nature.com/nature/journal/v526/n7575_supp/full/526S96a.html

NPC [National Petroleum Council]. (2012). Advancing technology for America’s transportation.

Available at: http://www.npc.org/reports/trans.html#ps&t

OECD/IEA [Organisation for Economic Co-operation and Development and International

Energy Agency]. (2016). Global EV outlook 2016. Available at:

https://www.iea.org/publications/freepublications/publication/Global_EV_Outlook_2016.

pdf

Plug In America. (2017). Chargers. Available at: https://pluginamerica.org/get-

equipped/charging/

SAE [Society of Automotive Engineers]. (2011). SAE charging configurations and ratings