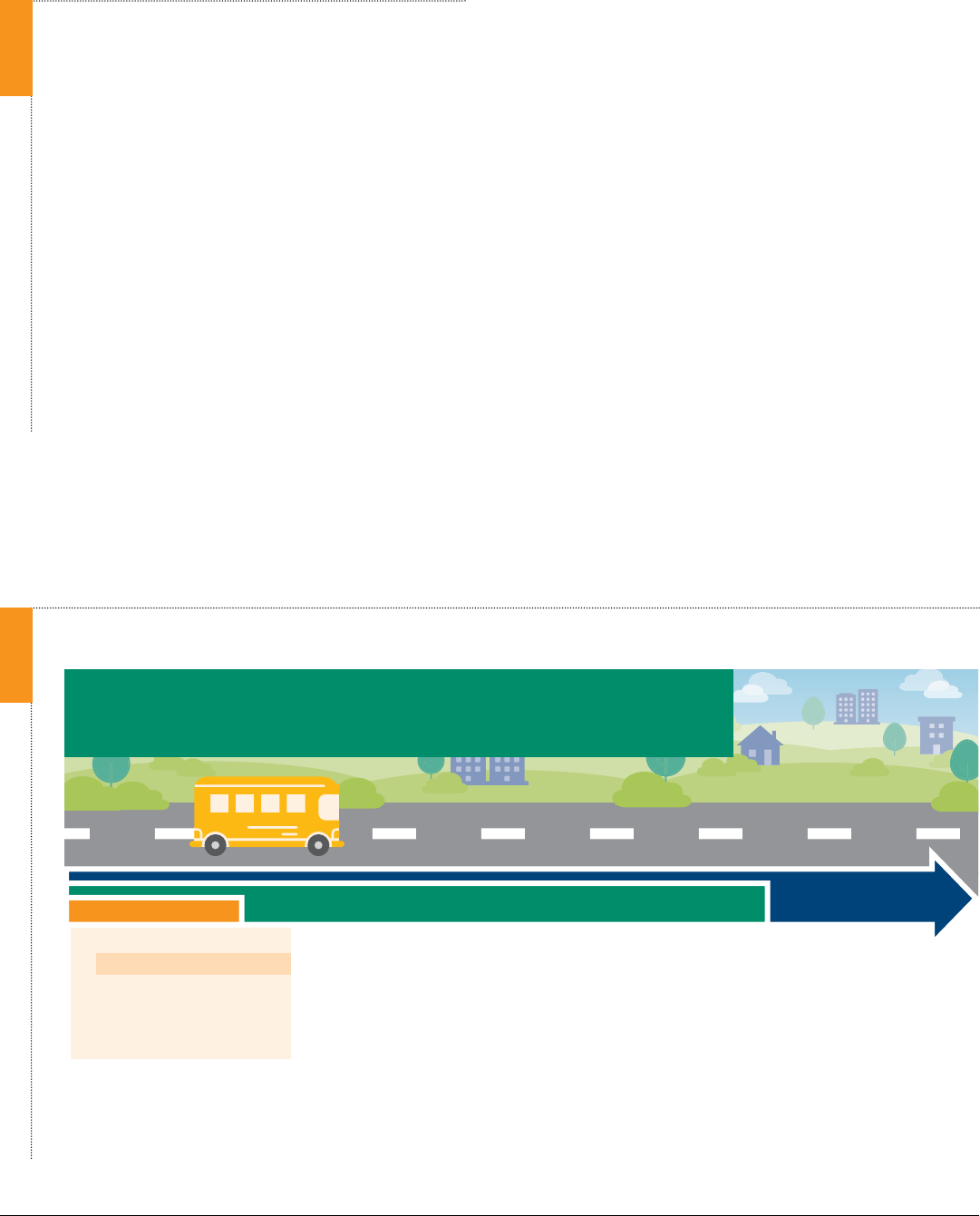

ELECTRIC SCHOOL BUS U.S. MARKET

STUDY AND BUYER’S GUIDE:

A Resource for School Bus Operators Pursuing

Fleet Electrication

ALISSA HUNTINGTON, JESSICA WANG, PHILLIP BURGOYNE-ALLEN,

EMMETT WERTHMANN, AND ELEANOR JACKSON

WRI.ORG

ISSUE BRIEF

2 |

CONTENTS

Executive Summary 2

1. Status of the Electric School Bus Market 3

2. Electric School Bus Basics 10

3. Summary of Available Electric Bus Models 17

4. Conclusion 26

Appendix A. Key Terms and Definitions:

Comparing Diesel and Electric School Buses 27

Appendix B. Additional Resources 29

Glossary 31

Endnotes 32

References 33

Acknowledgments 38

About the Authors 38

About WRI Electric School Bus Initiative 38

About WRI 39

Photo Credits 39

EXECUTIVE SUMMARY

Highlights

▪

School districts across the United States have started

transitioning to electric school buses (ESBs). As of

March 2022, 415 districts (or private eet operators)

had committed

1

to procuring 12,275 ESBs across 38

states and a range of operating conditions. States and

municipalities are setting electrication goals while

manufacturers scale production.

▪

Compared with the typical school bus that runs

on diesel fuel, ESBs have the potential to lower

operations and maintenance costs for eets and have

zero tailpipe emissions. Their large batteries can store

and deliver energy using “vehicle-to-everything”

technology, to power buildings and other devices,

which can support greater resiliency, including

through the integration of renewable energy. ESBs

also have the potential to generate revenue by

discharging energy from their batteries back onto the

grid, lowering utility costs and emissions. Though

this is a nascent market, technological advancements

should make this widely available in the near future.

▪

As of January 2022, 22 ESB models were available

from 12 manufacturers for Type A, C, and D buses: 14

newly manufactured vehicle models and 8 repowered

vehicle models.

2

There is the largest selection

of Type A models. Type C models are the most

commercially ready.

▪

Each generation of buses is more advanced than the

previous: Many manufacturers are on their second

or third iteration, some even further along. Electric

school buses have ranges of up to 210 miles for Type C

buses; all Type A, C and D buses listed oer over 100

miles of range, enough to cover most bus routes.

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 3

Context

Momentum around electric school buses (ESBs) is

growing in the United States as school districts across

the country transition to this cleaner and healthier

technology, bolstered by an infusion of new funding

from the federal government. The ESB transition

will require a coordinated eort among numerous

entities, including school district leadership and sta,

school bus manufacturers and contractors, utilities,

policymakers, regulators, local advocacy organizations,

and community members.

This publication is intended to serve as a resource

primarily for school districts, transportation directors,

and other school bus operators exploring school bus

electrication to provide a better understanding of the

state of the ESB market and available oerings. It aims

to present the growing interest and investment in this

sector along with key aspects of the current technology.

In Section 1, we explore the growing demand for these

buses and how manufacturers are positioning themselves

to meet that demand through a scan of the market.

Next, in Section 2, we explain key components of an

ESB and discuss the charging and related infrastructure

that is needed to support these buses. The core element

of the publication, Section 3, presents a catalog of the

22 ESB models available as of early 2022 with detailed

vehicle specications allowing readers to compare

various models and weigh important considerations.

We conclude by summarizing the status of school bus

electrication to date.

Approach and Methodology

The content of this publication has been gathered from a

variety of sources, with information on models available

in the United States from publicly available vehicle

specications sheets conrmed through discussions with

bus manufacturers when possible.

We explored school district experiences with ESBs

representing a variety of use cases in the United States—

rural, suburban, and urban; warm and cold weather,

including extreme temperatures; and early adopters

further along in the process, as well as those in earlier

stages of procurement. We compiled recent research

and reporting on school district commitments and

experiences and supplemented public information with

conversations with school districts and other partners. We

plan to update this publication annually as new vehicles

come to market and existing models are altered.

This resource is one of many from World Resources

Institute’s Electric School Bus Initiative and is intended

to be updated to expand upon topics like funding

and nancing, alternative service models, and utility

engagement.

3

1. STATUS OF THE ELECTRIC

SCHOOL BUS MARKET

There are nearly half a million school buses in the United

States that transport more than 20 million children to

and from school (FHA 2019; SBF 2021a). More than

90 percent of school buses on the road today are diesel

powered, but interest in ESBs has grown in recent

years (APP 2022). There are 12,275 ESB commitments,

representing around 2.5 percent of the current eet

size (Lazer and Freehafer 2022). The ESB market was

established in 2014, when two California school districts,

Kings Canyon School District and Escondido Union

High School District, became the rst school districts

to operate ESBs. Kings Canyon’s four early Trans Tech

models carried 25 students each and were able to travel

between 80 and 100 miles on a charge while Escondido’s

TransPower bus had a range of approximately 60 miles

(MPS 2014; Edelstein 2014; Adams 2014).

Since 2014, hundreds of other school districts across the

United States have begun to embrace eet electrication,

manufacturers have positioned themselves to meet

growing demand, and school bus electrication has

gained traction (Figure 1).

1.1 Rising Demand

A combination of factors is priming the market for ESB

adoption. Compared with the typical school bus that runs

on diesel fuel, ESBs have the potential to lower operations

and maintenance costs for eets and have zero tailpipe

emissions (Figure 2). If equipped with bidirectional

charging technology, ESBs can provide additional

benets, such as potentially acting as mobile generators

in an emergency.

Inuenced by these benets, communities and

policymakers are advocating for ESBs, which has resulted

in commitments to electrication. Implementation of

these commitments is aided by grants and incentives to

bring down the upfront price of the buses (Box 6).

4 |

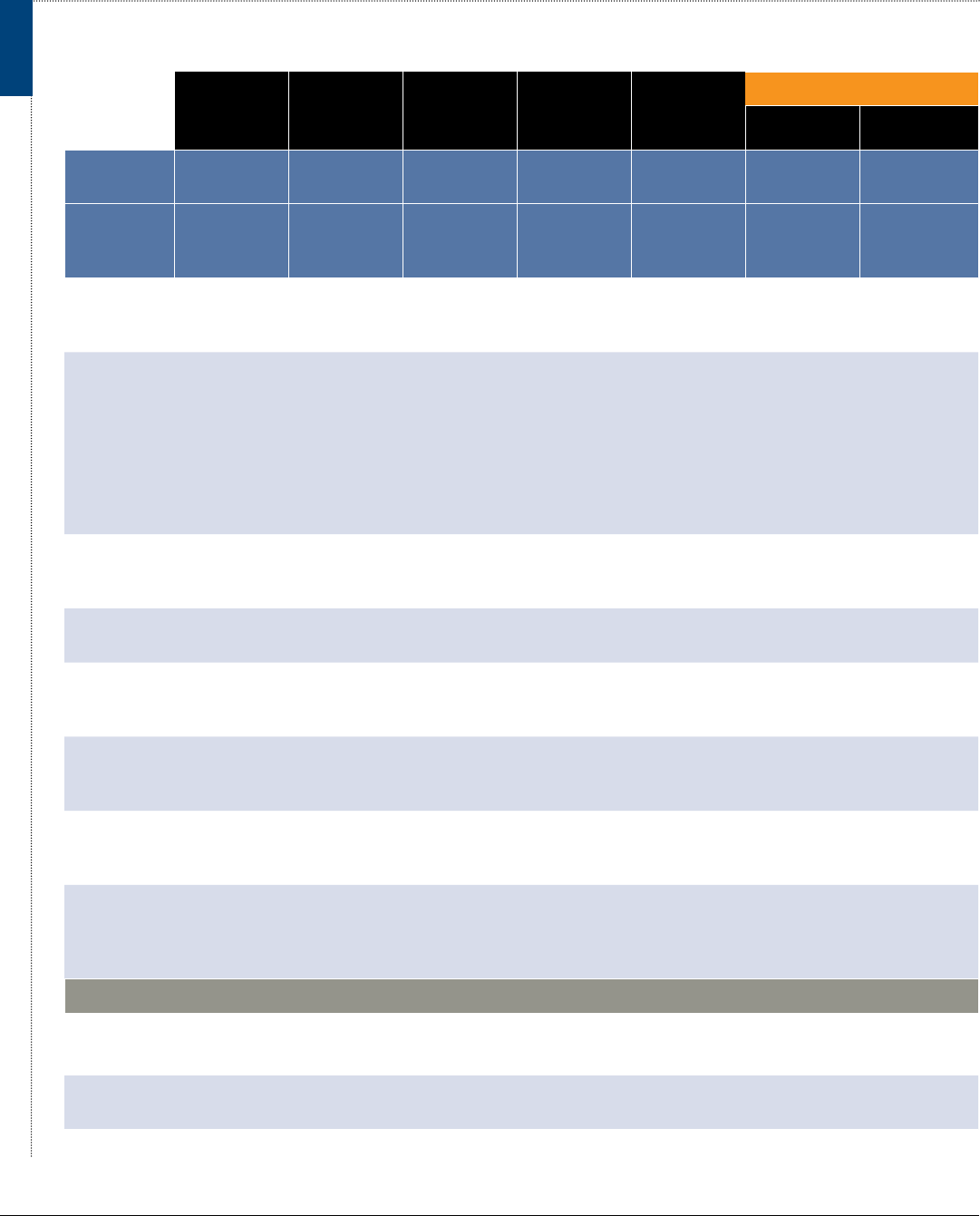

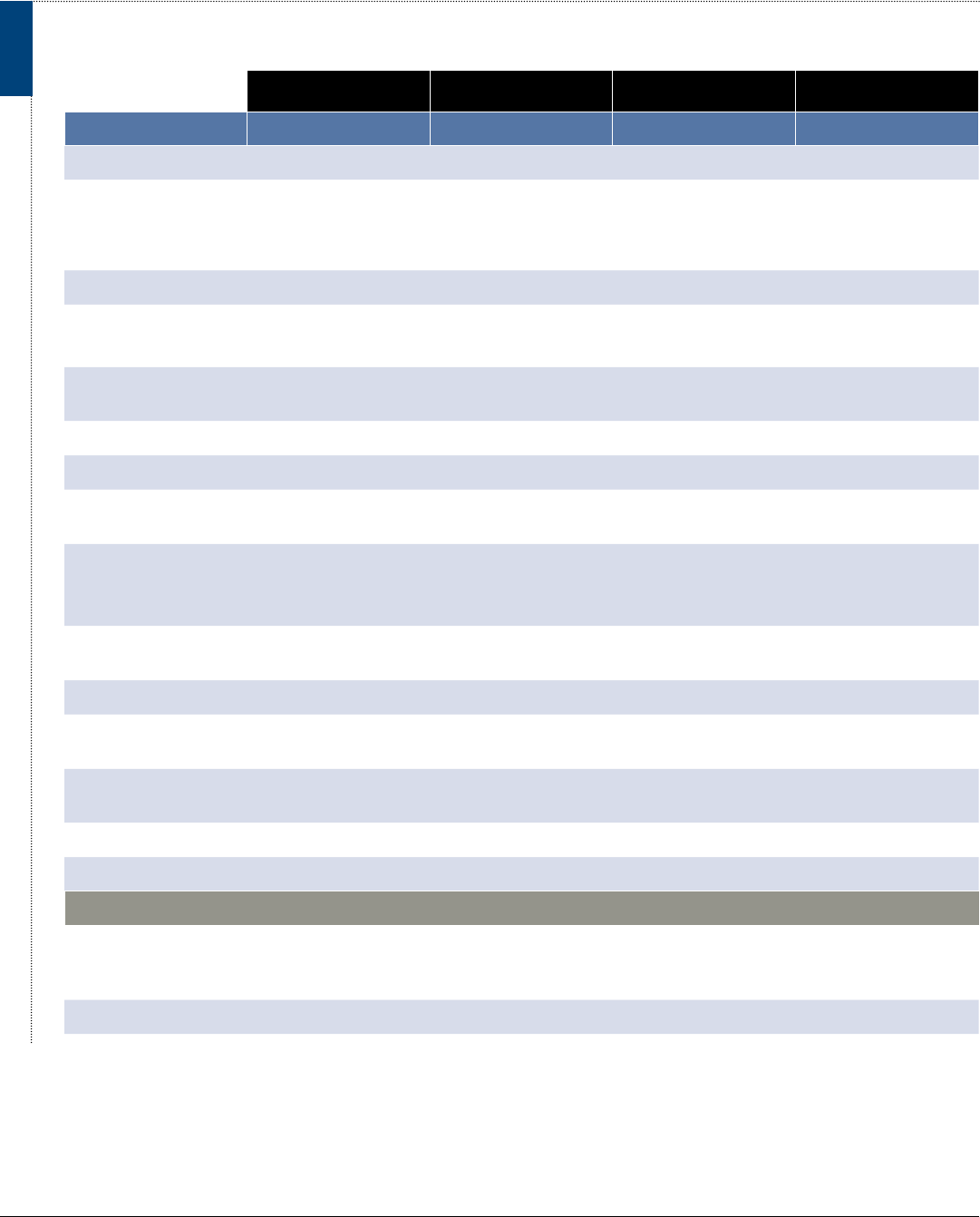

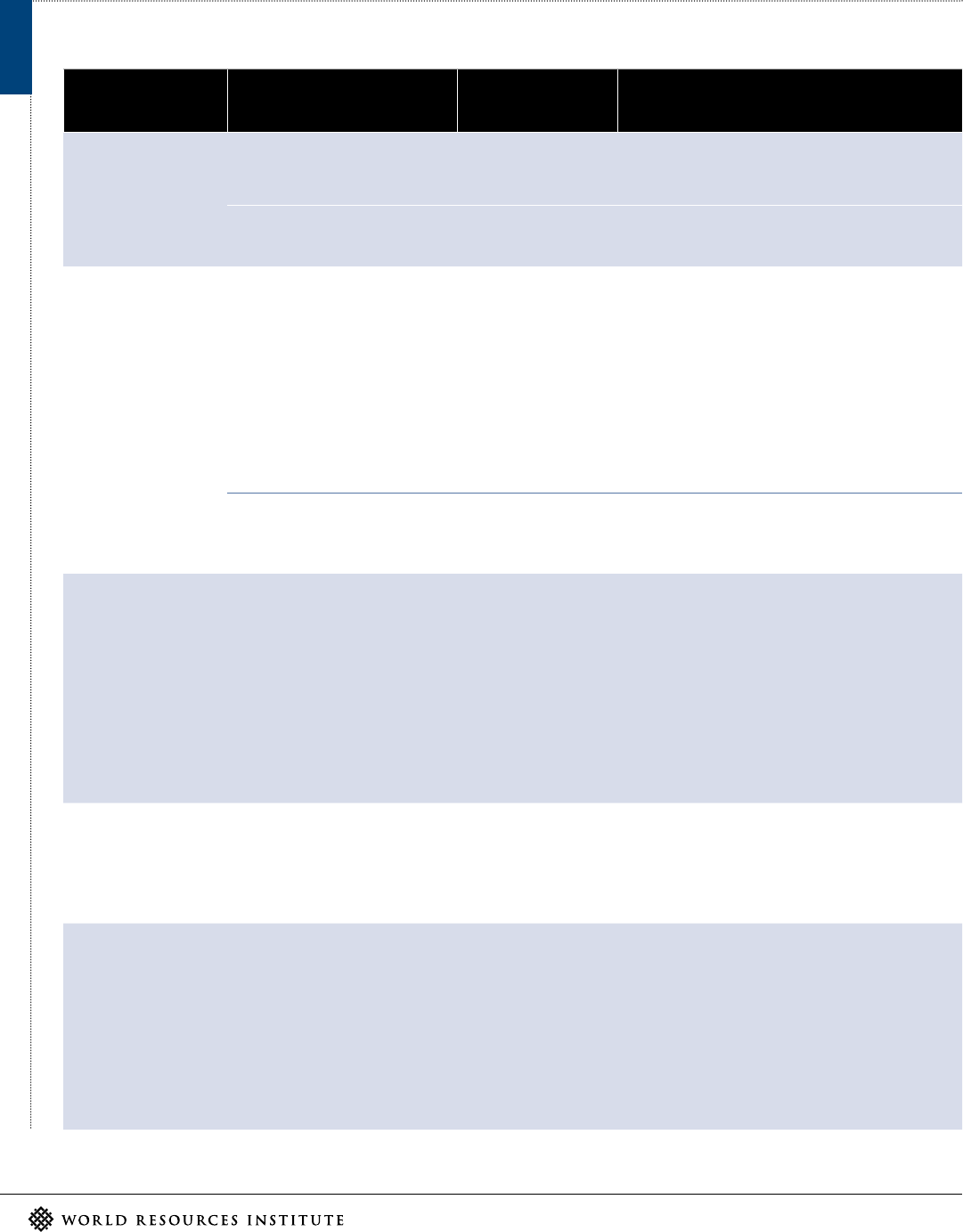

CUMULATIVE NUMBER OF ELECTRIC SCHOOL BUSES COMMITTED BY QUARTER IN THE

UNITED STATES

Notes: This graph depicts electric school bus (ESB) commitments at the earliest confirmed phase in the commitment process (awarded, ordered, delivered, or first operating)—286 ESBs

were excluded due to unknown dates of their commitment stages. Abbreviation: Q = quarter.

Source: Based on Lazer and Freehafer 2022.

FIGURE

2014

Q1

‘14

Q2

‘14

Q3

‘14

Q4

‘15

Q1

‘15

Q2

‘15

Q3

‘15

Q4

‘16

Q1

‘16

Q2

‘16

Q3

‘16

Q4

‘17

Q1

‘17

Q2

‘17

Q3

‘17

Q4

‘18

Q1

‘18

Q2

‘18

Q3

‘18

Q4

‘19

Q1

‘19

Q2

‘19

Q3

‘19

Q4

‘20

Q1

‘20

Q2

‘20

Q3

‘20

Q4

‘21

Q1

‘21

Q2

‘21

Q3

‘21

Q4

‘22

Q1

0

2000

1000

12,000

11,000

2

2

2

3

3

33

3

33

3

33

3

33

3

33

3

33

3

3

5

5

5

8

8

8

9

9

99

9

9

22

22

22

80

80

80

85

85

85

91

91

91

93

93

93

100

100

100

154

154

154

161

161

161

185

185

185

204

204

204

446

446

446

560

560

560

611

611

611

677

677

677

780

780

780

821

821

821

1202

1202

1202

1462

1462

1462

1555

1555

1555

11,682

11,989

First U.S. Electric School Buses

Begin Operation

California’s Kings Canyon School

District and Escondido Union High

School begin operating first electric

school buses with one each

Large Award of State Funding

in California

The California Energy Commission

approves nearly $70 million in funding

to replace more than 200 diesel school

buses with all-electric buses

Large Award of State Funding

in California

The California Energy Commission

approves nearly $70 million in funding

to replace more than 200 diesel school

buses with all-electric buses

First Large-Scale Utility Program

Dominion Energy announces it will

oset the additional cotsts of an electric

school bus, including charging

infrastructure, for 50 buses across its

Virginia service territory

Largest Procurement of Electric

School Buses

Montgomery County Public Schools, MD,

announces it will replace 326 diesel

school buses with electric school buses

over four years through a contract with

Highland Electric

Largest Partnership for

Repowered Buses

SEA Electric and Midwest Transit

Equipment announce they will partner

to convert 10,000 school buses to

electric over five years

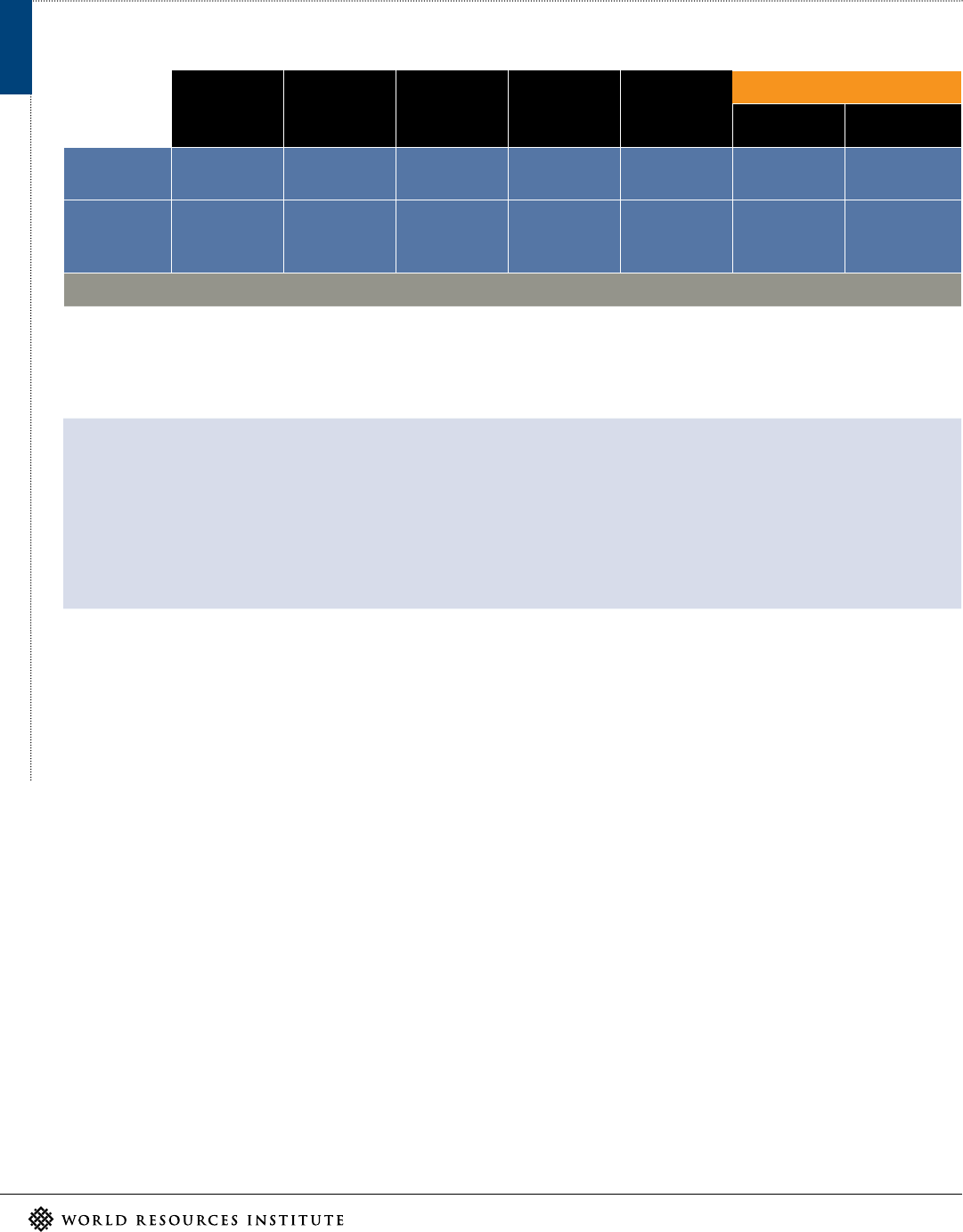

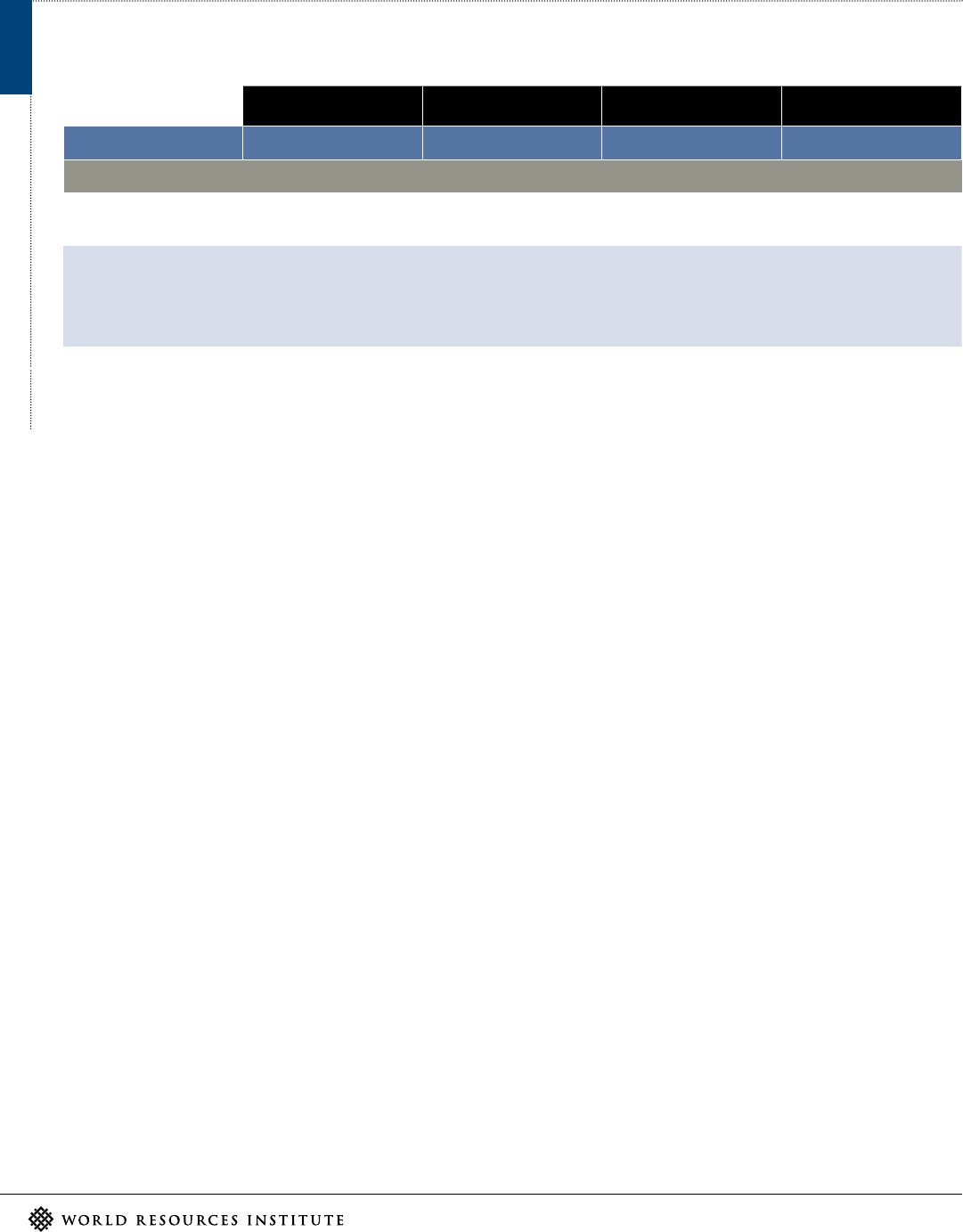

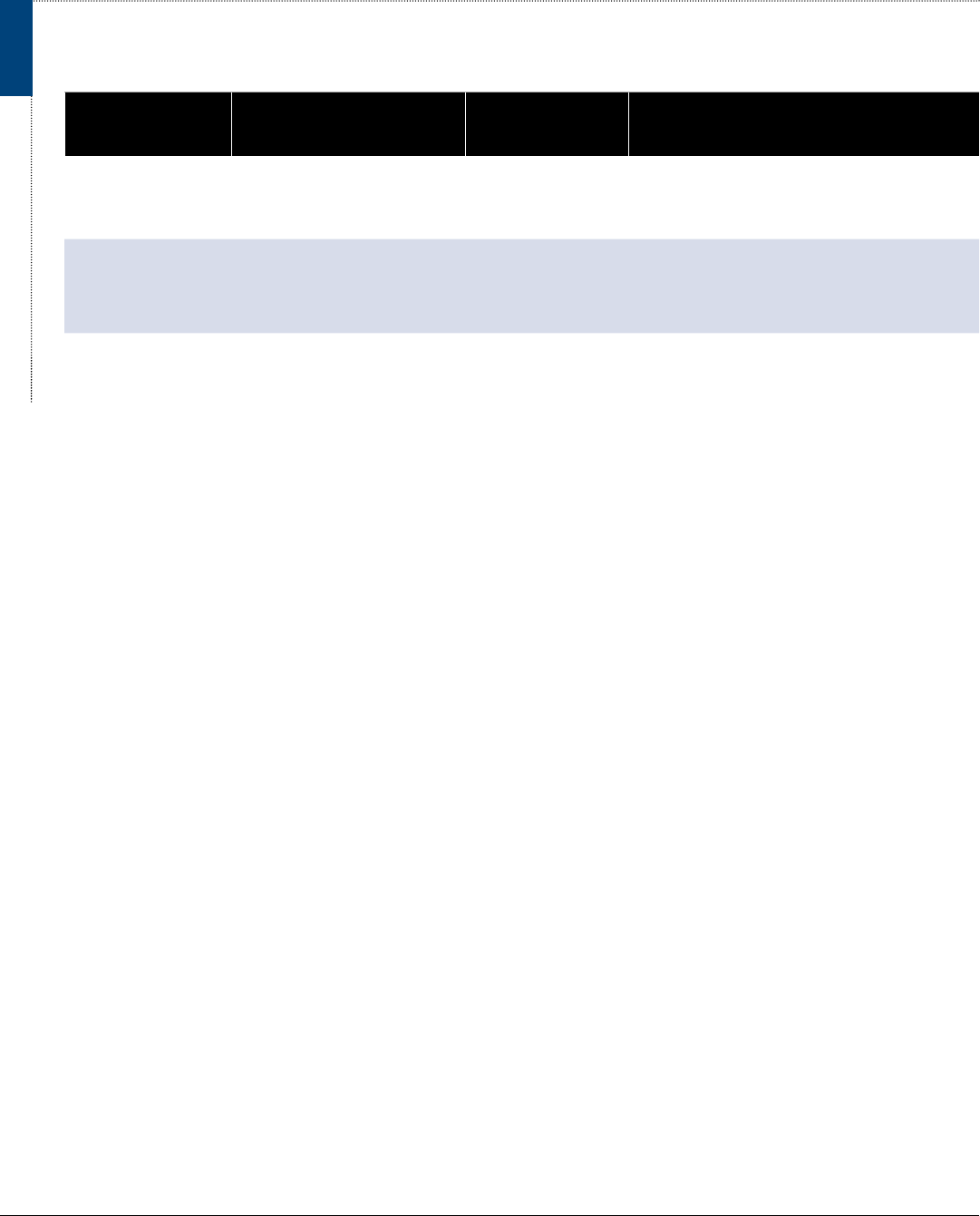

SAMPLE OF ELECTRIC SCHOOL BUS BENEFITS AND CONSIDERATIONS

Sources:

a.

Levinson 2022; Energetics Incorporated et al. 2021; Ercan et al. 2016;

b.

EDF 2021;

c.

Liu and Grigg 2018; Espinoza and Vemireddi 2018; Vieira et al. 2012;

d.

Austin et al. 2019;

e.

BTS

2021; FHA 2019;

f.

ANL 2020, comparing five fuels for school buses: electric, compressed natural gas, propane, diesel, and biodiesel. Utilizing various electricity mixes for electric school

busesand North American natural gas for compressed natural gas. Based on 15,000 miles per bus per year;

g.

U.S. PIRG n.d.;

h.

Hutchinson and Kresge 2022.

FIGURE

Lower Operations

and

Maintenance Costs

Research suggests that after the upfront cost, electric school buses

could save districts an estimated $4,000–$11,000 per school bus every

year on operational expenditures like fueling and maintenance and

repair costs (depending on labor costs, local electric utility rates, and

the price of petroleum fuels). Today, these savings alone are insuicient

to cover the vehicle price dierential without additional grant funding

or subsidies.

Health Benefits

There is increasing evidence that children are particularly susceptible

to the negative health impacts of diesel exhaust, which has been linked

to increased risk for asthma and pneumonia (Box 1). There is also

evidence that reducing this exposure can improve not just respiratory

health but also standardized test scores, especially for elementary-age

students. While there has been little research measuring the air quality

benefits of electric school buses specifically, these results strongly

suggest that adopting these vehicles— which have zero tailpipe

emissions— would have positive eects on students’ health and

academic outcomes, particularly for low-income students and Black

students, who are more likely to ride the school bus than their peers.

Climate Benefits

For school buses, electricity emits half as many greenhouse gas

emissions annually as the next-best fuel. Electricity is the only

viable fuel that will reduce greenhouse gas emissions over time

and as buses age as the grid integrates more renewables. Buses

can also be paired with on-site renewable energy projects.

Resilience and

Grid Potential

Electric school buses have the potential to serve as mobile

generators for buildings during outages (vehicle-to-building; V2B),

for the grid during high energy demand (vehicle-to-grid; V2G), or

for another load (vehicle-to-another-load; V2L). This technology is

constantly being improved upon, and manufacturers are working

actively to understand the impacts of higher charge and discharge

cycles on battery life. Charging electric school buses o-peak and

under managed charging oers grid benefits today by not charging

when energy demand is highest or by charging when renewable

energy is abundant.

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 5

HEALTHIER AIR FOR STUDENTS IN STOCKTON, CALIFORNIA

The residents of Stockton Unified School District (SUSD) experience some of the highest asthma rates in California, with the state ranking

Stockton in the 96

th

percentile for pollution burden and the 100

th

percentile for asthma. SUSD saw the conversion to ESBs as a way to help

improve air quality and protect student health.

With a host of partners, SUSD applied for the California Air Resources Board’s (CARB’s) Clean Mobility in Schools Project and was ultimately

awarded $4.8 million from the state program. SUSD leveraged the CARB grant to secure additional sources of funding from utility, local, and

state programs. In total, SUSD secured $8.3 million for 11 ESBs and charging infrastructure (a mixture of direct current fast and level 2 chargers;

see Table 1 for distinction) for 24 buses in phase one of the pilot.

SUSD’s pilot moved quickly despite COVID-19 budget cuts and constraints. SUSD received the initial CARB grant on January 7, 2020, had funds

approved by April, broke ground on the bus charging infrastructure in September 2020, and had the charging infrastructure operational in

December 2020. The district aims to eventually convert all 96 of the school district’s buses.

In addition to focusing on the air quality benefits of ESBs, SUSD engages students in clean energy projects to demonstrate that the green jobs

of the future are for them. “Zero-emission buses are a symbol of hope and a means of change for communities like Stockton,” says Gil Rosas

who was SUSD’s energy education specialist during its ESB transition. “Stockton has shown how a disadvantaged community can go from

design to construction to electric school buses in less than a year.”

Source: Rosas 2021. Learn more about Stockton’s experience by visiting Kaplan, L., and A. Huntington. 2021. “The Electric School Bus Series: Healthier Air for Students in Stockton,

California.” Washington, DC: World Resources Institute. https://www.wri.org/update/electric-school-bus-series-stockton-california.

BOX

Community Support

Community members can drive demand for school

bus electrication. Grassroots organizations and

advocacy groups, often made up of parents and other

caregivers, have been eective at pushing school district

commitments and creating policy changes. At the

national level, Chispa LCV has been driving the ESB

conversation since 2016 by creating the "Clean Buses

for Healthy Niños" campaign to ask decision-makers to

prioritize ESBs when spending the Volkswagen settlement

funds,

4

forming the Alliance for Electric School Buses,

and championing the numerous benets ESBs bring to

communities (Chispa n.d.). Its volunteers have supported

legislation in Nevada and helped hold school districts

to their commitments in Arizona (Schlosser 2021). In

Virginia, Mothers Out Front helped get Virginia Delegate

Mark Keam’s ESB bill passed (MOF n.d., 2021; FCPS

2021a). In New York, advocacy from groups helped push

both New York City’s and New York State’s commitments

to transition the eet by 2035 (News 12 Sta 2022;

EarthJustice 2022; Kaye 2022; CNY 2021). Students

have also been eective changemakers, especially at the

school district level. For example, in Miami, student

pressure at school board meetings helped convince the

district to pursue a grant for 50 ESBs (Casey 2021).

These are just a few examples of how communities have

driven demand for ESBs by advocating for their children’s

health and safety.

Policy Commitments

Policy commitments can inuence speed of adoption.

The New York State budget for scal year 2023 includes

a new, nation-leading requirement for all new school

bus purchases in New York State to be zero emission

starting in July 2027 (Lewis 2022). All school buses in

service statewide must be zero emission by 2035. The new

law also requires the New York State Energy Research

& Development Authority to oer technical assistance

to school districts and publish an implementation

roadmap. The legislation further allocates $500 million

in potential state funding for school bus electrication.

This new funding, part of a larger environmental bond

act, is subject to voter approval in November 2022. In

California, the governor’s budget proposal, currently

being considered in the state legislature, would allocate

$1.5 billion in one-time funding, available over three

years, to support school transportation programs, with a

focus on greening school bus eets (Gray 2022).

6 |

At the local level, Fairfax County Public Schools in

Virginia, with 1,625 school buses, one of the largest eets

in the country, adopted a goal for full eet electrication

by 2035 (FCPS 2021b; Schlosser 2019). In addition, after

receiving North Carolina’s rst ESB earlier this year, the

Eastern Band of Cherokee Indians set a goal of becoming

the rst school system in the state to electrify its full

eet and has already ordered four additional ESBs that

are expected to be delivered this summer (WLOS Sta

2022; Kays 2022).

Grants and Incentives

As of April 2022, about 80 percent of school districts

or eet operators with committed ESBs had only one

batch of ESBs so far—20 percent (83 school districts

or eet operators) had between two and four batches.

5

Funding at the utility, local, state, and federal levels

has catalyzed adoption, with school districts leveraging

A RURAL COUNTY’S EXPERIENCE WITH ELECTRIC SCHOOL BUSES

KNOX COUNTY, MISSOURI

After success with on-site solar, Knox County R-I School District—the second largest geographically in Missouri—began looking for other ways

to reduce expenditures, increase revenues, and expose students to a growing field that could oer well-paying clean energy jobs within their

own community. At the suggestion of Lewis County REC, the district’s electric cooperative, Knox County Superintendent Andy Turgeon and his

team turned their sights to an ESB.

In 2020, the district began searching for funding, ultimately securing four grants—one state, one federal, and two from utilities: Department

of Natural Resources Volkswagen settlement funding ($169,126); U.S. Department of Agriculture’s Community Facilities program ($116,626);

Associated Electric Cooperative Inc. ($30,000); and Lewis County REC ($15,000).

The district received its ESB six months after placing an order. The school district had slight challenges with regenerative braking and the

direct current to direct current (DC-DC) converter. When installing USB (universal serial bus) ports in the bus, one of the relay switches that

operates the regenerative braking was knocked loose. Turgeon and his team quickly identified and fixed the issue after plugging in a laptop

for remote communication and diagnostics. For the DC-DC converter, the cameras Knox County School District installed on the bus were not

shutting o and were draining the onboard 12-volt battery. Once identified, the manufacturer sent a new onboard battery and the bus mechanic

installed it within an hour.

Overall, Turgeon and the drivers have enjoyed the bus, noting how quiet and smooth the rides are. Looking ahead, Knox County schools

believe that full electrification of their 14-bus fleet is in their future and have already applied for grants for two more buses through the state’s

Department of Natural Resources.

Source: Turgeon, A. 2021. Learn more about Knox’s experience at Huntington, A., and L. Kaplan. 2021. “The Electric School Bus Series: Wiring Up in Knox County.” Washington, DC: World

Resources Institute. https://www.wri.org/update/electric-school-bus-series-knox-county.

BOX

dozens of funding sources across the country to oset

the high upfront prices of the buses, which can be three

to four times more than a diesel model (Levinson 2022;

Tables 2, 3, and 4).

States are an important source of funding for school

bus electrication. California has awarded over $116

million for ESBs through its California Hybrid and

Zero-Emission Truck and Bus Voucher Incentive Project

(California HVIP 2022). New York State’s Truck Voucher

Incentive Program and Massachusetts’ Vehicle-to-

Grid Electric School Bus Pilot Program are other early

examples of states providing funding for ESBs (NYSERDA

2022; MDER 2022). Across the board, the state

funding landscape has evolved due to the Volkswagen

settlement funds, which make up over one-third of state

public funding for ESBs allocated to date and are the

primary source of state funding for ESBs in most states

(McLaughlin and Balik 2022; Box 2).

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 7

In addition to state and local funding, the bipartisan

Infrastructure Investment and Jobs Act, signed into

law in November 2021, will provide an unprecedented

amount of funding—$5 billion over ve years to the U.S.

Environmental Protection Agency to establish the Clean

School Bus Program—to school districts and other eligible

contractors or entities starting in mid-2022. The program

will oer both rebate and grant programs to support the

replacement of existing school buses with cleaner zero-

or low-emission school buses, which should help bring

down the upfront price school districts pay for electric

models. This funding includes $2.5 billion in dedicated

funding for ESBs and another $2.5 billion for zero- and

low-emission school buses, including both electric and

alternative fuel buses. These programs will prioritize

projects that align with the Justice40 initiative, which

aims to deliver at least 40 percent of overall benets

from federal climate and clean energy investments to

underserved communities.

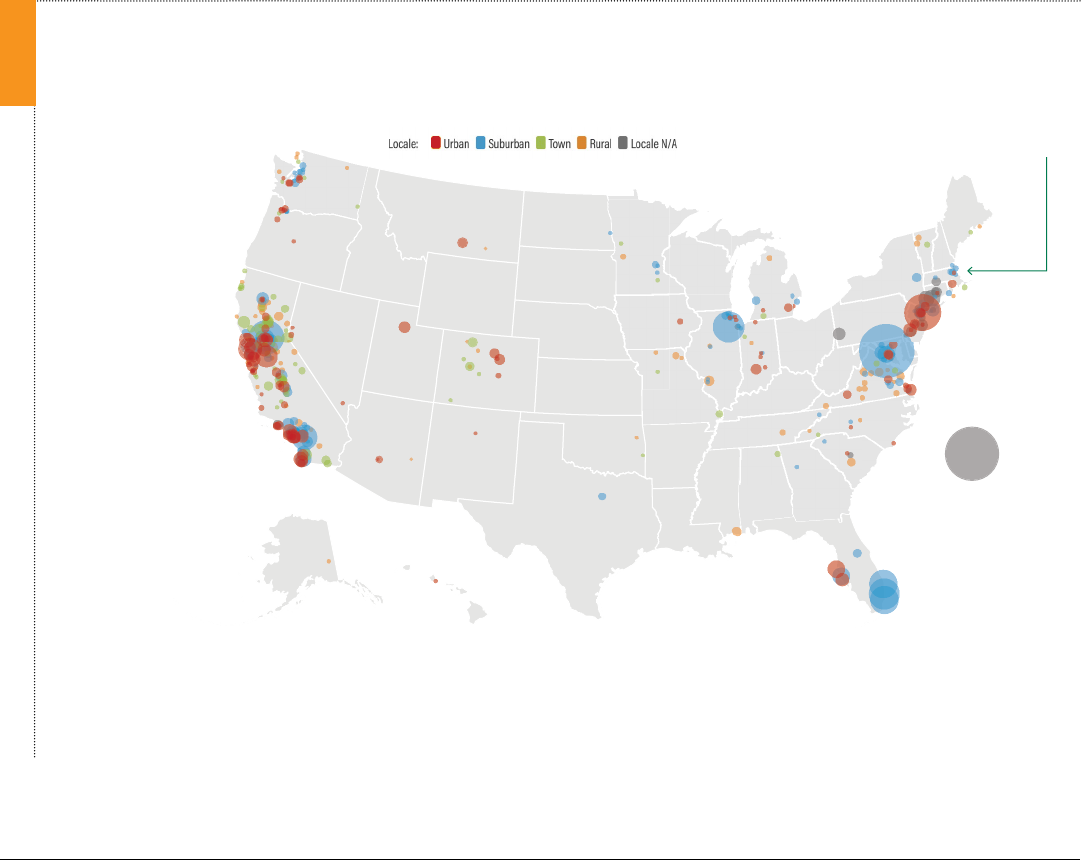

Current Market Status

School districts and cities across the country are

becoming part of the transition to ESBs, driving up

demand nationwide. As of March 2022, 415 districts (or,

in some cases, private eet operators) had committed to

procuring 12,275 ESBs (Lazer and Freehafer 2022; Figure

3). ESBs are committed in 38 states, the Cherokee Nation,

and the White Mountain Apache Tribe. Most are located

in California, which features robust and long-standing

state funding programs (Box 3).

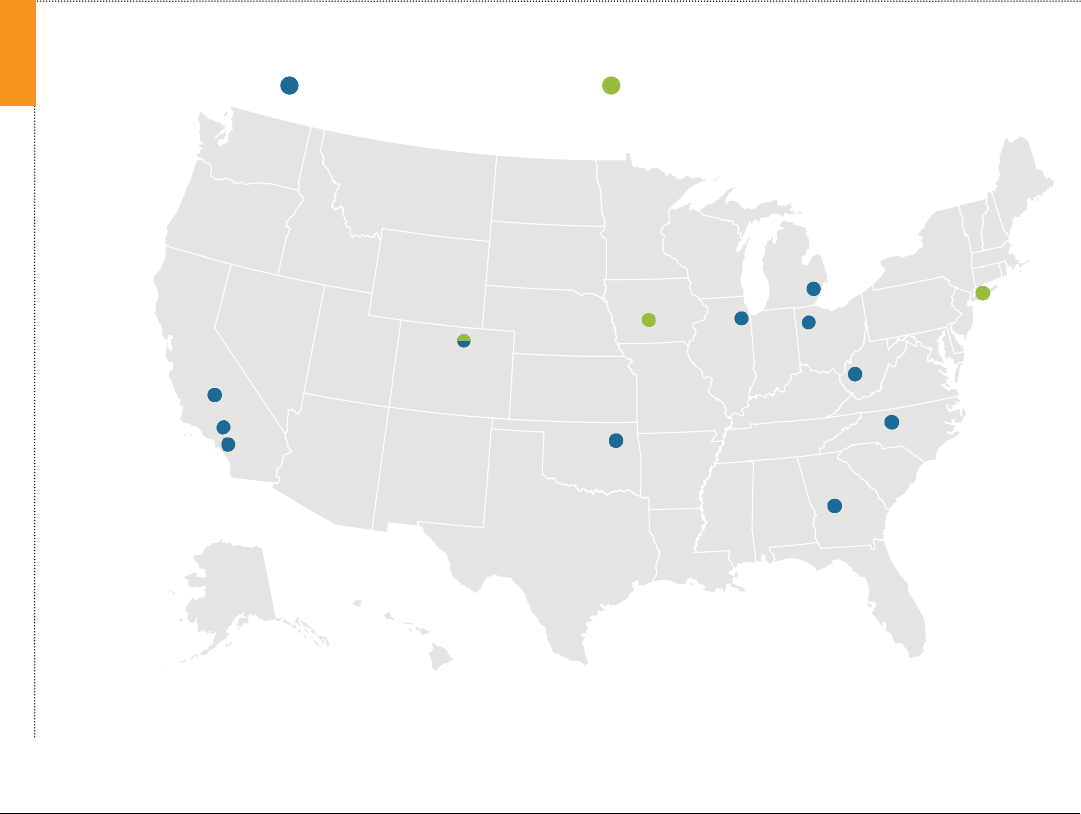

ELECTRIC SCHOOL BUSES IN THE UNITED STATES

Notes: Data as of March 2022. Midwest Transit Equipment and SEA Electric have not yet announced the location of their 10,000 repowered electric school buses (grey circle).

Sources: Lazer and Freehafer 2022; NCES 2018, 2020; examples gathered by authors.

FIGURE

La

rgest Electric School

Bu

s Fleet (50 buses)

T

win Rivers Unified

School Dist

rict, California

(B

ox 3)

Oldest Elec

tric School

Bu

s Fleets (Est. 2014)

K

ings Canyon Unified

School Dist

rict and

Escondido U

nion High

School Dist

rict, California

Extreme Heat Operations

Cartwright School District, Arizona

Largest Procurement

(326 buses)

Montgomery County

Public

Schools, Maryland

First Cold Weather Pilot

(2016—18)

Amherst, Cambridge, and

Concord, Massachusetts

First-in-Nation Requirement: All

new school bus purchases must

be zero emission starting in July

2027; fully electric fleet by 2035

New York

Extreme Cold Operations

Alaska Gateway School District, Alaska

8 |

BUILDING INTERNAL CAPACITY WITH ELECTRIC SCHOOL BUSES IN TWIN RIVERS,

CALIFORNIA

Twin Rivers Unified School District began operating its first ESBs in 2017. Currently, the school district operates the largest ESB fleet in the

nation with 50 electric Type A, C, and D buses from a variety of manufacturers (Lion, Trans Tech, Blue Bird, and Collins with orders placed for

Micro Bird and Thomas Built Buses). All are newly manufactured models; none are repowered models.

Reflecting on his district’s journey, Twin Rivers Transportation Director Tim Shannon encourages fleets to “think big” at the outset, as doing

multiple upgrades for infrastructure can be burdensome and costly. Depot upgrades include underground work, trenching, and laying pipe.

Fleets can minimize facility disruption by planning early on to accommodate a larger electric fleet. While total infrastructure costs depend on

several factors, the size of the fleet and the available power source are two of the greatest. To make nationwide electrification possible, Twin

Rivers highlighted the need for broader investments in public infrastructure so that school districts can use their electric buses for longer field

trips or activities, which has proved diicult to date.

Twin Rivers has experienced some operational issues, primarily problems with converters/inverters and battery replacements in three of its

eight first-generation buses. These replacements were covered by the eight-year warranties oered by the manufacturer. Twin Rivers has

not experienced this challenge in later-generation buses and has found that manufacturers and dealers have been responsive regarding

both immediate needs and longer-term modifications to their oerings. While Raymond Manalo, Twin Rivers’ vehicle maintenance manager,

emphasizes that forging strong partnerships with manufacturers and dealers is essential, he also cautions against relying too heavily on those

parties: Eectively training technicians to resolve issues internally can address simpler issues and reduce downtime. A school district can build

internal capacity for its maintenance technicians by receiving manufacturer or dealer training, which can be built into purchase contracts or

requests for proposals. Twin Rivers has also leveraged its network of local school districts operating electric buses as a form of mutual aid

when schools encounter issues or need parts.

Source: Shannon and Manalo 2021.

BOX

Electric school buses have successfully been deployed in

a variety of climates. For example, Tok Transportation

began operating Alaska’s only ESB, a Type C with a 138-

mile range, in October 2020 and has since been able to

operate in temperatures as low as -38 degrees Fahrenheit

(°F) (O’Hare 2021). In such extreme conditions, the

bus’s eciency is halved—a more substantial decrease

in eciency than that of buses operating in areas with

less severe winters regardless of fuel type (Henning et

al. 2019). However, Tok Transportation can manage

this drop in eciency as its average route length is

just 30 miles. Buses have also been deployed in hot

weather climates. Cartwright School District 83 outside

of Phoenix, Arizona, received the state’s rst ESB in

July 2021. The bus has an upgraded air conditioning

system that is appropriate for the Arizona heat and has

successfully operated in summer temperatures without

major battery impacts (Hannon 2021).

1.2 Scaling Supply

To meet the growing demand for ESBs, existing

manufacturers are ramping up production, and new

manufacturers continue to enter the eld (Figure

4). While initial oerings were limited, today many

manufacturers are on their second or third ESB model

iteration, some more, and are expanding their production

capacity to meet demand. For example, after expanding

its production capacity sixfold in late 2020 due to a sales

increase of 250 percent compared with the previous year,

Blue Bird became the rst manufacturer to achieve 800

electric-powered school buses either delivered or on order

(Blue Bird 2020; STN 2021c). The company reported

a backlog of over 380 buses on order last year and will

again increase production capacity in 2022 (Blue Bird

2021a, 2021b). Lion Electric, a Canada-based group,

announced it would expand its footprint by constructing

a U.S. manufacturing facility in Joliet, Illinois, that will

have an annual production capacity of up to 20,000

all-electric buses and trucks (Lion Electric 2021). In

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 9

response to the favorable market outlook due to the

federal government’s Infrastructure Investment and Jobs

Act, GreenPower announced it would double its ESB

production capacity in 2021; the manufacturer said it

would lease or purchase a manufacturing facility in West

Virginia (GreenPower 2021; Justice 2022). Providers

are also forging partnerships: Lightning eMotors, an

all-electric powertrain manufacturer, and Collins Bus,

a school bus body uptter, have partnered to deliver

more than 100 electric Type A buses by 2023 (Lightning

eMotors 2021).

School bus manufacturing is concentrated in the United

States, supported by federal Buy America regulations,

and in Canada. However, ESBs are still dependent on a

global supply of lithium-ion batteries, electric motors,

and other electric vehicle components that have less

domestic manufacturing capacity (FTA n.d.). The cost

of these components, particularly batteries, will directly

impact ESB capital cost and the industry’s ability to see

rapid ESB adoption. Despite these challenges, even as

the COVID-19 pandemic has presented unprecedented

hardships for the education sector, ESBs have persisted

as the only fuel type to see growth in new bus sales during

the pandemic with sales increasing 61 percent (STN

2021b). As ESBs continue to gain market share, it will

be crucial to also manage diesel bus scrappage in a way

that limits used vehicle ows to international markets,

permits repowering by not cutting frame rails, and allows

eet managers to hold on to buses long enough to become

acclimated to ESB replacements in their eets.

To meet demand, existing contractors and emerging

third-party services are looking for ways to support

school districts in this transition. Contractors, who

represent around 40 percent of the school bus market,

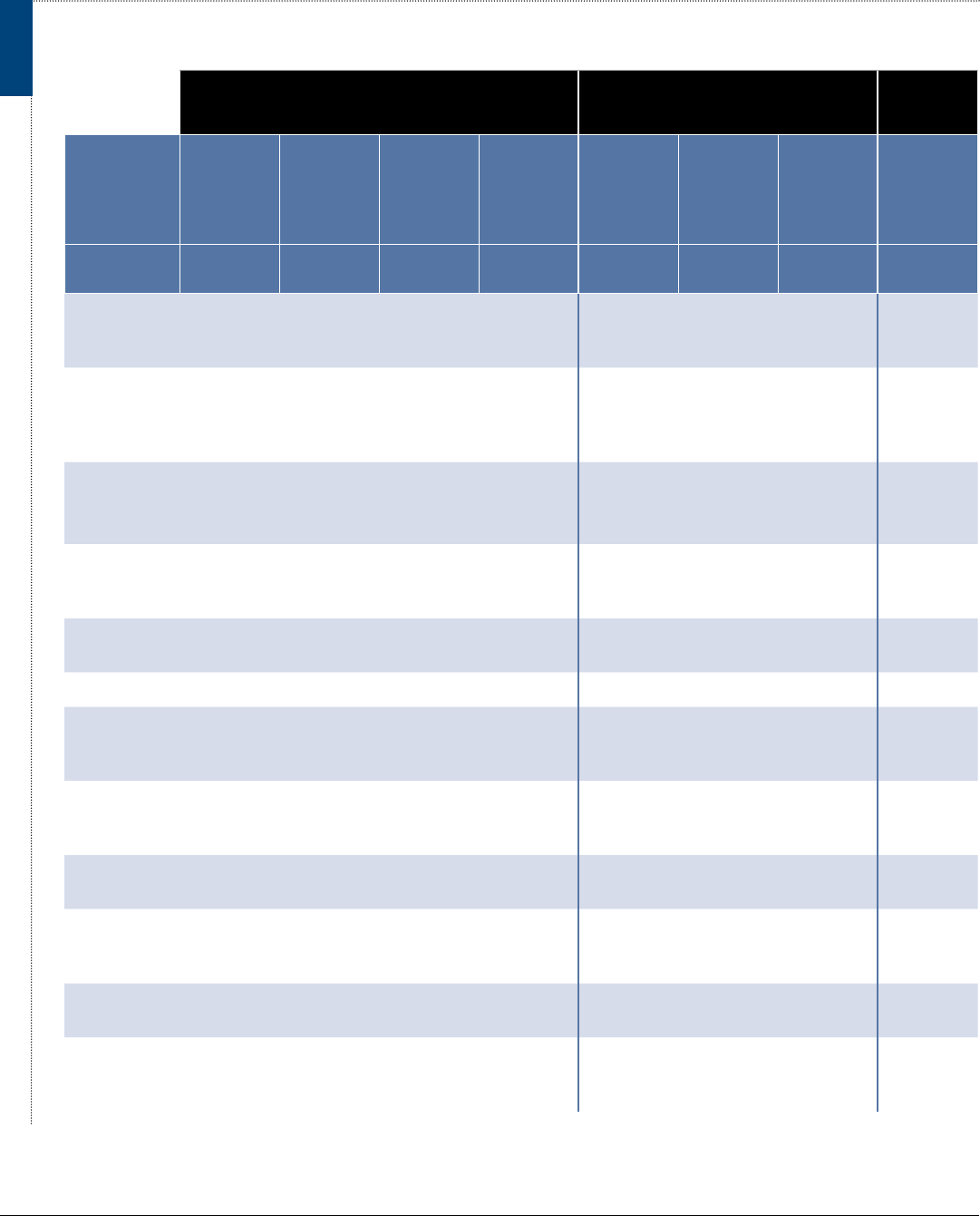

MAP OF ELECTRIC SCHOOL BUS MANUFACTURING FACILITIES IN THE UNITED STATES

Notes: This map does not include electric school bus manufacturing facilities in Canada. Lion Electric and Micro Bird both have facilities in Quebec.

Source: WRI authors based on publicly available information.

FIGURE

GreenPower

BYD

Phoenix Motocars

Lightning eMotors

IC Bus/Navistar

SEA Electric

Lion

Electric*

Motiv Power

Systems

Endera

GreenPower*

Thomas Built Buses

Blue Bird

Unique Electric Solutions

Newly Manuafactured Vehicle Companies Repower Companies*Facility to be constructed

10 |

are beginning to explore pathways to electrication

to meet customer demand (Gissendaner 2021). For

example, Student Transportation of America, a private

eet operator servicing school districts across the United

States and Canada, launched an Electric School Bus Pilot

Program in 2021, and Midwest Transit Equipment is

partnering with SEA Electric to repower 10,000 school

buses to electric through 2026 (SBF 2021b; SEA Electric

2021). New service providers are employing alternative

business models to lower the upfront cost barrier and

reduce new technology risks for school districts (Box 4).

TURNKEY ASSET MANAGEMENT AND

OTHER ASASERVICE MODELS

Structured as service contracts, districts can benefit from

expert project management, procurement support, and

ongoing operations and maintenance services. Services can

span from bus ownership to site energy management, with

dierent combinations of service solutions depending on the

specific needs and context of each customer.

Two examples are Highland Electric and Levo Mobility,

firms that leverage private finance, potential vehicle-to-

grid revenues, public funds, and the purchasing power of

multiple clients to provide bundled packages of services that

enable electrification. Montgomery County Public Schools

in Maryland is partnering with Highland Electric on the

largest procurement of ESBs in North America. The school

district announced in 2021 it would convert 326 buses to

electric by 2025 on a path to full electrification of its 1,400-

bus fleet.

a

Building on this progress, Highland signed a letter

of intent with school bus manufacturer Thomas Built Buses

in March 2022, which will allow Highland to provide ESB

subscriptions through 2025 at prices that put them at cost

parity with diesel.

b

In Illinois, Levo Mobility will use its turnkey

electrification solution to help Troy Community Consolidated

School District 30-C convert its 64-school bus fleet to zero

emission within five years.

c

Notes:

a.

Proterra 2021;

b.

DTNA 2022;

c.

Levo Mobility LLC 2022.

BOX

2. ELECTRIC SCHOOL BUS BASICS

In preparing for ESB adoption, project developers need to

understand considerations for both the buses themselves

as well as the charging infrastructure to power them. This

section outlines components of the ESB and its charging

infrastructure (Tables A1 and A2 in Appendix A provide

additional terms and units, respectively) and oers

considerations for implementation.

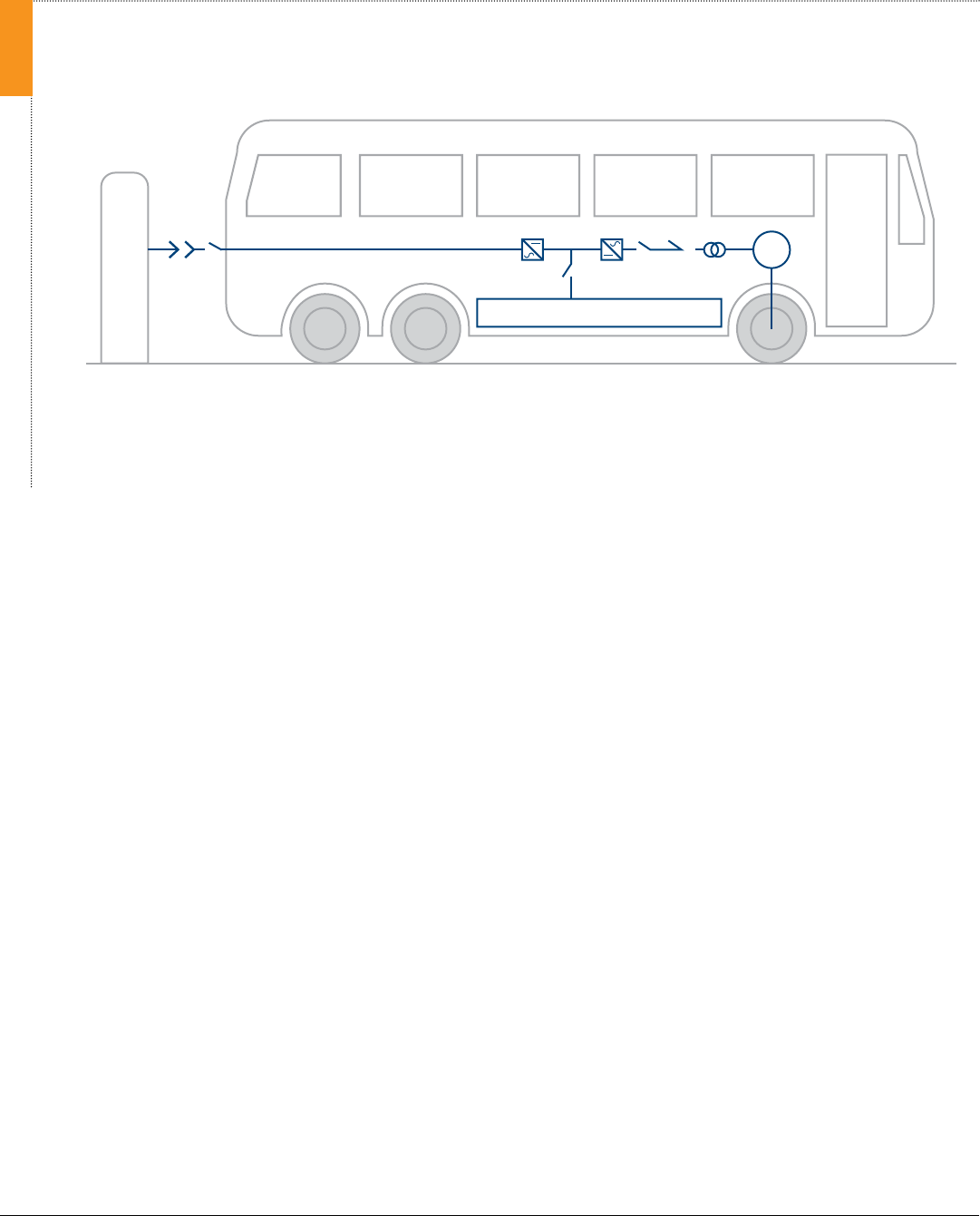

2.1 Electric School Bus

As school districts embrace electric buses, eet managers,

bus drivers, and maintenance technicians will need to

familiarize themselves with elements that vary between

diesel and electric (Figures 5 and 6). While many

elements of the body and inside the cabin remain similar,

two key dierences are present in electric models:

1. The presence of high-voltage electrical systems

2. The absence of internal combustion–

related components

ESBs contain high-voltage systems powered by a large

lithium-ion battery pack mounted to the chassis. Power

from the high-voltage battery is distributed to the electric

motor and other systems using high-voltage cables

(colored bright orange), direct current/alternating current

(DC/AC or AC/DC) inverters, and AC/AC transformers.

The high-voltage battery pack is supported by a thermal

management system that maintains battery health and

longevity by keeping the batteries within an optimal

temperature range regardless of external temperature

(vital to ESBs operating in cold and hot climates).

With the inclusion of an electric powertrain, ESBs do

not contain internal combustion engine components and

systems (see components highlighted in red in Figure 6).

Electric buses utilize motors comprising only around 20

parts (compared with 2,000 in a diesel engine); require

fewer uid changes (including elimination of engine oil);

and commonly use a direct drive system, eliminating the

need for a transmission.

With respect to vehicle servicing, technicians have fewer

parts to maintain for electric buses when compared with

their diesel counterparts. Moreover, many auxiliary

systems in ESBs, such as braking and steering, remain

similar to those of diesel buses, making them relatively

easy to keep up and service (see components highlighted

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 11

ELECTRIC SCHOOL BUS DIAGRAM

Note: Abbreviations: AC = alternating current; DC = direct current; M = motor.

Source: Ainsalu et al. 2018.

FIGURE

DC/ACAC/ACAC/DC

Battery Pack

Recharge Station

Plug-in recharge

Onboard AC line

in blue in Figure 6). Additionally, like diesel buses, ESBs

also have low-voltage auxiliary systems that use a lead-

acid battery to support components like the dashboard,

lights, and windshield wipers. However, to operate on

high-voltage systems, maintenance technicians do need

specialized training. For on-site depot maintenance

sta, completing this training can be both costly and

time consuming.

If qualied technicians are not readily available where

the bus operates, any issues that arise with the high-

voltage system must be resolved by the closest dealer

or manufacturer that has trained staff. Depending on the

proximity of the bus to these services, there can be delays

and challenges with bus uptime. To address this, it is

imperative that manufacturers and dealers work closely

with transportation managers, technicians, and their teams

to provide training to properly manage these systems and

related safety considerations and to decentralize where

the ability and knowledge to operate on high-voltage

systems is concentrated.

2.2 Charging Infrastructure

As school districts consider procuring ESBs, they must

also think about the corresponding infrastructure needed

to charge these buses. Infrastructure can be broken down

into hardware and software components. For charging

hardware or electric vehicle supply equipment, there are

three levels available today (Table 1).

Bus depots can and often do have a mix of level 2 (L2)

chargers and direct current fast chargers (DCFCs). With

lower power demand, several buses can typically charge

at the same time with multiple L2 chargers that can have

two ports per charger. For DCFCs, higher power demands

may restrict charging to fewer buses and only one

per DCFC charger.

Early and frequent engagement with a school district’s

electric utility is crucial. This is necessary to evaluate

the existing power supply and identify required system

upgrades and charging congurations to support eet

turnover. Once charging infrastructure is in place, which

can take approximately 12 to 24 months, bus operators

can take advantage of time-of-use rates (if available) and

managed smart charging to help realize greater energy

savings. For example, a 2015–18 ESB pilot at three

Massachusetts school districts found that unmanaged bus

charging and high parasitic loads during charging (e.g.,

12 |

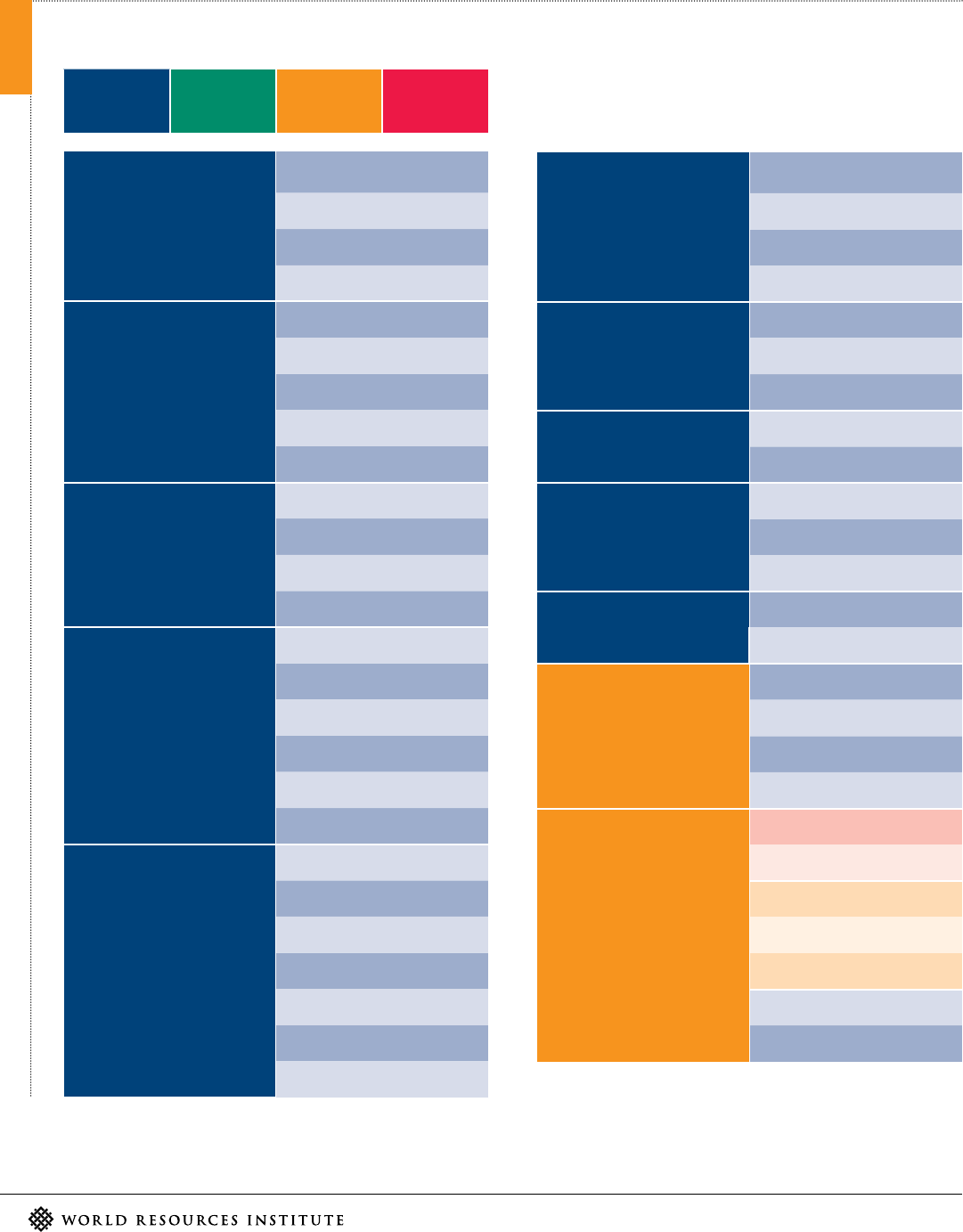

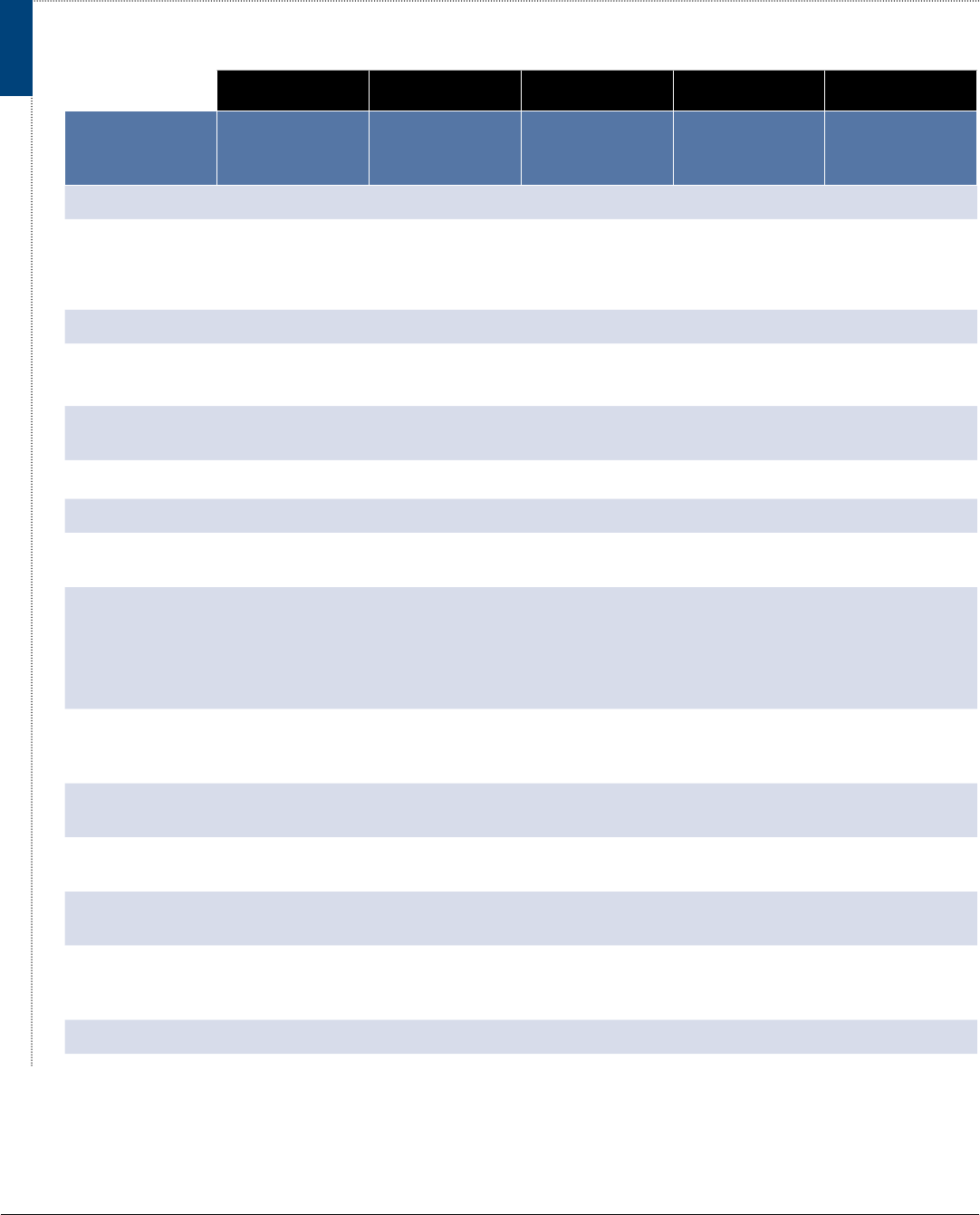

COMPARISON OF ELECTRIC AND INTERNAL COMBUSTION ENGINE VEHICLE COMPONENTS

COMMON EV ONLY

CHANGED

FOR EV

ICE ONLY

Body System

Body

Doors

Windows

Head/all lights

Suspension System

Springs

Shocks

Air leveling

Front axle

Control arms

Brake System

Brake calipers

Air compressor

Reservoir

Brake pedal

Steering System

Steering wheel

Gearbox

Power steering pump

Steering arm

Tie rod

Hydraulic system

Climate Control System

HVAC compressor

Blower

Ducts

Vents

Heat pump

Burner/heater

Controls

Gauge & Warning System

Instrument cluster

System monitor sensor

Display/HMI

Alert buzzer

Communications System

Transponder

PA system

Tracking

Lighting System

Control panel

Lights (interior, overhead)

Interior System

Seats

Flooring

Luggage storage

Public Interface

Display signage

Advertising

Chassis System

Frame

Body mounts

Engine mounts

Suspension mounts

Driveline System

Transmission

Driveshaft

Shifter

Rear axle(s)

Dierentials

Wheels

Tires

FIGURE

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 13

COMMON EV ONLY

CHANGED

FOR EV

ICE ONLY

Electrical/Power

Supply System

Battery

Generator/alternator

Inverter

Wiring

Voltage/current monitors

Distribution module

Outlets/connections

Engine System

Engine

Radiator

Turbocharger

Oil filter

Coolant hoses

Exhaust System

SCR catalyst

DEF tank

DPF canister

Muler

Exhaust pipes

Exhaust brake

Fuel System

Tank

Pump

Hoses

Filter

Separator

Injector

Power Unit

Motors

Drive reduction

E-axle

Battery

Inverter

Charger

Note: Abbreviations: ICE = internal combustion engine; EV = electric vehicle; HVAC = heating, ventilation, and air conditioning; HMI = human-machine interface; PA = public address;

SCR = selective catalytic reduction; DEF = diesel exhaust fluid; DPF = diesel particulate filter.

Source: Nair et al. 2022.

COMPARISON OF ELECTRIC AND INTERNAL COMBUSTION ENGINE VEHICLE COMPONENTS

CONT.

FIGURE

14 |

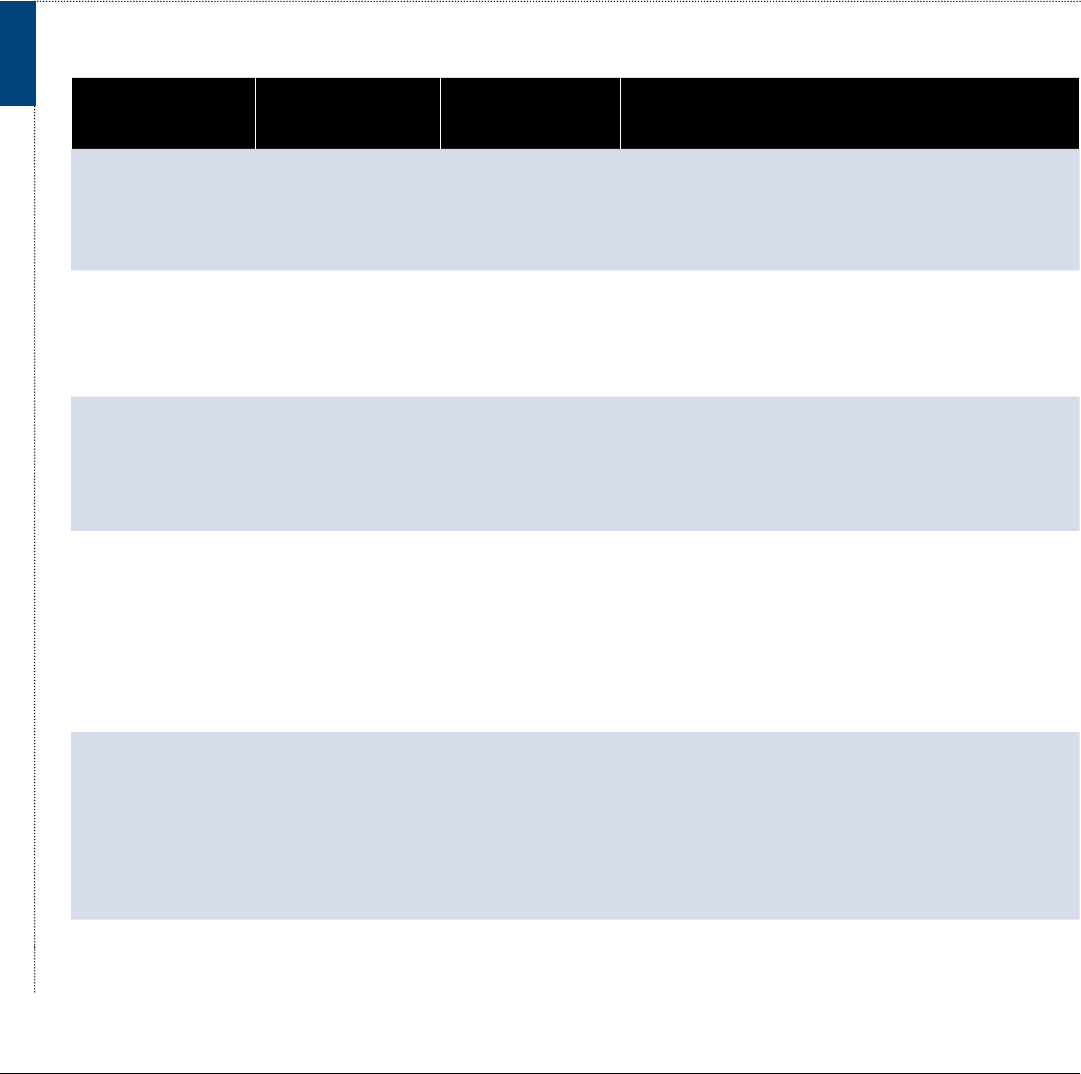

CHARGING LEVELS

Level 1 (L1) Level 2 (L2) Single Port

a

Direct Current Fast Charger

(DCFC) Single Port

Type of current

Typically for residential, personal

vehicle charging; not suitable for

ESBs due to low rate of charge

relative to the time it takes to

charge a battery

Alternating Current Direct Current

Voltage (V) 208/240 200–600

Power level (kW) ~7–20 ~24–150

ESB recharge time 5.5–13 hours

b

1–4.5 hours

b

Charger equipment cost

c

$400–$6,500

d

$10,000–$40,000

d

Installation cost

e

$600–$12,700

d

$4,000–$51,000

d

Notes: Abbreviations: V = volt; kW = kilowatt; ESB = electric school bus;

a.

Potential for dual port oering;

b.

See Tables 2, 3, and 4;

c.

Costs are largely dependent on the power output

(kilowatts) of the charger, the degree of control over charging, and other advanced features;

d.

Smith and Castellano 2015; ITSJPO 2019;

e.

Installation costs will be site and geography

dependent. Estimates do not include potential grid upgrade costs.

TABLE

bus heaters, fans, lights) contributed to ESB electricity

costs being 63 percent higher than necessary (VEIC

2018). To avoid the excess energy consumption, the

report authors recommended utilizing managed charging.

Beyond the hardware, managed charging uses software

designed to help eet operators optimize charging

schedules, costs, and bus performance. This software,

often provided by charging software developers, can

allow for scheduling charging times for when electricity

prices are lowest or for turning o charging to preserve

battery life without manual adjustments, even if the bus

is plugged in continuously (Box 5). Chargers equipped

with this software will likely be somewhat more expensive

upfront and incur ongoing subscription or service fees.

Managed charging software can be customized for a eet,

and operators can leverage tools through mobile apps or

online platforms.

to-grid; V2G). Since the rst vehicle-to-grid deployment

in 2014 at three California school districts, at least 15

utilities across 14 states have committed to pilot ESB V2G

programs (PCA 2014; Hutchinson and Kresge 2022).

Through V2G programs, buses also have the potential

to generate revenue by discharging energy from their

batteries back to the grid to be used elsewhere—this is a

nascent market but technological advancements should

make this widely available in the near future. While these

bidirectional concepts have been deployed by only a

handful of school districts to date, they oer potential to

increase resilience, generate revenue, and reduce costs

(Proterra 2019).

Electric bus adoption can also be paired with new or

existing on-site solar installation as an energy storage

solution (ENGIE Impact 2021; Soneji et al. 2020; Ellis

2020; Riley 2021). This approach could further decrease

energy costs while providing a power source for charging

during service disruptions. Installing on-site solar also

helps districts contribute to wider school district, city, or

state emissions reduction or sustainability goals.

With the right hardware and software, school districts

can take advantage of bidirectional charging, where

the vehicle can receive electricity to charge as well as

discharge back to a dierent load or onto the grid. If

equipped with this functionality, a bus can serve as a

backup battery for a building by providing power during

emergencies (vehicle-to-building; V2B) or for another

load (vehicle-to-another-load; V2L). Buses can also

store electricity in their batteries and later discharge it

onto the grid to reduce districts’ utility costs (vehicle-

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 15

ENERGYASASERVICE SOLUTIONS

Just as transportation-as-a-service oerings on the bus

side have emerged,as-a-service oerings that handle the

intersecting charging elements have also proliferated.As-

a-service arrangements can help school districts reduce

charging costs, finance necessary infrastructure upgrades,

and manage their energy needs within the grid capacity of

their depots. The robust market extends much beyond services

exclusive to the school bus industry, ranging from fleet energy

management firms like eIQ Mobility and Olivine to charging-

and infrastructure-as-a-service firms like The Mobility House,

Amply, and NextEra Energy’s Mobility Team.Other entrants

in this space include electric utilities and energy services

companies, which are experimenting with energy performance

contract oerings.This topic requires more detail than covered

in this report and is a dynamic space. More information can be

found in Cleary and Palmer (2020).

BOX

2.3 Considerations for Implementation

School districts that choose to adopt ESBs without

contractors or transportation-as-a-service providers

generally follow a similar roadmap to adopting ESBs,

laid out in Figure 7. Many of these stages overlap and are

executed concurrently.

While this publication predominantly focuses on

information that can support school districts in the

foundation-setting stage (Stage 1.1 in Figure 7), some

potential considerations and guiding questions for all ve

stages are listed below. This list is not exhaustive and will

be explored in more detail in future publications.

Stage 1. Foundation Setting

▪

What are your ultimate electrication goals?

▪

How are local community-based organizations,

students, parents, and other stakeholders being

brought into the process?

▪

Would a school district benet from leveraging an

“as-a-service” model (Boxes 4 and 5)?

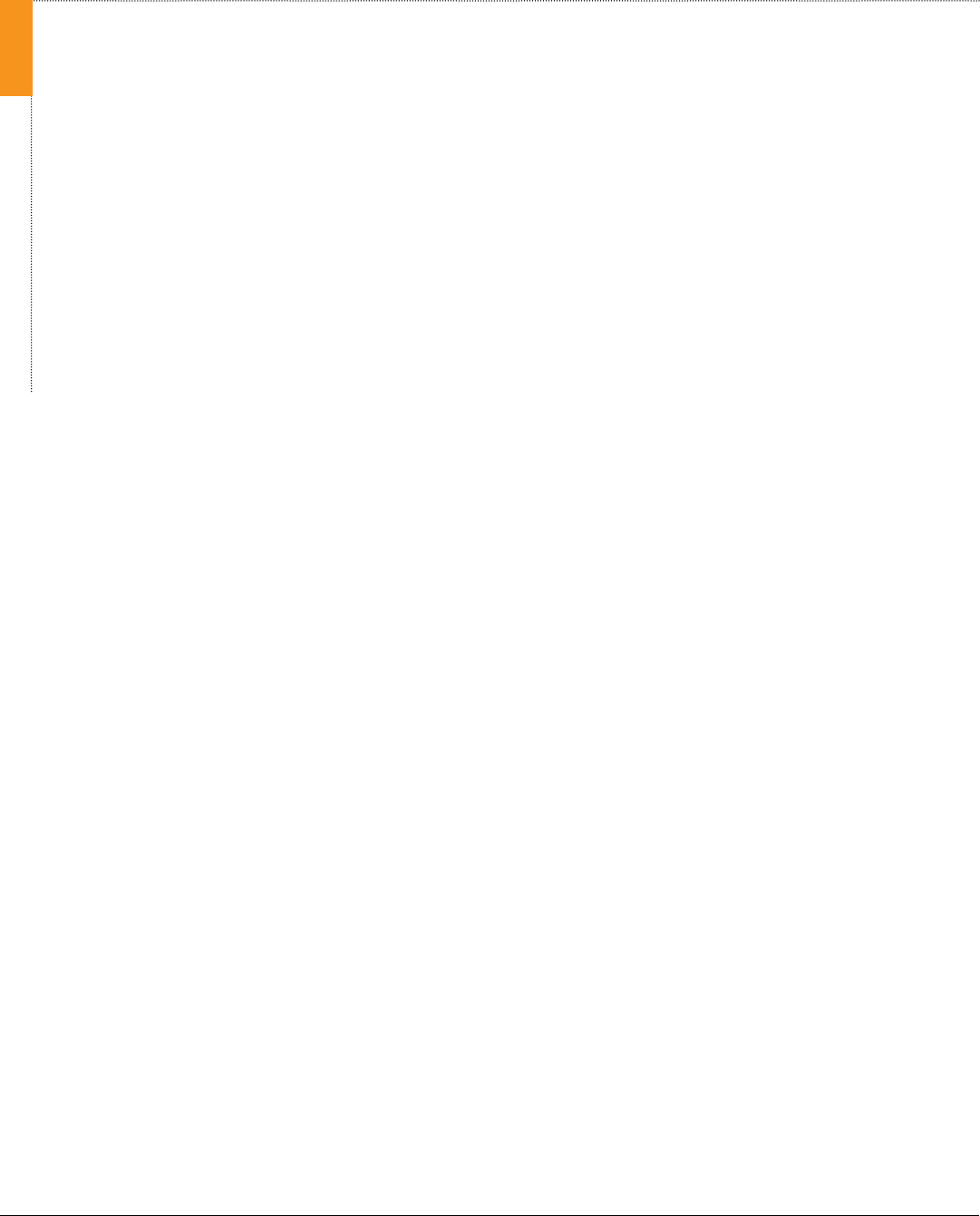

FIVE STAGES AND CORRESPONDING STEPS OF ELECTRIC SCHOOL BUS ADOPTION

Sources: WRI authors, based on technical assistance from the Electric School Bus Initiative.

FIGURE

Electric School Bus Roadmap

Transitioning to electric school buses generally follows a standardized process and can take around two years of planning.

Your timeline may be dierent and will depend on local capacity, financing and processes, and the availability of buses.

TO MONTHS

1. Foundation Setting

1.1 Visioning and market study

1.2 Community and stakeholder

engagement

1.3 Funding and financing research

1.4 Roadmap creation

4. Testing and Training

4.1 Fleet and equipment testing

4.2 Driver and mechanic training

5. Deployment and Scaling

5.1 Fleet deployment

5.2 Monitoring, tracking, and reporting

5.3 Community outreach and sharing

of lessons learned

5.4 Scaling strategy

TO MONTHS

2. Planning and Procurement

2.1 Facility and site assessment

2.2 Operations, fleet, and infrastructure plans

2.3 Procurement evaluation and requests for

information/requests for proposals

3. Charging Infrastructure

3.1 Utility coordination for rates and

interconnection requirements

3.2 Bus depot upgrades and solar pairing

3.3 Charger installation and evaluation

ONGOING

16 |

▪

What types of funding are available (e.g., voucher,

rebate, grant) to reduce the upfront price (Box 6)?

Can incentives be stacked?

▪

How can electrication help increase access to school

and after-school activities?

▪

What are your plans for retiring old

diesel school buses?

▪

Who will be responsible for recycling bus batteries?

▪

Are you considering newly manufactured or

repowered ESBs, or both?

THE REAL COST OF ELECTRIC SCHOOL

BUSES IS LOWER THAN YOU THINK

While the upfront price of ESBs is substantial, experts

anticipate significant price declines over the next decade

as battery costs decrease and the electric vehicle industry

achieves eiciencies of scale in component markets and

manufacturing. In fact, the real lifetime cost of ESBs can

be much closer to that of their diesel counterparts due to

significant savings on operational expenditures—such as

fueling and maintenance—that build up over the years a

vehicle is in use. These savings can range from an estimated

$4,000 to $11,000 per school bus every year (depending

on labor costs, local electric utility rates, and the price of

petroleum fuels).

a

Market experts predict that the lifetime

costs of ESBs will be around the same as diesel buses for new

purchases starting between 2025 and 2030.

b

This total cost

parity will be driven mainly by continuation of the precipitous

decline in battery prices over the past decade and further

development of new battery chemistries.

c

Notes:

a.

Levinson 2022.;

b.

Smith 2019; Watson et al. 2020.;

c.

BloombergNEF 2021.

BOX

Stage 2. Planning and Procurement

▪

Which models meet local restrictions and

requirements (e.g., street width restrictions, heating

and air conditioning requirements)?

▪

Which models meet your range needs?

▪

Which models best serve students with disabilities?

▪

Are there other features, such as Wi-Fi, that could

benet students and communities?

Stage 3. Charging Infrastructure

▪

Questions for utilities:

□ Are you currently subject to “demand charges?”

□ Does your electric utility have an electric vehicle–

specic time-of-use (TOU) rate?

□ Have you considered ongoing operations and

maintenance of the charger and associated

equipment through a service-level agreement

with the charger network provider?

□ Does your electric utility oer bidirectional

charging programs?

▪

What stakeholders will be important to engage

beyond utilities (e.g., landlords if facility is

leased, city agencies if building or electrical

permits are required)?

▪

How might driver behavioral patterns, like park

outs (drivers taking buses home at night), aect

charging planning?

▪

How will charging infrastructure impact your school

and surrounding community? Can charging be paired

with renewables? Can infrastructure be installed

near drivers’ homes in rural areas?

▪

Do you plan to use your buses as part of disaster

response strategies?

Stage 4. Testing and Training

▪

How are employees being trained to work with this

infrastructure (Box 7)? Who has access to training

programs and new jobs?

Stage 5. Deployment and Scaling

▪

How is route electrication executed? Can

routes that serve disadvantaged riders or drive

through underserved communities be prioritized

when electrifying?

▪

How can eet electrication positively impact other

energy- or sustainability-related goals?

▪

Can regional collaboration and support networks

be formed among schools converting their eets to

electric to support eld trips or sporting events (e.g.,

creating mutual aid networks for charging based on

existing or new partnerships; see Box 3)?

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 17

LESSONS LEARNED ON THE ROAD TO ELECTRIFICATION IN CARMEL CLAY, INDIANA

Carmel Clay Schools received Indiana’s first ESB in the summer of 2020. The school district is keen on finding new technologies to improve air

quality and reduce emissions and has pursued alternative-fuel school buses for several years. After being awarded Volkswagen settlement

funding, the school district paid the equivalent price of a diesel bus for a first-generation Type D electric bus.

In its year and a half of electric school bus operations, Carmel Clay has learned from several challenges, mostly operational issues aecting

range and reliability. For example, in winter months, the bus’s 12-volt onboard electric heater drained the battery faster than anticipated and it

was a struggle to maintain temperatures above 40°F inside the cabin. To resolve the issue, the manufacturer performed several modifications,

including rewiring the bus so the onboard battery did not draw as much power, but this adjustment did not fully resolve the issue.

Despite some challenges, Gary Clevenger, the assistant director of transportation and facilities for the school district, remains optimistic about

the potential of ESBs. He believes that the predictability of school bus routes makes them particularly conducive to electrification if reliability

issues can be addressed. However, he would like to see additional eorts to improve not just the technology itself but also the training provided

to maintenance technicians, as much of the down time resulted from waiting for technicians trained to work with high-voltage equipment.

Source: Clevenger and Decker 2022.

BOX

3. SUMMARY OF AVAILABLE

ELECTRIC BUS MODELS

As of January 2022, there were 22 models of ESBs

available for purchase in the United States, and

established manufacturers were expanding their oerings

based on the potential growth of the ESB market.

Electric models are available for Types A, C, and D

school buses.

6

Among the available electric models, the

Type C oerings are the most mature, or commercially

ready. Manufacturers gauge commercial maturity as they

move from pre-production assembly to full production,

a process that achieves modest volumes and means

a vehicle model is available for retail sale. Moreover,

electric bus models that enter commercial production will

have undergone multiple testing iterations prior to factory

line assembly and are more mature as a later-generation

product. Finally, a test of maturity can be applied to a

supportive supply chain where manufacturers and their

dealers establish formal maintenance networks to service

ESBs after delivery. In today’s market there are a mixture

of early-stage ESB models that have not yet been deployed

and mature models that are sold like conventional

school bus models.

3.1 Newly Manufactured Electric School Buses

A newly manufactured bus is one that has been designed

and built to operate with an electric powertrain from the

ground up, with one exception being some electric Type

A cutaway buses (see Type A). Although the purchase

price of newly manufactured buses is currently around

three to four times that of diesel buses—as batteries are

more expensive than internal combustion engines and

the market has yet to achieve economies of scale—the

costs associated with operations and maintenance are

substantially lower. According to one analysis, fueling

and maintaining electric models could be less than half

the cost of diesel over an expected lifetime of 12 years

(Tables 2, 3 and 4; EDF 2021). When considering models,

school districts should keep in mind the dierence

between a newly manufactured ESB and a repowered bus

(see Section 3.2).

Type A

Type A buses are small, typically accommodating fewer

than 36 passengers. There can be multiple entities

involved in the construction of a Type A bus with dierent

manufacturers responsible for dierent elements (e.g.,

the chassis, the powertrain, the body). Available electric

models are presented in Table 2.

Type A buses are constructed using three

distinct approaches:

▪

New repower cutaway: The diesel or gasoline

powertrain is removed from a new internal

combustion engine cutaway (usually produced by

18 |

Ford or General Motors) and replaced with an electric

powertrain. A school bus body is attached to the new

repowered cutaway.

▪

E-cutaway: The school bus body is attached to a new

purpose-built, electric cutaway.

▪

Non-cutaway: The bus chassis, powertrain, and body

are all assembled as a single integrated unit. The

bus is not built on a cutaway platform. This model is

comparable to Type C and D manufacturing.

AVAILABLE NEWLY MANUFACTURED ELECTRIC SCHOOL BUSES TYPE A

Lightning

eMotors

a

Lion

Electric

Micro Bird Motiv

b

Phoenix

Motorcars

c

COMING SOON

Endera GreenPower

MODEL

ELECTRIC

E

LIONA

MICRO

BIRD G

EPIC E ZEUS OSERIES NANO BEAST

BUILD TYPE

NEW

REPOWER

CUTAWAY

NON

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

ECUTAWAY

Price range

d

Not available $340,162–

$343,162

e

$236,390–

$251,425

f

Collins Bus:

$300,784

Trans Tech:

$322,015

g

Not available TBD TBD

Length (L)/

width (W)/

height (H)

h

L: 290”

W: 96”

Height not

available

L: 313”

W: 96”

H: 111”

L: 283”

W: 96”

H: 113–118”

L: 288”

Width and

height not

available

L: 277”/288”

W: 96”

H: 120”

L: 288”

W: 98”

H: 108”

L: 300”

W: 91”

H: 124”

Passenger

capacity

24 24 30 24 23 24 20

Charger

connector

L2: J1772

DCFC: CCS1

L2: J1772

DCFC: CCS1

L2: J1772

DCFC: CCS1

L2: J1772

DCFC: CC1S

L2: J1772

DCFC: CCS1 or

CHAdeMO

DCFC: CCS1 L2: J1772

DCFC: CCS1

Capable of

bidirectional

charging

Coming 2022 Yes Yes Not available Optional Yes Yes

Battery size

(kWh)

120 84/168 88 127 94/125/156 151 118.2

Range (miles) 100 75/150 100 105 100/130/160 135 150

TABLE

Type C

Type C buses, with passenger capacities between 40 and

83 and a curved hood that increases front visibility, make

up 70 percent of the overall school bus eet (Matthews

2021). Type C oerings are the most mature for the ESB

market and are listed in Table 3.

Type D

Type D, the largest of school buses seating up to

90 students, make up approximately 20 percent of

the market (Matthews 2021). Electric oerings are

presented in Table 4.

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 19

Lightning

eMotors

a

Lion

Electric

Micro Bird Motiv

b

Phoenix

Motorcars

c

COMING SOON

Endera GreenPower

MODEL

ELECTRIC

E

LIONA

MICRO

BIRD G

EPIC E ZEUS OSERIES NANO BEAST

BUILD TYPE

NEW

REPOWER

CUTAWAY

NON

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

ECUTAWAY

Battery

thermal

management

Dynamic liquid

cooled system

Liquid cooled Liquid cooled Not available Liquid cooled Liquid cooled PTC heating,

liquid cooled

Recharge time L2 (13.2 kW):

5.5–7.5 hours

DCFC (80

kW max): 1.5

hours–2 hours

L2 (19.2 kW):

6.5–11 hours

DCFC (24 kW):

5–9 hours

or (50 kW)

2.5–4.25 hours

L2 (19.2 kW): 7

hours

DCFC (50 kW):

2 hours

L2 (19.2 kW): 8

hours

DCFC (60 kW):

Charge time

not available

L2 (13 kW):

Depends on

battery pack

size

DCFC (50 kW):

Depends on

battery pack

size

Onboard AC

charger (6.6

kW): 7 hours

DCFC: (~50

kW) 2.5 hours

or (~125 kW) 1

hour

L2 (11 kW): 11

hours

DCFC (60 kW):

2 hours

Charge port

location

options

Front driver’s

side fender

Rear driver Front nose Not available Front driver’s

side fender

Front grille Front driver’s

side

Electric

drivetrain (Mfr.)

Cascadia

Motion

DANA TM4

SUMO-MD

EcoTuned Motiv Phoenix/TM4 Endera TM4

Transmis-

sion (direct

drive/2-speed)

None

(direct drive)

None

(direct drive)

2-speed Not available None

(direct drive)

2-speed None

(direct drive)

Brakes (air/

hydraulic)

Hydraulic Hydraulic Hydraulic Not available Hydraulic Hydraulic Hydraulic

(front—disc;

rear—drum)

Heat type

(electric/

diesel)

Electric Auxiliary diesel

or electric

Electric Not available Electric Electric Electric

Delivery time 2 months

(dependent

on chassis

availability)

7–9 months Up to 8 months Not available 6 months Expected

production

2023

6 months

(production

TBD)

WARRANTY INFORMATION

Battery 5 years/

60,000 miles

8 years 8 years/

100,000 miles

Not available 5 years/

150,000 miles

5 years/

100,000 miles

5 years/

100,000 miles

Drivetrain 5 years/

60,000 miles

5 years/

160,000 miles

5 years/

100,000 miles

Not available 5 years/

60,000 miles

5 years/

60,000 miles

3 years/

150,000 miles

AVAILABLE NEWLY MANUFACTURED ELECTRIC SCHOOL BUSES TYPE A CONT.

TABLE

20 |

Lightning

eMotors

a

Lion

Electric

Micro Bird Motiv

b

Phoenix

Motorcars

c

COMING SOON

Endera GreenPower

MODEL

ELECTRIC

E

LIONA

MICRO

BIRD G

EPIC E ZEUS OSERIES NANO BEAST

BUILD TYPE

NEW

REPOWER

CUTAWAY

NON

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

NEW

REPOWER

CUTAWAY

ECUTAWAY

WARRANTY INFORMATION

Chassis Not available 5 years Body (1

year/12,000

miles) and

structure (5

years)

Not available 3 years/36,000

miles

3 years/36,000

miles

3 years/250,000

miles

Additional Bumper to

bumper 3

years/36,000

miles

Up to 12 years Not applicable Not available Bumper to

bumper 3

years/36,000

miles

For the

earlier of 2

years/75,000

miles, Endera

warrants that

all vehicle

components

will be free

from defects

Additional

warranties

oered for

various parts

Extended

warranties

available case

by case

Notes: Abbreviations: TBD = to be determined; kWh = kilowatt-hour; PTC = positive temperature coeicient; DCFC = direct current fast charger; AC = alternating current; L2 = level 2

charger; Mfr. = manufacturer.

a.

As of April 2022, WRI was aware of an established public relationship between Lightning eMotors and bus body manufacturer Collins Bus;

b.

As of April

2022, WRI was aware of established public relationships between Motiv Power Systems and bus body manufacturers Collins Bus and Trans Tech;

c.

As of April 2022, WRI was aware of

an established public relationship between Phoenix Motorcars and bus body builder Pegasus Bus;

d.

Based on lowest price authors found announced publicly to date. Prices are meant

to be illustrative. School districts or contractors will need to work with a local dealer for an accurate price quote. Prices vary from state to state and depend on bus specification needs;

e.

Lion: STBC 2020; DTS 2020;

f.

Micro Bird: NYOGS 2022; KDE 2022.;

g.

Motiv: NYOGS 2022;

h.

State and city requirements and needs will influence a school district’s dimension needs. For

example, some geographies have a width maximum for school buses.

Sources: WRI author collaboration with Micro Bird, Lion, Phoenix Motorcars, Lightning eMotors, Endera, and GreenPower. Other information gathered from public specifications.

AVAILABLE NEWLY MANUFACTURED ELECTRIC SCHOOL BUSES TYPE A CONT.

TABLE

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 21

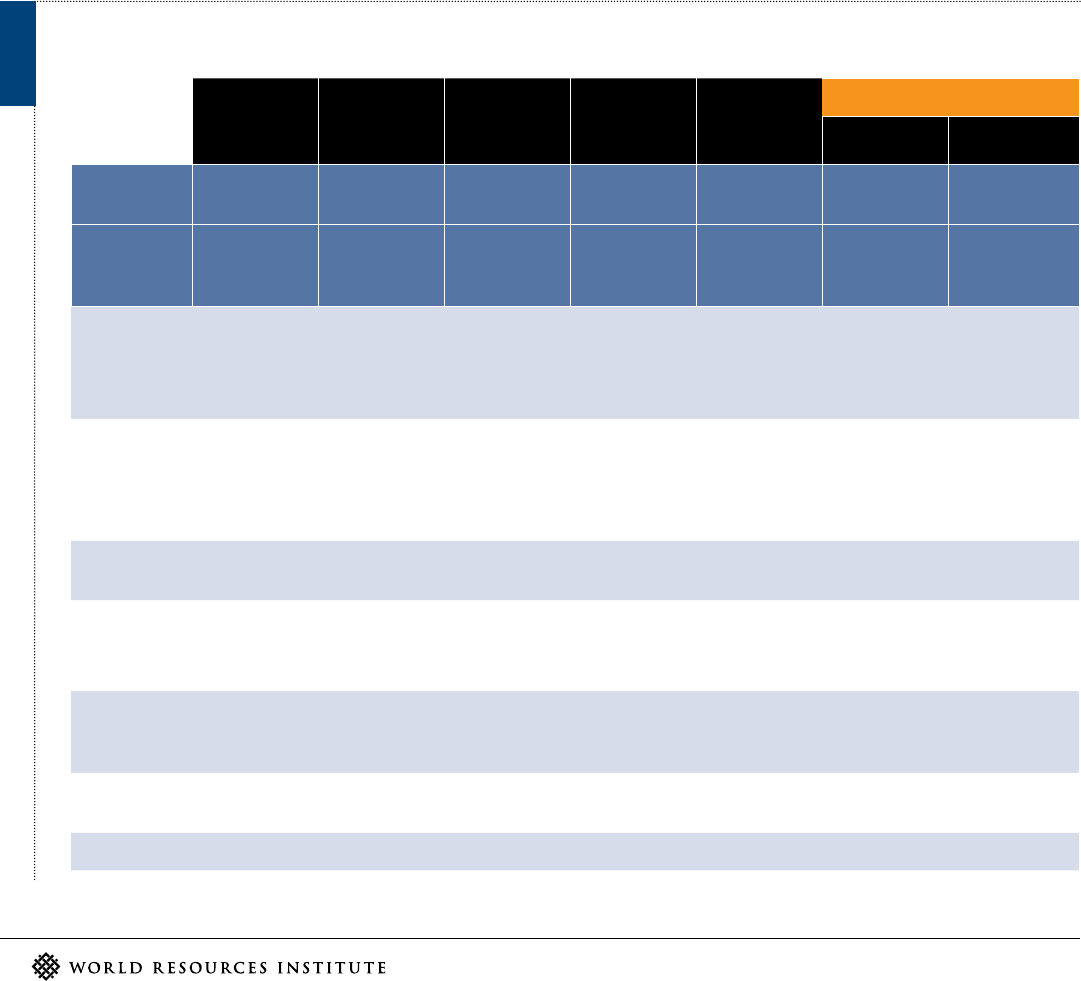

AVAILABLE NEWLY MANUFACTURED ELECTRIC SCHOOL BUSES TYPE C

Blue Bird Lion Thomas IC Bus/Navistar BYD

MODEL BLUE BIRD VISION LIONC

SAFTLINER C

JOULEY

IC CE SERIES

ELECTRIC BUS/

PBE

TYPE C

Price range $326,810–$365,000

a

$338,253–$422,302

b

$335,287–$437,000

c

$347,870–$364,123

d

Not available

Length (L)/width

(W)/height (H)

L: Max 477”

W: 96”

H: 123”

L: 473”

W: 96–102”

H: 122”

L: 396”

W: 96”

H: 144”

L: 303.9”/474.9”

W: 96”

H: 123”

L: 435”/462”

W: 102”

H: 132.9”

Passenger capacity 77 77 81 29–72 78

Charger connector L2: J1772

DCFC: CCS1

L2: J1772

DCFC: CCS1

DCFC: CCS1 L2: J1772

DCFC: CCS1

L2: J1772

DCFC: CCS1

Capable of bidirec-

tional charging

Yes Yes Optional Yes Optional

Battery size (kWh) 155 126/168 226 210/315 255.5

Range (miles) 120 100/125 138 135/210 155

Battery thermal

management

Liquid cooled Liquid cooled Set to maintain 70°F

battery temp

Set to maintain 70°F

battery temp

Water cooling

Recharge time L2 (19.2 kW): 8 hours

DCFC (60 kW): 3

hours

L2 (19.2 kW): 6.5–11

hours

DCFC: (24 kW) 5–9

hours or (50 kW)

2.5–4.25 hours

DCFC: (25 kW) 8.25

hours or (60 kW) 3.4

hours

L2 (19.2 kW): 8 hours

DCFC (60 kW): 3

hours

L2 (20 kW max):

12.5–13 hours

DCFC (150 kW): 1.5–2

hours

Charge port location

options

Rear or front

passenger side/front

passenger side

Rear passenger, front

nose, or both

Front passenger

side—optional rear

charge port curbside

Front right side—

optional rear right

side

Curbside rear

Electric

drivetrain (Mfr.)

DANA TM4 DANA TM4 SUMO-MD Proterra DANA TM4 SUMO-MD BYD

Transmission (direct

drive/2-speed)

None

(direct drive)

None

(direct drive)

2-speed None

(direct drive)

None

(direct drive)

Brakes (air/hydraulic) Air disc or drum

(hydraulic in 2022)

Hydraulic

(air available)

Air Air disc Front/rear air

disc, ABS

Heat type (electric/

diesel)

Electric (diesel

supplemental heat

option)

Auxiliary diesel

or electric

Electric Electric

(optional diesel)

Electric or diesel

Delivery time 8 months 6–8 months 6–8 months 7–11 months Not available

TABLE

22 |

Blue Bird Lion Thomas IC Bus/Navistar BYD

MODEL BLUE BIRD VISION LIONC

SAFTLINER C

JOULEY

IC CE SERIES

ELECTRIC BUS/

PBE

TYPE C

WARRANTY INFORMATION

Battery 8 years/125,000

miles/160,000 kWh

discharge

8 years/160,000 kWh

discharge (12-year

extend available)

8 years/175,000

miles/200,000 kWh

discharge

8 years/

175,000 miles

15 years

Drive 5 years/

100,000 miles

5 years/

100,000 miles

5 years/ 100,000

miles (motor, trans-

mission, inverter)

5 years/

100,000 miles

5 years/

250,000 miles

Chassis Standard Blue Bird

chassis warranty

(5 years or more)

Standard warranty

bumper to bumper

(8 years)

3 years/

50,000 miles

Standard IC Bus

chassis warranty

(5 years or more);

basic chassis

warranty is 1 year

12 years/

500,000 miles

Additional Not applicable Extended warran-

ties up to 12 years

available

Extended warran-

ties up to 12 years

available

1 year/unlim-

ited mileage for

high-voltage

steering pump, air

compressor

Not applicable

Note: Abbreviations: TBD = to be determined; kWh = kilowatt-hour; °F = degrees Fahrenheit; DCFC = direct current fast charger; L2 = level 2 charger; Mfr. = manufacturer; ABS =

antilock braking system.

Sources: WRI author collaboration with manufacturers listed in table.

a.

Blue Bird: Farquer 2021; NYOGS 2022;

b.

Lion: KCRISD 2020; HPS 2020;

c.

Thomas: Farquer 2021; Lydersen 2021;

d.

IC

Bus/Navistar: NYOGS 2022; KDE 2022.

AVAILABLE NEWLY MANUFACTURED ELECTRIC SCHOOL BUSES TYPE C CONT.

TABLE

Electric School Bus U.S. Market Study and Buyer’s Guide: A Resource for School Bus Operators Pursuing Fleet Electrification

ISSUE BRIEF | June 2022 | 23

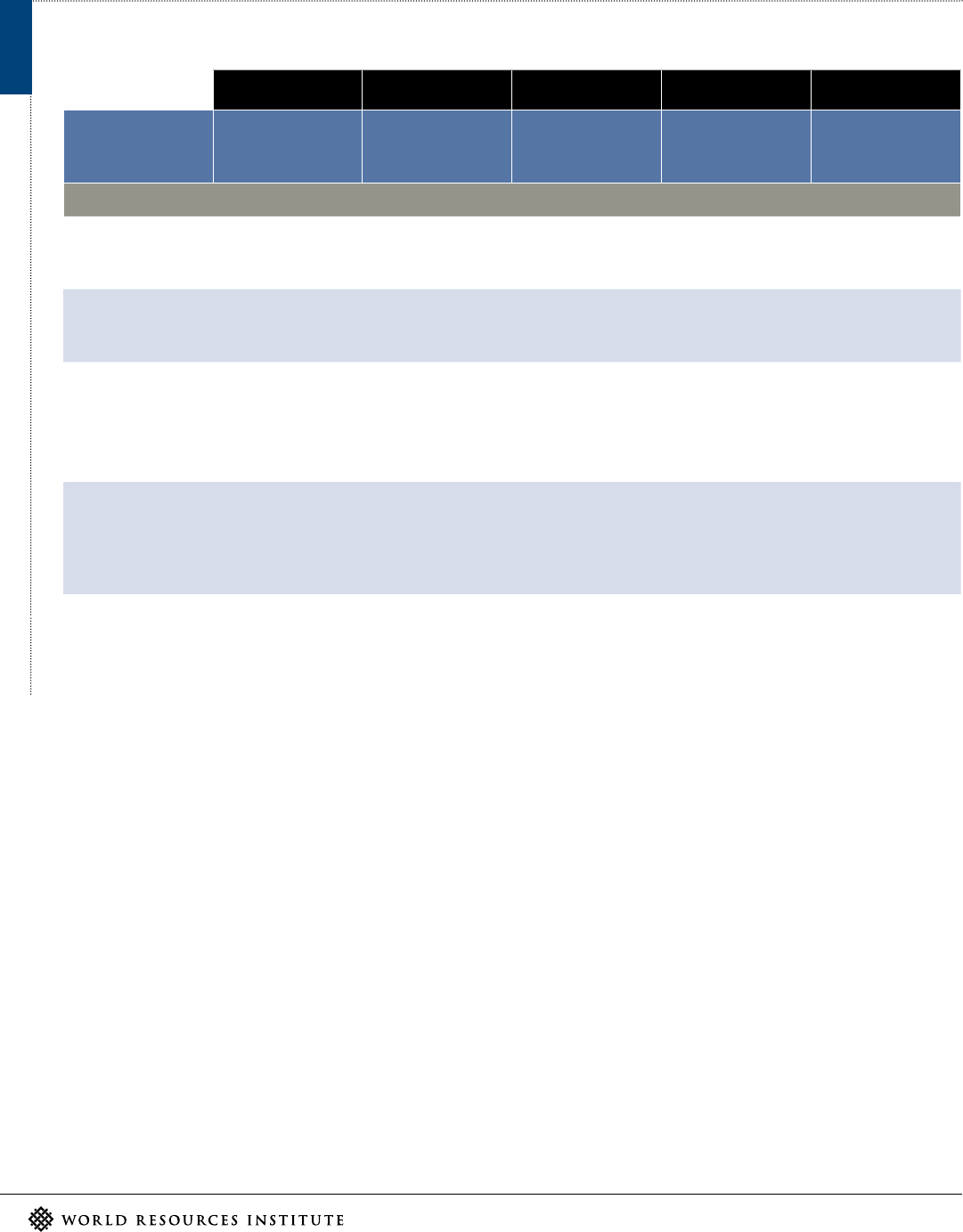

AVAILABLE NEWLY MANUFACTURED ELECTRIC SCHOOL BUSES TYPE D

Blue Bird Lion GreenPower BYD

MODEL ALLAMERICAN LIOND BEAST TYPE D

Price range $340,445–$373,239

a

Not available $371,900

b

Not available

Length (L)/width (W)/

height (H)

L: Max 489”

W: 96”

H: 123”

L: 473”

W: 102”

H: 122”

L: 480”

W: 102”

H: 138”

L: 435”/462”/486”

W: 102”

H: 132.9”

Passenger capacity 84 83 90 84

Charger connector L2: J1772

DCFC: CCS1

L2: J1772

DCFC: CCS1

L2: J1772

DCFC: CCS1

L2: J1772

DCFC: CCS1

Capable of bidirectional

charging

Yes Yes Yes Optional

Battery size (kWh) 155 126/168 193.5 255.5

Range (miles) 120 100/125 150 155

Battery thermal

management

Liquid cooled Liquid cooled PTC for heating, liquid

cooled

Water cooling

Recharge time L2 (19.2 kW): 8 hours

DCFC (60 kW): 3 hours

L2 (19.2 kW): 6.5–11 hours

DCFC: (24 kW) 5–9 hours or

(50 kW) 2.5–4.25 hours

L2 (19.2 kW): 10.5 hours

DCFC (60 kW): 3.5 hours

L2 (20 kW max): 12.5–13

hours

DCFC (150 kW): 1.5–2 hours

Charge port location

options

Rear of bus/front

driver’s side

Rear passenger Rear driver’s side Rear curbside

Electric drivetrain (Mfr.) DANA TM4 DANA TM4 SUMO-MD TM4 BYD

Transmission (direct

drive/2-speed)

None

(direct drive)

None

(direct drive)

None

(direct drive)

None

(direct drive)

Brakes (air/hydraulic) Air (disc or drum) Air Air disk brakes, ABS Front/rear air disc

brakes, ABS

Heat type (electric/diesel) Electric Auxiliary diesel or electric Electric Electric or diesel

Delivery time 8 months 7–9 months 6 months Not available

WARRANTY INFORMATION

Battery 8 years/125,000

miles/160,000 kWh

discharge

8 years/160,000 kWh

discharge (12-year extend

available)

5 years/100,000 miles 15 years

Drive 5 years/100,000 miles 5 years/100,000 miles 5 years/100,000 miles 5 years/250,000 miles

TABLE

24 |

3.2 Repowered Electric School Buses

(Types A, C, and D)

Electric repowering is the process of taking an existing

school bus, removing the internal combustion engine

components, and replacing them with a new electric

powertrain and high-voltage battery (Kelly and Gonzales

2017).

7

Repowered buses can be half the price of a newly

manufactured electric bus, be assembled in a shorter

timeframe, and work within an existing eet by extending

the useful life of the bus body (Wachunas 2022).

Additionally, repowered buses present an opportunity to

reduce scrappage and waste—and with fewer components

required to complete a build, repowers can limit

susceptibility to supply chain delays. A eet can consist of

both repowered and newly manufactured buses as both

use the same charging infrastructure.

As of April 2022, there were three companies oering

repower solutions—SEA Electric, Unique Electric

Solutions, and Lightning eMotors. Table 5 shows

currently available options for repowered ESBs from

these three manufacturers. As this approach grows in

popularity and availability, repower kits, produced by

these types of companies, could be used by entities such

as dealers and post-production service providers to