Government of the

District of Columbia

Muriel Bowser

Mayor

Fitzroy Lee

Interim Chief Financial Officer

Tax Rates and Tax Burdens

Washington Metropolitan Area

Including: Washington, DC Maryland Virginia

Montgomery Co. Alexandria

Prince George's Co. Arlington Co.

Fairfax City

Fairfax Co.

Falls Church

2019

Issued April 2021

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

i

A Comparison of Tax Rates and Burdens in

the Washington Metropolitan Area

Table of Contents

List of Major Charts, Maps, and Tables ............................................................................. ii

Executive Summary ............................................................................................................ iv

Acknowledgments ................................................................................................................ vii

Part I: A Comparison of Tax Burdens in Selected

Washington Metropolitan Area Jurisdictions, 2019

Overview ................................................................................................................ 2

Individual Income Tax ........................................................................................... 4

Real Property Tax .................................................................................................. 9

Sales Tax .............................................................................................................. 14

Automobile Tax... ................................................................................................ 16

Part II: A Comparison of Tax Rates in the Washington

Metropolitan Area as of January 1, 2020

Alcoholic Beverage Tax ....................................................................................... 28

Cigarette Tax ......................................................................................................... 29

Financial Institution Taxes .................................................................................... 30

Income Taxes

Corporate Franchise ........................................................................................ 31

Individual Income ........................................................................................... 32

Unincorporated Business Franchise ................................................................ 35

Inheritance and Estate Taxes ................................................................................. 37

Insurance Premiums Tax....................................................................................... 39

Motor Vehicle Taxes…………………………………………………..................41

Motor Vehicle Excise Tax .............................................................................. 41

Motor Vehicle Registration............................................................................. 41

Motor Vehicle Fuel Tax .................................................................................. 43

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

ii

A Comparison of Tax Rates and Burdens in

the Washington Metropolitan Area

Table of Contents, continued

Property Taxes

Real Property .................................................................................................. 44

Property Tax Relief Programs ........................................................................ 47

Tangible Personal Property ............................................................................. 52

Public Utilities Tax ............................................................................................... 55

Recordation and Transfer Taxes ........................................................................... 58

Sales and Use Taxes.............................................................................................. 60

Water and Sewerage User Charges (Residential) ................................................. 63

Miscellaneous Taxes ............................................................................................. 66

Uniform Disposition of Unclaimed Property…………………………………… 68

Appendix: Additional Tax Burden Maps................................................................................. 69

Office Locations and Telephone Numbers ............................................................................... 76

List of Major Charts, Maps, and Tables

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan

Area Jurisdictions, 2019

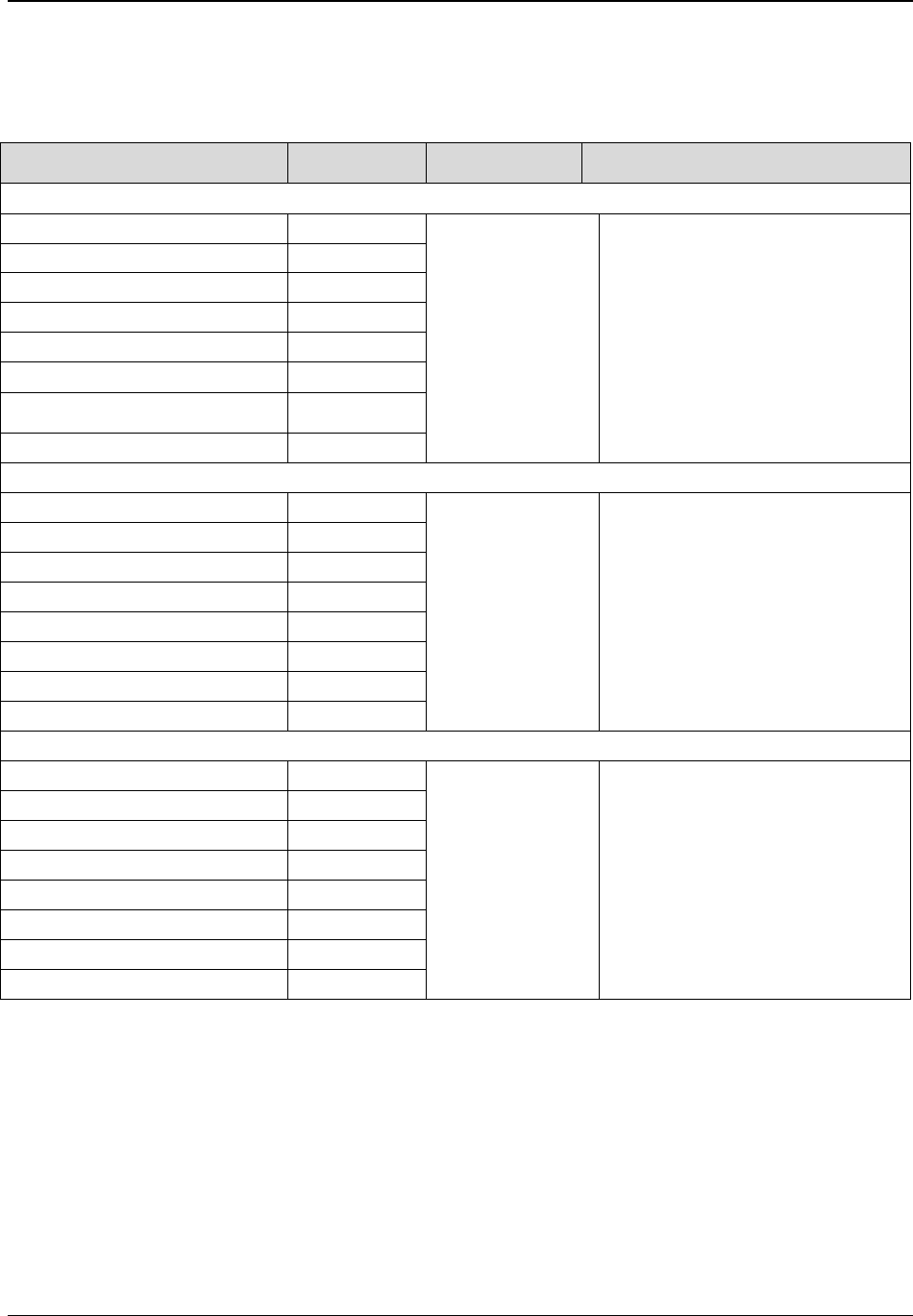

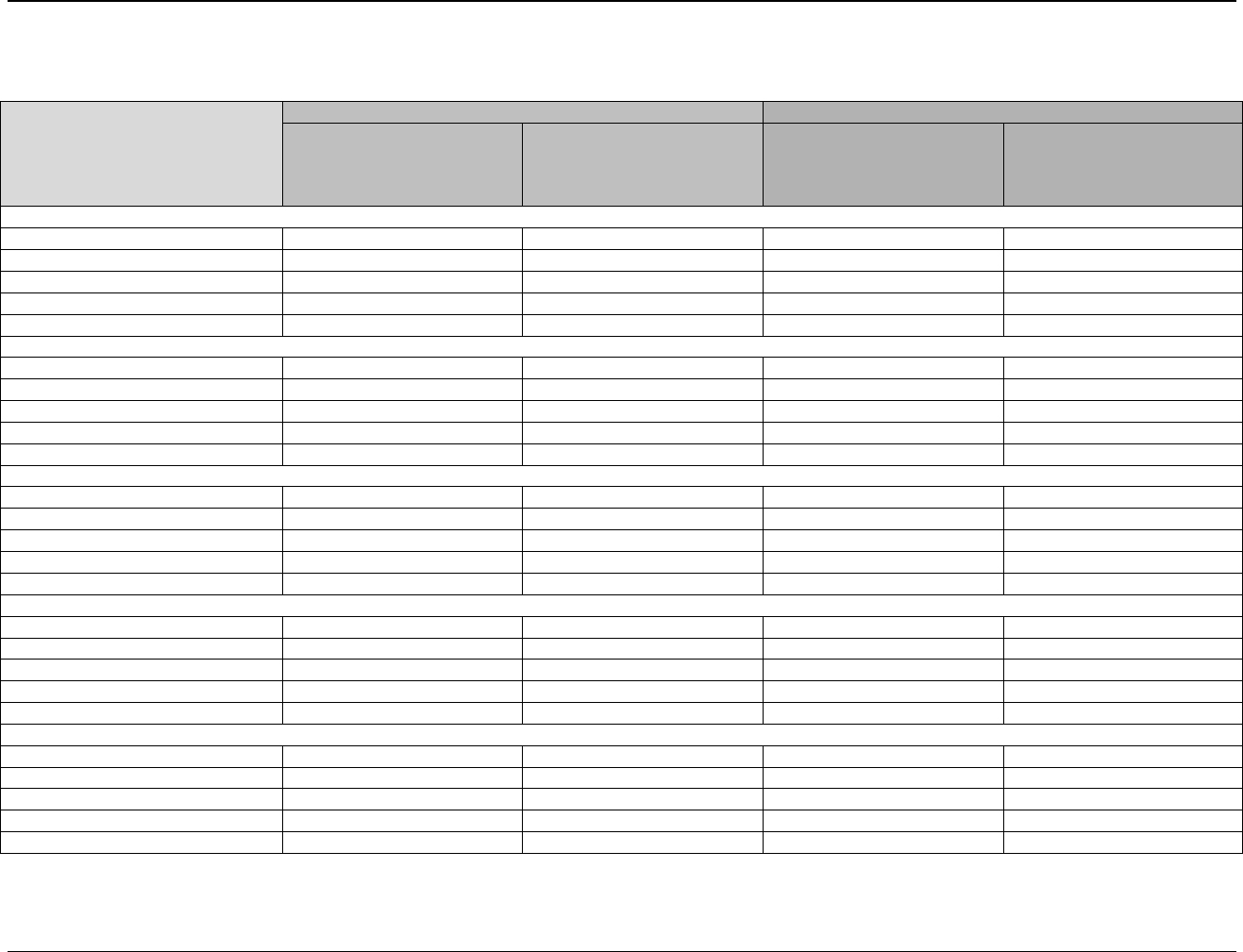

Table 1 Individual Income Tax, Washington Metropolitan Area (2019).....…........7

Chart 1 2019 Metropolitan Area Individual Income Tax Burdens….......................8

Table 2 Housing Value Assumptions for Major

Washington Metropolitan Area Jurisdictions, Calendar Year 2019……..10

Table 3 Calculation of Effective Residential Property Tax Rates………………..13

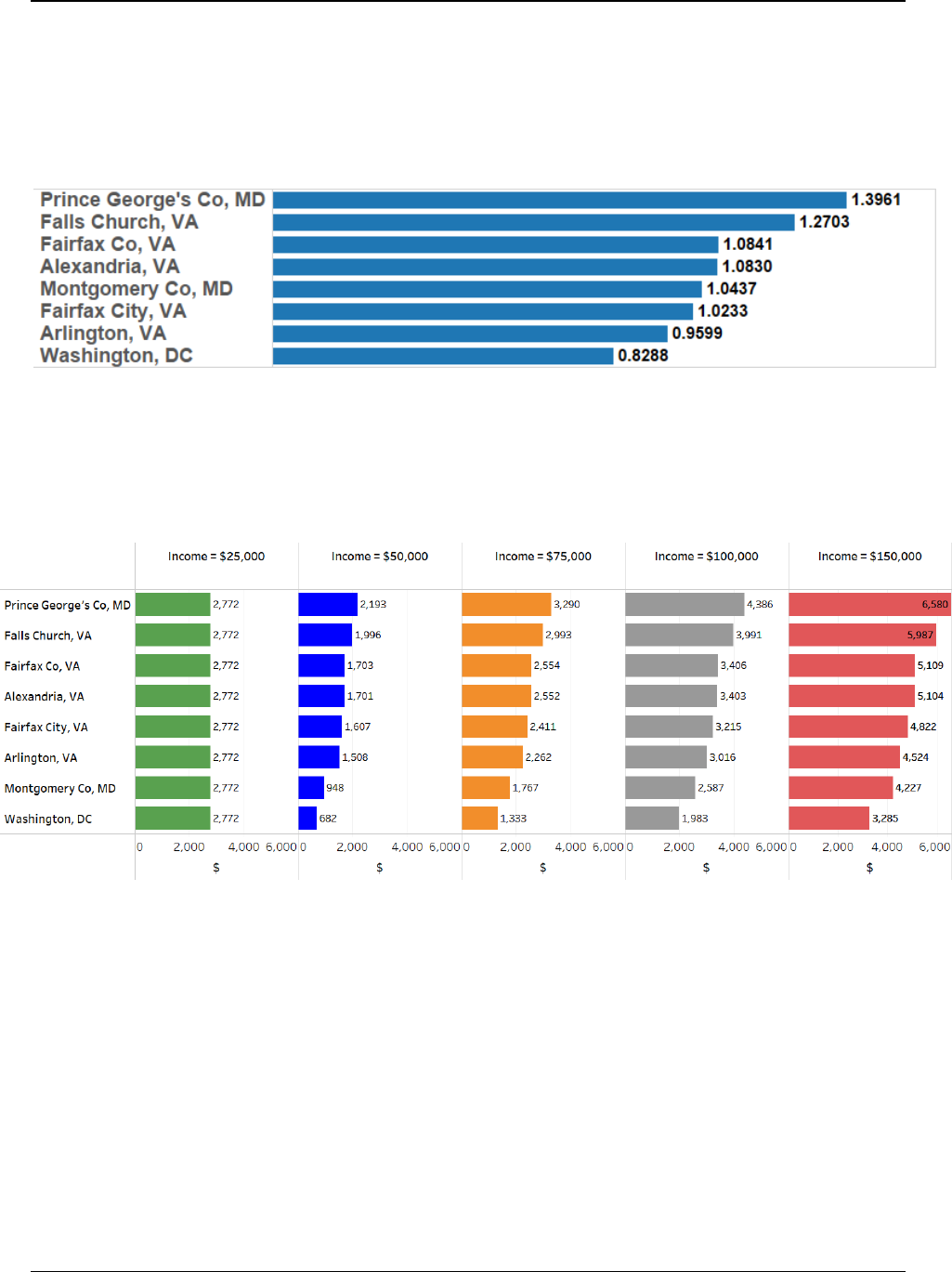

Chart 2 2019 Metropolitan Area Effective Property Tax Rates……………….....14

Chart 3 2019 Metropolitan Area Real Property Tax Burdens...……………….....14

Table 4 Selected Sales Tax Rates ……………………………………………….15

Table 5 Automobile Tax Assumptions, 2019 ........................................................17

Table 6 2019 Major State & Local Tax Burdens for a Family of Three

in Selected Washington Metropolitan Area Jurisdictions ........................19

Table 7 Summary of Average Tax Burdens for Selected

Washington Metropolitan Area Jurisdictions and DC, 2019 ...................20

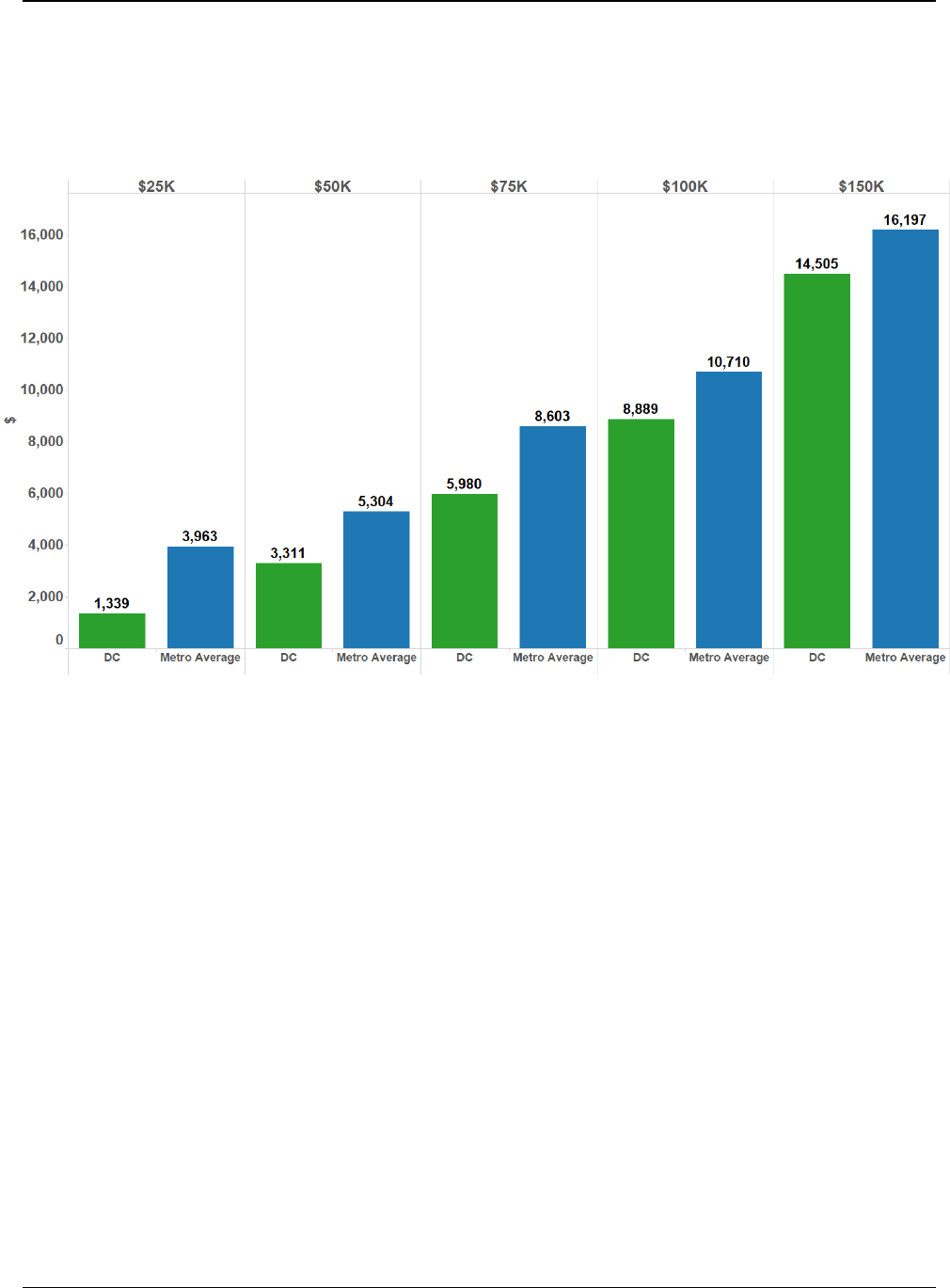

Chart 4 DC’s Combined Tax Burdens Compared with Average of Other Metro

Areas, 2019…………………………….…………….…………………..21

Chart 5 Estimated Tax Burdens for Five Hypothetical Families, 2019………… 22

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

iii

A Comparison of Tax Rates and Burdens in

the Washington Metropolitan Area

Table of Contents, continued

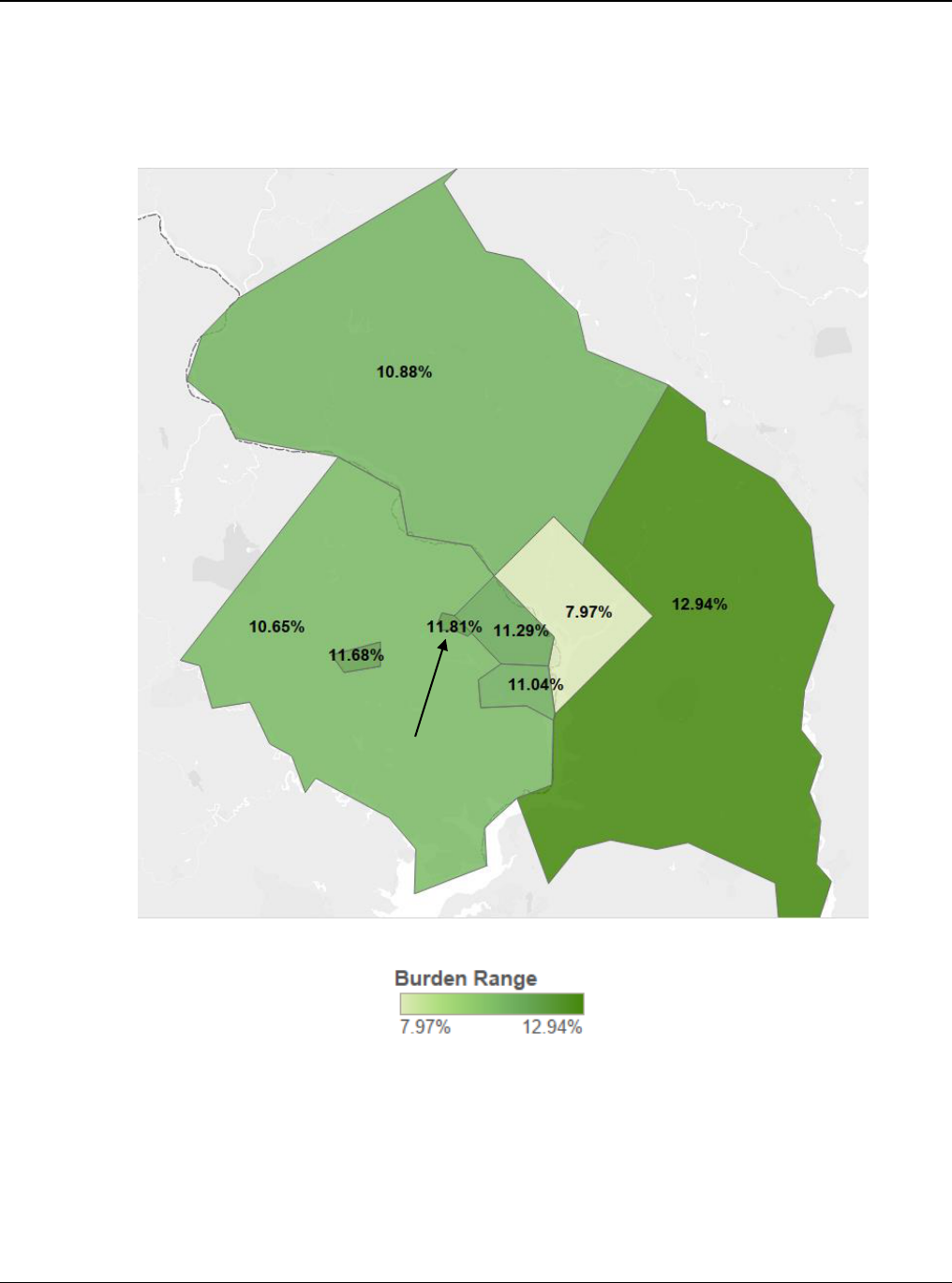

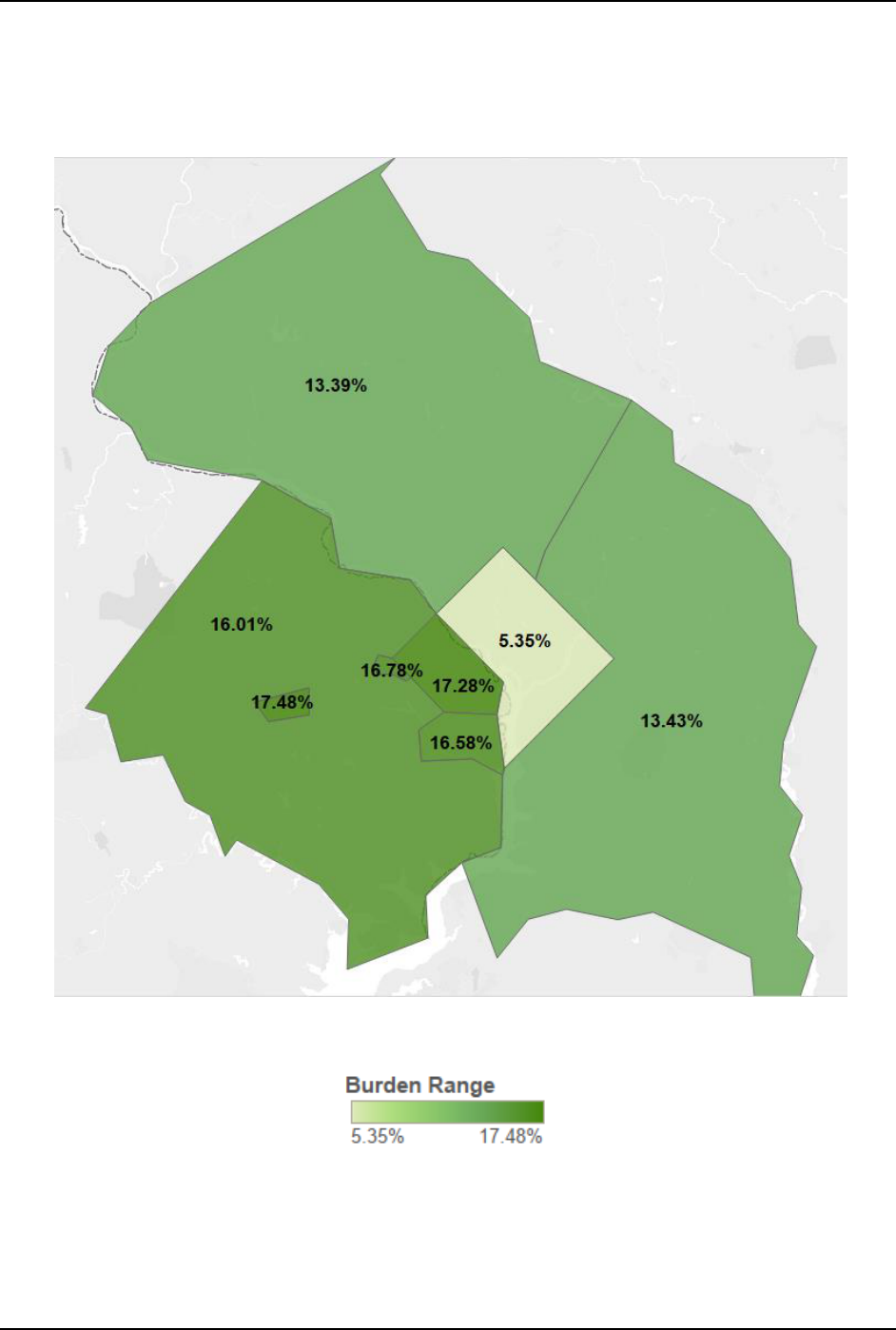

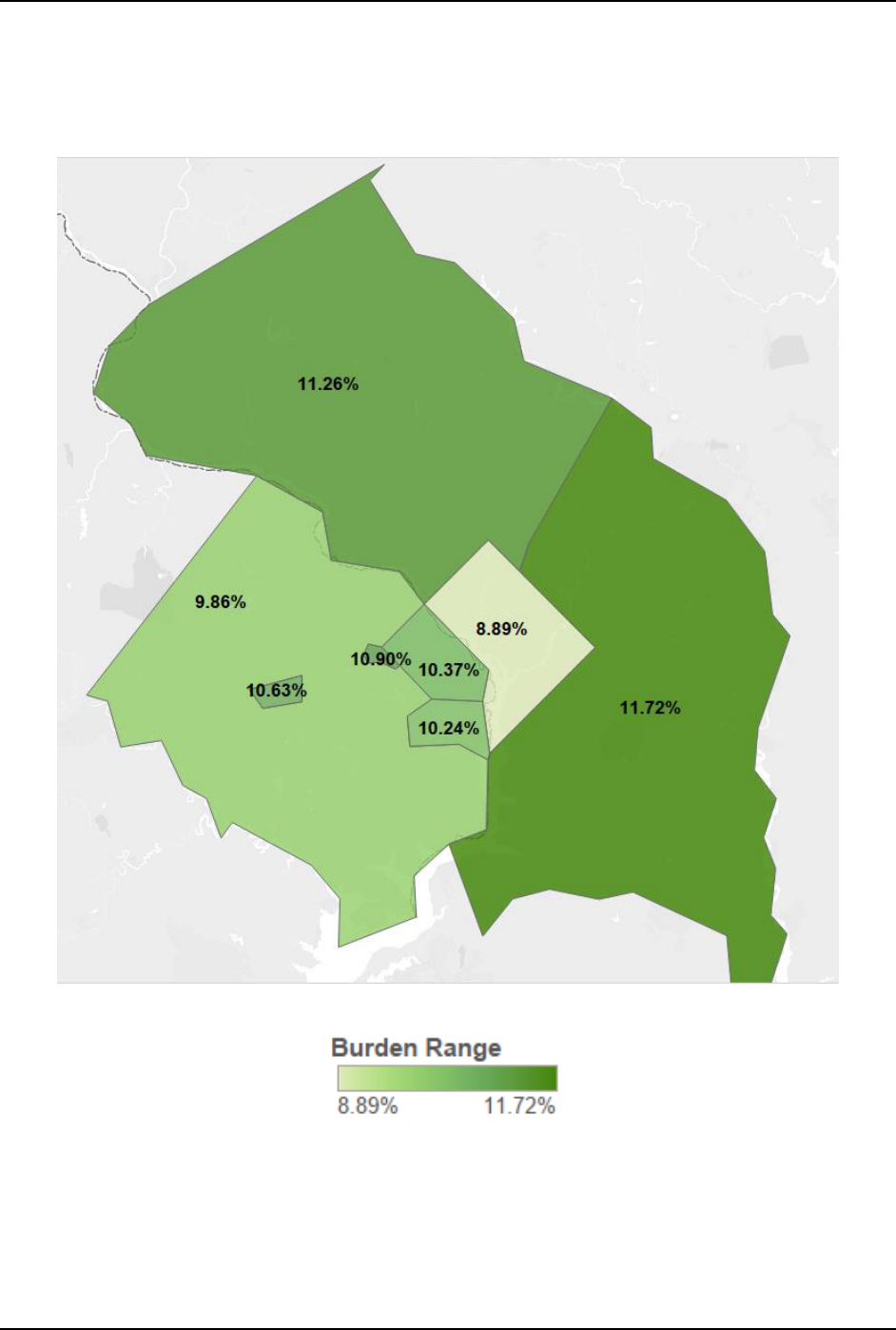

Map 1 Combined 2019 Metro Area Tax Burdens (Income, Property, Sales, &

Auto) as a % of Income (Family Earning $75,000/Year)……………......24

Table 8 Selected State and Local Tax Rates in the DC Metropolitan Area, as of

December 31, 2019 .....…………………………………………………..25

Table 9 Demographic Statistics for Selected Metropolitan Area Jurisdictions,

2019…...………………………………………………………………….26

Part II: A Comparison of Tax Rates in the Washington Metropolitan Area as of

January 1, 2020 (unless otherwise noted)

Table 10 Metropolitan Area Tax Rates on Alcohol …..…......................................28

Table 11 Metropolitan Area Tax Rates Per 20 Cigarettes…………………...…....29

Table 12 Unincorporated Business Franchise and Business License Taxes ..…….36

Table 13 Insurance Premiums Tax Rates………………………………………….40

Table 14 Annual Registration Fees for Passenger Cars……………………………42

Table 15 Real Property Tax Rates, As of December 31, 2019 ..........................…..46

Table 16 Property Tax Relief Programs ...........................................................…...50

Table 17 Tangible Personal Property, Tax Year 2019– 2020 (FY 2020)…………54

Table 18 Public Utilities Tax to Residential Consumers………………………….56

Table 19 Public Utilities Tax to Suppliers ..........................................…………....57

Table 20 Metropolitan Area Sales and Use Tax Rates..…………………………..62

Table 21 Water and Sewerage User Charges (Residential), 2019………………...64

Appendix

Map 2 DC Metropolitan Area Map……………………………………...............70

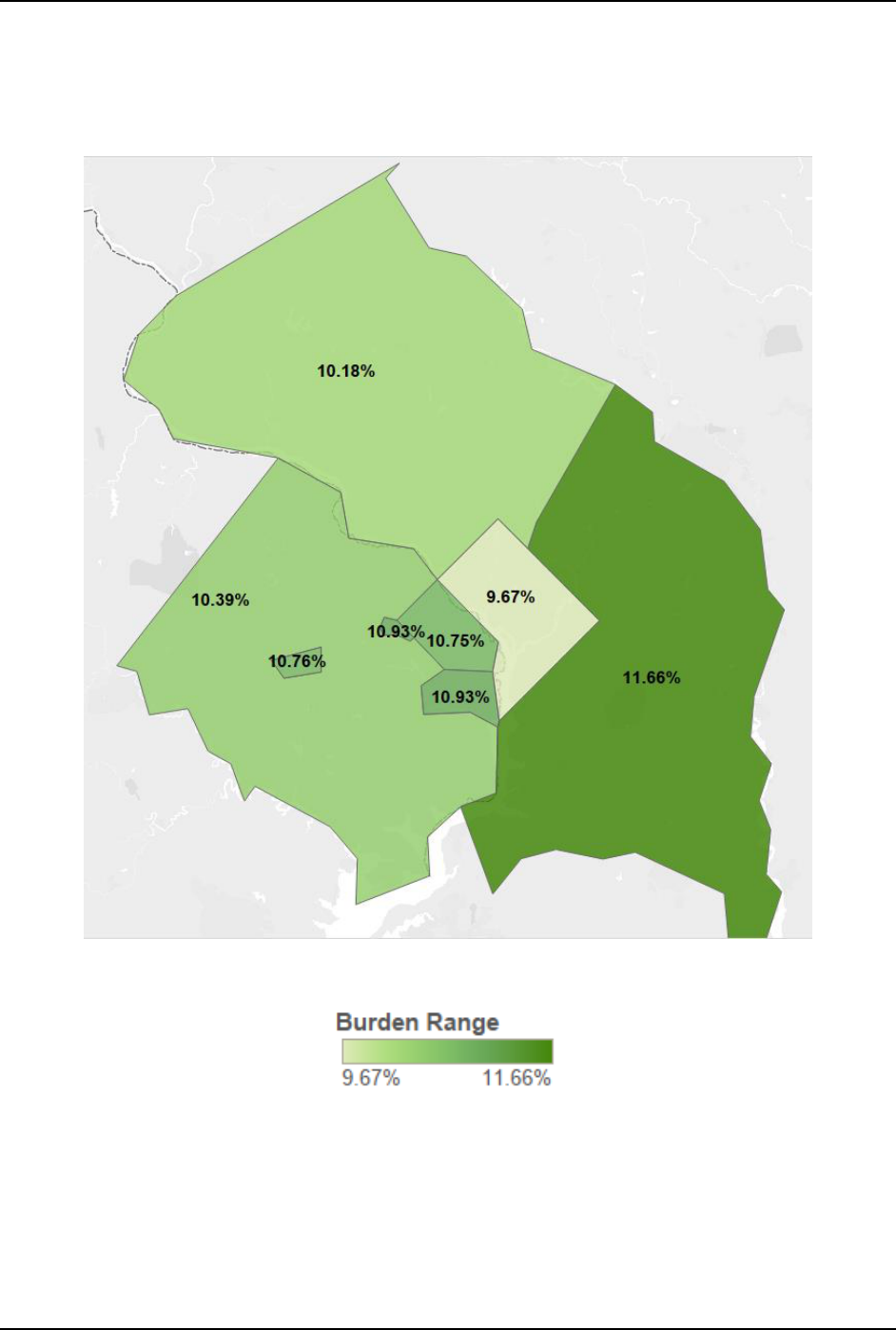

Map 3 Combined 2019 Metropolitan Area Tax Burdens (Income, Property, Sales,

& Auto) as a % of Income (Family Earning $25,000/Year)……..……...71

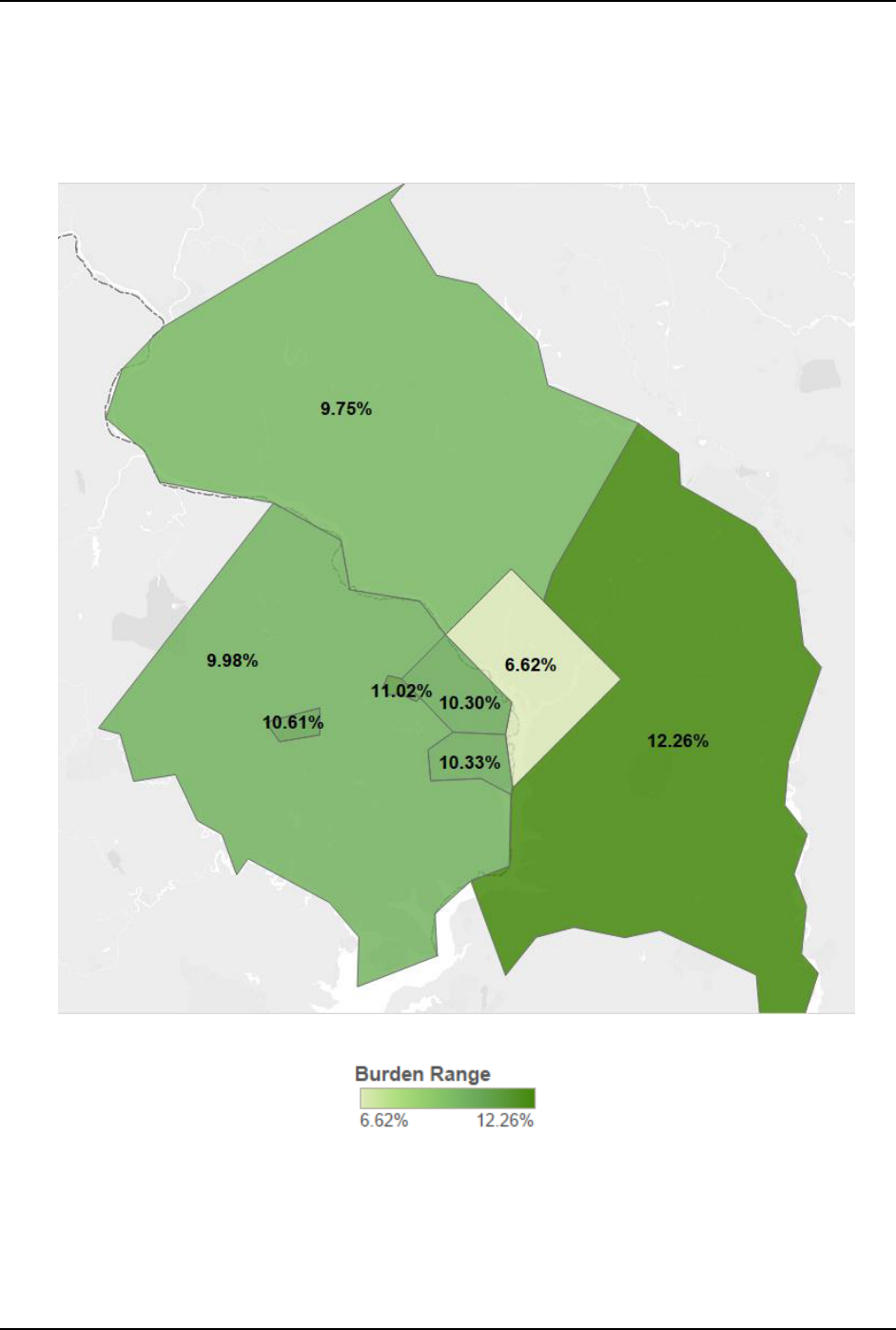

Map 4 Combined 2019 Metropolitan Area Tax Burdens (Income, Property, Sales,

& Auto) as a % of Income (Family Earning $50,000/Year)………….....72

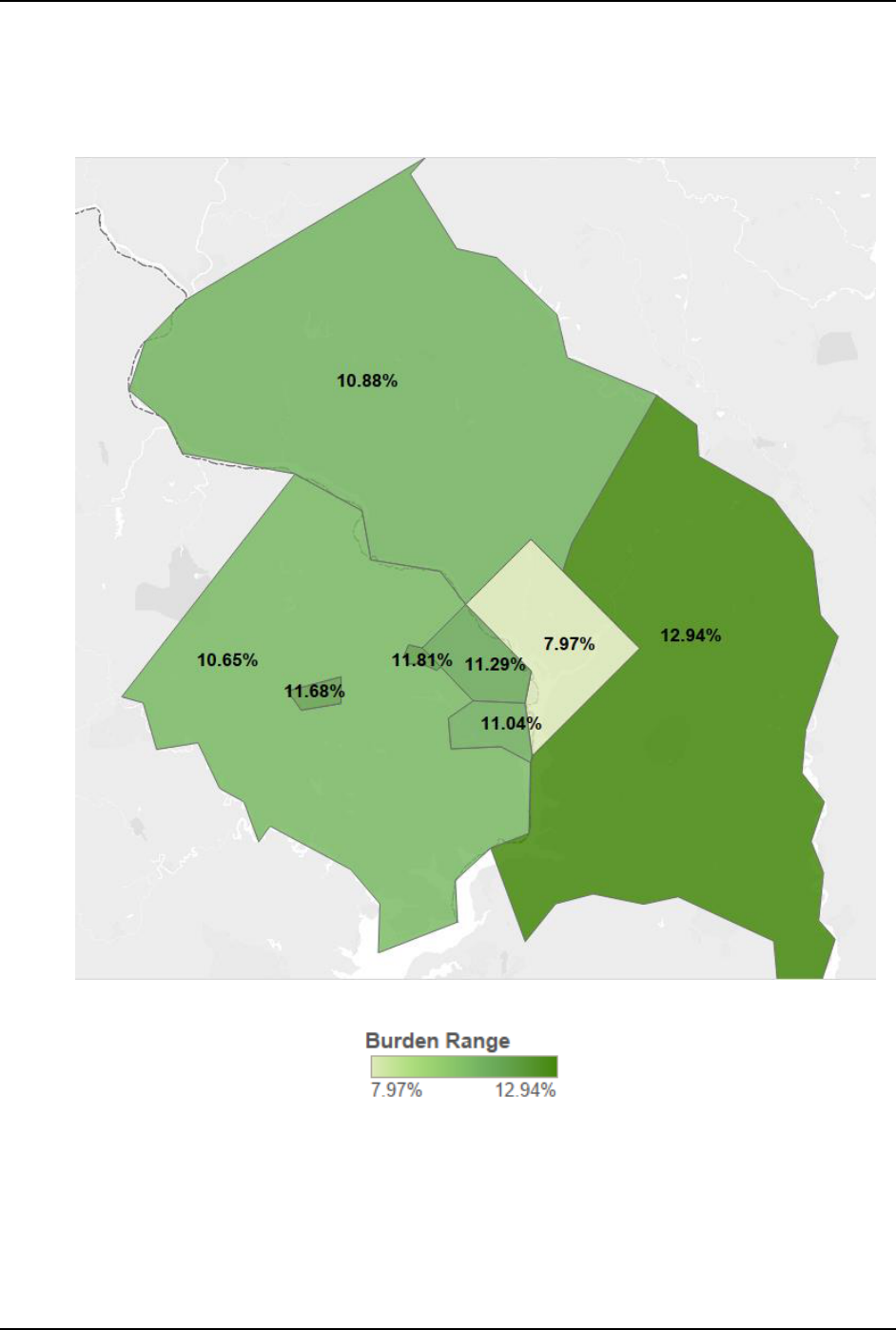

Map 5 Combined 2019 Metropolitan Area Tax Burdens (Income, Property, Sales,

& Auto) as a % of Income (Family Earning $75,000/Year)….................73

Map 6 Combined 2019 Metropolitan Area Tax Burdens (Income, Property, Sales,

& Auto) as a % of Income (Family Earning $100,000/Year)…………...74

Map 7 Combined 2019 Metropolitan Area Tax Burdens (Income, Property, Sales,

& Auto) as a % of Income (Family Earning $150,000/ Year)……..........75

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

iv

Executive Summary

Overview

This publication contains two studies: (I) the Washington, DC Metropolitan Area tax

burden comparison, and (II) the Washington, DC Metropolitan Area comparison of tax rates.

Hypothetical state and local tax burdens for a family of three, at five income levels, are

presented in Part I of this publication. These burdens reflect individual income, real property,

sales, and automotive taxes in the District of Columbia and selected jurisdictions in the

Washington metropolitan area. The District’s tax structure employs taxes typically used by local

governments, such as real and personal property taxes, deed taxes, and others. At the same time,

the District has taxes usually associated with the state level of government, such as the income

tax, estate tax, sales and use taxes, excise taxes, gross receipts taxes, and motor vehicle taxes.

About two-thirds of the District’s generated revenues come from taxes usually administered by

the states.

Taxation of individuals is an important factor in considering the competitiveness of a

given jurisdiction within a major metropolitan area. Simply comparing nominal tax rates,

however, does not provide an accurate picture of how one location

compares to other jurisdictions, and can be misleading given that

statutory rates do not reflect the wide array of adjustments and

provisions made to the tax base, such as tax deductions, credits,

and other preferences. Further, the District’s tax rates are often

compared to either state rates, or other city rates, and not usually a

combination of both rates that would be applicable to residents

living in those locales. As such, this study calculates the combined

state and local tax burdens a hypothetical family [at five different

income levels] would face living in DC as compared to

neighboring jurisdictions.

In order to compare different locations within the major metropolitan Washington area,

this study estimates hypothetical state and local tax burdens for a family of three in eight

Washington-area jurisdictions: the District of Columbia, the Maryland counties of Montgomery

and Prince George’s; the Virginia counties of Arlington and Fairfax; and the Virginia cities of

Alexandria, Fairfax, and Falls Church. Part II of the report also includes rates for Loudon and

Prince William Counties in Virginia. The hypothetical family comparison accounts for

differences in tax bases as well as tax rates across jurisdictions and can be conducted at a variety

of income levels.

In this study, the hypothetical family consists of two wage-earning spouses and one

school-age child. The gross family income levels used are $25,000, $50,000, $75,000, $100,000,

and $150,000. The wage and salary split is assumed to be 70-30 between the two spouses. All

other income is assumed to be split evenly. The family at each income level is assumed to own a

single-family home, except for families at the $25,000 income level, who are assumed to occupy

rental housing. All families are assumed to reside within the confines of the jurisdiction, and all

wage and salary income is assumed to have been earned in the jurisdiction.

…this study calculates

the combined state and

local tax burdens that a

hypothetical family [at

five different income

levels] would face living

in DC as compared to

neighboring jurisdictions.

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

v

The four taxes used in the comparison are the individual income tax; the real property tax

on residential property; the general sales and use tax; and automobile taxes, including the gasoline

tax, registration fees, and personal property tax for tax year 2019.

This study is not intended to measure the overall level of taxation in a jurisdiction; rather,

it attempts to measure a hypothetical tax burden for a family given assumptions identified for

each tax. There is no single “best” way of measuring tax burdens. To estimate tax payments, the

study makes critical assumptions about typical households, their sources of income, and

consumption patterns. Property tax liabilities are particularly difficult to measure accurately

because of varying assessment practices, property characteristics, and relief mechanisms. The

methodology used to derive the estimated tax burden for each tax is presented in the section

pertaining to that tax.

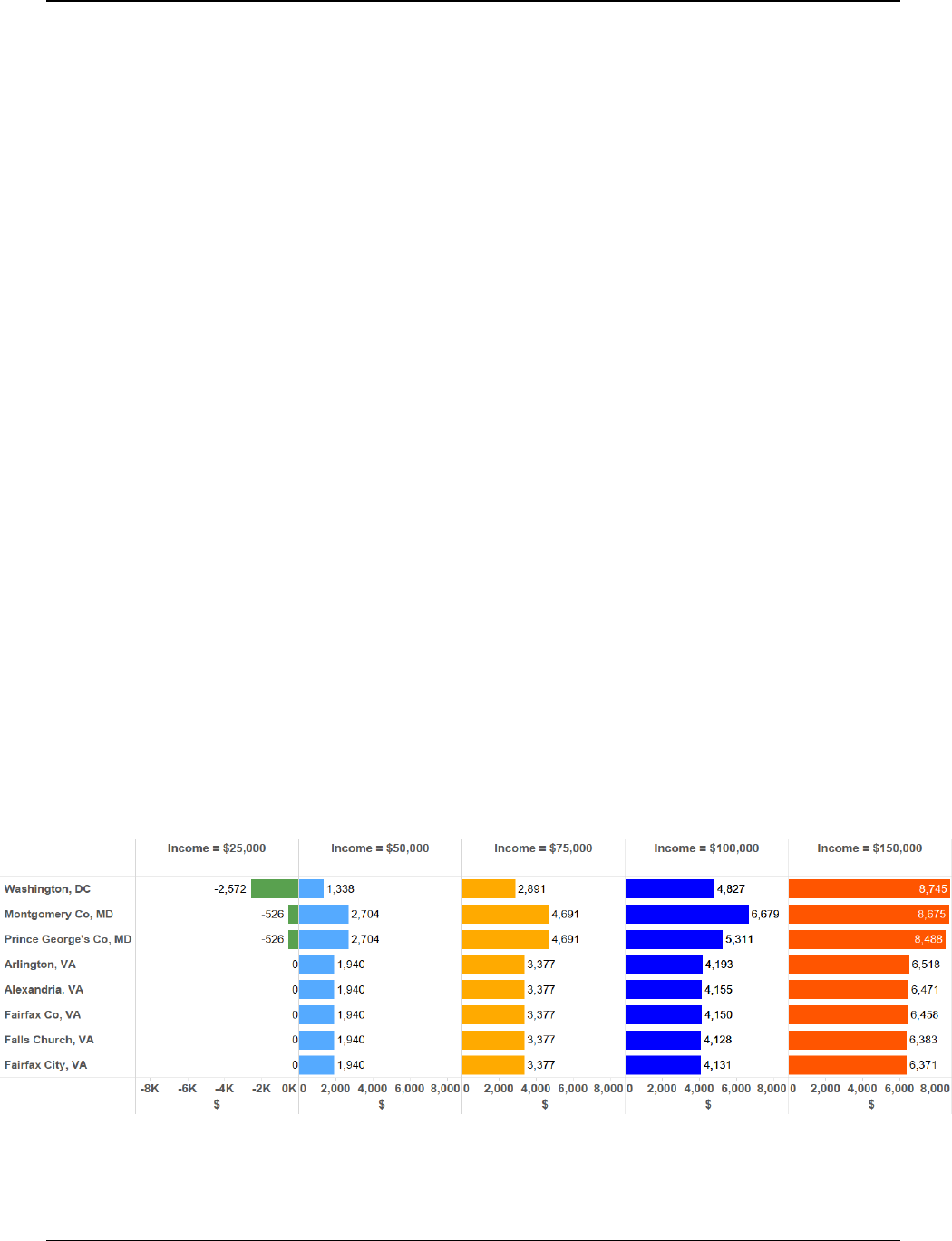

Findings

The main results of the study are presented in Tables 6 and

7, pages 19-20, and are also illustrated in Charts 4 and 5 on pages

21-23. When combining the four different tax burdens studied

together, the District of Columbia taxes its residents lower relative

to neighboring jurisdictions at each income level. At the

$25,000/year income level, the five Virginia jurisdictions rank

highest in the combined tax burdens, with Fairfax City’s burden

being the highest. At the $50,000- and $150,000-income levels,

Prince George’s County, Maryland’s tax burden ranks first, with

Falls Church, Virginia, ranking second. At the $75,000- and

$100,000-income levels, Falls Church ranks first with Prince

George’s County ranking second. At the four highest income levels,

Fairfax City and Alexandria, Virginia, share the third and fourth ranks, while Arlington and

Fairfax County share the fifth and sixth ranks. At every income level Montgomery County,

Maryland’s combined tax burden ranks seventh, while DC’s is eighth.

Individual Income Tax: The District’s individual income tax burden is lower than the

metropolitan average (excluding DC) at all levels except at the $100,000- and $150,000-income

level. The District’s income tax burden ranges from less than 0 percent (negative $2,572,

representing a tax refund), at the $25,000 income level to 5.8 percent ($8,745) at the $150,000

income level, (see Table 7, page 20). DC has the highest income tax burden at the $150,000-

income level; Montgomery County ranks highest for the $100,000-income level, while

Montgomery and Prince George’s Counties are tied with the highest burdens for the $50,000- and

$75,000-income levels. At the $25,000-level the Virginia jurisdictions rank highest (even with a

$0 tax burden) because the two Maryland counties and DC offer a refund through an Earned

Income Tax Credit (and a refundable property tax credit in DC). Except at the highest income

level, the tax burdens in the Maryland jurisdictions are higher than in DC and Northern Virginia

because these two counties levy their own local income tax, in addition to the income tax levied

by the state of Maryland. Without taking the local income taxes into account, the families in DC

would have a higher income tax burden than the families in the Maryland counties at the highest

three income levels. This fact highlights a reason for analyzing tax burdens in a more

comprehensive manner by including both state and local taxes.

Main Finding:

When combining the

four different tax

burdens together, the

District of Columbia

taxes its residents lower

relative to neighboring

jurisdictions at each

income level.

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

vi

Property Tax: The real property tax burden for District of Columbia homeowners falls

below the area-wide average (excluding DC) for homeowners at all income levels, a result of its

lower property tax rate and homestead deduction. For DC homeowners (those families earning

$50,000 or more) the tax burden ranges from 1.36 percent ($682) of income at the $50,000

income level to 2.19 percent ($3,285) at the $150,000 income level. In the District, the 2019

nominal rate of $0.85 per $100 of taxable assessed value is multiplied by the effective assessment

level (statutory assessment level of 100% X median assessment sales ratio) and applied to the

market value of the home after deducting $74,850 for the homestead exemption. For homeowners

at all income levels, Prince George’s County, Maryland has the highest property tax burden. In

this study, the families earning $25,000/year are assumed to rent instead of own and based on the

way that the property tax equivalent of rent is calculated for the study, the property tax burden at

this income level is assumed to be the same for all the metro jurisdictions. The high property tax

equivalent of rent reflects the high cost of rental housing in the metro region. As previously noted,

DC provides a property tax credit for renters which is reflected in the income tax burdens since it

is administered through that tax.

Sales and Use Tax: The District’s sales tax burden is higher than the metropolitan area

average (excluding DC) at all income levels. The general sales tax rate in the District of Columbia

is 6.0 percent (the same as Maryland and Northern Virginia’s general rates). However, each

jurisdiction has a multiple rate system in which sales tax rates on items such as food consumed

away from home and rental vehicles are higher than the general rate, thus the tax burdens

calculated for this study differ from one another.

Automotive Taxes: The District of Columbia automotive tax burden is lower than the

metropolitan area average (excluding DC) at all income levels. Unlike Virginia localities, the

District and Maryland jurisdictions do not levy a personal property tax on automobiles. The

combined state and local registration fees in Virginia are comparable to the state rate in Maryland.

The District imposes the highest registration fee in the metropolitan area, ranging from $72 for a

vehicle weight under 3,500 pounds to $155 for vehicles of 5,000 pounds or more.

The District of Columbia gasoline tax rate of 23.5 cents per gallon at the end of 2019 is

lower than Maryland’s recently increased rate of 36.79 cents per gallon, and lower than Virginia’s

30.12 cents per gallon (combined state + local rate).

See Map 1 (page 24) for an illustration of the metro area jurisdiction’s combined tax

burdens (income, property, auto, and sales) as a percentage of income, for a family earning

$75,000/year. At all income levels, DC has the lowest combined tax burden of the surrounding

jurisdictions. For maps illustrating combined metro area burdens for the other income levels, see

the Appendix on page 69.

This report is organized in two sections. Part I presents the Washington, DC Metropolitan

Area tax burden comparisons; and Part II contains a comparison of tax rates across the

Washington, DC Metropolitan Area.

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

vii

Acknowledgments

Each year the Government of the District of Columbia, Office of the Chief Financial

Officer, Office of Revenue Analysis publishes Tax Rates and Tax Burdens: Washington

Metropolitan Area as required by DC Code 47-817.

1

Taxpayers and government officials in the

District of Columbia have a significant interest in the relative tax position of the District

compared to the surrounding jurisdictions.

The Office of Revenue Analysis acknowledges and sincerely appreciates the time, effort,

and courtesy of officials in the Washington metropolitan area who cooperated in providing

information for this report. To properly compare tax rates and tax burdens, uniform and reliable

data must be used. Officials from the area jurisdictions assist with data compilation included in

this report. Part I of this volume compares tax burdens for the 2019 tax year and Part II compares

tax rates effective as of January 1, 2020.

I would also like to thank Lori Metcalf, who prepared this document, and Bob Zuraski,

Farhad Niami, and Charlotte Otabor, who offered editing assistance.

Questions and/or comments relating to this publication should be addressed to Lori

Metcalf, Fiscal Analyst, Office of Revenue Analysis, 1101 4

th

Street, SW, Suite 770 West,

Washington, DC 20024, or call (202) 727-7775.

Norton Francis

Chief Economist and

Deputy Chief Financial Officer (Interim)

April 2021

1

“In establishing a real property tax rate or rates, the Council shall make a comparison of tax rates and burdens applicable to

residential and nonresidential property in the District with those such rates applicable to such property in jurisdictions in the

vicinity of the District. The comparison shall include other major taxes in addition to the tax on real property. Without in any way

limiting the authority of the Council, it is the intention of Congress, that tax burdens in the District be reasonably comparable to

those in the surrounding jurisdictions of the Washington metropolitan area.”

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

1

Part I

A Comparison of Tax Burdens

in Selected Washington

Metropolitan Area Jurisdictions

2019

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 2

Overview

There is wide diversity in state and local tax systems in the United States. The fifty states

and the District of Columbia employ a broad range of taxes and fees to fund state and local

government operations. The combination of taxes and fees used by a particular jurisdiction is

dependent upon many factors, including its revenue needs, the local government tax base, the

fiscal relationships between the state and the local government, constitutional and legal

limitations on the powers of taxation, and the jurisdiction’s philosophy of government taxation.

The District’s tax structure includes taxes typically imposed by local governments, such

as real and personal property taxes, deed taxes, and others. At the same time, the District also

levies taxes usually associated with the state level of government, such as individual and

corporate income taxes, excise taxes, and motor vehicle related taxes. About two-thirds of the

District’s locally generated revenues come from taxes usually administered by a state.

The District is often compared to other cities, or states, independently, without

considering its unique situation of having to charge taxes that both a city and a state normally

levy. Therefore, the Office of Revenue Analysis produces a report comparing District tax

burdens on a hypothetical family to the combined state and local tax burdens the family would

face if it lived in the largest city in each state. As a companion to that nationwide study, the

present study compares the state and local tax burdens of a hypothetical family of three in the

eight major Washington metropolitan area jurisdictions: the District of Columbia; the Maryland

counties of Montgomery and Prince George's; the Virginia counties of Arlington and Fairfax;

and the Virginia cities of Alexandria, Fairfax, and Falls Church. Each jurisdiction provides its

own level of services and levies various taxes to pay for those services. The study does not

attempt to compare the level of services provided by each jurisdiction.

Further, this study defines the term ‘tax burden’ as the dollar amount of taxes owed if the

final incidence of each major tax examined (income, property, sales, and auto) is on the

individual.

2

Similar to the assumptions in the nationwide study, the hypothetical family in this

study consists of two wage-earning spouses and one school-age child. Families with annual gross

income levels of $25,000, $50,000, $75,000, $100,000, and $150,000 for each jurisdiction are

analyzed. The wage and salary split is assumed to be 70-30 between the two spouses.

The family at each income level over $25,000 is assumed to own a single-family home

and to reside within the confines of the city or county. However, at the $25,000 income level, the

study assumes that the household rents and does not own its housing unit and owns one

automobile. Families with annual income of $50,000 are presumed to own their home and one

automobile; and families with annual incomes of $75,000, $100,000, and $150,000 are assumed

to own their own home and two automobiles. This study compares the tax burden in each

jurisdiction for the hypothetical family across four major tax categories: individual income tax,

real property tax, sales tax, and automobile-related taxes.

2

This approach differs from the use of the phrase ‘tax burden’ that may be more common in the field of economics, which includes an economic

analysis of which group bears the ‘burden’ of a tax by ultimately having to pay it, also known as the ‘incidence’ of a tax.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 3

This study does not intend to measure the overall level of taxation in a jurisdiction;

rather, it attempts to measure a hypothetical tax burden for a family given the assumptions noted.

There is no single "best" way of measuring tax burdens. To estimate tax payments, the study

makes critical assumptions about typical households, their sources of income, and consumption

patterns. Property tax liabilities are particularly difficult to compare accurately because of

varying assessment practices, property characteristics, and relief mechanisms.

The methodology used to derive the estimated tax burden for each tax is presented in the

section pertaining to that tax. The methodology used in this report is best suited to provide a

relative comparison of tax burdens, within a single tax type and within a single year, across each

of the jurisdictions studied. Comparisons across the different types of taxes or across years

should be made with caution. As in past years, readers are advised not to compare the

hypothetical tax burdens across years; any number of small changes in the assumptions of the

study can result in misleading information under such comparisons. The purpose of the study

remains to compare tax burdens on a hypothetical household in different jurisdictions in a

specific year, and not over time.

The individual income tax rates, exemptions, and deductions in effect for calendar year

2019 in the District of Columbia, Maryland, and Virginia are shown in Table 1, on page 7.

Factors used in the housing value assumptions are detailed in the property tax section, and the

assumed housing values by income level for each jurisdiction are shown in Table 2, page 10. The

assumptions used to derive the automobile tax burdens are contained in Table 5, page 17.

Table 6, page 19, presents detailed data on state and local tax burdens for each type of tax

by income level for each selected metropolitan area jurisdiction. The District's tax burden is

compared with the average for the metropolitan area at each income level for the four tax

categories, separately and combined, in Table 7, page 20. Chart 4 on page 21 presents the DC

combined tax burdens compared to the metro area averages at each income level.

Finally, selected state and local tax rates in the Washington metropolitan area as of

December 31, 2019 are outlined in Table 8, page 25. To provide context, selected demographic

information for the metro area jurisdictions is presented in Table 9, page 26.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 4

Individual Income Tax

Income Tax Calculations

The income tax burden of a hypothetical family is estimated using the actual income tax

system in each jurisdiction and assumptions about the sources of income for families at different

income levels. The features of the individual income tax systems used in the Washington, DC

Metropolitan Area are presented in Table 1 (page 7).

The five income levels used in this study are divided between wage and salary income. In

previous versions of this report, capital gains and interest income were included, in addition to

the assumptions of major itemized deductions on the following page. However, capital gains and

interest income are not included in the current report to remove some of the variation that

inconsistently changed the original income levels used, with little methodological benefit. (See

the following page for more information on the itemized deductions that continue to be included

in this report.) The following income levels are used for the income tax starting point in each

jurisdiction and the District of Columbia, where Spouse 1 is assumed to earn 70 percent of the

total income and Spouse 2 is assumed to earn 30 percent.

Gross

Income:

$25,000

$50,000

$75,000

$100,000

$150,000

Spouse 1:

$17,500

$35,000

$52,500

$70,000

$105,000

Spouse 2:

7,500

15,000

22,500

30,000

45,000

Total itemized deductions used for calculating state and local income taxes, which are

also used in the federal tax computation, are shown below. The methodology for two of the

itemized deductions—the medical and dental expenses deduction and the charitable contribution

deduction—have changed for the current report. In the past, the amounts for these deductions

were based on actual average deduction amounts for taxpayers within a range around each

income level for Washington, DC, taxpayers who were married filing jointly and had itemized

deductions. However, the pool of married filing joint taxpayers that also itemized was

insufficient at the lower income levels to produce representative deduction amounts. Therefore,

in the current report, Internal Revenue Service (IRS) data for all itemizers in tax year 2018 are

used to calculate the average percent of AGI reflected by each of these deductions, respectively.

For the gross medical deduction, the average share is eight percent of AGI. For charitable

contributions, the level of four percent of AGI is applied across incomes. These changes in the

methodology make the inputs in the income tax calculations more consistent across incomes and

conform more closely to the methodology across the other tax types (which do not rely on DC-

specific data).

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 5

Gross Income Level

Deduction $ 25,000 $ 50,000 $ 75,000 $100,000 $150,000

Medical (Gross) 1/ 2,000 4,000 6,000 8,000 12,000

Nondeductible Medical 2/ -1,875 -3,750 -5,625 -7,500 -11,250

Net Medical Deduction 125 250 375 500 750

Deductible Taxes 3/ 3/ 3/ 3/ 3

Mortgage Interest 4/ 4/ 4/ 4/ 4/

Contribution Deduction 2/, 5/ 1,000 2,000 3,000 4,000 6,000

Total Deductions-without taxes

And mortgage interest 6/ 1,125 2,250 3,375 4,500 6,750

1/ Medical deductions allowed when the total is more than 7.5 percent of federal AGI. All or part of medical deduction

may be allowed in some states.

2/ New methodology for assumptions of medical and contribution deductions. 8% of AGI for medical (minus the 7.5% of

AGI limit); 4% for charitable. Data from: Table 2.1. Returns with Itemized Deductions: Sources of Income, Adjustments,

Itemized Deductions by Type, Exemptions, and Tax Items, by Size of Adjusted Gross Income, Tax Year 2018.

Available at this link.

3/The tax deduction varies from city to city and is based on real and personal property taxes computed in the current 2019

Study and individual income taxes computed in the 2018 study for tax year 2018.

4/ Assumed mortgage interest varies by income but at each income level is the same entire metro area and is based on 5th

year interest paid on a home purchased in 2014 at an interest rate of 4.17%.

5/ Contribution Deduction represents charitable contributions claimed.

6/ Note: the current report does not include miscellaneous deductions, taxable interest income or capital gains, which have

been included in previous reports. Further, if all itemized deductions do not exceed the amount of the standard deduction,

the standard deduction amount will be automatically used.

Because the Federal Earned Income Tax credit (EITC) at the $25,000 income level in

some states will determine the state’s EITC, it is necessary to compute the 2019 federal

individual income tax at each income level using the above assumptions. DC, Maryland, and

Virginia each allow taxpayers to begin their state income tax computations with federal adjusted

gross income (AGI)

Further, depending on levels of deductions used in each state, the standard deduction may

be more advantageous for certain taxpayers. In 2019, the federal standard deduction increased to

$24,400; and state level standard deductions vary by state. Because the federal standard

deduction was significantly increased in the Tax Cuts and Jobs Act of 2017 (TCJA), more of the

families included will now take the standard deduction. This also means that if states require

taxpayers taking the federal standard deduction to also take the state standard deduction, those in

states with standard deductions lower than their itemized deductions may face an increased tax

liability in 2019 as compared to 2017 (both Maryland and Virginia require taxpayers taking the

federal standard deduction to also to take the state standard deduction. The DC standard

deduction is now the same as at the federal level). For the current study of tax year 2019, all

families earning $75,000 per year and below would take the federal standard deduction as it was

higher than the itemized deductions assumed for these income levels in the report.

The 2019 deductible real and personal property taxes computed in the current year’s

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 6

Metro Area study are used for the 2019 property tax deduction. For the 2019 state and local

individual income tax deduction, 2018 tax burdens from the previous year’s study were used.

Each of these figures was used in computing the 2019 federal income tax burden, which is the

starting point for the Metro-area income tax burden calculations.

The highest individual income tax rate in Maryland is 5.75 percent and is not reached

until taxable income exceeds $300,000 for joint filers ($250,000 for single filers). In addition,

Maryland local tax rates, which are applied to all taxable income, range from 3.03 percent in

Charles County, to 3.2 percent in Montgomery and Prince George’s Counties. At the $25,000

income level, one-half of the federal earned income credit is deducted from state tax liability in

Maryland (and nonrefundable), while 28 percent is fully refundable (meaning that the taxpayer

may receive money back if their credit is more than their tax liability). In contrast, Virginia's

maximum 5.75 percent tax rate is reached when taxable income exceeds $17,000 and 20 percent

of the federal earned income credit is deducted from Virginia’s tax liability (and not refundable);

and the District's maximum rate of 8.95 percent in 2019 was not reached until the $1,000,000

taxable income level is exceeded. At the $25,000 income level, eligible DC taxpayers received

40 percent of the federal earned income credit as a deduction from their District tax liability and

the DC credit is refundable.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 7

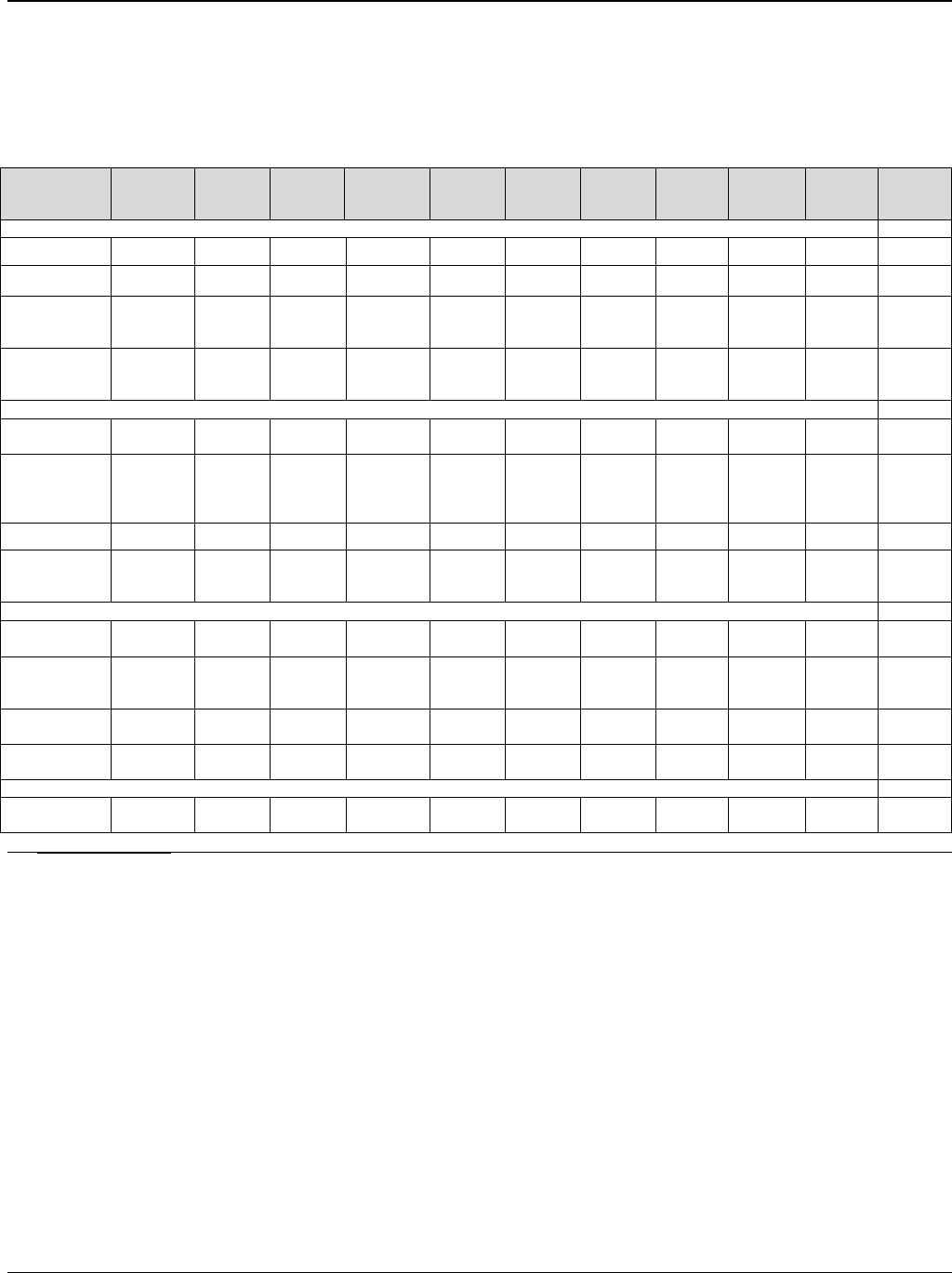

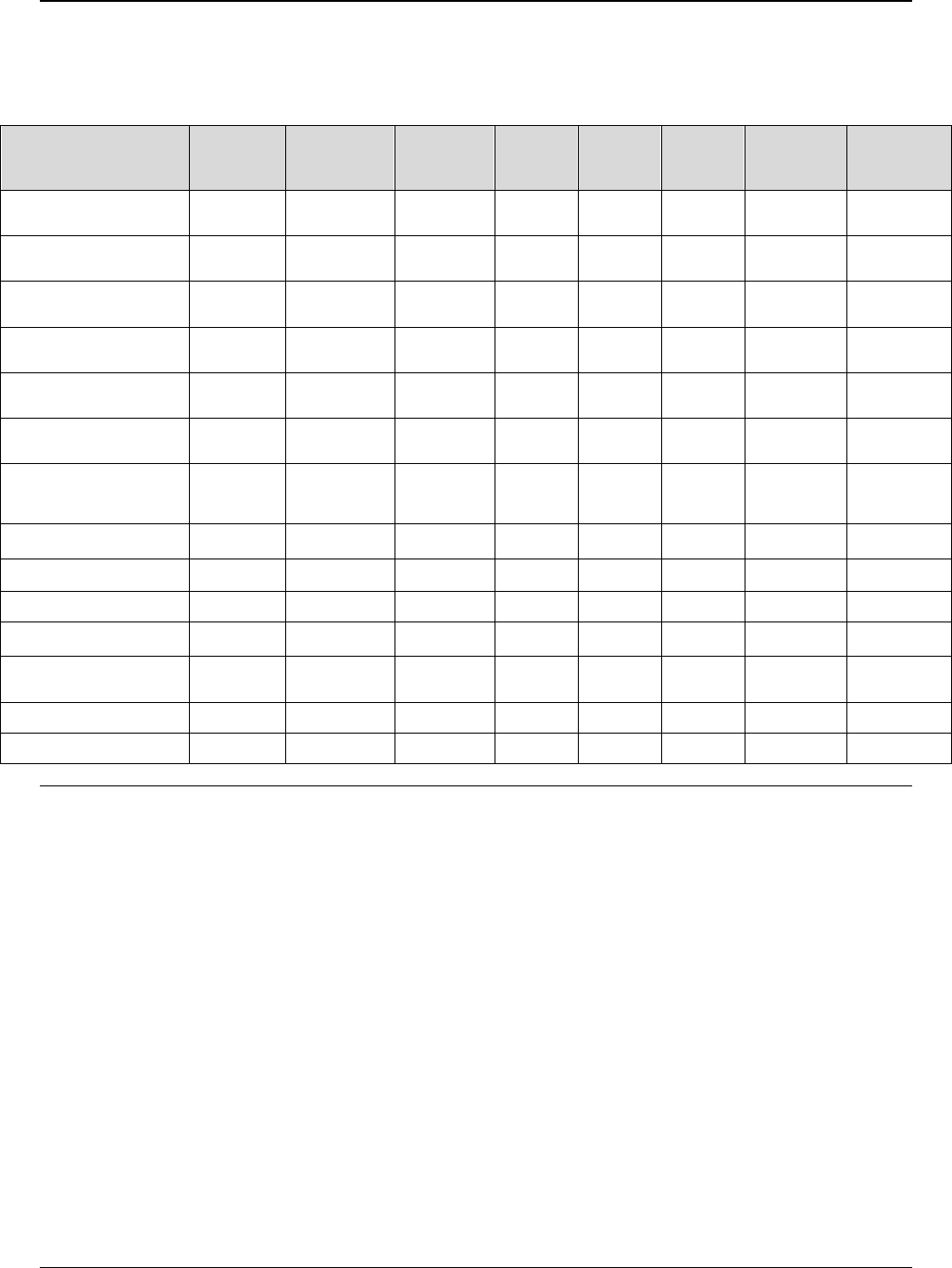

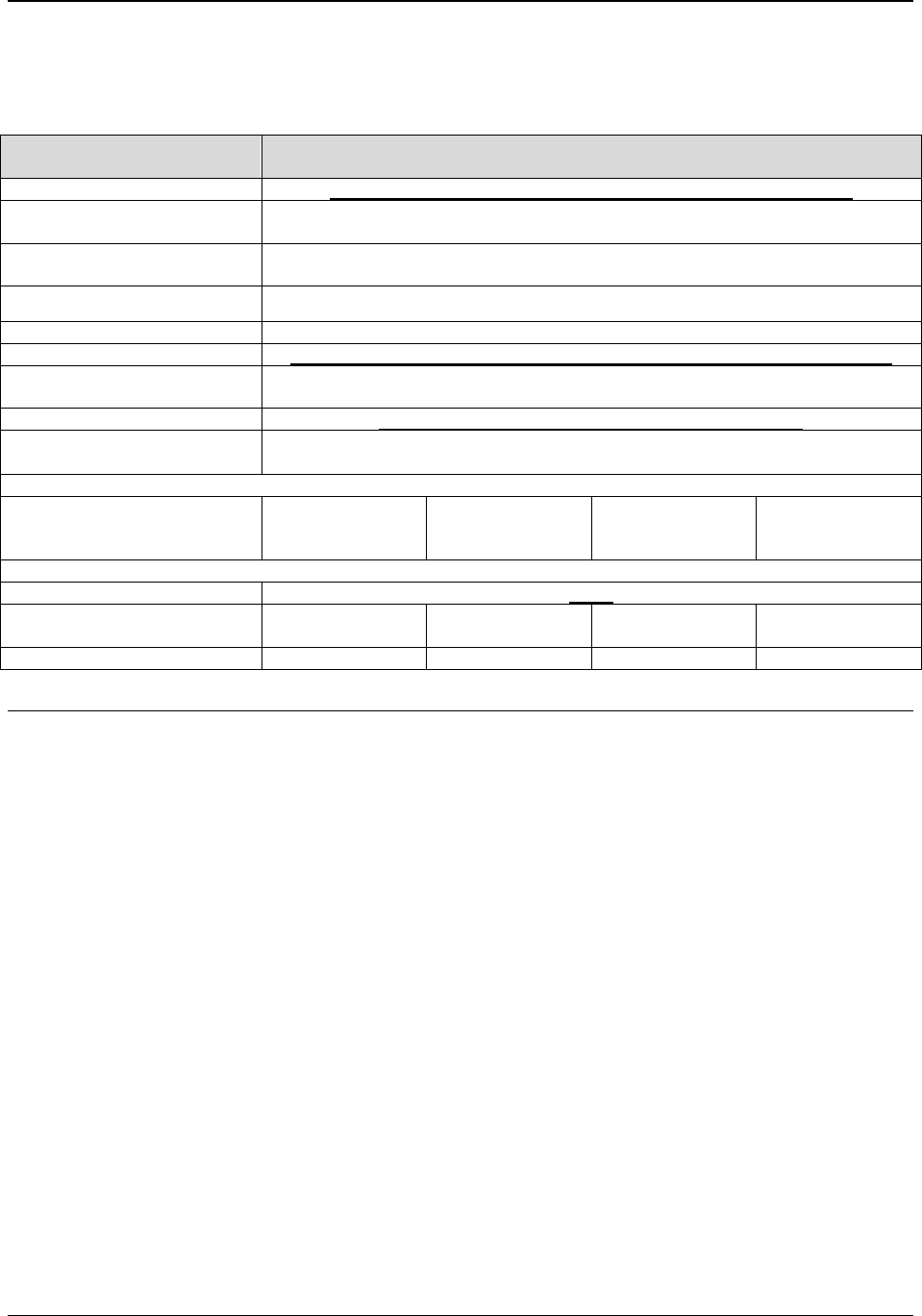

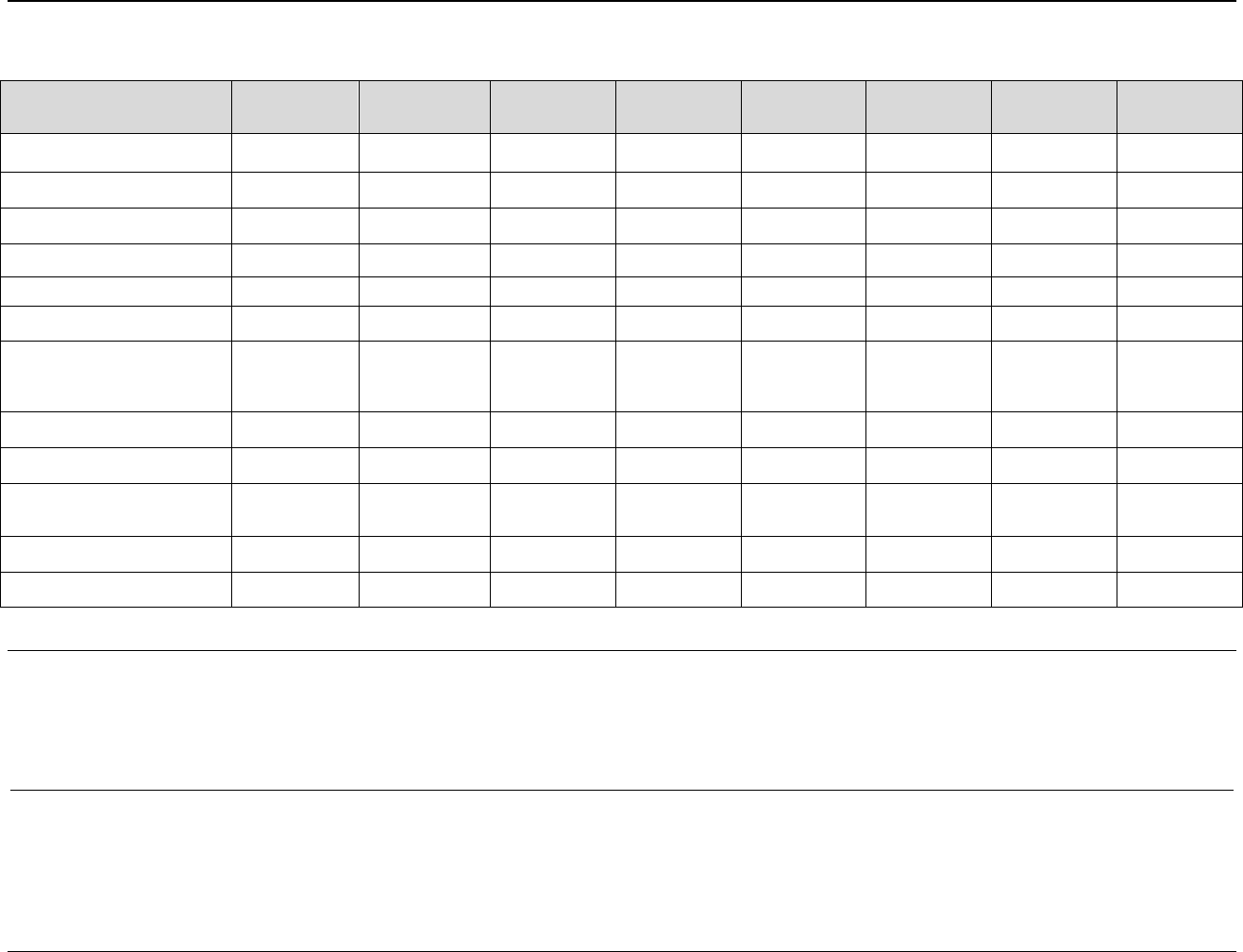

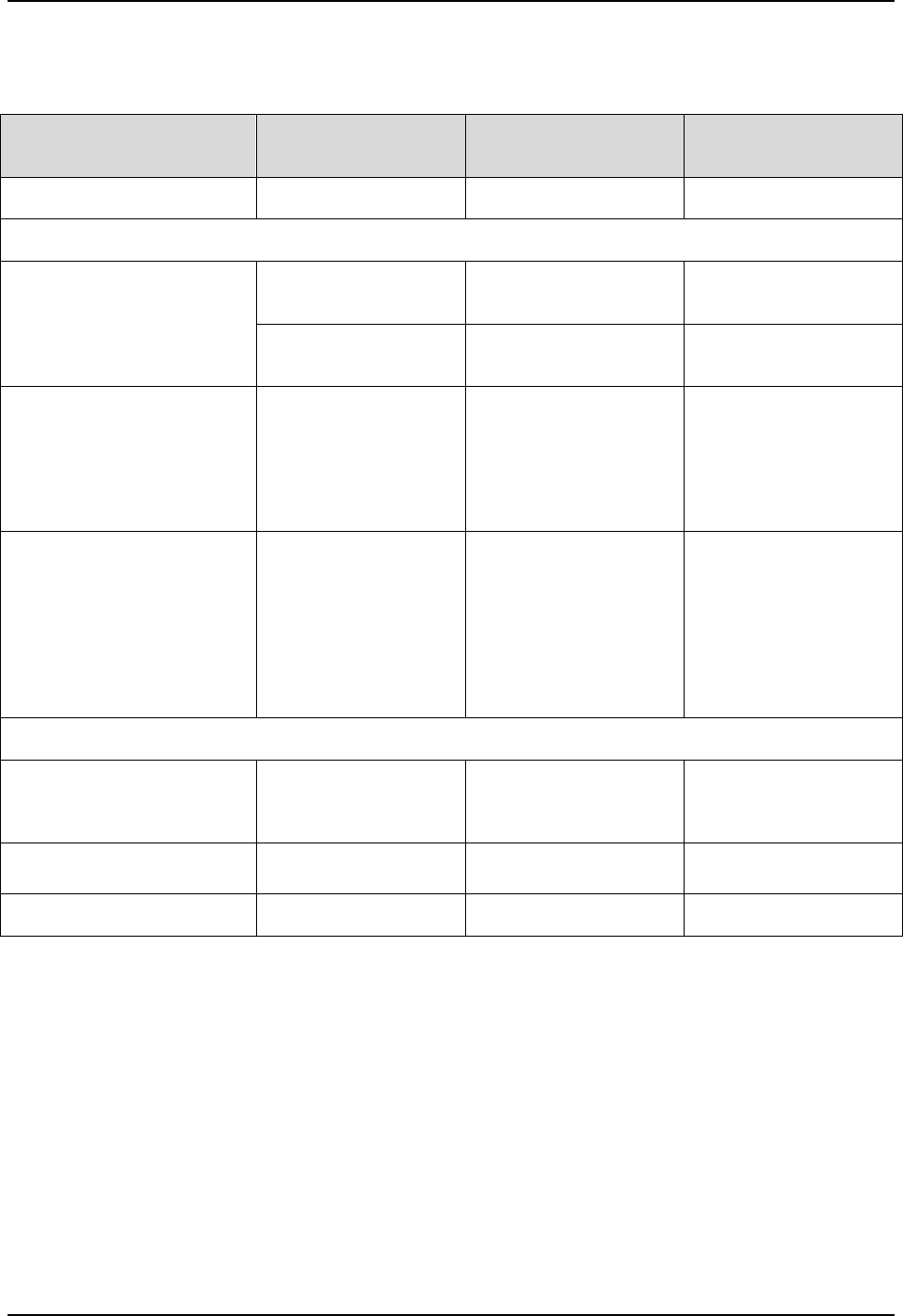

Table 1: Individual Income Tax Washington Metropolitan

Area (2019)

PERSONAL EXEMPTIONS

EXEMPTIONS

TAXABLE

INCOME 5/

RATES

DISTRICT OF COLUMBIA

Single

$0 1/

$0 - $10,000

$10,001-$40,000

$40,001-$60,000

$60,001-$350,000

$350,000-$1,000,000

Over $1,000,000

4.0%

$400 + 6.0% of excess > $10,000

$2,200 + 6.5% of excess > $40,000

$3,500 + 8.5% of excess > $60,000

$28,150 + 8.75% of excess > $350,000

$85,025, plus 8.95% of the excess above

$1,000,000

Married Filing Separately

$0

Married Filing Jointly

$0

Head of Household

$0

Dependent (additional to federal)

$0

Blind (additional to federal)

$0

Age 65 and over (additional to

federal)

$0

Standard Deduction

$24,400 1/

MARYLAND 2/

Single

$3,200

$0 - $1,000

$1,001-$2,000

$2,001-$3,000

$3,001-$150,000

$150,001-$175,000

$175,001-$225,000

$225,001-300,000

Over $300,000

2.0%

$20 + 3.00% of excess > $1,000

$50 + 4.00% of excess > $2,000

$90 + 4.75% of excess > $3,000

$7,072.50 + 5% of excess > $150,000

$8,322.50 + 5.25% of excess > $175,000

$10,947.50 + 5.5% of excess > $225,000

$15,072.50 + 5.75% of excess> $300,000

Married Filing Separately

$6,400

Married Filing Jointly

$6,400

Head of Household

$3,200

Dependent (additional)

$3,200

Blind (additional)

$1,000

Age 65 and over (additional)

$1,000

Standard Deduction

3/

VIRGINIA

Single

$ 930

$0 - $3,000

$3,001-$5,000

$5,001-$17,000

Over $17,000

2.0%

$60 + 3.00% of excess >$3,000

$120 + 5.00% of excess > $5,000

$720 + 5.75% of excess > $17,000

Married Filing Separately

$ 930

Married Filing Jointly

$1,860

Head of Household

$ 930

Dependent (additional)

$ 930

Blind (additional)

$ 800

Age 65 and over (additional)

$ 800

Standard Deduction

4/

Source: Survey of State Revenue Department Officials; State Web Sites; and Federation of Tax Administrators, “State Individual Income Taxes

for tax year 2019.” March 29, 2019. 2019 State Tax Handbook, Wolters Kluwer/ CCH Group, 2018.

1/ As a result of the 2017 Tax Cuts and Jobs Act and DC’s federal conformity provisions, DC personal exemptions are reduced to zero and

the federal standard deduction will apply thereafter. Standard deduction listed is for married couples filing jointly.

2/ Maryland rates do not include local rates that may be as low as 1.75% in Worcester County and as much as 3.20% in Howard, Montgomery

and Prince George’s Counties, among others.

3/ The standard deduction for an individual is 15% of Maryland AGI not to exceed $2,250 ($4,550 for joint and head of household returns and

those filing as qualifying widow(er) with dependent child). The minimum is $1,500 for single, married filing separately and dependent

taxpayers. All others are allowed a minimum of $3,000.

4/ Single - $3,000; married persons filing separately - $3,000; and married persons filing jointly or combined separate - $6,000.

5/ Brackets and rates are for married filing jointly.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 8

Income Tax Burdens

At the $25,000 income level, the metro area average individual income tax burden

(excluding DC) represents a negative 0.60 percent of family income (due to refunds through the

EITC). The metro area average income tax burden is 4.32 percent at $50,000; 5.00 percent at

$75,000; 4.68 percent at $100,000; and 4.70 percent at $150,000 (see Table 7, page 20).

The District’s individual income tax burden is lower than the average of the other metro

areas at every level except at the $100,000- and $150,000-income level. The District’s individual

income tax burden ranges from a negative $2,572, or negative 10.3 percent at the $25,000

income level to $8,745 or 5.8 percent at the $150,000 income level. (The family earning $25,000

per year in the District also receives a refund through the EITC, as well an income tax refund of

property tax paid through the Schedule H credit, which is available to renters). The Montgomery

and Prince George’s county individual income tax burdens exceed the metropolitan average at

every income level except at $25,000.

In those two Maryland counties, the tax burden is a negative 2.1 percent at the $25,000

income level, and 5.8 percent at the $150,000 income level in Montgomery County and 5.7

percent at that level in Prince George’s County. For the Virginia area jurisdictions (Arlington

County, Alexandria, Fairfax City, Fairfax County, and Falls Church), the average of the four

individual income tax burdens is 0 percent at the $25,000 level, and 4 percent at the $150,000

income level. (Chart 1 below presents income tax burdens in dollars, ranked by highest to lowest

burdens at the $150,000 income level.)

Chart 1: 2019 Washington Metropolitan Area Individual

Income Tax Burdens

Source: ORA.

Note: Negative income tax burdens are a result of refundable tax credits.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 9

Real Property Tax

Property Tax Calculations

Real property tax burdens in the metropolitan area are a function of residential real estate

values, the ratio of assessed value to market value, applicable tax deductions or credits, and the

tax rate. The District allows a homestead deduction from the value of residential property before

the tax is calculated on owner-occupied properties ($74,850 in 2019), while the Virginia

jurisdictions do not allow any deductions for the typical homeowner. Montgomery County,

Maryland offers a property tax credit to offset the county income tax for owner-occupied

properties which is applied to County property taxes. The amount set by the County Council for

tax year 2019 was $692 and was applied to each family in the study assumed to own a home. The

state of Maryland has a supplemental homeowners’ tax credit for incomes up to $60,000 per year

but is only applicable if property taxes exceed a certain amount. None of the study’s families in

Montgomery or Prince George's County would have qualified because calculated taxes did not

meet the limit required. Both the District of Columbia and the state of Maryland have limits on

the amount a property’s assessment can increase from one year to the next (both are capped at 10

percent), however neither of these are included in the study because it is a point in time

calculation.

The effective property tax rates used for property tax burden calculations for each of the

metropolitan jurisdictions, presented in Chart 2, page 14, indicate a variety of ranges in these

rates and are net of property assessment levels. For the present 2019 Study, median sales ratio

statistics have been included to derive an “effective assessment level” that results from

multiplying the statutory property assessment level times the median sales ratio statistic. Median

sales ratios are a measure of the property valuation and assessment practices within a

jurisdiction. A sales ratio (or assessment sales ratio) is the ratio of the appraised value of the

property to the sales price, or market value; the median is the median ratio value of all the

properties included in the study.

3

If property assessments do not keep up with market value,

residents’ property taxes will be lower than they would otherwise be if taxed at the full market

value of the property. Including the available median sales ratio statistic into the property tax

burden calculations is an attempt to reflect how property tax systems in each jurisdiction are

administered in practice.

In addition to tax rate and effective assessment level differences, data presented in Table

2, page 10, show assumed market value differences of a residence for purposes of this study at

the different income levels. The $25,000 income level families are assumed to reside in a rental

unit and the $50,000, $75,000, $100,000, and $150,000-income families are assumed to live in

an owner-occupied house. A series of assumptions and calculations were made to estimate the

median house value for the Washington, DC metropolitan area for each income level used in the

report.

Data for the area’s median house value and median income were retrieved from the

3

“Glossary for Property Appraisal and Assessment,” International Association of Assessing Officers. 2013. Page 150.

https://www.iaao.org/media/Pubs/IAAO_GLOSSARY.pdf.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 10

Census Bureau’s 2019 American Community Survey. A linear multiplier was calculated by

dividing the area’s median house value by its median household income for mortgage holders.

This multiplier was used to scale the house values to the various income levels in the report

(multiplying it by each income level). This assumption serves as an input for both the property

tax burden calculations and the mortgage interest deduction for the income tax burden. This

method, which has been used since 2012, assumes that house values increase in a linear fashion

with income. Since 2014, the use of median household income of mortgage holders, rather than

the median income of all households, has been used to calculate the linear multiplier. However,

any analysis should focus on the relative rankings within a given year. Table 2 below presents

the metro area house value assumptions used in this study.

The mortgage interest amount (for use as an itemized deduction in the income tax) in the

2019 study is derived by calculating an amortization schedule for the estimated value of a house

purchased in 2014.

Table 2: Housing Value Assumptions For

Major Washington Metropolitan Area Jurisdictions

Calendar Year 2019 1/

FAMILY

INCOME

DISTRICT OF COLUMBIA,

MONTGOMERY COUNTY, MD

PRINCE GEORGE’S COUNTY, MD

ALEXANDRIA, VA

ARLINGTON COUNTY, VA

FAIRFAX COUNTY, VA

FALLS CHURCH, VA

FAIRFAX CITY, VA

$ 50,000

157,090

$ 75,000

235,635

$100,000

314,180

$150,000

471,269

Source: ORA.

1/ For the $50,000 income levels and above, data on 2019 median household incomes for mortgage holders and median

house values for the Washington DC, MSA were retrieved from the Census Bureau's ACS 2019. A multiplier was

then applied to each income based on the relationship of median income to median home value.

Property Tax Equivalent of Rent

As previously noted, the study assumes that the family with an annual income of $25,000

does not own a home (and as a result does not pay property tax directly), but instead rents.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 11

Given the high real estate values in the metro area, the assumption that families earning $25,000

per year rent is likely more realistic than the assumption that they own a home. Because renters

indirectly pay property taxes through their rent,

4

this study and previous Tax Burden Studies

calculate a percentage of rent constituting property taxes. This concept is called the property tax

equivalent of rent (PTER) and is an important tool in comparing the incidence of the property tax

on renters versus homeowners. In a 2020 50-State Property Tax Comparison report, the Lincoln

Institute of Land Policy and the Minnesota Center for Fiscal Excellence note that states vary in

how they tax rental properties in comparison to homesteads; on average cities tax apartments 34

percent more than homesteads.

5

Their report presents a table illustrating this information for the

largest city in each state; Charleston, South Carolina, has the largest difference in effective rates

between apartment buildings and homesteads, taxing apartments more than four times the

effective rate of that levied on homesteads.

6

Conversely, in six of the largest cities in each state

(and DC), apartments are given preferential treatment over homesteads with the most preference

toward apartments given in Bridgeport, CT.

7

In eight cities, apartments are given the same

treatment as homesteads.

To relieve the implicit tax burden on renters that exists in some locations, some states

have property tax circuit breaker programs that offset renters’ tax burdens (often through the

income tax since they do not pay property taxes directly). These programs must make

assumptions of the PTER to calculate the amount that renters are paying in property taxes, and

the amount of relief they will receive through the circuit breaker program. Of the states that offer

circuit breaker programs, the PTER assumptions generally range from 6 to 25 percent (NM has a

low of 6 percent while MA uses a 25 percent assumption); on average, states assume that 17

percent of rent goes toward paying property taxes.

8

DC’s circuit breaker program assumes 20

percent.

Prior to the 2016 Tax Burden Study, a 20 percent assumption was used with some

reservation given that it has a large impact on the calculated tax burdens of the families earning

$25,000 per year. In particular, the assumption often seemed unrealistic in cities with higher

rental prices where calculated PTERs would be the highest. However, rental buildings in more

competitive markets may not be able to pass on all taxes paid, given that prices are set by the

local market, and as the Lincoln report illustrates, the specific PTER level in a city is primarily

based on the tax system in each jurisdiction. It is not clear whether states with higher PTER

percentages in their circuit breakers have data backing up the percentage of PTER in their state,

or if these states are using the circuit breaker to provide a subsidy to lower income renters hit

hardest by higher rental markets.

9

In a January 2016 report, the Minnesota Department of

Revenue (MN DOR) used several techniques based on both ACS and internal tax data to assess

the percentage of rent that constitutes property taxes throughout Minnesota. MN DOR found the

statewide PTER hovered around 15 percent each year from 2009 to 2014, though in Minneapolis

4

“50-State Property Tax Comparison Study for Taxes Paid in 2018.” The Lincoln Institute of Land Policy and the Minnesota Center for Fiscal

Excellence. June 2019: pg. 4.

5

Ibid.

6

Ibid, pg. 104-5.

7

Ibid. The study found that in Washington, DC, the classification ratio between apartments and homesteads is 1.07, indicating that homesteads

are treated slightly preferentially to rental buildings by the property tax rates (exclusive of credits) in DC.

8

Based on analysis of state programs in the Lincoln Institute of Land Policy’s Significant Features of the Property Tax Database for 2017.

9

This discussion does not intend to assess appropriate levels of PTER used in circuit breaker programs, or to advocate that they

be changed. It is intended solely to consider whether and how these levels are used as an input for the Tax Burden Study’s calculation of renters’

tax burdens as compared to homeowners’ tax burdens across the 50 states.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 12

it was often up to 16.9 percent.

10

After considering the available information we have used a level of 15 percent for PTER

since the 2016 Study to be more realistic in the property tax burden on renters, particularly in

cities with more expensive rental markets. Future refinements may be made as new information

and data become available. To compute a percentage of said rent constituting property taxes for

the 51-City Tax Burden Study, the property tax equivalent of rent (PTER) was calculated by first

obtaining data on 2019 median rents for each MSA from the U.S. Department of Housing and

Urban Development.

11

The PTER for each jurisdiction was calculated as 15 percent of the

median rent for the Washington, DC MSA. Unlike the 51-City Study in which median rents for

each metropolitan area are used to reflect different housing markets in different areas, all the

jurisdictions in the present study are in the Washington, DC, metropolitan statistical area, and

thus have the same housing assumptions, for both rental costs and house values.

The 2019 median rent for a studio apartment was $1,540 per month in the DC MSA.

Even with the lower assumption of PTER in the current study, taking 15 percent of this rent over

an entire year implies that the lowest income families in the report are spending 74 percent of

their incomes on rent in the Washington, DC area. However, viewed in the context of some DC

metro area statistics it may not be that unrealistic. In 2017, of renters earning less than

$50,000/year, more than 80 percent were spending more than 30 percent of their income in

rent.

12

Further, a 2016 DC Fiscal Policy Institute Analysis of 2014 Census data found that 42

percent of extremely low-income renters (between $16,100 - $32,100/year for a family of four)

in DC paid 80 percent of their income or more in rent, while over half of renters at this income

level paid more than half of their income in rent.

13

Property Tax Burdens

Real property tax burdens for District of Columbia residents fall below the area wide

averages (excluding DC) at all income levels, except at the $25,000 income level where property

tax burdens are assumed to be the same across the region. As previously noted, the family

renting in DC and earning $25,000 would receive a property tax credit through the income tax

that is presented in the study as an offset to the income tax burden. Using the same housing cost

assumptions across the region means that the real property tax burdens for those assumed to own

their homes only reflect differences in both real property tax rates and property tax relief

provisions among the metropolitan area jurisdictions. The metropolitan area average burden for

the real property tax is 3.33 percent of income at the $50,000 income level; 3.40 percent at the

$75,000 level; 3.43 percent at the $100,000 level; and 3.46 percent at the $150,000 level (Table

7, page 20). Chart 3 below presents property tax burdens in dollars, by income level, for each

jurisdiction.

To calculate property tax burdens, nominal real estate tax rates for each jurisdiction are

10

The MN Renter’s Property Tax Refund program allowed renters to qualify for a refund on their rent of up to 17% of rent paid

(dependent on the renter’s income level) in 2018.

11

U.S. Department of Housing and Urban Development, “2017 50

th

Percentile Rent Estimates.” Data for studio apartments used.

12

Analysis of

U.S. Census Bureau, 2013-2017 American Community Survey 5-Year Estimates.

13

Zippel, Claire. “A Broken Foundation: Affordable Housing Crisis Threatens DC’s Lowest-Income Residents.”

DC Fiscal Policy Institute. December 8, 2016.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 13

multiplied by an effective assessment level (which is the announced or statutorily prescribed

assessment level times the median assessment sales ratio statistic for each jurisdiction). The

effective property tax rate (which does not include homestead or other deductions or exemptions)

is then multiplied by the housing values to determine the real property tax due. Homestead

exemptions or other property tax relief provisions are deducted or included as applicable in the

calculation of the final property tax burden.

For the District of Columbia, the nominal tax rate of $0.85 per $100 of assessed value is

multiplied by the effective assessment level of 97.5 percent (statutory assessment level of 100%

X median assessment sales ratio of 97.5%), and then applied to the market value of the house,

less $74,850 for the 2019 homestead exemption. Therefore, the homeowner with $50,000 in

income would pay tax on $82,240 of house value; on $160,785 at the $75,000 income level; on

$239,330 of house value at the $100,000 income level; and on $396,419 at the $150,000 income

level (each of these amounts represents the median house value at that income level minus

$74,850 for the homestead deduction).

Because Virginia's property tax relief program is targeted toward the elderly (age 65 or

older), and to persons permanently and totally disabled whose incomes do not exceed $72,000,

no adjustments are made in the property tax burdens for the hypothetical family of three in the

Virginia jurisdictions.

In calculating the real property tax burdens in the Maryland jurisdictions, nominal rates of

$1.091 per $100 of value in Montgomery County and $1.465 per $100 of value in Prince

George’s County were used as the starting point to calculate the effective rates as described

above. These nominal rates in Maryland include the countywide rate, plus the state rate ($0.112

per $100 of value). The Montgomery County rate also includes a transit tax, fire district tax, a

weighted average of 23 municipal district taxes, and a tax for the Maryland National Capital Park

and Planning Commission (MNCPPC), while the Prince George’s County rate includes a

stormwater/flood control tax and a tax for the MNCPPC and a Washington Suburban Transit

Commission (WSTC). As previously mentioned, in 2019 Montgomery County, Maryland

offered an income tax offset credit on property tax bills for owner-occupied residences of $692.

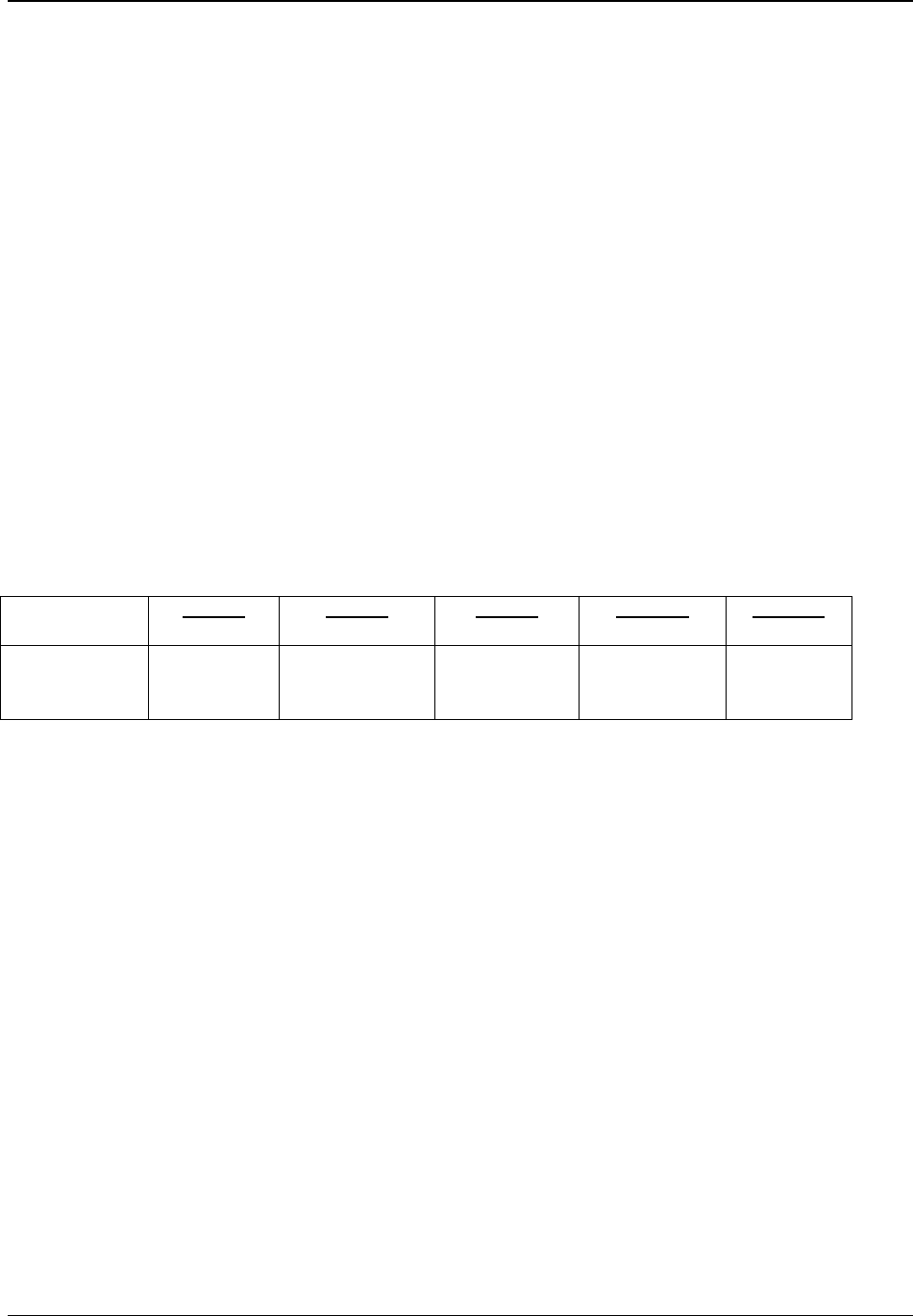

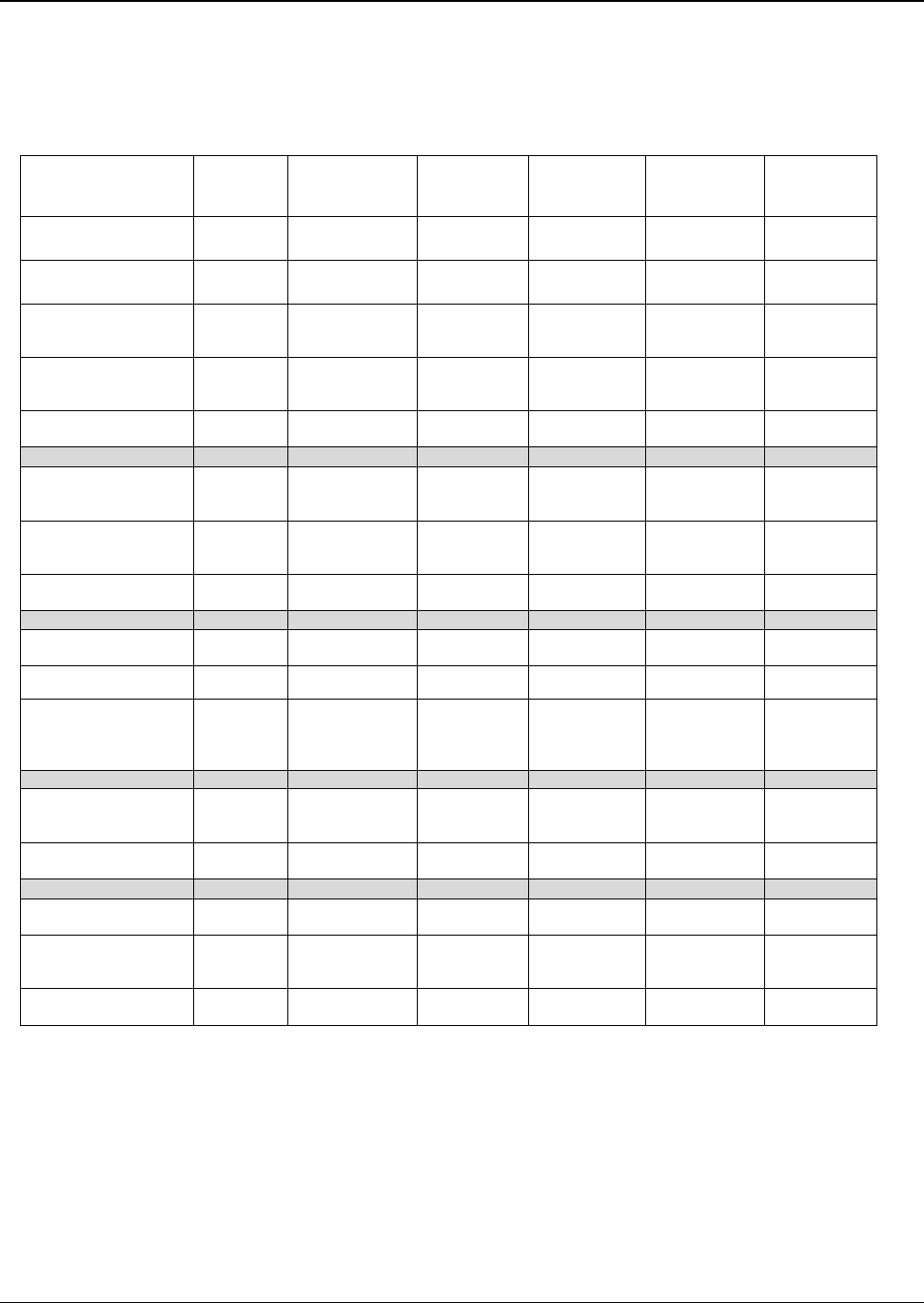

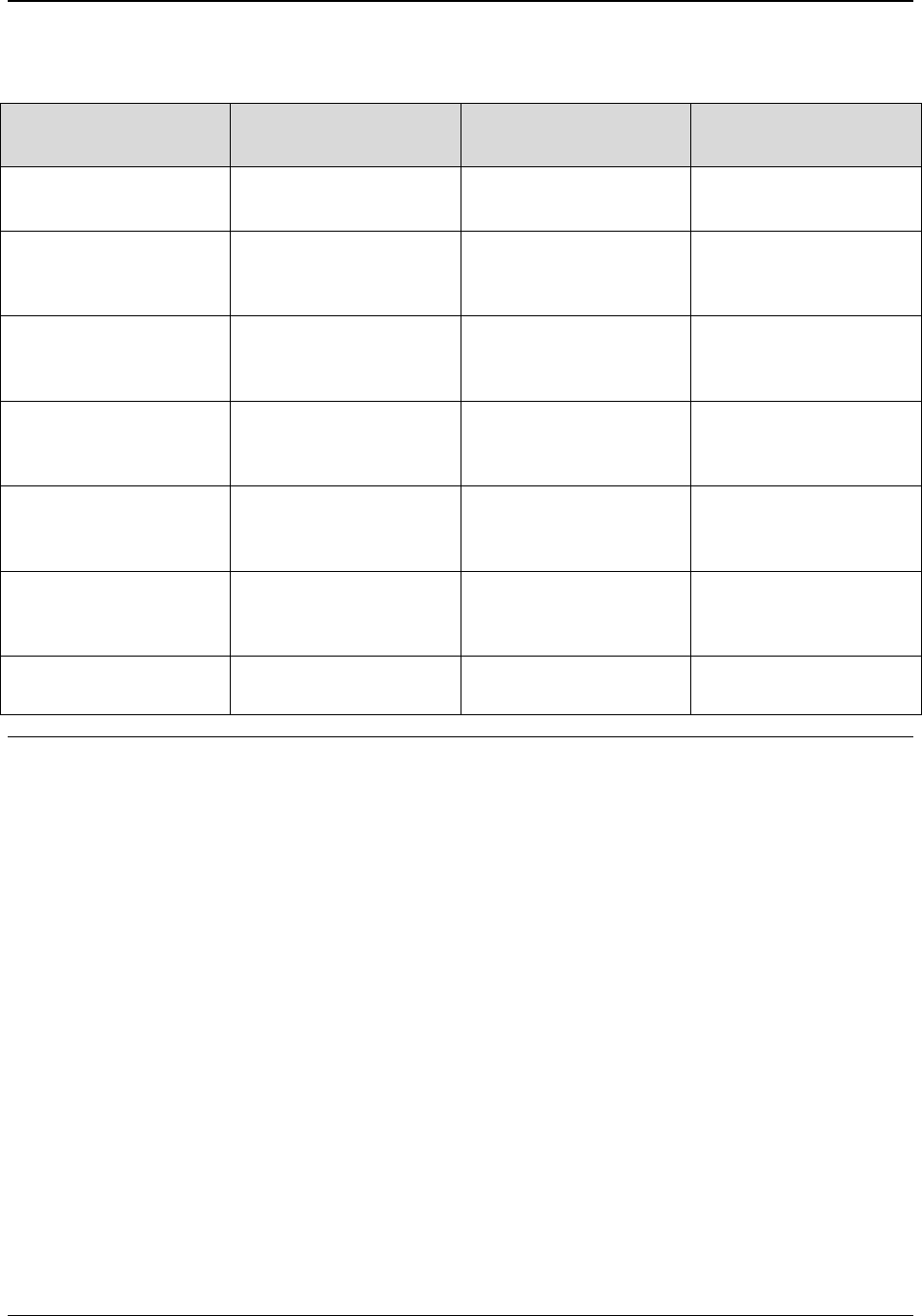

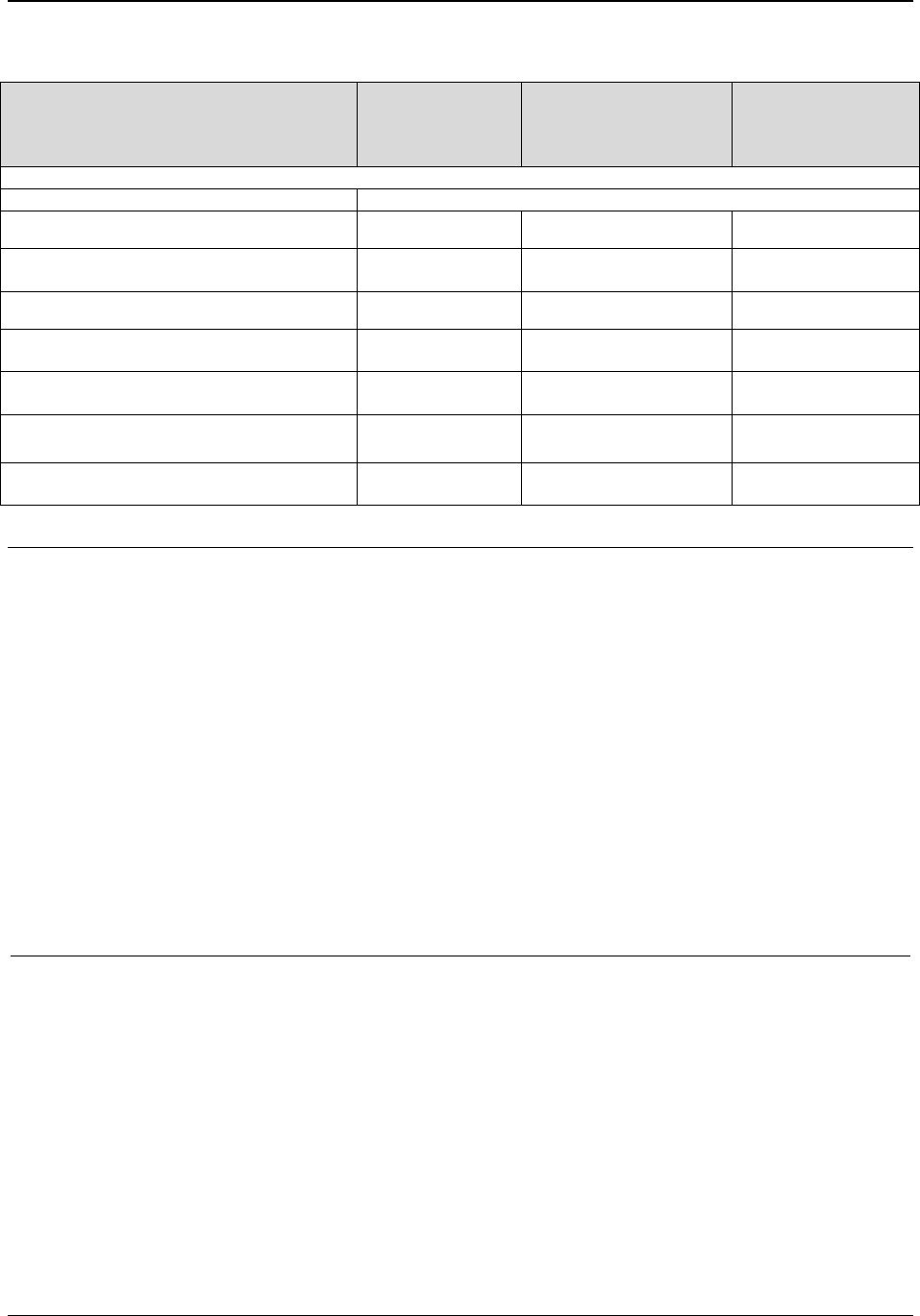

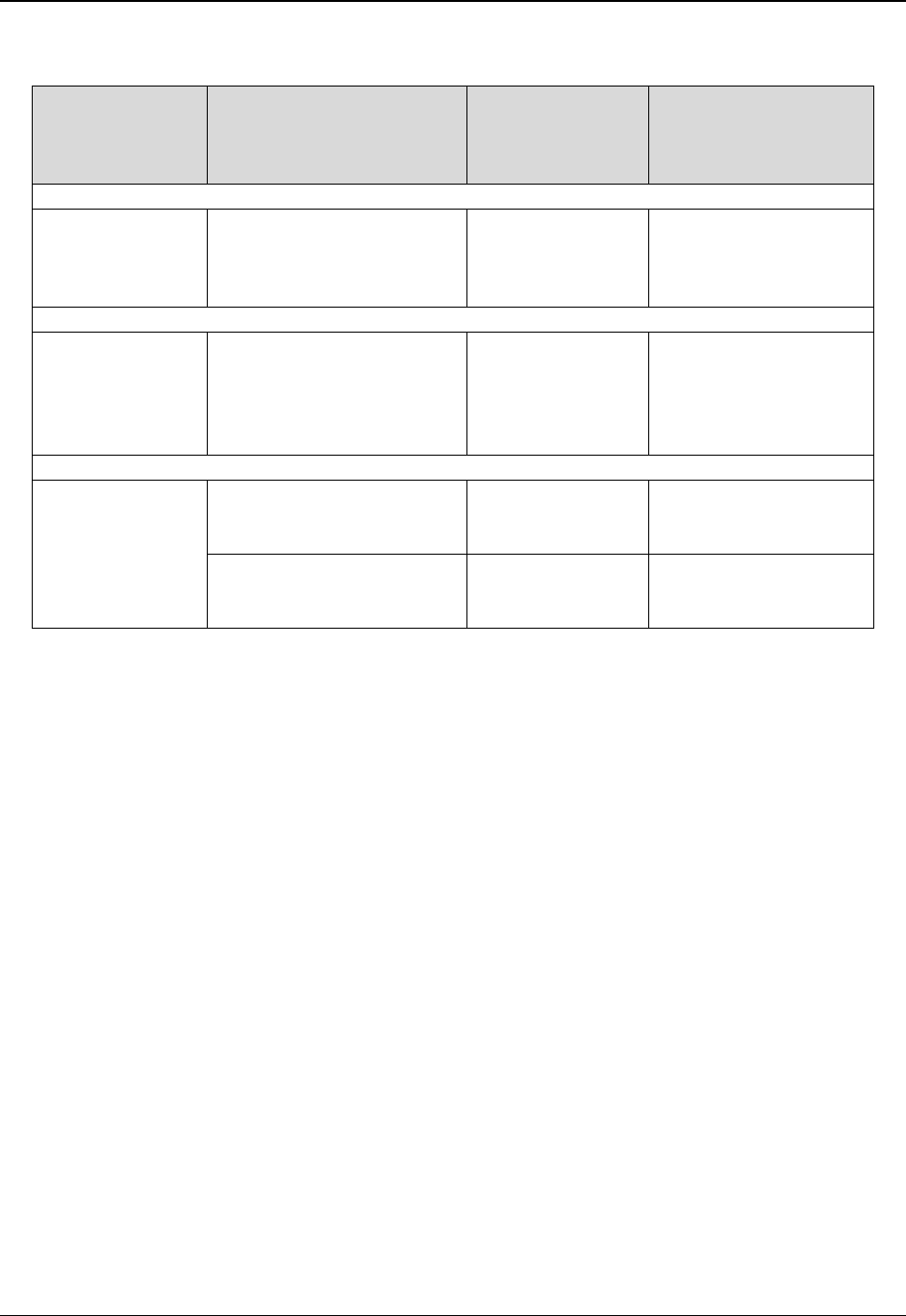

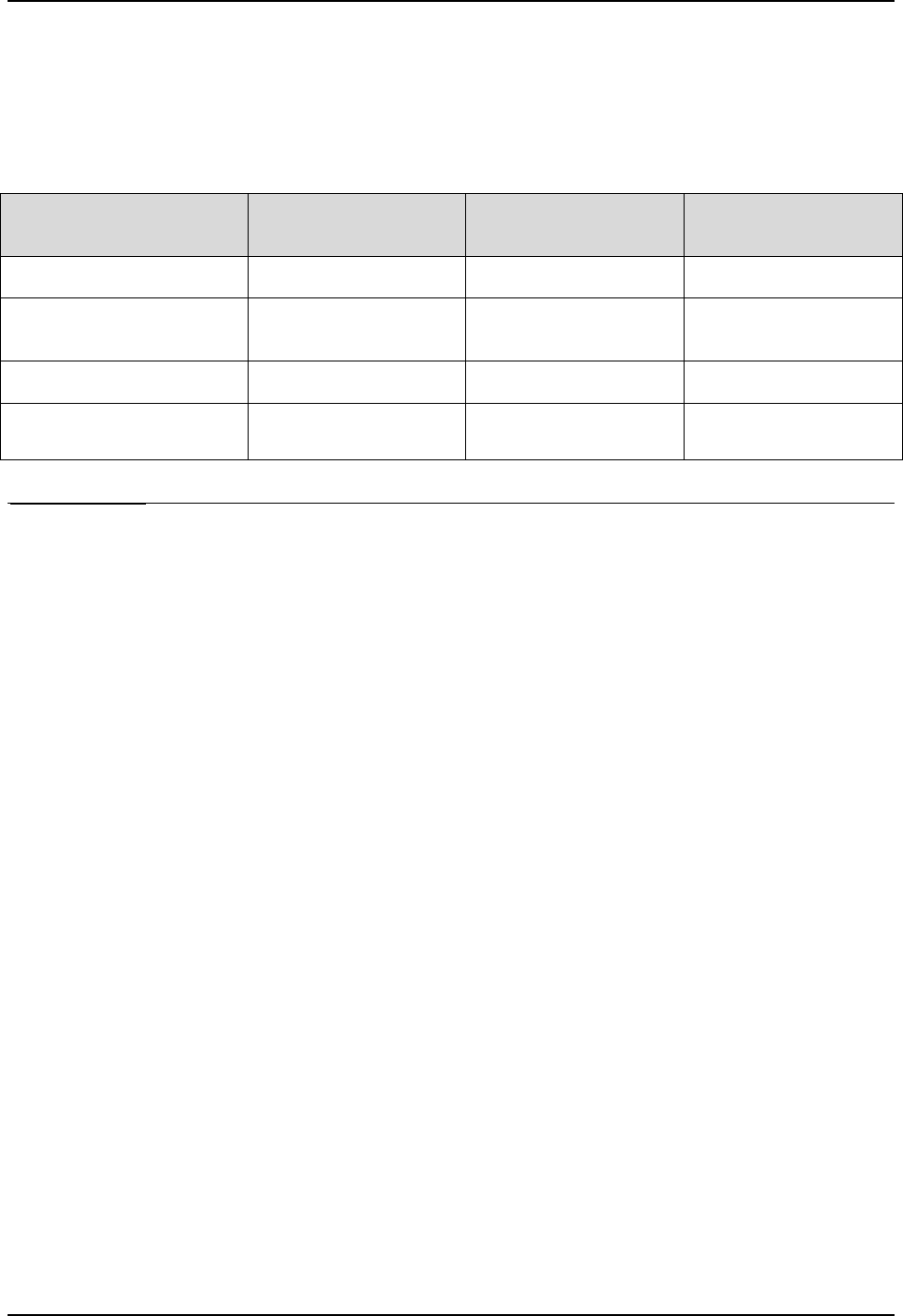

Table 3: Calculation of Effective Residential Property Tax

Rates

NOMINAL RATE

EFFECTIVE ASSESSMENT LEVEL

EFFECTIVE RATE

JURISDICTION

PER $100 of Assessed Value

(Statutory Assessment Level x

Median Sales Ratio) *

PER $100 of Assessed Value

(Nominal Rate x Effective

Assessment Level)

Prince George's Co, MD

1.465

95.30%

1.3961

Falls Church, VA

1.355

93.75%

1.2703

Fairfax Co, VA

1.18

91.87%

1.0841

Alexandria, VA

1.13

95.84%

1.0830

Montgomery Co, MD

1.091

95.70%

1.0437

Fairfax City, VA

1.075

95.91%

1.0233

Arlington, VA

1.026

93.56%

0.9599

Washington, DC

0.85

97.50%

0.8288

Source: Survey of local revenue officials and local government web sites. Rates as of December 31, 2019.

Note: Maryland jurisdictions’ rates include state rate of $0.112/$100 of assessed value. Rate for Montgomery County, Maryland

is a weighted rate that includes transit tax, fire district tax, municipal district taxes, and the Maryland-National Capitol Park and

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 14

Planning Commission (MNCPPC) tax. Prince George’s County rate includes rates for MNCPPC, transit, and stormwater

districts. Arlington rate includes stormwater fee. All jurisdictions have a statutory assessment level of 100% of market value.

Chart 2: 2019 Washington Metropolitan Area Effective

Property Tax Rates (Per $100 of Assessed Value)

Source: Survey of local revenue officials and local government web sites. Rates as of December 31, 2019 and

presented as effective rates after incorporating median assessment sales ratios.

Chart 3: 2019 Washington Metropolitan Area Real Property

Tax Burdens

Source: ORA.

Notes: Rental tax burden calculated differently. See pages 10-12 for details. A DC property tax credit for renters is

presented with the income tax burdens.

Sales Tax

Sales Tax Calculations

The sales tax burdens differ among the jurisdictions because some consumption items

included are taxed at a different rate than the general sales tax rate. Sales tax rates in 2019 for

certain items in the metro area are presented below.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 15

Table 4: Selected Sales Tax Rates

JURISDICTION

GENERAL

RATE

GROCERIES

RESTAURANT

MEALS

ADMISSIONS

DISTRICT OF COLUMBIA

6.0%

Exempt

10.0%

10.25%

MARYLAND

6.0%

Exempt

6.0%

10.0%

VIRGINIA

6.0% 1/

2.5% 1/

6.0%-10.0%

2/

1/ Combined local and state rate.

2/ There is no state tax on admissions in Virginia; however, Alexandria does levy a 10% admissions tax, not to exceed $0.50/person.

The estimated sales tax burdens for hypothetical households at each of the five income

levels are reported in Table 6, page 19. These burdens are derived by applying local and state

sales tax rates to data on average 2019 levels of consumption for various items by income level

provided by the U.S. Bureau of Labor Statistics in the Consumer Expenditure Survey (CES). The

average expenditures by income level have been adjusted for a 3-person household. It is

important to note that the sales tax burdens will be a function of the size of the sales tax base in a

particular jurisdiction and the specific sales tax rates that apply to the consumer items included.

The same CES categories have been included since the 2013 Tax Burden Study and

include: food (at home); food (away from home); over-the-counter drugs; housekeeping supplies,

household furnishings, and equipment; apparel and footwear; new and used cars and trucks;

vehicle finance charges, maintenance and repairs, and insurance; vehicle rentals, leases, and

licenses and other charges; public and other transportation; entertainment: fees and admissions,

audio visual equipment and services, and reading; and personal care products and services.

14

Factoring in both state and local sales tax rates for the jurisdictions in this study,

Maryland, DC, and Virginia had the same general sales tax rate of 6.0 percent at the end of 2019.

The District has higher rates for alcoholic beverages, restaurant meals, parking, and hotel rooms,

than do Maryland and Virginia.

15

The District, like Maryland, exempts all non-snack food

purchased in grocery stores from the general sales tax. Virginia levies a 2.5 percent sales tax on

all food purchased in grocery stores.

Residential usage of utilities is not in the general sales and use tax base in the District and

the State of Maryland, and gas, electricity, or water delivered to consumers through mains, lines

or pipes are not subject to the sales tax in Virginia. Further, utility taxes levied by Montgomery

and Prince George's Counties are not accounted for in the tax burden calculations. While

Montgomery County's energy tax is levied upon the distributor, its cost is effectively borne by

14

In cases where a category includes items that are both taxed and not taxed, such as “drugs” which includes both

prescription and over the counter (OTC) drugs, the expenditure amount is divided by two before applying the tax

rate of the item that is taxed (For example, states often tax OTC drugs but not prescription drugs. Similarly, states

often tax personal care products, but not personal care services.)

15

The District’s general sales tax rate increased from 5.75 to 6 percent on October 1, 2018.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 16

the customer. Prince George's County sets the tax rates annually based on a formula driven by

total consumption and revenue for each type of energy in prior years.

Sales Tax Burdens

The District’s sales tax burden is just above the metro area average (excluding DC) at

each income level. The District sales tax burdens generally are higher than those in Maryland but

tend to be lower than those in Virginia at the $25,000/year income level (except in Fairfax

County, which is lower than the District). The District has the highest sales tax burdens of all the

jurisdictions at the $50,000, $75,000, and $100,000 and $150,000-income levels, while the

Virginia jurisdictions were the highest for the $25,000 income level. As noted above, the general

sales tax rate in the District of Columbia is 6 percent (the same as Maryland and Northern

Virginia’s state plus local general rates). However, each jurisdiction has a multiple rate system in

which sales tax rates on items such as food consumed away from home and rental vehicles are

higher than the general rate, thus the tax burdens calculated for this study differ from one

another.

Automobile Tax

The taxes related to ownership of automobiles include the gasoline tax, motor vehicle

registration fees, and, where applicable, personal property taxes. The assumptions used to

calculate the automotive tax burdens are shown in Table 5, page 17.

Virginia localities are the only area jurisdictions that levy a personal property tax on

automobiles. The personal property tax rates for the seven Virginia jurisdictions included in this

study vary from $3.70 to $5.33 per $100 of value and are presented in Table 8 (page 25). Since

1999, the Commonwealth of Virginia has reimbursed all localities in Virginia for the vehicle

portion of the Personal Property Tax as part of the Personal Property Tax Relief Act (PPTRA).

From 2002 to 2005, the reimbursement amount was 70 percent of the first $20,000 of a vehicle’s

assessed tax bill. Beginning in 2007, Virginia began to reimburse localities a fixed amount based

on the 2004 level of state reimbursement. Unless the General Assembly provides additional

funding, that reimbursement is not expected to increase, and with no increases, it will cover a

gradually decreasing portion of the tax on vehicles. For 2019, the reimbursement to Alexandria

covered 53 percent of the tax bill for vehicles with assessed values between $1,000 and $20,000.

In Arlington County, vehicles that are valued at $3,000 or less, and are PPTR eligible, have no

tax liability and pay only an annual decal fee. For vehicles with assessed values between $3,000

and $20,000, the Arlington County reimbursement covered 28 percent of the tax bill. In Fairfax

County, the resident’s tax bill was reduced by 60 percent on the assessed value between $1,000

to $20,000.

The basis for assessing the tax also differs among the Virginia area jurisdictions.

Alexandria, Fairfax County, and Falls Church use the vehicle’s trade-in value; the clean loan

value is used in Arlington County. For both methods, however, values are obtained from the

National Automobile Dealers Association Used Car Pricing Guide.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 17

The District of Columbia’s registration fee is the highest in the metropolitan area. In the

District, the annual fee for a vehicle weighing less than 3,500 pounds (Class I) is $72; for

vehicles weighing 3,500 pounds to 4,999 pounds (Class II), the fee is $115; for vehicles 5,000

pounds and over (Class III), the fee is $155; and for Class IV, clean fuel or electric vehicle, the

fee is $36 (See Table 15, page 41). For tax year 2019, Maryland’s fees are slightly lower than the

District’s; the fee for vehicles less than 3,700 pounds is $135 for two years ($67.50 for one year),

and for vehicles over $3,700 pounds it is $187 for two years ($93.50 for 1 year).

The District of Columbia gasoline tax rate of 23.5 cents per gallon at the end of 2019 is

lower than the rate in both Maryland and Virginia.

16

Effective July 1, 2013, Virginia’s state

gasoline tax rate changed from 17.5 cents per gallon to 3.5 percent of the statewide average

wholesale price per gallon. In 2019, this equated to 16.8 cents per gallon (including a 0.6 cents

per gallon storage tank fee). In addition, since 2018 there is now a Virginia Motor Vehicle Fuel

Sales tax which adds 7.6 cents per gallon. There is also a special 2.1 percent sales tax levied by

all the Northern Virginia jurisdictions, making the total tax used in this study 30.12 cents per

gallon. In 2015, Maryland’s gas tax increased from 23.5 cents per gallon to 32.1 cents per gallon

and has further increased to 36.79 cents per gallon at the end of 2019.

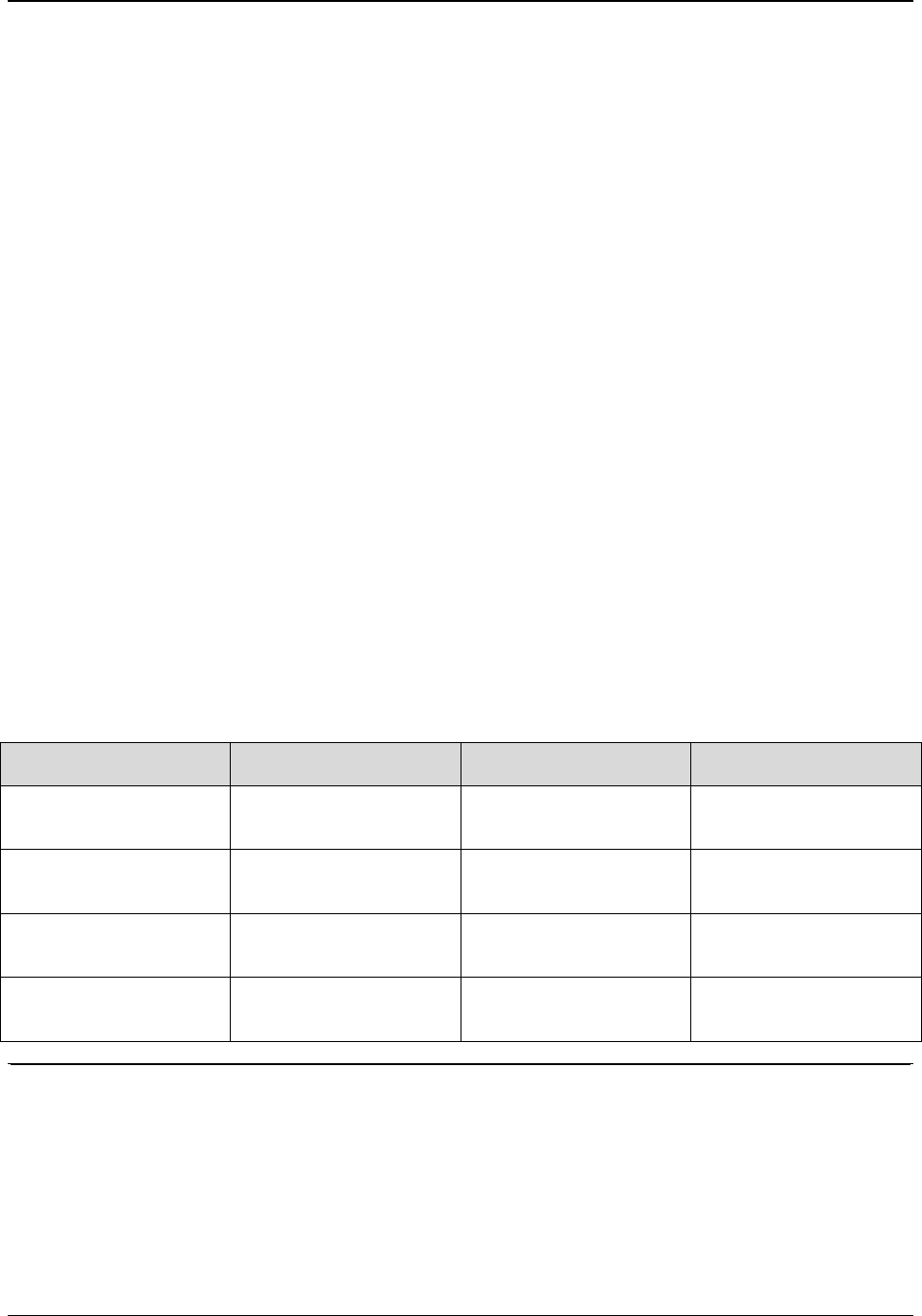

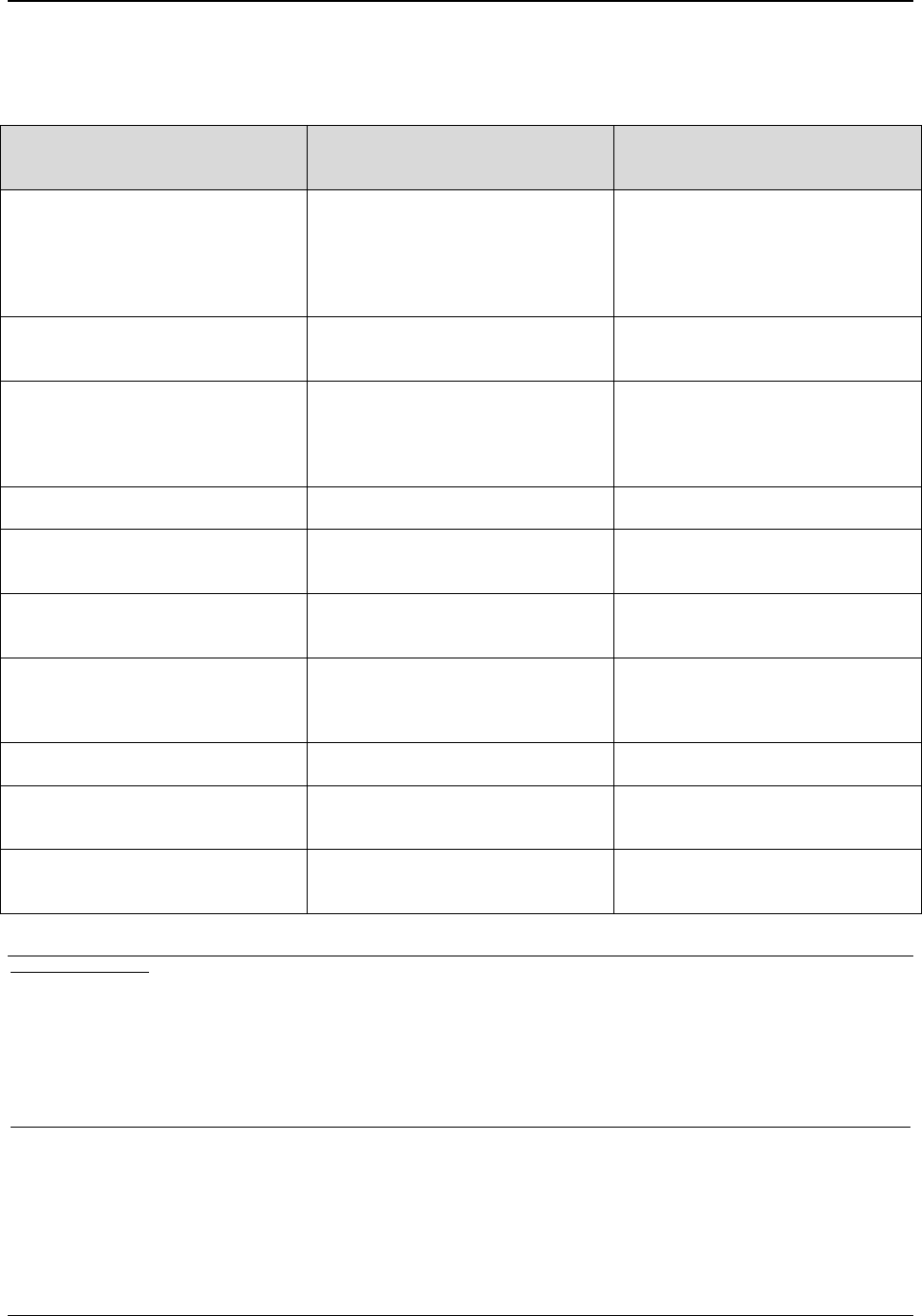

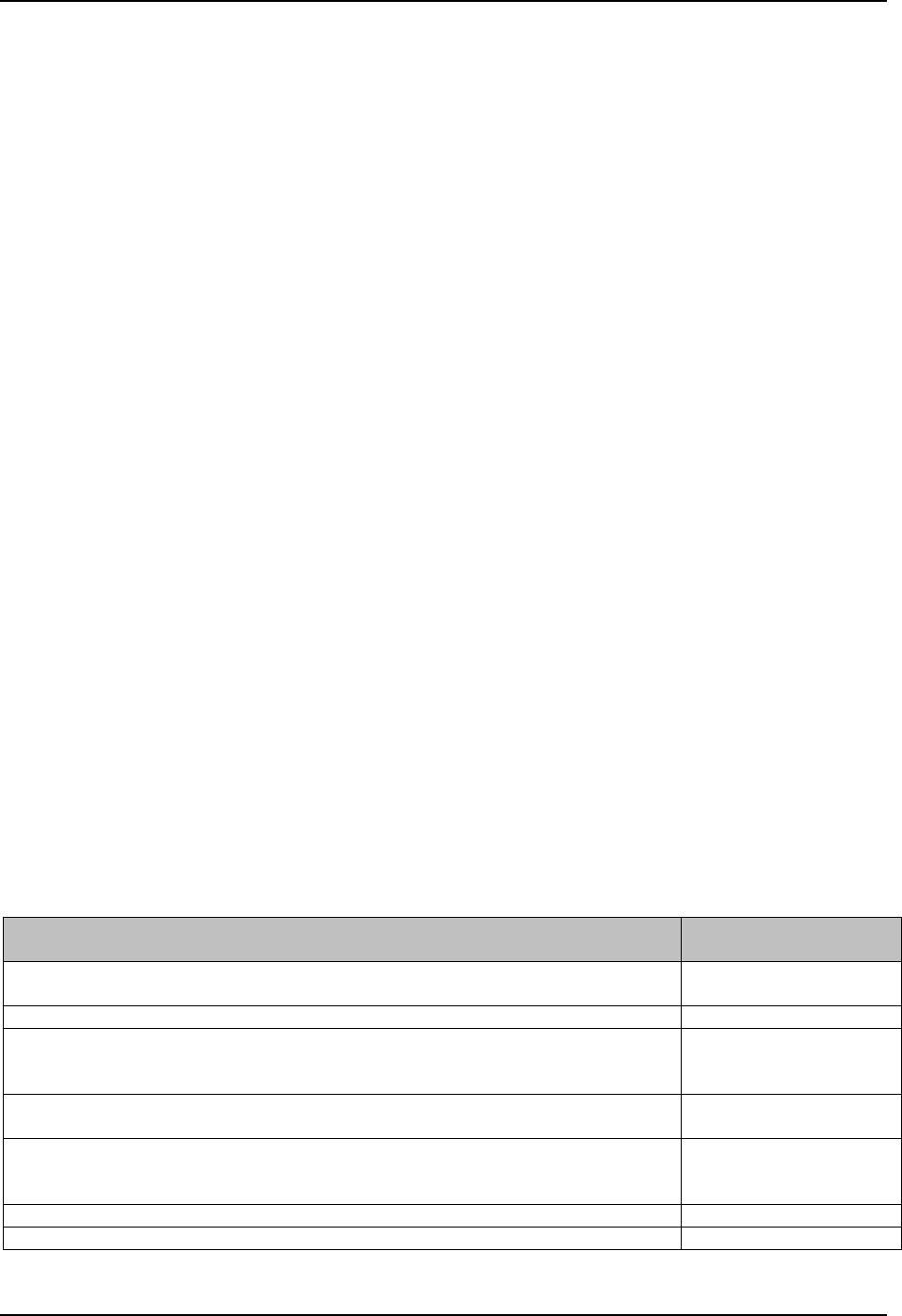

Table 5: Automobile Tax Assumptions 2019

Market

Values

Estimated

Estimated

Engine

Mileage

Annual

Income

Size

Retail

Trade-In

Loan

Per

Gasoline

Level

Description of

Auto

Liters 1/

Weight

2/

Year

Price 2/

Value 2/

Value 2/

Gallon 1/

Usage 3/

$ 25,000

Sedan, 4 Door

1.8

2,920 lbs.

2016

$13,575

$10,300

$13,439

29

517 gallons

4-cylinder, Auto

$ 50,000

Sedan, 4 Door

1.4

2,930 lbs.

2018

$14,100

$10,950

$13,959

34

441 gallons

4 Cylinder, Manual

$ 75,000

Sedan, 4 Door

2.5

3,340 lbs.

2018

$20,175

$16,400

$19,973

33

455 gallons

4 Cylinder, Automatic

4WD Utility, 4 Door

3.5

4,464 lbs.

2013

$18,050

$14,875

$17,870

19

395 gallons*

6 Cylinder, Automatic

$100,000

Sedan, 4 Door

2.5

3,906 lbs.

2018

$22,925

$18,725

$22,696

30

500 gallons

6 Cylinder, Automatic

4WD Utility, 4 Door

3.5

4,697 lbs.

2013

$17,675

$14,250

$17,498

20

375 gallons*

6 Cylinder, Automatic

$150,000

Sedan, 4 Door

2.0

3,814 lbs.

2019

$54,220

$50,580

$53,678

25

600 gallons

6 Cylinder, Automatic

AWD Utility, 4 Door

3.5

4,095 lbs.

2015

$18,550

$15,150

$18,365

24

313 gallons*

6 Cylinder, Automatic

1/ Gas Mileage Guide, EPA fuel economy estimates for city driving, US Department of Energy. http://www.fueleconomy.gov/

2/ National Automobile Dealers Association Used Car Guide. http://www.nadaguides.com

3/ Assumes 15,000 miles driven for primary car; 7,500 for secondary car (secondary car denoted with an asterisk).

16

A surcharge went

into effect for fiscal year 2021. The surcharge will be $0.103 per gallon, and will be increased annually, beginning on

October 1, 2022, by the cost-of-living adjustment

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 18

Auto Tax Burdens

Virginia localities have the highest auto tax burdens at all income levels, with Fairfax

City ranking highest at all levels except the $150,000 level, where Arlington is highest. DC has

the lowest auto tax burdens at all levels, with Montgomery and Prince George’s Counties in

Maryland ranking sixth and seventh at all levels. The District and Maryland jurisdictions do not

levy a personal property tax on automobiles, as do Virginia localities.

Part I: A Comparison of Tax Burdens in Selected Washington Metropolitan Area Jurisdictions

2019 Tax Rates and Tax Burdens – Washington Metropolitan Area

Page 19

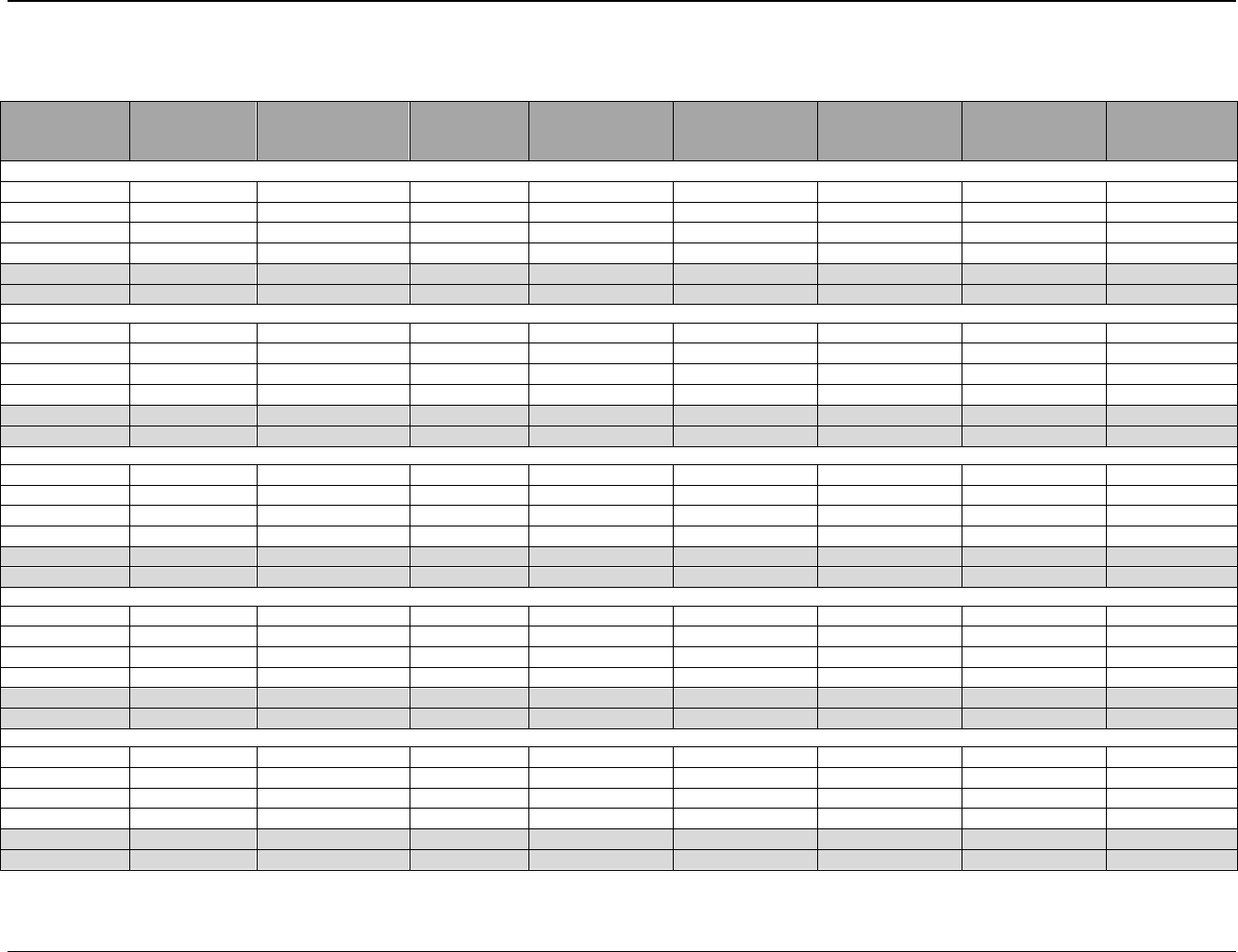

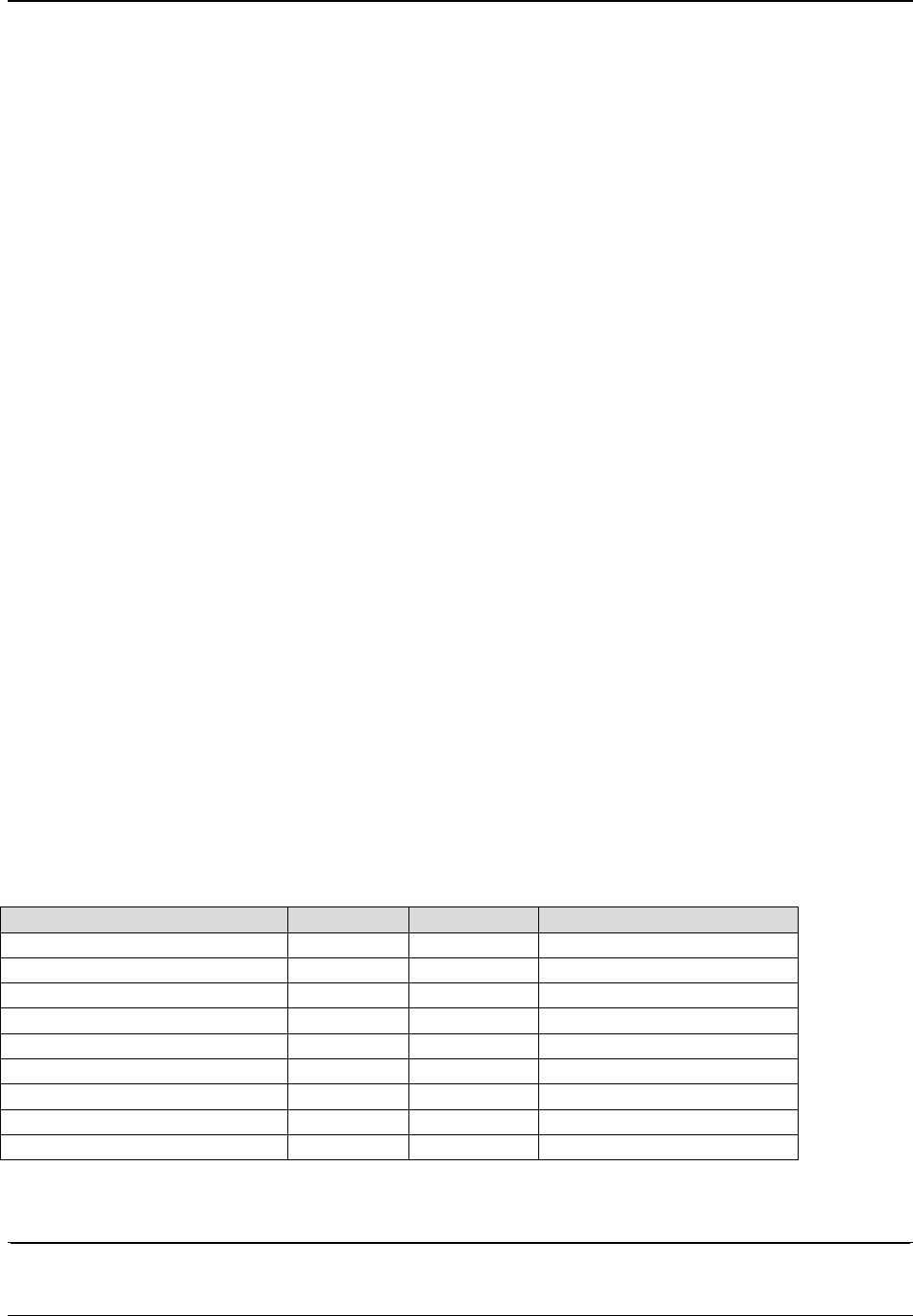

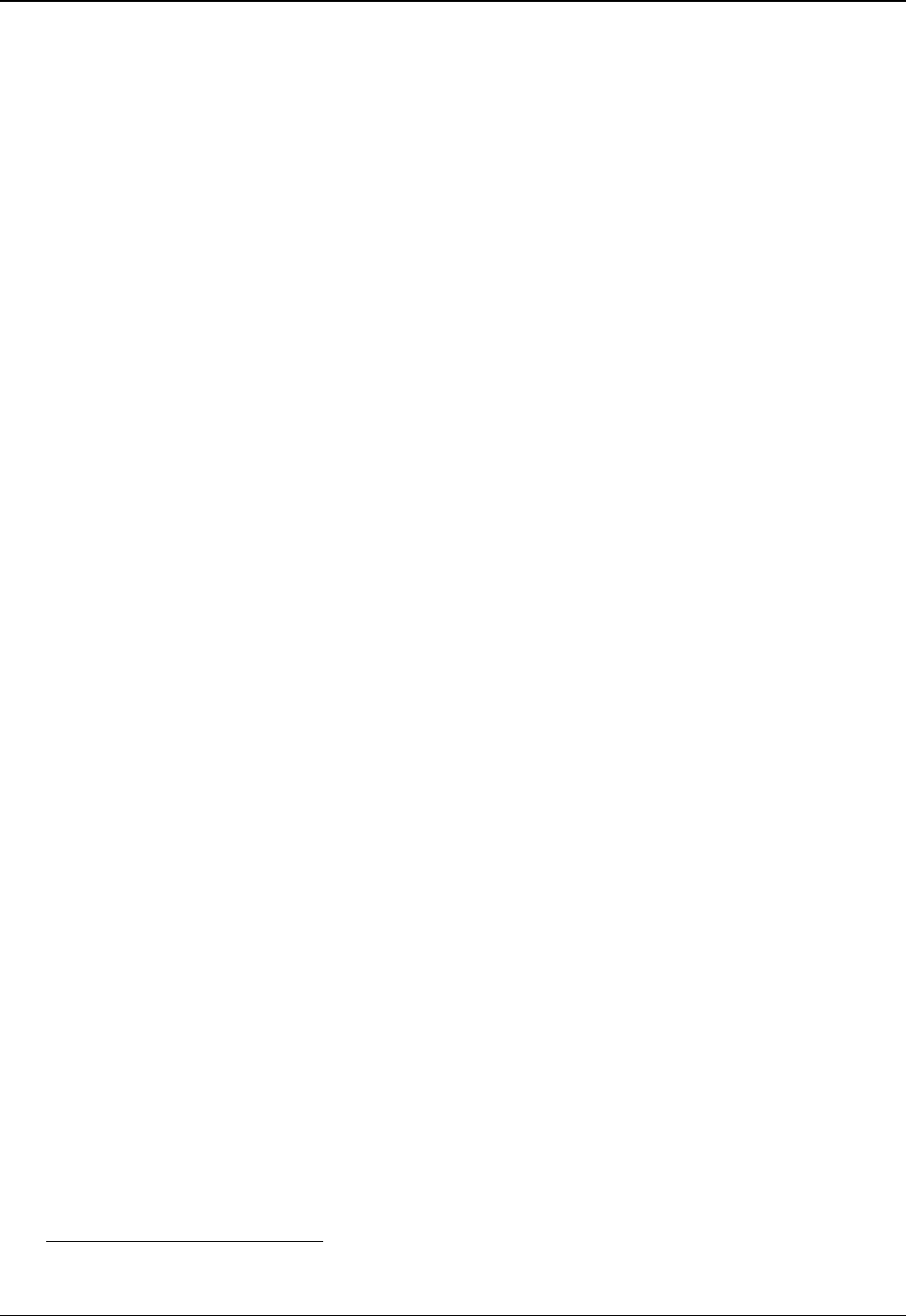

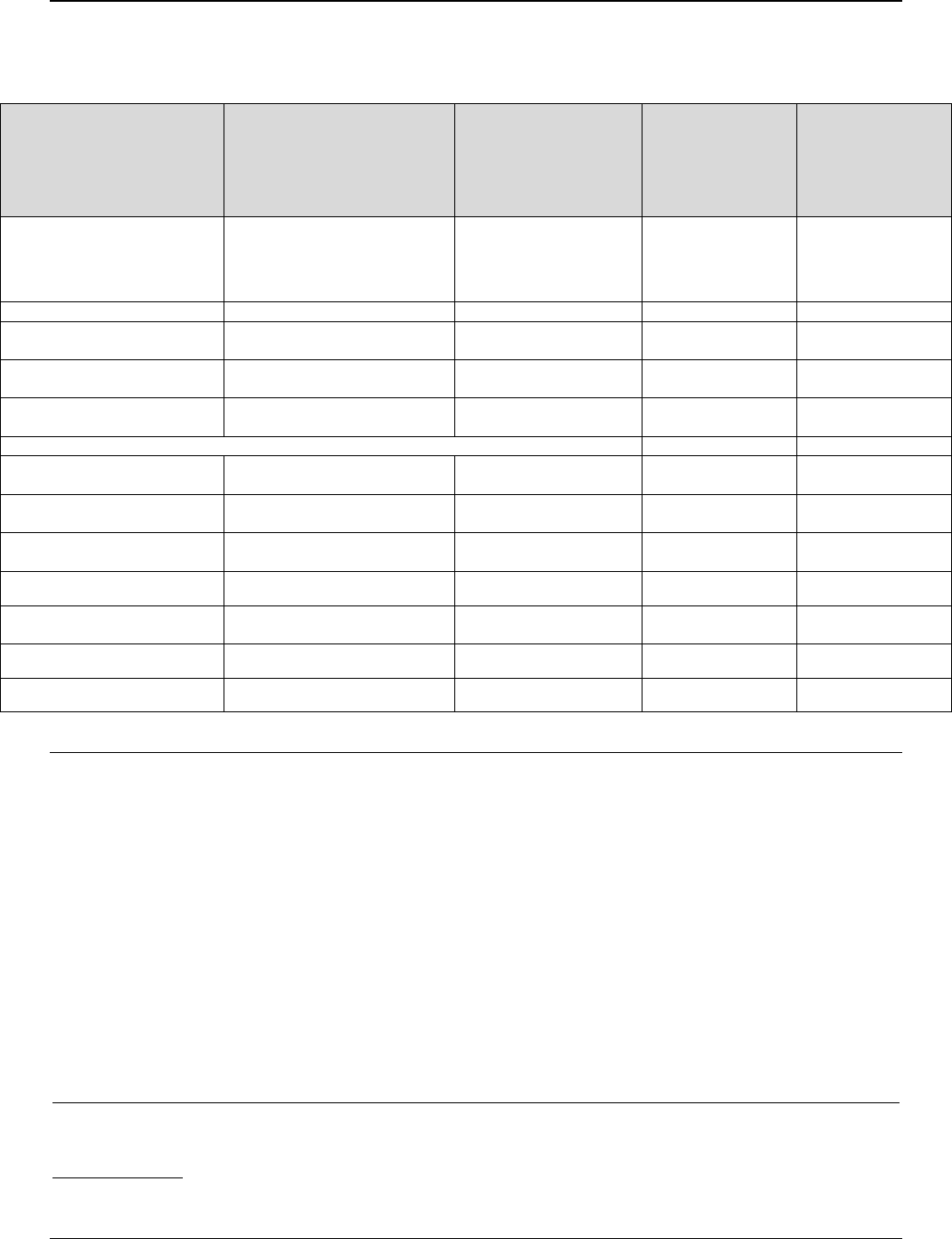

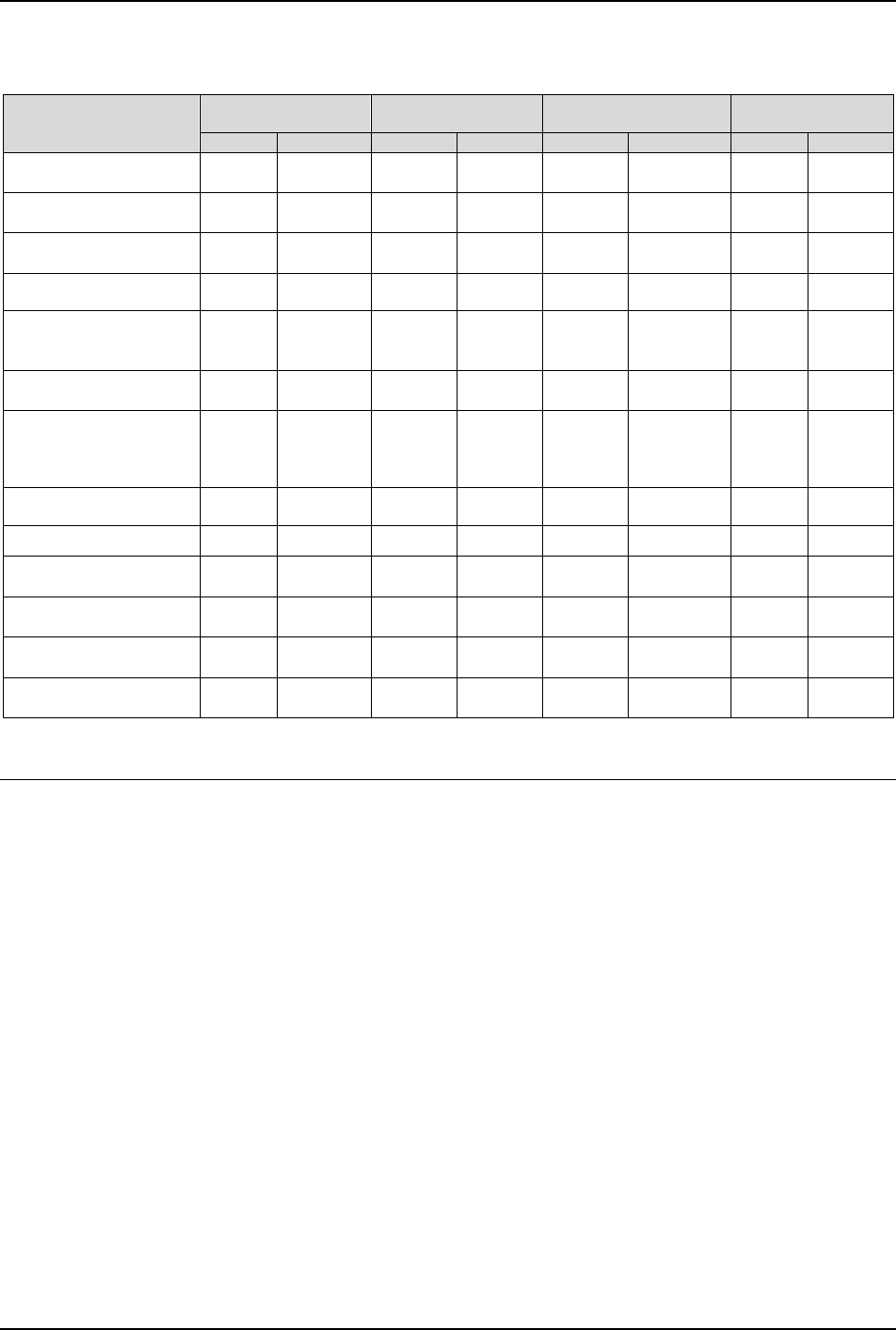

Table 6: 2019 Major State & Local Tax Burdens for a Family of Three

In Selected Washington Metropolitan Area Jurisdictions

TAX

DISTRICT

OF

COLUMBIA

MONTGOMERY

COUNTY

PRINCE

GEORGE’S

COUNTY

ALEXANDRIA

ARLINGTON

COUNTY

FAIRFAX

COUNTY

FAIRFAX

CITY

FALLS

CHURCH

$25,000 INCOME LEVEL

Income 1/

-2572

-526

-526

0

0

0

0

0

Real Property

2,772

2,772

2,772

2,772

2,772

2,772

2,772

2,772

Sales and Use

945

844

853

954

954

840

954

954

Automobile

193

258

258

419

595

389

645

470

TOTAL

1,339

3,348

3,357

4,145

4,321

4,001

4,371

4,196

RANK

8

7

6

4

2

5

1

3

$50,000 INCOME LEVEL

Income

1,338

2,704

2,704

1,940

1,940

1,940

1,940

1,940

Real Property

682

948

2,193

1,701

1,508

1,703

1,607

1,996

Sales and Use

1,115

992

1,004

1,111

1,111

967

1,111

1,111

Automobile

176

230

230

413

591

378

649

466

TOTAL

3,311

4,874

6,132

5,165

5,150

4,989

5,307

5,512

RANK

8

7

1

4

5

6

3

2

$75,000 INCOME LEVEL

Income

2,891

4,691

4,691

3,377

3,377

3,377

3,377

3,377

Real Property

1,333

1,767

3,290

2,552

2,262

2,554

2,411

2,993

Sales and Use

1,370

1,228

1,250

1,294

1,294

1,135

1,294

1,294

Automobile

387

475

475

1,056

1,535

923

1,680

1,194

TOTAL

5,980

8,161

9,706

8,278

8,467

7,990

8,762

8,858

RANK

8

7

2

3

5

6

4

1

$100,000 INCOME LEVEL

Income

4,827

6,679

5,311

4,155

4,193

4,150

4,131

4,128

Real Property

1,983

2,587

4,386

3,403

3,016

3,406

3,215

3,991

Sales and Use

1,643

1,481

1,514

1,530

1,530

1,341

1,530

1,530

Automobile

436

510

510

1,148

1,627

962

1,758

1,250

TOTAL

8,889

11,257

11,721

10,235

10,366

9,859

10,633

10,899

RANK

8

7

2

3

6

5

4

1

$150,000 INCOME LEVEL

Income

8,745

8,675

8,488

6,471

6,518

6,458

6,371

6,383

Real Property

3,285

4,227

6,580

5,104

4,524

5,109

4,822

5,987

Sales and Use

2,030

1,842

1,893

1,826

1,826

1,607

1,826

1,826