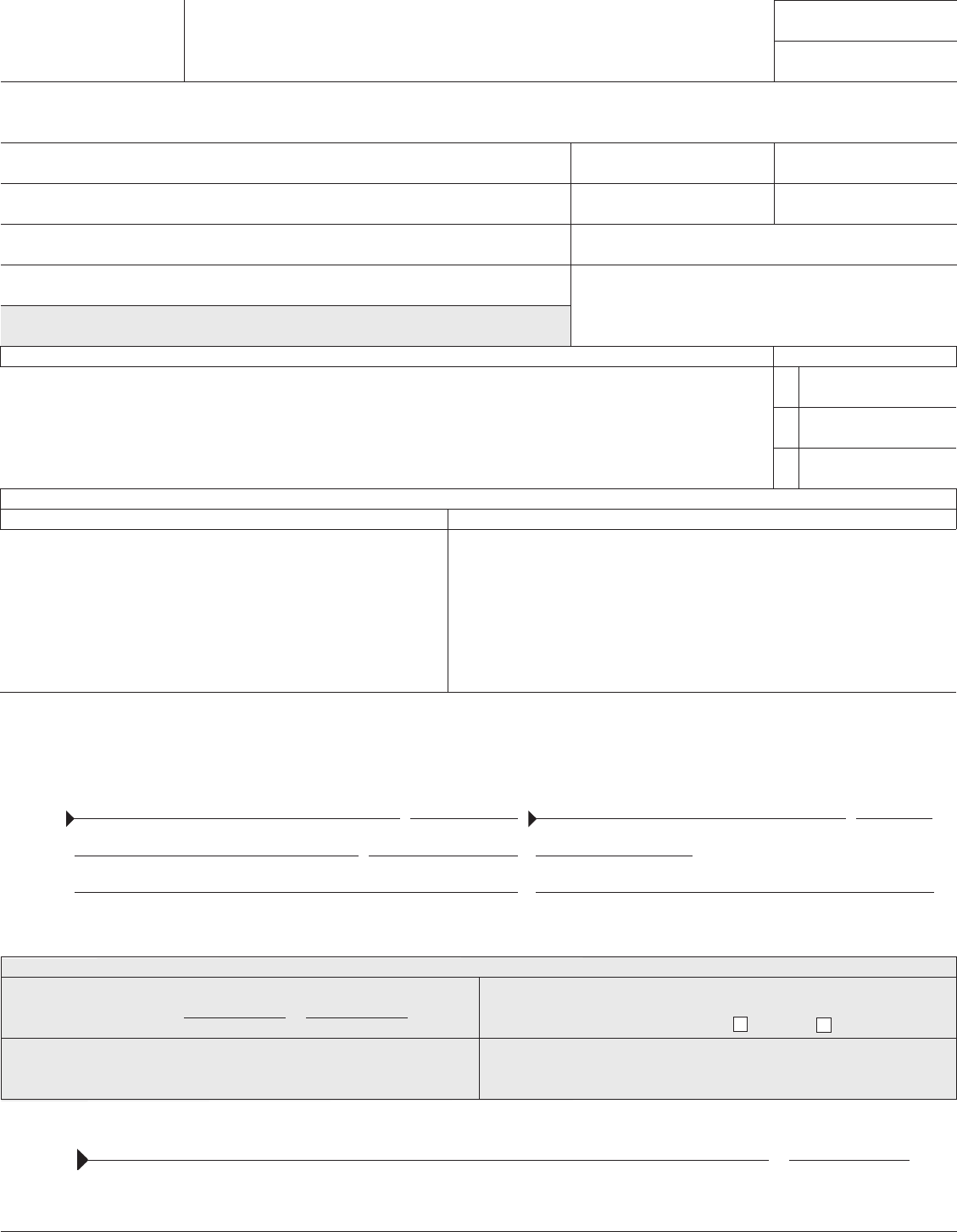

Telephone Number

( )

Property Type

County ID or Schedule Number

Legal Description

Name of Property Owner

Street or Other Mailing Address

City

Address of Property (if different than above)

Zip Code

State

City State Zip Code

County Name

Tax District

Precinct or Township

Totals

96-173-1999 Rev. 12-2018 Supersedes 96-173-1999 Rev. 12-2016 Authorized by Neb. Rev. Stat. § 77-1229

File with the county

assessor on or before

May 1, or a penalty

will be assessed.

Taxable Value

1 Commercial and industrial property total (from schedule)................................... 1

2 Agricultural machinery and equipment total (from schedule) ................................ 2

3 TOTAL TAXABLE VALUE before exemptions (total of lines 1 and 2)........................... 3

• Attach all supporting schedules

Personal Property Return

Nebraska Net Book Value

Tax Year

Depreciation Worksheet Reviewed

Date

Initials

For County Assessor’s Use Only

PENALTY 10% 25%

Describe any leased or consigned property in your custody, and list the name and address of the lessor or owner.

Description of Property Name and Address of Lessor or Owner

Under penalties of law, I declare that I have examined this return, including any attached schedules, and to the best of my knowledge and belief, it

is correct and complete.

Please complete this return and file with the county assessor’s office. Your county assessor may require a copy

of your federal depreciation worksheet, if applicable.

DateSignature of County Assessor

Failure to timely report all personal property on this return will result in a forfeiture of the exemption

under the Personal Property Tax Relief Act for the personal property not timely reported on this return.

Total personal property value exempted under Total personal property value exempted under

Personal Property Tax Relief Act Beginning Farmer Tax Credit Act

$ $

Title

Date

Date

Daytime Phone Number

sign

here

Signature of Property Owner

Signature of Preparer

Daytime Phone Number

Email Address Email Address

Print

Reset

0

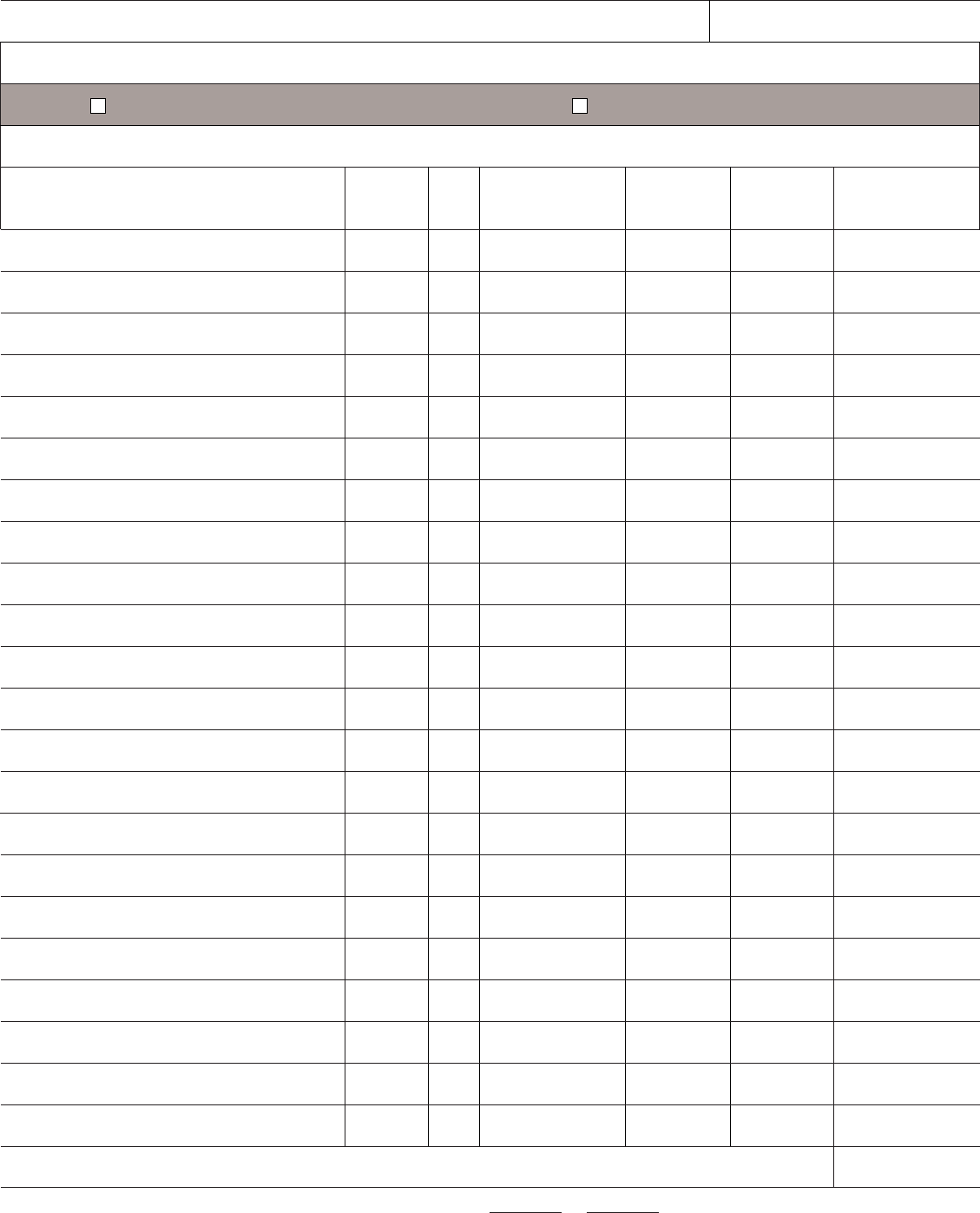

Name on Personal Property Return

• Attach as many schedules as necessary to your Nebraska Personal Property Return.

• Retain a copy for your records.

For Tax Year

Personal Property Schedule – Nebraska Net Book Value

96-158-1999 Rev. 12-2016 Supersedes 96-158-1999 Rev. 12-2013

Authorized by Neb. Rev. Stat. § 77-1229

1 Commercial and Industrial Property 2 Agricultural Machinery and Equipment

(D)

Nebraska

Adjusted Basis

(E)

Recovery

Period

(G)

Net Book Taxable Value

(Col. D X Col. F)

(Round to Whole Dollar)

$ % $

Total this page (if more than one schedule is used, total each page separately).

Enter the total of all pages on line 1 or line 2, as appropriate, on the Personal Property Return .......... $

(A)

Item Name/Description

(B)

Year

Placed in

Service

(C)

Number

of Items

(F)

Net Book

Depreciation

Factor

Type of Property

(Check only one box.)

You may include more than one item on a line ONLY when items were

placed in service in the same calendar year and have the same recovery period.

Schedule Number of

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

0.00%

0

$0

Personal Property Return Nebraska Net Book Value

Instructions

Who Must File. You must le a Personal Property Return if you:

• Hold or own any depreciable taxable tangible personal property on January 1 at 12:01 a.m. of the year for which

the assessment is being made;

• Lease depreciable taxable tangible personal property from another person; or

• Lease depreciable taxable tangible personal property to another person, unless the property is listed and valued on

a return led by the lessee.

If you bring depreciable taxable tangible personal property into the state after 12:01 a.m. on January 1 and prior to July 1

in any year, you must list the property on or before July 31, unless you can show the property was placed in service after

January 1 at 12:01 a.m. or was assessed in another county or state.

When and Where to File. This return must be led on or before May 1 with the county assessor in the county where

the taxable tangible personal property is located. If you have property in more than one county, you must le a return

with each county in which you have property. If you have property at more than one location in the same county, contact the

county assessor to determine if more than one return is required.

Situs for Property. Taxable tangible personal property of an established agricultural or commercial business is assessed

at the place of business, unless the property has acquired local situs elsewhere. Property will acquire local situs elsewhere if

it is kept in a location, other than the location of the business, for 50% or more of the calendar year.

What Property is Taxable. All depreciable tangible personal property which has a Nebraska net book value greater than

zero is taxable, except licensed motor vehicles, livestock, and certain rental equipment.

Irrigation equipment, such as pivots, pumps, and motors, is personal property and must be listed on the Personal Property

Return. These items are not included in the value of land.

What Property Must be Listed. You must list all taxable tangible personal property that you own or that you lease from

another person.

If you are unable to list leased property because you do not know the Nebraska adjusted basis, you must provide a description

of the property and the name and address of the owner or lessor of the property.

Exempt Value. The Personal Property Tax Relief Act allows for an exemption of the rst $10,000 of value of taxable tangible

personal property in each tax district in which a Personal Property Return is led. Failure to timely report taxable tangible

personal property on the return will result in a forfeiture of this exemption for the untimely reported personal property. The

county assessor will make a nal determination of exempt value upon review of timely led data, schedules, and any tax

district changes when tax rates are nalized in October. The exempt value granted will appear on the tax statement.

Beginning Farmer or Livestock Producer Exempt Value. Qualied beginning farmers or livestock producers that have

timely led Exemption Application, Form 1027, may have up to $100,000 of taxable agricultural or horticultural machinery

and equipment value exempted for three years. The applicant must le a Personal Property Return with the county assessor

on or before May 1 of each year to receive this exemption. The Personal Property Tax Relief exemption is applied prior to

granting the beginning farmer exemption.

Penalties. Any taxable tangible personal property value not reported by the May 1 ling deadline will be subject to a penalty.

Depreciable taxable tangible personal property added after May 1 and on or before June 30 of the year the property was

required to be reported is subject to a penalty of 10% of the tax due on the value added.

Depreciable taxable tangible personal property added on or after July 1 of the year the property was required to be reported

is subject to a penalty of 25% of the tax due on the value added.

Protests. Taxable tangible personal property protests must be led with the county clerk on or before June 30. The appeal

must be in writing and include a statement of the reasons why the requested change should be made and a description of the

property to which the protest applies. Incomplete protests will be dismissed by the county board of equalization.

You may also protest if the county assessor noties you of a change in the value of property, of the addition of omitted

property, of the failure to le a return, or of the assessment of a penalty. You have 30 days from the date the notice is mailed

to le a written appeal of the action with the county board of equalization.

Collection of the Tax. Personal property taxes are due and payable on December 31 and become delinquent in halves on

May 1 and September 1 following the due date (except in counties with a population of greater than 100,000 which have

delinquent dates of April 1 and August 1). On the due date, the taxes become a rst lien on all personal property you own. If

the taxes are not paid, any personal property you own, whether taxable or not, is subject to seizure to satisfy the lien.

Acceleration of Taxes Due. When all or a substantial amount of your taxable tangible personal property is sold, attached,

or removed, or any attempt to do so is made, the tax is accelerated and becomes immediately due and payable.

Definitions

Depreciable Tangible Personal Property. Depreciable tangible personal property is any tangible personal property

which is used in a trade or business (commercial, industrial, or agricultural) or for the production of income, and which has

a determinable life of more than one year.

Any capital or depreciable improvements or additions to an item of personal property will be listed separately for property

tax purposes.

Year. Year is the number of years since the property was placed in service. The factor shown for Year One will be the percent

used for January 1 of the year following the year the property was placed in service. The factor shown for Year Two will be

the percent used January 1 of the second year following the year the property was placed in service, etc.

Placed in Service. Placed in service is when the property is ready and available for a specic use. For additional information,

please refer to IRS Publication 946.

Example 1. John Smith bought a machine for his business. The machine was delivered in 2015. However, it was not

installed and operational until 2016. It is considered placed in service in 2016. If the machine had been ready and available

for use when it was delivered, it would be considered placed in service in 2015 even if it was not actually used until 2016.

Number of Items. Number of items is the quantity of each specic item. Identical items may be grouped together on one

line of the Nebraska Personal Property Schedule only when these items were placed in service in the same calendar year and

have the same recovery period.

Nebraska Adjusted Basis. Nebraska adjusted basis is the adjusted basis for federal income tax purposes, increased by

the amount of the depreciation, amortization, or deduction under Section 179 of the Internal Revenue Code, taken on the

personal property. Generally, the Nebraska adjusted basis will be the cost of the item, including sales tax, freight charges, and

installation and testing charges. It will not include the refunded sales tax on agricultural machinery and equipment purchased

on or after January 1, 1992 for use in commercial agriculture.

If property rehabilitation expenses result in an increased federal adjusted basis of the property, the Nebraska adjusted basis

must be increased accordingly.

Trade-In. (change per Neb. Law 2018 LB 1089)

For property purchased after January 1, 2018 and before January 1, 2020, if there is an election to expense the new piece of

equipment under Section 179 of the Internal Revenue Code and the old piece of equipment is traded in as part of the payment,

the Nebraska adjusted basis is the cash paid (boot), plus the remaining Nebraska net book value of the old piece of equipment.

Prior to this change, the Nebraska adjusted basis was the cash paid (boot), plus any remaining federal adjusted basis in the

personal property being traded.

Basis for Property Gifted or Inherited. For property that is transferred by gift or inheritance, the Nebraska adjusted

basis is the same as it was for the previous owner, whether or not there is a change in the adjusted basis for federal income

tax purposes caused by the transfer.

For property that is transferred in the creation, dissolution, or reorganization of corporation, partnership, or trust, that is tax-

free for income tax purposes, the Nebraska adjusted basis is the same as it was for the previous owner.

Example 2. A son inherits a business from his father. The tangible personal property of the business will have the same

Nebraska adjusted basis as it had when the business was owned by the father. The year the property was placed in service

will also be the same as it was for the father.

Example 3. A farmer incorporates his farming operation and transfers a tractor to the corporation. The tractor was placed

in service three years earlier with a Nebraska adjusted basis of $40,000 and has a recovery period of seven years. For

property tax purposes, the corporation will be taxed on a three-year-old tractor with a Nebraska adjusted basis of $40,000,

a depreciation factor of 55.13% (from Table 1), and a net book value (taxable value) of $22,052.

Recovery Period. Recovery period is the period over which the value of property will be depreciated for Nebraska property

tax purposes. Table 2 includes recovery periods for some assets. If you have property not contained in Table 2, use the federal

MACRS recovery period.

Depreciation Factor. Depreciation factor is the percentage of the Nebraska adjusted basis that is taxable. Use Table 1 to

nd the appropriate depreciation factor for the recovery period and year.

Example 4. You purchased and placed in service ofce furniture for $5,000 two years ago. You elected to take a Section

179 deduction for the full amount of $5,000 in that income tax year. Even though for income tax purposes this property

is “fully depreciated,” it is still taxable for property tax purposes in the current year, since ofce furniture has a recovery

period of seven years (from Table 2). The Nebraska adjusted basis of $5,000 is multiplied by the depreciation factor of

70.16% (from Table 1) to produce a current year net book taxable value of $3,508.

Net Book Value. Net book value is the taxable value for property tax purposes. It is the Nebraska adjusted basis of the

tangible personal property multiplied by the appropriate depreciation factor for the recovery period and year. The property

tax is imposed on the net book value of tangible personal property.

Example 5. A computer server has a Nebraska adjusted basis of $12,000. The server was placed in service three years

ago. The server has a recovery period of ve years. The depreciation factor (see Table 1) is 41.65%. The net book value

(taxable value) of the computer is $4,998.

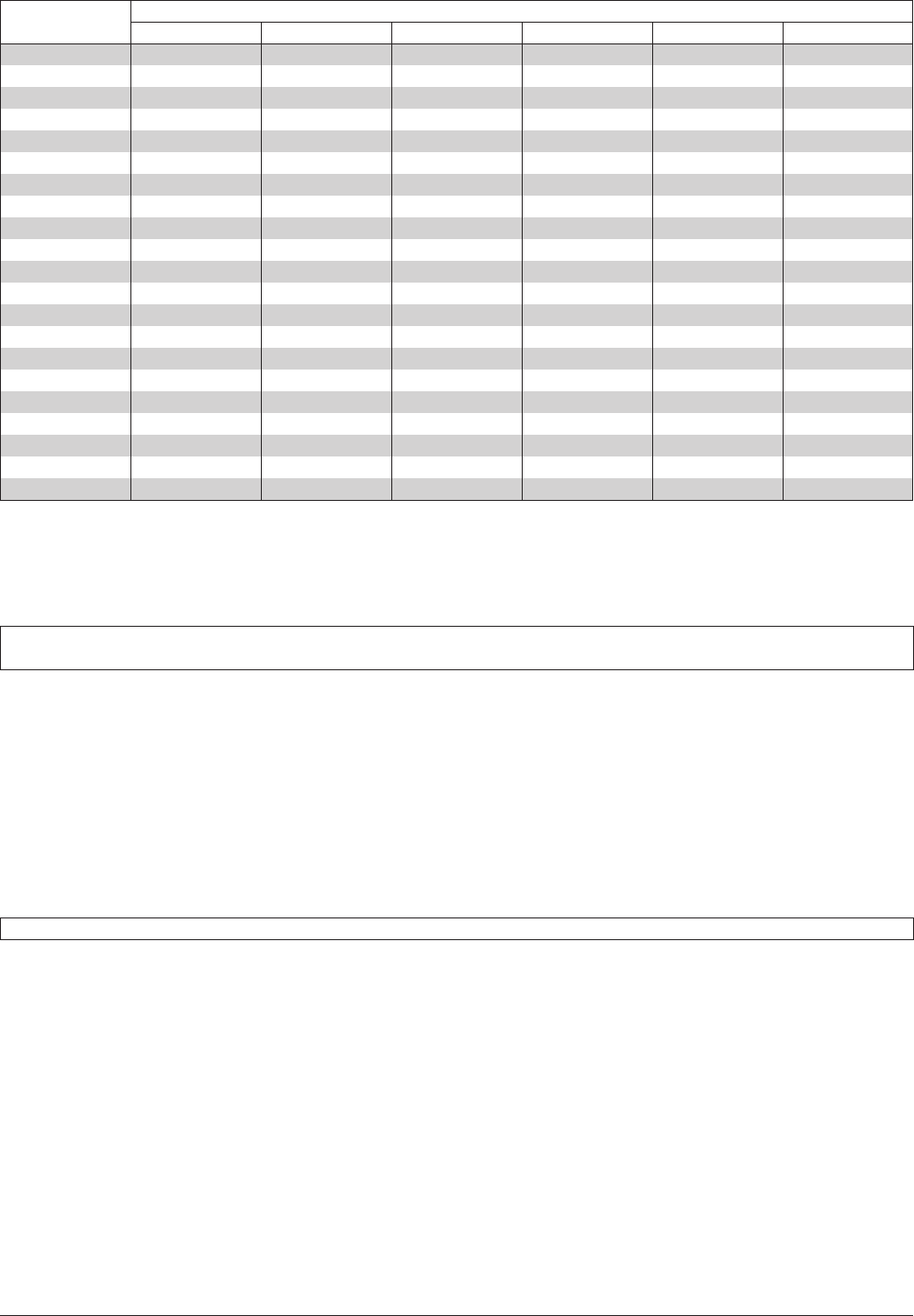

1 75.00% 85.00% 89.29% 92.50% 95.00% 96.25%

2 37.50 59.50 70.16 78.62 85.50 89.03

3 12.50 41.65 55.13 66.83 76.95 82.35

4 0.00 24.99 42.88 56.81 69.25 76.18

5 8.33 30.63 48.07 62.32 70.46

6 0.00 18.38 39.33 56.09 65.18

7 6.13 30.59 50.19 60.29

8 0.00 21.85 44.29 55.77

9 13.11 38.38 51.31

10 4.37 32.48 46.85

11 0.00 26.57 42.38

12 20.67 37.92

13 14.76 33.46

14 8.86 29.00

15 2.95 24.54

16 0.00 20.08

17 15.62

18 11.15

19 6.69

20 2.23

21 0.00

Office furniture, fixtures, and equipment (such as desks, files, safes, and communication equipment) ...... 7

Information system and data handling equipment (such as computers, printers/copiers, external hard

drives, calculators, etc.). ......................................................................................................................... 5

Transportation:

Light and heavy general purpose trucks and cars (unlicensed) .................................................................. 5

Trailers and trailer-mounted containers (unlicensed) ................................................................................... 5

Airplanes and helicopters not used for commercial or contract carrying of passengers

or freight .................................................................................................................................................. 5

Railroad cars and locomotives not owned by railroad transportation companies ........................................ 7

Property not assigned a class life (refer to IRS Pub. 946) ............................................................................ 7

Water transportation vessels, barges, etc. ................................................................................................... 10

Agricultural:

Agricultural machinery and equipment, including irrigation equipment ........................................................ 7

New agricultural machinery and equipment placed in service on or after January 1, 2018 ......................... 5

Cable Television:

Subscriber connection and distribution systems .......................................................................................... 7

Program origination ...................................................................................................................................... 5

Service and test ........................................................................................................................................... 5

Microwave systems ...................................................................................................................................... 5

Construction:

Assets used in construction by general building, special trade, heavy and marine construction

contractors, operative and investment builders, real estate subdividers and developers,

and others except railroads ..................................................................................................................... 5

Distributive Trades and Services:

Wholesale and retail trades, and personal and professional services ......................................................... 5

Recovery Period in Years

3 5 7 10 15 20

Table 1 — Nebraska Net Book Depreciation Factors

Part A Personal Property Used in All Business Activities,

Without Regard to the Type of Business

Table 2 — Recovery Periods

[Equivalent to the Federal “Modified Accelerated Cost Recovery System” (MACRS).

For the complete Table of Class Lives and Recovery Periods, please refer to IRS Publication 946.]

Part B Other Personal Property Used in the Following Business Activities

Year

Recovery

Period

Table 2 (continued)

Manufacturing:

Grain and grain mill products ....................................................................................................................... 10

Sugar and sugar products ............................................................................................................................ 10

Vegetable oils and vegetable oil products .................................................................................................... 10

Other food and beverages ........................................................................................................................... 7

Yarn, thread, woven products, and nonwoven fabrics .................................................................................. 7

Wood products and furniture........................................................................................................................ 7

Printing, publishing, and allied materials ...................................................................................................... 7

Rubber products and finished plastic products ............................................................................................ 7

Leather and leather products ....................................................................................................................... 7

Glass products ............................................................................................................................................. 7

Stone and clay products .............................................................................................................................. 7

Primary nonferrous metals ........................................................................................................................... 7

Foundry, steel mill, and fabricated metal products ....................................................................................... 7

Electrical and nonelectrical machinery and other mechanical products ...................................................... 7

Manufacture of motor vehicles ..................................................................................................................... 7

Manufacture of aerospace products............................................................................................................. 7

Manufacture of athletic, jewelry, and other goods ........................................................................................ 7

Sawmill equipment in permanent sawmills .................................................................................................. 7

Sawmill equipment in temporary facility ....................................................................................................... 5

Knitted goods and textured yarns ................................................................................................................ 5

Carpets and dyeing, finishing, and packaging of textile products and manufacture of medical

and dental supplies ................................................................................................................................. 5

Apparel and other finished products ............................................................................................................ 5

Special tools and devices for food and beverages, rubber products, finished plastic products,

glass products, fabricated metal products, and manufacture of motor vehicles ...................................... 3

Miscellaneous:

Electric utility transmission and distribution plant ........................................................................................ 20

Waste reduction and resource recovery plants ............................................................................................ 7

Furniture and appliances used in rental property......................................................................................... 7

Oil and Mineral:

Mining – assets used in mining and quarry (for example, sand, gravel, stone, etc.) ..................................... 7

Exploration for and production of petroleum and natural gas, including gathering pipelines

and related storage facilities, compression or pumping equipment ........................................................ 7

Drilling onshore oil and gas wells................................................................................................................. 5

Recreation:

Assets used in provision of entertainment for fee (for example, bowling alleys, billiard and pool halls,

theaters, miniature golf courses, etc.) ..................................................................................................... 7

Theme and amusement parks ..................................................................................................................... 7

Telephone Communications and Radio and Television Broadcasting:

Cable and long-line systems (transmission lines) ........................................................................................ 20

Telephone distribution plant (poles, lines, aerial wires, underground conduits, etc.) ................................... 15

Telephone central office equipment (central office switching equipment) .................................................... 10

Telephone station equipment ....................................................................................................................... 7

Computer-based telephone central office switching equipment (function are those of a computer

or peripheral equipment used in its capacity as telephone central office equipment) ............................. 5

Radio and television broadcasting (except transmission towers) ................................................................. 5

Telegraph And Satellite Communications:

Central office control facilities (switching and monitoring signals) ............................................................... 10

High-frequency radio and microwave systems (transmitters, receivers, transmission lines, and towers) .................. 7

Computerized switching, channeling, and associated equipment ................................................................ 7

Satellite ground segment property ............................................................................................................... 7

Equipment installed on customer premises ................................................................................................. 7

Support equipment ...................................................................................................................................... 7

Headend ...................................................................................................................................................... 7

Recovery

Period